Apr 01, 2022

Strategy Bulletin Vol.302

From punitive Yen appreciation to beneficial Yen weakness

Key Points

- In the three weeks of March, the dollar-yen rate plunged ¥10. It is a well-known fact that factors contributing to the yen's depreciation are piling up, but this sudden plunge caught market participants by surprise. Market participants may have been so caught up in cyclical theory that they overlooked the underlying long-term trend of the Japanese yen.

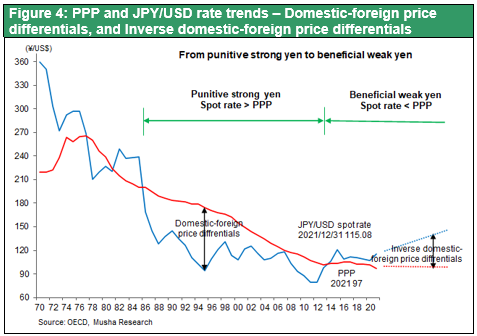

- The structural depreciation of the yen may be underway at the bottom of the market. It is possible that the era of punitive yen appreciation (when the exchange rate level exceeds purchasing power parity and places an additional burden on competitiveness) is clearly over and that we have entered an era of gratuitous yen depreciation (when the exchange rate level falls below purchasing power parity and boosts competitiveness).

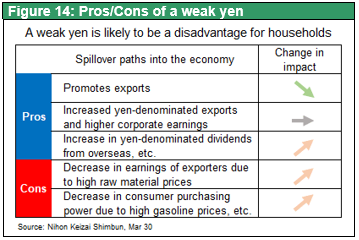

- In the short term, there are two sides to the argument: "A weak yen is good or bad" and no conclusion can be reached. However, from a long-term, national-interest perspective, there are significant advantages to a weaker yen. The BOJ's stance of aggressive monetary easing is admirable from the perspective of the national interest. Bad criticism of the weak yen by the business community, politicians, the media, and some economists based on short-term, self-interests is unbecoming. Wisdom in dealing with the new normal of a weak yen is desirable.

(1) The yen's solo plunge caught market participants by surprise

Changing Perception of the Yen

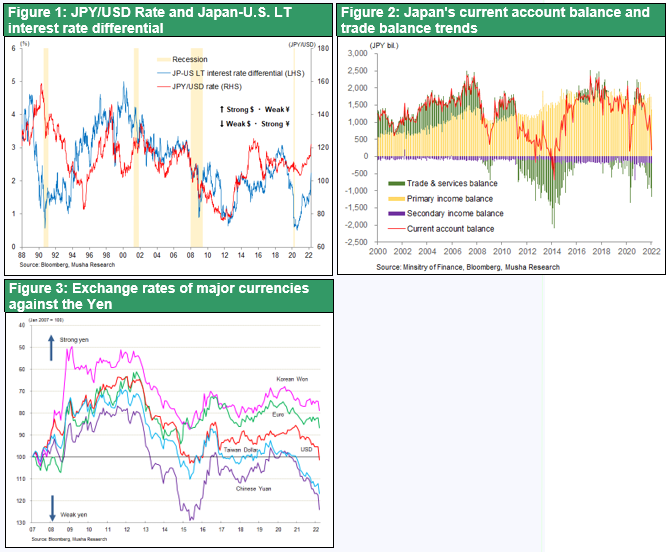

In the three weeks of March (3/10 ¥115/$ ➡ 3/28 ¥125/$), the dollar/yen rate plunged ¥10. The yen's weakening against the dollar is due to a number of factors, including (1) a widening interest rate differential resulting from tighter U.S. monetary policy, (2) Japan's falling trade deficit, and (3) massive capital outflows (U.S. equity investment, bond investment, global direct investment and M&A).

The dollar-yen rate did not move in response to a rise in the U.S. long-term interest rate to 2.0% (3/10), but since then the yen has weakened like cutting a weir. The yen's single digit depreciation against all currencies and the fact that contingency yen buying did not occur may have led to a fundamental shift in perceptions about the yen.

Hard to see any factors preventing the yen from depreciating.

Exchange rates basically fluctuate in a cyclical manner due to differences in business confidence, inflation, and interest rates between the two countries. .However, the level of exchange rates is generally determined by purchasing power parity. The purchasing power parity of the Japanese yen (OECD) is 97 yen in 2021and expected to be and to hit the 90-yen level in 2022. Therefore, market participants had believed that there would be no significant deviation from this level and that there would be a limit to the yen's depreciation. Since the deviation from purchasing power parity over the past five years has been around 5%, market participants last year believed that there was a limit to the yen's depreciation and that a 10% deviation would result in an exchange rate of less than 110 yen. However, this time the conventional wisdom has been broken, with the negative deviation rate reaching 20% (116 yen) to 30% (126 yen).

If this is the case, it is difficult to see any reason to stop the yen's depreciation. In addition to the ongoing disparity between interest rates and inflation and the worsening trade balance, if the prospect of further yen depreciation prevails, the outflow of capital from Japan will accelerate. The only factor that could prevent the yen from weakening would be the BOJ's tight monetary policy. Suddenly, the magma of the yen's depreciation has been exposed.

(2) From Punitive Yen Appreciation to Beneficial Yen Weakness

Historical Characteristics of the Japanese Yen Moving in One Direction

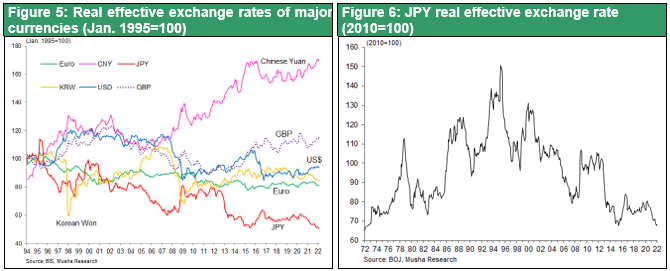

Looking back at the long-term trends of currencies, the uniqueness of the Japanese yen and the Chinese yuan stands out. Let us consider the real effective exchange rates of major currencies since 1995, as shown in Figure 5. The real effective exchange rate is an indicator of currency trends, excluding differences in price inflation rates, weighted by trading partner countries, and is a powerful indicator of price competitiveness. If productivity remains unchanged, an increase in the real effective rate can be understood as a decrease in price competitiveness, while a decrease in the real effective rate can be understood as an increase in price competitiveness. The Figure shows that the dollar, euro, British pound, and South Korean won have cycled within a range of +20% and -20%. In contrast, only the Japanese yen has consistently declined, while the Chinese yuan has consistently risen. Figure 6 traces the real effective exchange rate level of the Japanese yen(2010=100) since the introduction of the floating exchange rate system, and shows a clear unidirectional movement, with a consistent rise from the early 1970s to 1995 (67 ➡ 150) and a consistent decline from 1995 to 2022 (150 ➡ 67).

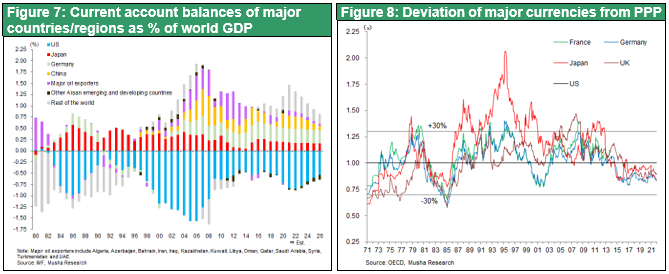

Leaving China aside, why does a major long-term trend exist only for the Japanese yen? It is because Japan's price competitiveness became extremely strong at one point, and market forces (economic rationality) and the power of the hegemonic U.S. (U.S. national interest) acted to suppress this competitiveness. There are rules for how the exchange rate level is determined. The rules are: (1) since countries trade with each other, it is necessary to ensure that there is no unilateral advantage or disadvantage to either side, and (2) in order for international trade to be sustained, it is necessary to work to correct imbalances in the balance of trade and other areas.

Japan's overly strong competitiveness and the punitive appreciation of the yen

Japan's currency was cheap relative to its competitive strength both during and after the fixed exchange rate era, and the country accumulated a large trade surplus; Japan's overwhelming strength in the 1980s and 1990s was neighborhood-destroying (see Figure 7) and correcting it through exchange rates required causing an excessive appreciation of its currency. The U.S., the hegemonic and reserve currency nation, demanded such a punitive appreciation of the yen. As shown in Figure 8, from the late 1980s to 2001 and from 2009 to 2013, the Japanese yen suffered from the punitive appreciation of more than 30% above its purchasing power parity, and Japan's competitiveness deteriorated significantly, and its trade surplus disappeared.

The Strong Yen is the Main Cause of Japan's Wage Slump

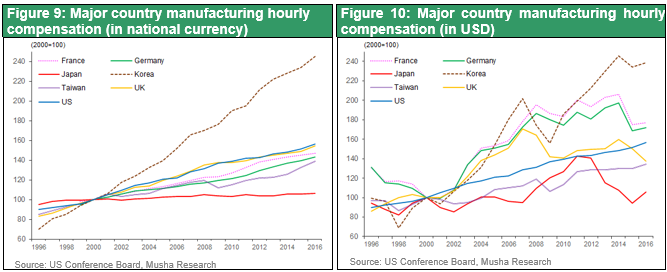

The punitive appreciation of the yen has put intense downward pressure on wages in Japan. As shown in Figure 9, Japanese wages in yen terms have not increased at all since 2000. However, in dollar terms, Japanese wages continued to rise until around 2013, on par with wages in the US. In other words, Japan's yen-based wage restraint may have been brought about to bring Japanese wages back in line with international levels, which had become too high because of the strong yen.

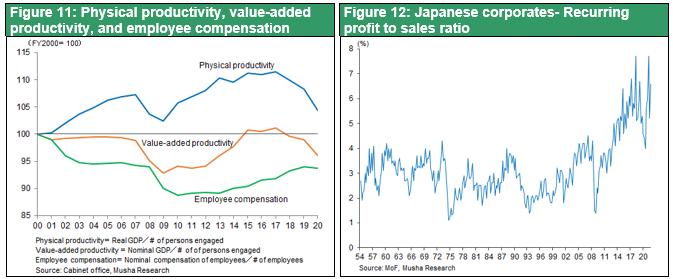

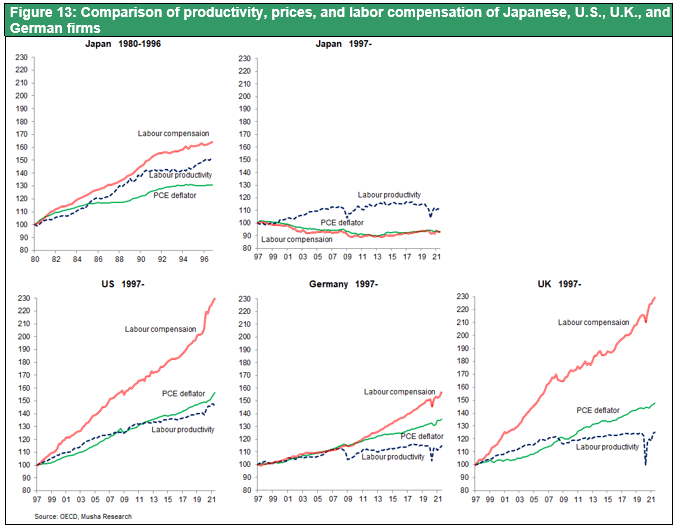

Figure 11 shows the trends in productivity and labor compensation at Japanese firms, indicating that physical labor productivity has been rising at the same rate as in other countries. Despite this, value-added productivity has not increased at all. The value created was lost to buyers due to the appreciation of the yen and the drop in selling prices caused by deflation. However, companies reduced labor compensation to secure profits and resources for R&D and overseas investment and achieved a shift in their business model. In some respects, wage restraint was the costs that enabled Japanese companies to shift their business models in the face of the strong yen. Figure 13 compares productivity, prices, and labor compensation of Japanese, U.S., U.K., and German firms , and shows that only in Japan, immediately after 1997 when the yen became extremely strong, both wages and prices continued to fall far below productivity. While it is common practice around the world for prices and wages to rise faster than productivity, the opposite was true for Japan.

An Era of Beneficial Yen Weakness is in Sight

However, now that it has fallen into a trade deficit nation, Japan may be entering an era of gratuitous yen depreciation. In other words, an era in which the exchange rate remains considerably (20-30%?) lower than purchasing power parity and Japan's price competitiveness is given a benefit from a foreign exchange perspective. In addition to economic rationality, the U.S. national interest in building a supply chain free of China's influence will also support the yen's depreciation. The yen's depreciation will be essential for rebuilding the world's high-tech production clusters, which are concentrated in China, South Korea, and Taiwan, and which are at the forefront of the U.S.-China confrontation.

Beneficial depreciation of the yen will bring back the concentration of high-tech industries in Japan

The up-gradation and expansion of TSMC's Kumamoto plant will be the focus of attention. The government has provided 400 billion yen to compensate for high costs in Japan, and at 120-130 yen to the dollar, the cost competitiveness of the Japanese plant will increase significantly. TSMC, which is concentrated in Taiwan, will have no choice but to diversify its factories to other countries, and it is expected to build a large production cluster in Japan. The appreciation of the yen to over 80 yen to the dollar during the BOJ's Shirakawa era caused Elpida Memory to go bankrupt and be acquired by Micron Technology, but Micron's Hiroshima plant in Japan today should be the most profitable improvement in the company's profitability. It can be said that Japan's chances of regaining the high-tech industry clusters it once lost are greatly enhanced.

(3) Exchange rate theory from a long-term, national interest perspective; the yen must remain weak

A weak yen is good for exporters and bad for importers, and there are conflicting interests among the parties involved, so no answer can be given. However, if we consider Japan's national interest and the prosperity of the Japanese economy over the long term, this is a very good thing. International competition is a race to bring in global demand into Japan. If the yen weakens, exports will increase and imports will decrease, and factories relocated overseas will return to the domestic market, substituting domestic production for imported goods. This will lead to an increase in domestic investment and production in Japan and higher incomes. In the past, when the yen was super strong, the opposite was true. Japanese companies moved their factories overseas, and domestic demand was taken over by cheap Chinese goods. Now, however, Japanese companies' costs (generated domestically) have dropped to half of what they were 30 years ago. And when the coronary pandemic is over, foreign tourists should rush to Japan, where prices have become less expensive. Thus, the basis of all economic activities is to strengthen the recovery of price competitiveness. A weak yen is essential for this.

The business community's "bad yen depreciation theory" is simply wrong

There is much discussion in the media of a "bad yen" that will hit households directly due to higher import prices. At a regular press conference (3/29), Kengo Sakurada, the representative secretary of the Keizai Doyukai (Japan Association of Corporate Executives), said, "I don't think this is an appropriate level" and "Exporters are not the only ones pulling the Japanese economy forward, although the weak yen is beneficial to export-oriented companies. He developed the weak yen dreadful thing theory. While smoothing adjustments are necessary because sudden changes can cause confusion, we should not resist the trend of a weaker yen. Importing companies should not bemoan the yen's depreciation and blame it, but instead should shift their strategies to substituting domestic production.

The Bank of Japan's firm stance of aggressive monetary easing is encouraging from the perspective of the national interest.

The key to overcoming deflation lies in sustaining the gratuitous depreciation of the yen.