Nov 16, 2021

Strategy Bulletin Vol.294

Theoretical Conflicts over the Stock Market

- The New Capitalism in the U.S.

The Age of "New Capitalism

Ever since Prime Minister Kishida adopted the slogan of "building a new capitalism" as his administration's slogan, "new capitalism" has become a popular topic in economic discussions. The DX/GX revolution, changes in work styles and lifestyles, financial and stock markets, economic policies, corporate policies and systems, mergers and acquisitions, are all part of the "new capitalism. Without the "new concept of capitalism," we will not be able to understand and achieve results. After the 19th century exploitation of labor and class conflict, the 20th century separation of management and ownership, and the fiduciary responsibility demanded of institutional investors, Musha Research believes that capitalism is now evolving into a new stage of development. We are about to enter a new era in which households will combine the functions of both workers and owners (shareholders), and the Internet will provide the optimal matching of all economic resources. The full picture of this new era and where it will ultimately lead is still unclear, but in the U.S., the flames of capitalism evolution have clearly been lit. Japan is lagging far behind in this dynamism. We would like to elucidate various issues from the concept of "new capitalism" in the future. As a starting point, we would like to begin by commenting on an article published in today's Nikkei Shimbun.

Is Mr. Iwai's "Dysfunctional capital markets due to excessive emphasis on shareholders" correct?

In the first article in the Nikkei's "Questioning the New Capitalism" series that started today, Katsuhito Iwai, a specially invited professor at International Christian University, points out the problem of dysfunctional capital markets due to excessive emphasis on shareholders. Since the collapse of the bubble economy, while sales, salaries, and capital investment have remained flat, dividends have quadrupled, and share buybacks have spurred shareholder returns. The original purpose of the stock market was to provide companies with funds for growth, but in reality, funds are flowing out of companies to shareholders. Thirty percent of the shareholders are foreign investors, and the market has become a place to plunder the nation's wealth. Japan is now seen by foreign investors as the easiest target for takeovers."

Since Mr. Iwai is the first writer of the Nikkei's "Questioning the New Capitalism" series, it is likely that the Nikkei considers him to be the leading expert on capitalism in Japan and believes that his views represent the standard view of the academic community.

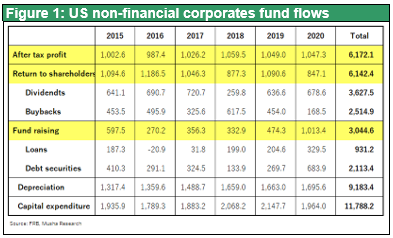

This view is far removed from the reality of finance in developed countries in terms of factual recognition. First, let's compare shareholder returns in Japan and the United States. Looking at shareholder returns for companies listed on the Tokyo Stock Exchange, if we assume that Japanese companies pay out 15.6 trillion yen in dividends (dividend payout ratio of 32%, dividend yield of 2.06%) and assuming buy back 8 trillion yen per year, the total shareholder return is about 24 trillion yen, or almost half of the 47 trillion yen in projected profits. In the case of U.S. companies (excluding financial institutions), the total profit for the past six years (2015-2020) was $6.17 trillion, and shareholder return was $6.14 trillion of which $3.63 trillion was dividends and $2.51 trillion was share buybacks. In the U.S., it has become the norm for companies to return their entire profits to shareholders. The U.S. stock market has become a place for corporate capital outflows even more than in Japan.

Capitalism Evolving in the U.S.: The Stock Market Has Changed from a Place to Raise Capital to a Place to Return Income

However, US companies have invested $11.78 trillion, or 1.9times profit. The difference of $2.6 trillion between the profit and the depreciation of $9.18 trillion has been covered by the $3.0 trillion increase in debt, mainly due to bond issuance. The financial structure (e.g., debt to equity ratio ) of companies has been increasing.

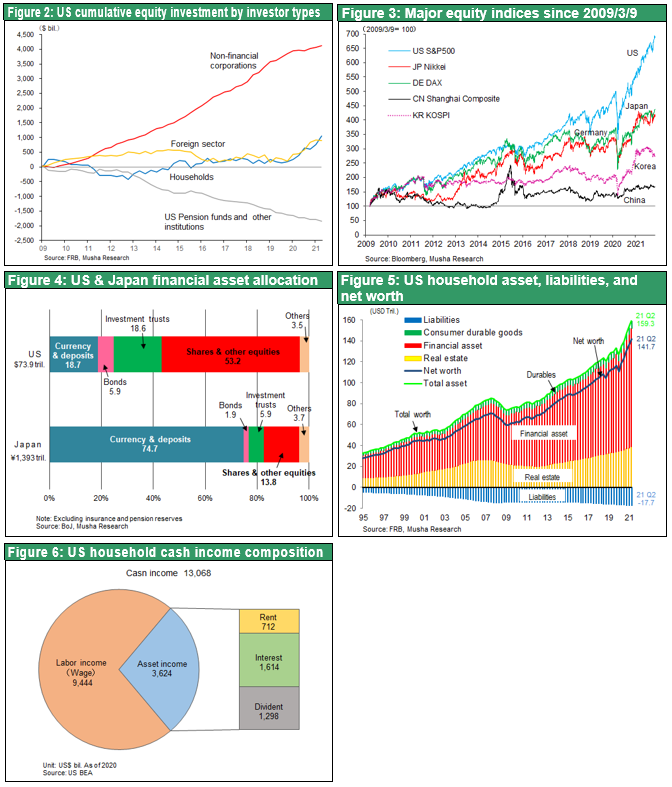

This price-oriented (or shareholder-oriented) corporate financial behavior has been almost the sole engine of the U.S. stock market rally. In the 11 years since the GFC, U.S. stock prices (the SP500 index) have risen more than sixfold, and the cumulative net investment in stocks by investor type during this period has been $4.1 trillion by corporations (non-financial), far exceeding the $0.9 trillion by households, $1.0 trillion by foreign investors, and -$1.8 trillion by financial institutions and pension funds. It can be said that the stock market rally has been driven exclusively by share buybacks. This rise in stock prices and other asset prices has greatly boosted the net worth of households, and this wealth effect has been the driving force behind the increase in U.S. consumption.

In the U.S., traditional fund flow that households' savings are invested in companies through bank lending and the issuance of securities, has completely changed.

Simply put, (1) the stock market has gone from being a place for companies to raise funds to a place for companies to return income; (2) the financial portfolio that determines future investment used to be a bank loan portfolio, but now it is a market portfolio based on stock prices (market capitalization of stocks); and (3) 70% of household savings are in stocks and investment trusts, and rising asset prices are the biggest factor in increasing savings. and (4) managers are evaluated and judged based on stock prices.

In the process, asset price hikes that appear to be bubbles and speculation aimed at earning margins have become rampant, creating the appearance of a gamble room.

Japan's blind economic debate

The "dysfunction of capital markets due to excessive emphasis on shareholders," as Mr. Iwai calls it, is far more prevalent in the United States than in Japan, and Japan is following suit much later. In the U.S., the only people criticizing the state of the U.S. financial markets are some on the left (progressive), such as Democratic Congresswoman Elizabeth Warren, and most academics and economists, including Treasury Secretary Janet Yellen, do not see the problem. On the contrary, they support the policy of pushing up asset prices through aggressive monetary policies such as QE and zero interest rates.

In finance and economics, the gap between the reality of the past, as assumed by old textbooks, and the ongoing reality, which is dynamically changing, has become extremely large. From the point of view of Mr. Iwai, U.S. stocks are in the midst of a bubble created jointly by the public and private sectors and are on the way to a financial crisis. As investors, we cannot sit on the sidelines and ignore these two views.