Feb 21, 2022

Strategy Bulletin Vol.299

A renaissance of the "consumption is a virtue" philosophy

- The root cause of Japan's economic defeat: the entrenched acceptance of deflation

(1) Japan's ingrained passive economic mentality

As the charismatic investor W. Buffett once said, "When the tide goes out, you can see who's been swimming naked”. the coronary pandemic has brought us a surprising revelation: the atrophied economic mindset of the Japanese people is out of step with global norms.

In terms of the number of people infected and the number of deaths, Japan is less than one tenth the size of the United States and the United Kingdom and is the least developed country in the world. However, Japan is the worst among the G7 countries in terms of the economic damage caused by the economic decline and slow recovery after the corona crisis. Tsutomu Watanabe, a professor at the University of Tokyo, says this alarming gap can only be explained by psychological factors. In a pandemic, there is a conflict between two opposite desires: the desire to protect against coronary infection and the desire not to damage economic activity. In the balance between the two, Japan is far out of step with the world average. This is the fact that the animal spirit has been severely undermined in Japan.

Deflation has destroyed Japan's animal spirit

This negative economic mentality is not something that Japan has had for a long time: more than two decades of deflation have destroyed the animal spirit. Since the bursting of the bubble, risk aversion and the avoidance of challenges have always been the right choices, so it is not surprising that they have become part of the economic psyche. Only in Japan have a surprising number of anti-growth arguments emerged, such as "cash is king", "the idea of " and "the steady-state society that accepts the reality of no growth".

Deflation is neutral taken together because it is a transfer of income from sellers to buyers. We often see the argument that deflation is good for consumers because it works to the advantage of consumers as buyers and to the disadvantage of companies as sellers. While this is true in the present context, it is what the consequences are that are important. Companies that lose profits are forced to hire fewer people and lower wages, which in turn increases unemployment, lowers wages, and hurts household consumption. Companies are the only value creators in the economy, so undermining their activities and stifling innovation will cost them dearly in the long term.

Deflation also raises real interest rates, discouraging borrowers and increasing the preference for cash. As the future value of money increases, people postpone consumption and save more. They also stop investing and hoard cash. As capital, the blood of the economy, does not circulate, the body is slowly being undermined. This was the reality of the lost 20 years.

(2) The economy will go into deflation if left to its own devices

How rising productivity creates deflationary pressure

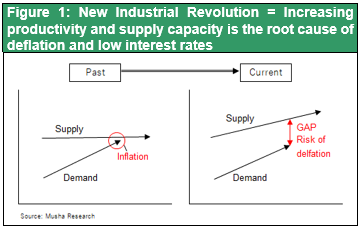

In order to understand why consumption is a virtue, it is important to confirm the principle that an economy has a natural tendency to become deflationary if left to its own devices. As societies develop, technology improves and so productivity rises. This means that the supply of goods increases and therefore the price of goods becomes cheaper. We will be able to produce more goods for the same amount of time as before. The main principle of economics is that if the supply for a good increases significantly, and the demand stays the same, the price will fall.

For example, if productivity doubles while demand remains the same, the number of working days will fall from 200 to 100. The company's profits will increase because it will not have to pay wages for the remaining 100 days. The price of the product can then be reduced. Since without reduction in prices, the company cannot compete. On the other hand, there is a surplus of workers, so there is competition to reduce wages. In other words, the economy has a natural tendency towards deflation.

This is not just a problem in Japan, the world is facing the risk of insufficient demand. Globalization and the DX revolution have brought the world into an era of unprecedented productivity growth, which is fueling an increase in supply. Peasants in China, India and elsewhere are becoming modern factory workers, and a dramatic productivity revolution is underway. The speed of this revolution is incomparable to that of the Industrial Revolution of the 18th and 19th centuries. The factories of the Industrial Revolution were equipped with steam engines at best, but today they are equipped with machinery hundreds of times more powerful, using electricity, semiconductors, and other technologies. In addition to unprecedented technological innovation, emerging economies with populations of billions of people around the world are raising productivity at an astonishing rate.

Statistics fail to capture the exponential rise in technology and productivity

The fruits of this productivity increase are rarely captured by economic statistics, so people underestimate the magnitude of the demand shortage and the risk of deflation. For example, photography and music are now completely free, and we enjoy many, many times more photographic activities and music listening than we did just ten years ago. However, the photographic film and developing industry and the music recording (vinyl and CD) and player equipment industry have disappeared and considerable employment has been lost. This is seen in economic statistics as a contraction of economic activity (i.e., a reduction in value creation), but if we take the infinite fall in prices and convert it into real terms, it is actually a massive value creation. Such destruction of industry and employment (i.e. massive, invisible value creation) by digitalization, the internet and AI is happening everywhere.

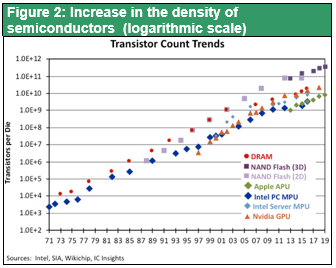

Moore's Law, which describes the increasing density of semiconductors, has been changing exponentially, doubling in two years (= 32 times in 10 years, 1000 times in 20 years and 33000 times in 30 years). With costs falling at this rate, the productivity gains from their practical application are unimaginable, and the benefits they bring are immeasurable. This means that productivity growth (i.e. an increase in supply capacity) and deflationary pressures are affecting the world economy more than statistics suggest.

The "consumption is virtue" philosophy that led to the evolution of capitalism

So, what can we do to stop deflation? It depends on how to create new demand in response to this remarkable increase in supply. What would be desirable is for living standards to improve dramatically and for consumer confidence to rise, stimulating demand. If this does not happen, then overproduction will plunge the entire world into a catastrophic recession. If productivity doubles, then we must take measures to stimulate demand by doubling living standards. If last year you worked 100 days a year, earned a salary of one million yen, and lived on one million yen, this year you must work the same amount, earn a wage of 2,000,000 yen, and live on 2,000,000 yen, or there will be no balance.

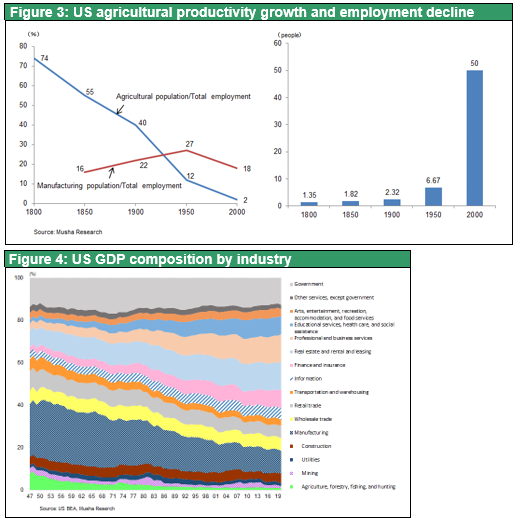

In 1800, the agricultural population of the United States was 74% of the total population. Two hundred years ago, 74 people worked in agricultural production to provide food for 100 people; today, only two people are needed. Agricultural productivity has increased from 1.35 to 50 . This means that 72 people who used to work in agriculture are now unemployed. So where did they go? They started new jobs outside agriculture. We can see this by looking at the jobs we have today. Most of the jobs we have today did not exist two hundred years ago. It was "industry as a means of satisfying human desires", in other words, new industries were born which enriched people's lives. New jobs were created in a variety of industrial products that enabled elevated levels of mass consumption; in energy-related industries such as oil and electricity that supported these products; in the financial industry that managed increased incomes; and in modern education and modern medicine, including food service, leisure, sports, entertainment, travel, and fashion.

The capitalist economy has developed through the development of these new patterns of enjoyment and satisfaction of needs. The development of new, socially value-adding businesses has allowed for the smooth absorption of surplus labor and capital. Deflation has been prevented and economic growth has continued because most citizens have been able to enjoy a standard of living at the level of former royalty and aristocracy. Marx's gloomy prediction of the collapse of capitalism due to the over-accumulation of capital and the decline in the rate of profit caused by the exploitation of labor has completely failed, but this is because income has been redistributed under a democracy that respects human rights, and the idea that consumption is a virtue has triumphed.

The "consumption is virtue" philosophy shared in the US and the opposite in Japan

People who do not recognize this historical fact shout that "saving is a virtue", but as technology continues to develop, the number of unemployed people will only increase if they do not spend on luxuries (i.e. improving their standard of living). There are few academics or economists in Japan who would advocate the simple fact that consumption is a virtue, but in the US it is common knowledge. The primary objective of US policy is not to relieve retirement or future anxiety, or to improve fiscal health, or to reduce inequality, but to improve living standards.

In Japan, after the collapse of the bubble economy, the idea of "poverty and purity" dominated the public consciousness, saying that it was OK not to grow. But this seemingly stoic and emotive ideology was clearly a mistake from an economic historical point of view. Japan must do whatever it can to rid itself of this backward-looking economic mentality.

Has the Fed turned "inflation hawk"?

We would like to add that the economic and monetary theory and policy of the United States is based on the premise that consumption is a virtue. Japanese academics and bureaucrats, who hold the value idea of "saving is a virtue", would naturally miss the point.

In the U.S., the end of emergency monetary easing in response to the Corona pandemic has led to a sharp rise in long- and short-term interest rates and a fall in stock prices. There are many supporters in Japan.

The question that will divide investment strategy this year is whether the Fed has become an inflation hawk or remains a dove. The answer to this question will be whether the commander in chief of US economic policy recognizes the value of "consumption is a virtue".

(3) The virtuous circle of de-deflation that has now begun in Japan

Asset inflation has begun in Japan

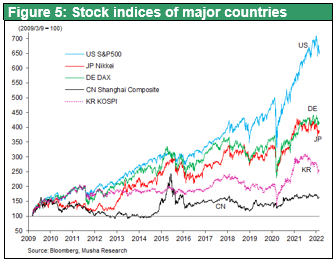

The good news is that the worst of deflation has passed with the advent of Abenomics. The yen has stopped appreciating, deflation (a constant decline in prices) has ended, and companies in Japan are regaining their animal spirits. The Nikkei 225 is up 4.1 times, the same as the German DAX, and second only to the NY Dow at 5.1 times, compared to the NASDAQ at 11.2 times, driven by GAFAM, but better than China and Korea at 2-3 times.

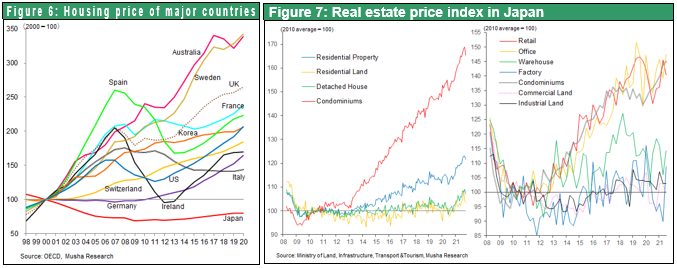

Asset deflation has also ended in real estate. Japanese property prices have been in the midst of one of the world's most prolonged periods of decline. As shown in Figure 6, housing bubbles have formed and burst in most countries since 2000, but most of them have bottomed out within a few years and regained their previous peaks. Only in Japan, where the bubble burst and prices continued to fall for 20 years, condominium and commercial property prices have started to rise sharply since 2013, when Abenomics began (Figure 7).

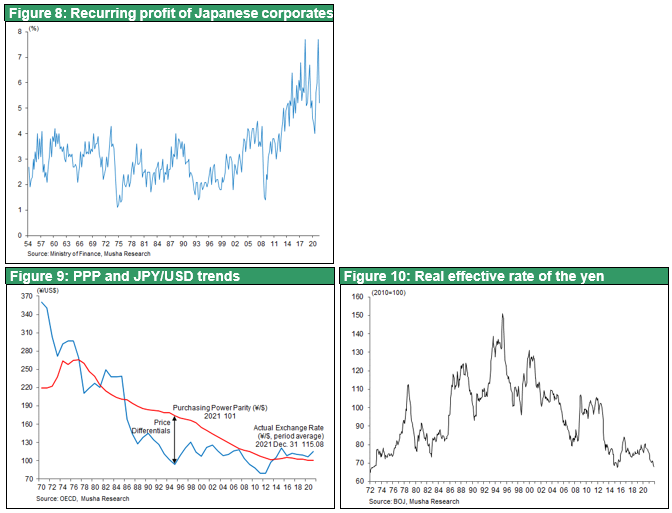

Restoring price competitiveness will lead to rapid growth in corporate profits

Japan's corporate earnings are on track to reach a record high in FY2021. As shown in Figure 8, the recurring profit margin in the corporate statistics had been cyclical, hovering between1~4% until around 2013, but it has grown rapidly since then and today stands at almost 8%, the highest level ever. This is due to the rapid recovery in price competitiveness following the end of the super-strong yen, which undermined the price competitiveness of Japanese companies. The real effective exchange rate of the yen (2010=100) rose sharply from 67 in 1970 to 150 in 1995, before returning to the 1970s level of 70 in 2021. This means that the domestic cost of Japanese companies doubled against their trading partners, which severely impaired their price competitiveness, but from there the relative price of goods in Japan halved compared to 1995, indicating a remarkable recovery in price competitiveness (Figures 9 and 10).

Corporate management reform is also making progress: there is now a shared sense of urgency to reform the corporate sector in the face of the DX and GX revolutions. Top global niche companies such as Keyence, Recruit, Shin-Etsu Chemical, Nidec, Daikin Industries, Murata Manufacturing and HOYA are now among the top companies in terms of market capitalization, a position previously reserved for elite companies such as banks and conglomerates. Sony and Hitachi, which were ahead of the curve in management reform, are also making a comeback. How can high-tech be used to solve problems in the real world? The new frontier is the integration of cyber and physical interfaces. Japan is home to many of the world's strongest players in elemental technologies such as sensors, motors and power semiconductors.

In the field of finance, Japan has unique business models such as Masayoshi Son, the world's leading venture capitalist, Sogo Shosha, an investment bank like no other, Fast Retailing, a leading SPA (Specialty store retailer), Recruit, a matching business, and Toyota, a potential world leader in EVs. Japanese companies are coming into their own.

In the world of stock investment, Japanese individuals will replace the Bank of Japan and foreigners as the major investors. In Japan, the number of individual stock investment accounts (NISA and iDeCo) has grown rapidly, and the total number of accounts for both has exceeded 12 million. In Japan, 1,040 trillion yen, or 75% of personal financial assets (excluding pension insurance reserves), is sitting in zero-interest cash deposits, one of the largest waiting lists for investment in the world. The lost animal spirit is steadily improving in the form of a resurgence of value creation in companies, rising share prices and increased risk-taking by individuals. It is highly desirable to protect and nurture this virtuous circle, which has now definitely started to work.