Dec 03, 2021

Strategy Bulletin Vol.295

Is US-China decoupling possible?

Adherence to Trump's value-based stance against China (Communist Party)

In the first eleven months of the Biden administration, some aspects of its policy towards China have become more noticeable.

The perspective of the values conflict - democracy versus autocracy

However, the diplomatic moves to encircle China have gone further than the Trump administration. Increased engagement in the Indo-Pacific region has been a key element of the AUKUS (US-UK-Australia military technology sharing) and Quad (US-Japan-Australia-India strategic dialogue) have been held one after another.

The withdrawal from Afghanistan was also aimed at focusing on the Asia Pacific region with an eye on China. In addition, the Biden administration has focused on human rights issues such as forced labor. In March, the USTR made human rights abuses in the Xinjiang Uyghur Autonomous Region a top priority and suspended all imports of cotton and tomato products from the region. In June, it introduced some restrictions on imports of solar panel-related products.

Staging a scene of US-China cooperation

On the other hand, there are many factors that appear to be softening the attitude toward China. Talks have resumed in areas such as climate change, military, trade, and security. There are more and more collaborative situations, such as the joint declaration at COP26 in Scotland and the online talks by US-China leaders on November 16 to create collision avoidance rules.

Exclusion of China in the semiconductor supply chain has not worked at all

What is particularly surprising is that the construction of an international supply chain (EPN) that excludes China is likely to cause the sign to collapse. It is said that the Biden administration has followed the path of the Trump administration 1. export control, 2. strengthening of investment examinations for the United States, and 3. exclusion of Chinese goods in government procurement due to security requirements. However, in reality, semiconductor-related products have hardly been decoupled. Except for the most advanced equipment such as EUV (extreme ultraviolet) equipment, there has been little decoupling in the semiconductor sector. The WSJ reported that between November 2020 and April 2021, the Commerce Department has approved $61 billion in exports to Huawei (69% approved) and $42 billion to SMIC (90% approved), totaling more than $100 billion. (Oct. 22). The WSJ reported that between November 2020 and April 2021, the Commerce Department has approved $61 billion in exports to Huawei (69% approved) and $42 billion to SMIC (90% approved), totaling more than $100 billion. (Oct. 22).

Semiconductor equipment exports to China soar

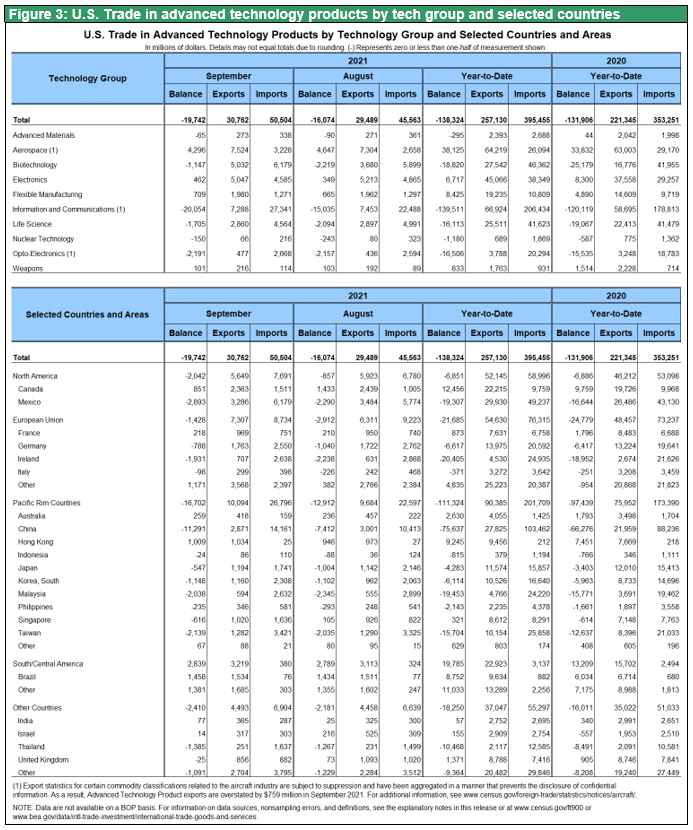

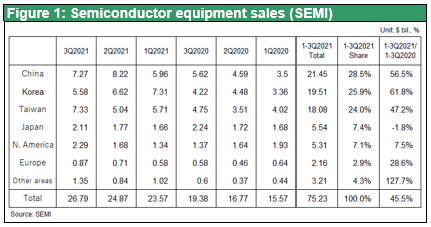

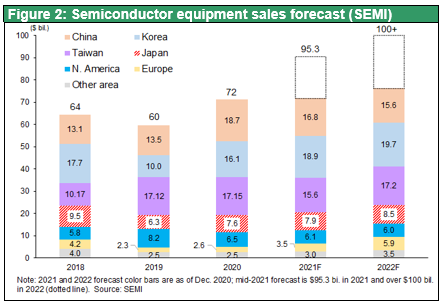

Exports of semiconductor manufacturing equipment to China are increasing rapidly. Global semiconductor manufacturing equipment sales in the first to third quarters of 2021 were $ 75.23 billion, up 45.5% year-on-year, of which China was $ 21.45 billion, up 56.5% year-on-year, above average. China's global share for the first three quarters was 29%, far exceeding South Korea's 26%, Taiwan's 24%, Japan's 7%, and North America's 7%, making it the largest in the world. Applied Materials, the leader in the US semiconductor manufacturing equipment industry, had sales of $ 23.1 billion in 2021, up 34.1% year-on-year, of which $ 7.53 billion (33% of the total) was destined for China. This can be confirmed by the fact that the total export of high-tech products to China from January to September 2021 was 27.8 billion dollars, up 27% from the previous year, which is much higher than the overall growth rate of 16% according to the US customs statistics.

Figure 2 shows the SEMI (Semiconductor Equipment and Materials International Association) forecast for shipments of semiconductor manufacturing equipment as of December 2020.China was expected to become the world's largest market in 2020, but to decline significantly from 2021 onwards due to US restrictions on exports to China. However in fact, it has continued to grow at the highest rate in the world.

As semiconductor investment is seen as a leading indicator of future semiconductor production share, US approval of semiconductor equipment supply to China will further strengthen China's ability to supply high-tech products.

It may be pushed by the lobbying activities of various industry groups. “If the U.S. semiconductor industry loses access to Chinese customers, up to $124 billion in production would be lost, more than 100,000 jobs would be at risk, $12 billion in R&D spending and $13 billion in capital expenditures would be threatened. If we lose access to China for aircraft, we will lose $51 billion in annual sales" (Barron's)

Surge in securities investment in China

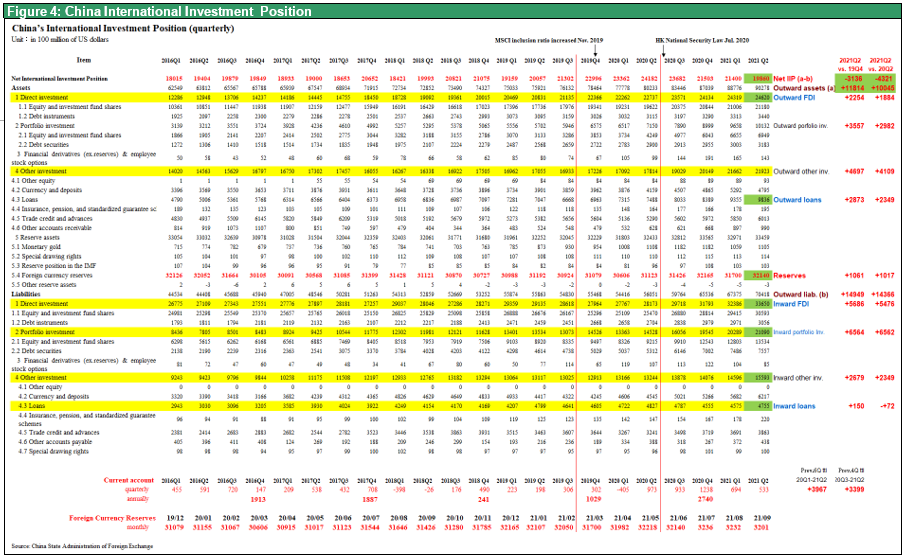

Wall Street has also seen a significant increase in investment in China. There is competition for the enormous amounts of savings held by Chinese households. The Chinese government is opening up to foreign investment by approving 100% ownership of Chinese subsidiaries of financial institutions such as JP Morgan Chase, Goldman Sachs and BlackRock. As of the end of September, the total amount of yuan-denominated stocks and bonds held by foreign investors exceeded US$1 trillion, according to the Nikkei reports. According to China's international investment position, over the past year (3Q2020 - 2Q2021), equity and investment trust inflows into China have surged to $1.2 trillion. U.S. public pension funds and university foundations also appear to be channeling funds via venture capital into Chinese private equity.

Visa issuance restrictions for Chinese are also relaxed

In addition, universities that depend on Chinese students to pay tuition fees, high-tech companies that depend on Chinese researchers, etc. have requested deregulation of Chinese researchers and international student visas. It is said that 50,000 visas have already been issued.

A striking contrast with Congress's hardline stance on China

Contrary to this, a bipartisan annual report submitted to Congress by the US-China Economic and Security Investigation Commission (USCC) in mid-November contained a rigorous analysis of economic security and was hard-lined in 32 areas. A plan has been proposed. In particular, the tightening of regulations in the financial sector is emphasized. “Chinese authorities are working with foreign capital and fund managers to make China's capital markets function as a means of funding the Chinese Communist Party's technological development goals and other policy goals."

The 32 new recommendations include the following hardline measures:

i. Restricting investment in variable interest entities (VIEs) linked to Chinese companies,

ii. Requests for disclosure of procurement and investment from companies using forced labor in Shinji, companies registered in the US Department of Commerce's company list and the Ministry of Finance's military-industrial complex company,

iii. It is obligatory to report whether the Chinese Communist Party Committee exists somewhere in the business activities of US companies. It has also been proposed to limit the use of cloud computing and data service businesses owned by Chinese companies.

If this happens, it may have such an impact that the flow of capital between the United States and China will be blocked. There appears to be a growing divergence of views between Congress and the administration and business and finance.