May 06, 2022

Strategy Bulletin Vol.305

The key is the strengthening of TSMC's Japan base and Taiwan-Japan industrial cooperation

- The decisive factor of Japanese industrial revival, the weakening of the yen has arrived! (2)

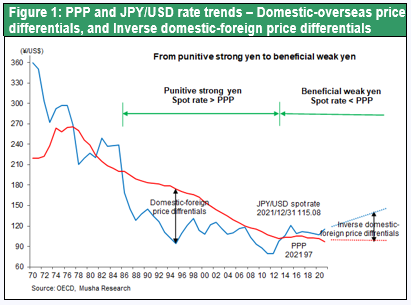

The era of the benevolent depreciation of the yen, in which exchange rates that are considerably lower (by more than 30%) than purchasing power parity have taken hold and Japan's price competitiveness is benefited from the exchange rate, has begun. As in the era of punitive yen appreciation, this time too, the national interest of the hegemonic US will be key, as well as economic rationality. The US is concentrating on building a supply chain away from China, and as part of this, it will be necessary to rebuild the world's high-tech production clusters in Japan, which are concentrated in China, South Korea and Taiwan. A weaker yen will be essential for this, which will benefit Japan.

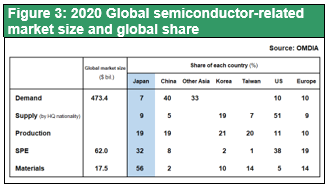

Fortunately, Japan has lost ground in core and final high-tech products such as semiconductors, LCDs, TVs, mobile phones and PCs, but has differentiated itself in the digital periphery (sensors, actuators, components, materials and equipment) and gained a high market share. Although each of those products is niche and the market size is not necessarily large, it can be said that they are holding back the bottlenecks in the global high-tech supply chain. Japan will be key when it comes to building a high-tech supply chain outside China.

The already lost digital hub will be complemented by the TSMC/Taiwan collaboration, and the Japanese high-tech industry will be resuscitated. A reverse cycle of what happened with the punitive appreciation of the yen is expected: the biggest beneficiaries of the yen's depreciation to the 130 yen level will probably be the high-tech industries, which were the biggest victims of the strong yen.

(1) Japanese hi-tech revival with TSMC at its core, propelled by the 130-yen depreciation

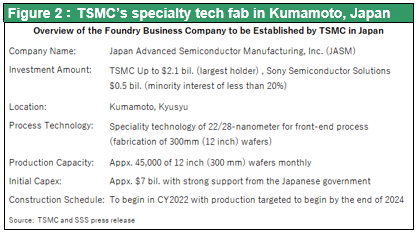

The dream TSMC becoming the savior of Japanese hi-tech comes true

TSMC will become the savior of Japanese hi-tech, and the weak yen at ¥130 will be the driving force behind this. Under the 80 yen to the dollar appreciation of BOJ Governor Shirakawa's time, Elpida Memory went bankrupt and was acquired by Micron Technology, and today Micron's Hiroshima plant in Japan should be the most profitable plant in the world. Similarly, TSMC's Kumamoto plant (Figure 2) is expected to be upgraded and expanded under this weaker yen. The government has pledged about 400 billion yen to the Kumamoto plant to compensate for high costs in Japan, and at 120-130 yen to the dollar, the cost competitiveness of Japanese plants will increase significantly. It is assumed that TSMC, which is concentrated in Taiwan, will have no choice but to diversify its plants to other countries in terms of geopolitical risk hedging and requests from the US, and may build up its production system in Japan to a substantial extent.

Losing the high-tech race, Japan has lost cutting-edge core components and specialized in components, materials, equipment, and legacy semiconductors at the bottom end of the high-tech division of labor in Asia. Japan lacks key elements such as design, advanced manufacturing technology (e.g. EUV) and semiconductor demand, but Taiwanese companies such as TSMC could fill Japan's deficiencies. Many experts, including former Elpida Memory president Yukio Sakamoto and semiconductor engineer and commentator Takashi Yunoue, are skeptical about the METI-led policy to foster the semiconductor industry, which is centered on attracting Kumamoto plant. The failure of all previous development measures, the small demand for semiconductors in Japan to begin with, the lack of human resources, and the loss of advanced core technologies are some of the factors of concern pointed out.

Certainly, there are large areas in Japan today that are lacking in order to rebuild high-tech industry clusters. Figure 3 shows the global share of the semiconductor-related market, as estimated by Omdia, and although Japan has a high share of 56% in materials and 32% in equipment, its share of production is 19% (including 10% at Japanese plants of overseas companies) and its share of semiconductor demand is 7%, which is noticeably low.

But no country has all of the ecosystem in place. Both Sakamoto and Yunoue also overlook the fact that the biggest cause of Japan's high-tech defeat was the punitive appreciation of the yen. As will be discussed below, it is important to emphasize that the gratuitous depreciation of the yen can be regarded as a decisive support for the revival of Japan's high-tech industry clusters.

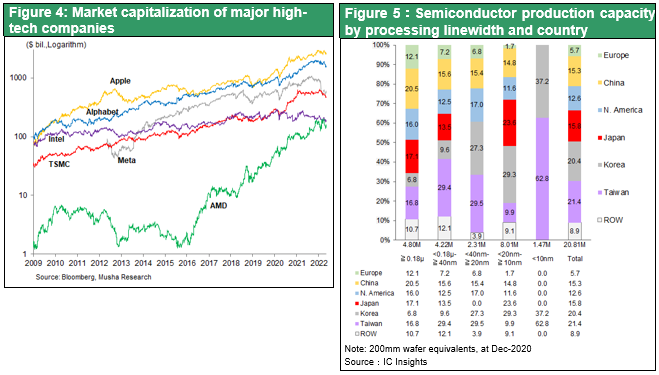

TSMC has become the center of global high-tech

Although it is often assumed that the main players in the global high-tech industry are internet platform providers, GAFAM, and similarly semiconductors are now led by design companies , this is not necessarily the case. There is no doubt that TSMC, which has secured the most advanced technology in semiconductors worldwide, is at the core of the supply chain value chain. In terms of market capitalization, TSMC is almost $500 billion, far ahead of Intel, and vying for the top spot with NVIDIA and comparable to MeTa (Facebook), one of the GAFAM companies.

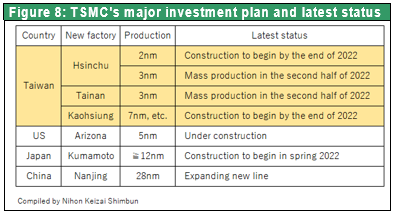

TSMC boasts cutting-edge, unrivalled technological capabilities. Figure 5 shows the market share of each country by processing line width, and it is clear that Taiwan (TSMC) dominates in cutting-edge devices. The technology gap between TSMC and its only rival, South Korea's Samsung Electronics, has widened. TSMC has started mass production of the world's most advanced '3-nanometer' semiconductors at a new plant in Taiwan. It has also decided to start construction of a new plant in Taiwan by the end of the year for more advanced '2-nanometer' semiconductors. Specifically, new state-of-the-art semiconductor plants will be set up in Hsinchu, Tainan and Kaohsiung, with an investment of around ¥1 trillion, one after the other across Taiwan. Aiming to strengthen economic security, countries around the world also provided large subsidies and aggressively lured TSMC to their shores. However, TSMC refused to budge (except for the decision to build a state-of-the-art plant in Arizona in 2020 under pressure from the Trump administration), and only one new plant overseas, in Kumamoto, Japan, has been built. And that too is not a factory for cutting-edge products." (Nikkei 4.15.22)

TSMC's overwhelming presence, three pieces of evidence

There are countless episodes that demonstrate TSMC's overwhelming technological strength.

- AMD's pursuit of Intel was made possible by TSMC. In the past, Intel dominated microprocessors for PCs, and after NEC's rival product, the V series, was defeated in trade friction, AMD continued to exist as the only marginal supplier (with a market share of around 10%) to avoid a monopoly. AMD has grown rapidly, and with a market capitalization of USD 145.5 billion, it is now close to Intel (market capitalization USD 183.8 billion). In 2009, AMD separated its manufacturing division as a contract manufacturing company, Global Foundry, and became dependent on TSMC to produce its products. In 2021, AMD's sales growth rate was 65%, making it the number one player in the industry, ahead of Intel, whose sales have been stagnant at -1%. The company's market capitalization, combined with its spun-off manufacturing arm, Global Foundry, is almost the same size as Intel's.

- Intel also relies on TSMC for the supply of cutting-edge semiconductors. Intel CEO Pat Gelsinger visited Taiwan by private jet on 7 April. The visit was a surreptitious one, with the press completely shut out, but the aim was clear: negotiations on the procurement of 3-nanometer and 2-nanometer products. Mr Gelsinger's visit to Taiwan also took place in December last year. The top executive himself went to Taiwan and directly approached TSMC leaders and "pleaded for the supply of advanced semiconductors" (according to sources). (Nikkei 4.15.22)

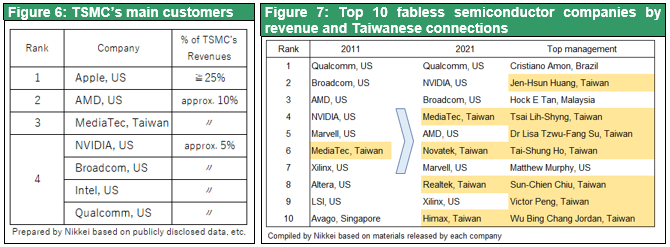

- The rapid growth of semiconductor design companies in Taiwan, thanks in no small part to TSMC. The semiconductor industry is divided into IDMs (vertically integrated device companies) such as Intel and Samsung, fabless companies that only do design, and contract manufacturing companies (foundries) such as TSMC, and it has become common knowledge that the companies with the highest growth potential are fabless companies. Most high-growth companies such as NVIDIA, Broadcom, Qualcomm and MediaTek were in this category. However, it has gradually become clear that the source of competitiveness of fabless companies lies in TSMC's superior production capacity. As shown in Figure 6, fabless companies depend on TSMC for all their advanced devices, indicating a strong interdependence between the two. Even more surprisingly, most of the growing fabless companies are managed by Taiwanese. As shown in Figure 7, of the top ten fabless companies, only two were Taiwanese ten years ago in 2011, but by 2021 there are seven, and it can even be seen that a semiconductor industry pyramid is forming with TSMC at the top. The center of high technology is not the software system, but TSMC, a die-hard hardware company.

Assumption that TSMC will focus on Japan, well-founded

TSMC is a one-country Taiwanese producer, which is also a risk for TSMC. Intel is also planning to build a manufacturing base in Europe, with EU subsidies.

The prospect of TSMC increasing its manufacturing base in Japan may be strengthened by the yen's depreciation and the prospect of improving the profitability of its Japanese plants.

The first factor is the evolution of semiconductor technology: it is thought that miniaturization through the race to reduce line width, in which TSMC has taken the lead, is reaching its limits; Moore's law, which states that the degree of integration will double in 18 months, is approaching its limit, and new technological breakthroughs such as 3D (three-dimensional) technology and chiplet technology will be necessary to break through this limit. This means that technological evolution of not the front-end process of baking and composing circuits on silicon wafers, but the back-end process of assembling them, will become important. Synergy between materials manufacturers and equipment manufacturers will be essential. Cooperation from Japan, which has the world's strongest infrastructure in these peripheral technologies, may become essential.

Secondly, the Japanese Government's long-standing and enthusiastic efforts to attract Taiwan company to Japan have laid the foundations for cooperation between Japan and Taiwan. TSMC is participating in the new generation semiconductor developing project that MITI organized and driven by NIAIST(National Institute of Advanced Industrial Science and Technology) as a leading member of back-end process. Tsukuba where NIAIST located TSMC has deployed an R&D base outside Taiwan for the first time. A number of Japanese materials and equipment manufacturers are participating under TSMC, the coordinator of the back-end project. TSMC has also established an advanced semiconductor technology alliance with the University of Tokyo from 2019 , and a multi-layered technical cooperation relationship is being developed. This Japanese modesty highlights the difference between Japan and the US, which competed with Japan to attract TSMC semiconductor plants. See the claims made by TSMC founder Maurice Chan against the US, below.

Thirdly, with smartphones entering the maturity phase, we are now on the edge of what new high-tech equipment demand will look like: new flagship products in the era of 5G, IoT, EVs and smart robots could be born in Japan, and the demand for semiconductors that Japan has lacked could be revitalized. Japan is also home to a range of machinery and electrical equipment manufacturers. It is quite possible that many new machines will be born in Japan.

When examined in this way, Japan may be considered to have the most favorable conditions for a semiconductor manufacturing base that TSMC is building and strengthening outside Taiwan.

TSMC distrustful of US support, slipping closer to Japan?

Comments from Maurice Chan, founder of TSMC, have become a hot topic. 'The US is trying to expand its own semiconductor production, but the US already lacks manufacturing talent. The $52 billion subsidy bill, which has yet to be passed in the House and Senate, is not even close to being passed. The US can no longer go back to being the semi-conductor powerhouse it used to be. He expressed his dissatisfaction with the US (Nikkei Shimbun, 23 Apr).

In contrast, could this be taken as an indication of Japan's superiority as a production base?

(2) A weak yen is essential for creating high-tech industrial clusters (icicles) in Japan

Industrial clusters and icicles

How are industrial clusters created? Many products are the specialty of a particular region. Some are derived from natural resources or marine and mountain delicacies that are unique to the area, but most are the product of chance. How did Detroit become an automobile mecca, when Henry Ford was born in Dearborn, a suburb of Detroit, where the first mass production plant was built? Why Silicon Valley became a high-tech mecca began when researchers and entrepreneurs from Stanford University established a base there. The emergence of these industrial clusters is akin to the growth of icicles over the course of a winter. Why do giant icicles form at certain spots on gutters? It starts when the first drop drops from a protrusion on the gutter, or from debris, or from some other reason. The second and subsequent drops naturally drip from the same point, so huge icicles eventually form. In this way, the formation of icicles requires (1) the first drop and (2) low temperatures that enable sustained icing of the water droplets. When considering industrial agglomeration, the first drop can be likened to a policy, and the second drop to sustained low temperatures, to a currency depreciation that enables the maintenance of favorable price competitiveness.

The US and the West are now under pressure to build a de-Chinese supply chain. In addition, each country is keen to secure its own supply of semiconductors, which are the brains of its industry. If they must create their own industrial icicles, they will need to ensure that the first drop of these icicles is created not by chance, but by policy. It is also necessary to maintain favorable exchange rates so that the icicles can grow quickly and reliably.

High-tech tidal wave + weak yen give Japan a chance to revive

Japan's high-tech revival is vital to the country's economic recovery. And with the weak yen, the necessary and sufficient conditions for Japan's revival are being fulfilled. Having lost the high-tech hub, Japan is in the unique position of having overwhelmingly dominated the niche sectors at the periphery of the bottom, with bottlenecks in the global supply chain concentrated in Japan. The semiconductor and electronics industry is now also facing a turning point in the tide. (i) further evolution and breakthroughs in semiconductor technology and miniaturization, and (ii) the key electronics products that accept semiconductors are also changing from smartphones to post-smartphones. It is not always possible for the previous winners to continue winning.

It should be clear from the analysis so far that Japan has the conditions to become a winner in the next era when a new ecosystem is needed.

Once again, it will be seen that the regeneration of high-tech industry clusters in Japan (the formation of an Icicle) requires sufficiently low temperatures, i.e., a weak yen. The fiscal and monetary authorities should bear in mind that it is necessary to maintain the yen's depreciation, which contributes to strengthening the price competitiveness of micro-industries. The most urgent task for Japan today is to rebuild its high-tech industrial cluster, with TSMC at its core, and the yen's persistent depreciation to 130 yen to the dollar will be a godsend.

(3) Supplement: National competition in high-tech industries that makes big government a necessity

~Citing from Strategy Bulletin Vol. 284 (Issued on July 13, 2021)

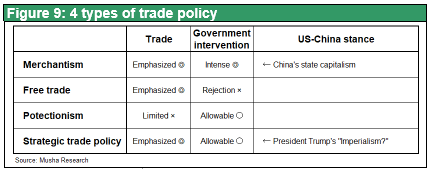

It is important to recognize that the principle of free trade does not apply to today's high-tech, semiconductor, software, and other advanced sectors. The overwhelming portion of the cost of high-tech and other advanced sectors is the accumulation of past investments (R&D investments, sales networks, business acquisitions), and the variable costs that are influenced by macroeconomic factors such as wages, inflation, and exchange rates are so small that macroeconomic policy adjustments are completely ineffective. Once a country becomes a high-tech powerhouse, no amount of currency appreciation or wage hikes can take away its competitiveness. This is called the hysteresis effect, and it is a world in which the principle of increasing returns works. In other words, the winner takes all and cannot be easily destroyed. In state-capitalist China, the power of fostering high-tech companies through national projects is immense, as seen in the rapid rise of Huawei. China's extreme heavy mercantilism was so overwhelmingly in its favor that it was inevitable that the Trump administration would cause trade friction to counter it. But that was not enough, and the Biden administration is embarking on a state-wide industrial development effort.

The rise of Huawei is a good example of China's state involvement, although Huawei's strength has now reached a point where normal market competition is completely uncontrollable. Why did this happen when we were a little careless? The reason lies in Huawei's overwhelming investment in development. As shown in Figure 11, over the past decade, Huawei's R&D investment has increased tenfold (from $1.9 billion in 2009 to $18.9 billion in 2019), while other companies have remained almost flat. This overwhelming investment in R&D by Huawei can only be attributed to government support. It is obvious that Huawei's very strong price competitiveness under government support has overwhelmed other companies with high costs based on market prices, destroying the corporate profits of the entire telecommunications equipment industry, and causing a situation where others cannot compete at all. This is a typical example of social dumping by state capitalism. The U.S. government considered the possibility of fostering domestic telecom equipment companies and called on Cisco and other related manufacturers to acquire Ericsson and Nokia, or to take a stake in them, but Cisco and other U.S. manufacturers reportedly refused, saying that these companies were too unprofitable to be acquired.

At last, the U.S. government is not only shutting down Huawei, which has leapt to become the world's most powerful 5G-related equipment company but is also promoting the exclusion of China in many other high-tech fields and trying to build a new global supply chain that excludes China.

In order to level the playing field, the U.S. will have to provide corporate support, and government involvement will be critical in the global decarbonization movement that has gained momentum in the 2020s. Supporting specific industries and companies with economic penalties and advantages in terms of carbon emissions is truly a public intervention in the private sector.

In the first place, the pastoral free trade theory and the comparative advantage theory were not viable in the 21st century. The following issues can be pointed out.

1. The overwhelming portion of costs are fixed costs (i.e., accumulated past investment in R&D, accumulated capital investment, sales franchise investment, etc.) → Hysteresis effect, world of increasing returns, not easily destroyed, policy is decisive for fixed costs

2. Generalization of international division of labor between processes within a company → For example, Musha Research is also developing international division of labor within a company, even though it is a small company, such as using a database in the U.S. as a material, completing it as a product in Singapore, and selling it in Europe under a Japanese brand and franchise. In this kind of division of labor, the allocation of value-added among countries changes due to the partitioning among countries, and the overwhelming allocation is to HQ (the country where the headquarters is located), which does not fit the law of comparative advantage and factor cost equalization.

3. All direct labor processes will eventually become unmanned → Mother factories will play a decisive role as the key to know-how in manufacturing process organization.

I would like to confirm the significance of state intervention through trade and industrial policy by introducing the new trade theory of Paul Krugman, who won the Novel Prize in Economics. In response to the limitations of the classical free trade theory, the new trade theory proposed by Krugman in the 1980s sought the cause of the international division of labor and the emergence of trade in the form of lower costs resulting from the advantages of scale brought about by the regional concentration of industries. It also believed that what brings about the concentration of industry in a particular region is not a God-given innate, but an acquired second innate. Second nature is a trait that is acquired by chance or policy, but like a gene, it may be small at first, but it is destined to develop in the future. Silicon Valley has the presence of Stanford University and the wonderful weather and nature that attracts talented engineers. In the case of Bangalore, India, policy was decisive. In the case of Detroit, the coincidence of being the hometown of Henry Ford, the founder of the automobile industry, led to the regional concentration of the automobile industry. In each case, the first drop was crucial.

It is similar to the formation of icicles. In winter, large icicles hang down from rain gutters in cold regions such as Hokkaido. The only reason I can think of is that the first drop fell from there. Perhaps there was some small debris on the rain gutters that caused the drops to fall. The paint may have been applied unevenly, creating uneven surfaces. If for some reason the first drop of water is determined to form a tiny icicle, the second drop will always fall from the same spot, and the third and fourth drops continue to grow. Eventually, a large icicle is formed, but this is entirely determined by where the first tiny drop fell from. The hysteresis effect of accumulation further increases efficiency and strengthens competitiveness. Krugman calls the Silicon Valley of high technology and the Seattle of airplanes the places where roulette just happened to stop, but the first drop significantly increases the so-called externality, making it more advantageous for companies, workers, and engineers to be located in close proximity to each other.

When such ex post facto forces bring about the first drop and determine the future fate of the country, government intervention in the form of managed trade, trade policy, and industry development measures, rather than free trade, is sometimes necessary. This means that it is important for the government to intervene to give the second nature. The effect of this first drop has been maximized in the high-tech industry.

This series of arguments shows that there are limits to the market mechanism, or the optimal allocation of resources by the market.

As we have discussed above, this trend is irreversible as long as there are decisive circumstances that make big government inevitable. In the past, the success of the Ministry of International Trade and Industry (MITI)-led Super LSI Technology Research Association (1976-1980) was highly criticized during the Japan-U.S. trade friction, and since then the Japanese government has been reluctant to support industrial technology, partly because of the increasing budget deficit.

However now is the time to change such stance.