Jun 06, 2022

Strategy Bulletin Vol.307

First Summer after the Covid-19, Time for Japanese Stocks

Investment opportunities for Japanese stocks have arrived, and a summer rally may be expected this year. The soft landing (no serious recession) of the U.S. economy is in sight. Once it becomes clear that U.S. stocks have bottomed out, we believe that Japanese stocks will become a focal point of global trading.

Pent-up demand will explode

Markets have passed the sharp selloff that lasted until mid-May and are settling down. With the bottoming out of U.S. equities clear, we believe Japanese equities will become the focus of global buying. The market has digested the triple whammy of the pandemic, the Ukraine

war, inflation, and US interest rate hikes, and can no longer ignore the underlying positives. The fact that the Covid-19 has been conquered is significant. The pandemic has accumulated desire and savings. The power of its release is considerable. After the end of the Corona pandemic, this summer will probably see an explosion of pent-up desire in both the U.S. and Japan.

Soft Landing Likely for the U.S.

The U.S. GDP for the first quarter of 2022 is -1.5%, but this is due to a decline in net exports and inventories, while consumption, which accounts for 70% of GDP, is steady at 3.1%, so there is nothing to worry about. Favorable factors such as strong consumer confidence plentiful savings and good wage growth with narrowing inequality are conspicuous that contribute continuous strength of consumption. Since inflation is occurring in three stages, first in durable goods, then in services, and then in wage increases to supplement living expenses, it will take 2-3 years to fully subside, but none of this will take hold for a long time. The Fed has now largely done its job and will likely tone down the tightening as further declines in stock prices and deteriorating sentiment will increase the risk of recession. Both the market and the authorities are aware that supply chain disruptions and rising energy prices have their own deflationary effects, both of which are outside the Fed's control.

The driving forces behind the U.S. stock market (SP500 Index), which has increased sevenfold in the 12 years since the GFC, are the increased innovation and strong corporate profits due to the digital revolution. As they are still intact the long-term stock market trend is not impaired at all. The U.S. is the world's largest producer of oil and gas and the world's largest exporter of grains, so the surge in commodity prices should not have a negative impact to the US.

Some good news from the Ukrainian side will be likely

The war in Ukraine is protracted, but catastrophe has been averted. Crude oil and gas prices will not be further disturbed, despite high volatility. The establishment of a de-Russian energy regime will be realized over time. The situation is likely to improve, not worsen, with a counteroffensive by Ukraine, which has received new arms supplies since June, plunging Russia into both military and economic difficulties, and inevitably leading to increased criticism of Putin at home. This summer may bring good news from the Ukrainian side.

China will take steps to avert a stall

China's economic slowdown is the biggest concern, but the Xi administration is likely to take some measures before the party congress. The economy has stalled due to the lockdown caused by the rekindling of the Covid-19 crisis, a drop in domestic demand caused by the dissolution of the real estate bubble, and a sharp decline in the growth rate of exports and imports. China, which was supposed to be the winner of the Corona disaster, is now the loser. The restructuring of global supply chains dependent on China has begun. It appears that a substantial outflow of funds is occurring from China ($600 billion in net international investment position has been lost in one in 2021). However, monetary easing and the resurgence of public investment will prevent a sudden acceleration of the decline.

Japan will become a bright spot for global investment

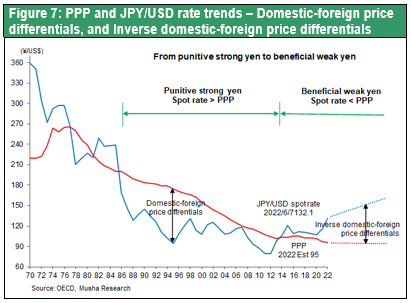

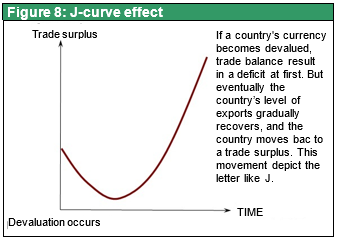

This means that Japanese equities will have a chance to take advantage of this situation. Musha Research's "Nikkei 225 will reach 40,000 yen" is becoming more likely to come true. Japan's advantageous position emerges amidst ample investment funds and difficulties to find attractive investment targets in the world. The yen's depreciation has significantly enhanced Japan's position in the international division of labor, and the J-curve effect has ended its initial negative period and is now entering a harvesting period. In other words, at the beginning of the yen's depreciation, the unit cost of imports rises, and the trade deficit increases, at which point the yen's depreciation appears negative, but eventually the yen's depreciation will bring about a significant volume change. In the domestic market, there will be a shift from expensive imports to cheap domestically produced goods, and in overseas markets, underpriced Japanese products will displace foreign products and increase their market share, leading to increased production, employment, and investment in Japan. For companies that manufacture overseas, the depreciation of the yen greatly increases the profits of overseas factories, which in turn benefits the parent company in Japan in the form of increased financial income and services, such as intellectual property fees and dividends. For companies that have conducted global M&A, which have increased significantly over the past decade, the fruits of their investments made when the yen was strong will blossom at once. It is inevitable that, after a certain period of gestation, the yen's depreciation will greatly stimulate domestic economic activity.

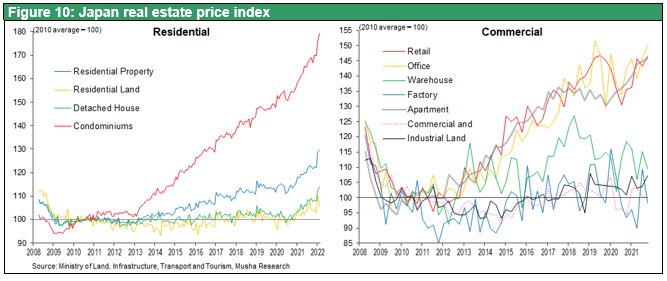

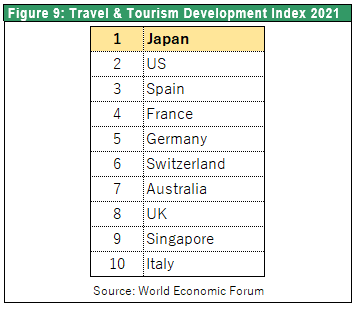

Concerns that the Kishida administration's "new capitalism" would be anti-market in nature appear to have been unfounded. The slogan of doubling incomes has shifted to a more market-oriented policy of doubling asset incomes, which is to be welcomed. There are a lot of favorable factors such as (1)post-Covid -19 pent-up demand and accumulated savings will be released after this summer, (2) the US-China conflict and the weak yen will bring high-tech industries back to Japan, (3) Japan, the world's most popular tourist destination, will be greatly stimulated by the weak yen, (4) Japan is also experiencing a housing boom that has come full circle, and (5) corporate earnings are at record highs and stock price valuations are at record lows that force domestic and foreign investors to be aware of the risk of not holding Japanese stocks. This is a good time to invest in Japanese stocks.

<Figure Analysis >

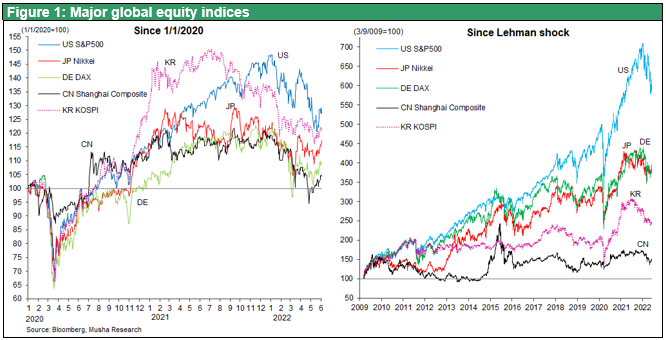

I. The post GFC uptrend in Japanese and U.S. stock prices is alive and well, and the adjustment in the first half of 2022 may be almost over. The driving force behind the U.S. stock market (SP500 index), which has increased sevenfold in the 12 years since the GFC, and the trend of increased innovation and corporate profits due to the digital revolution are alive and well. The 20% decline since the beginning of the year indicates that we may have reached a major bottom.

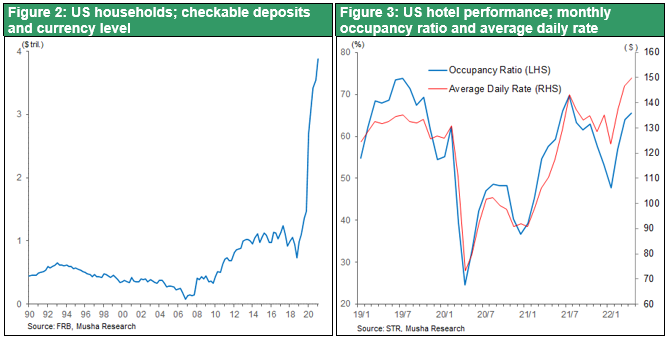

II. Savings surge under the pandemic pent-up demand explodes, and summer will be a boom time for big trips out. U.S. households' deposits are surging due to government support for the disaster and curbs on consumption. Travel demand to explode in the summer since the suppress of the pandemic.

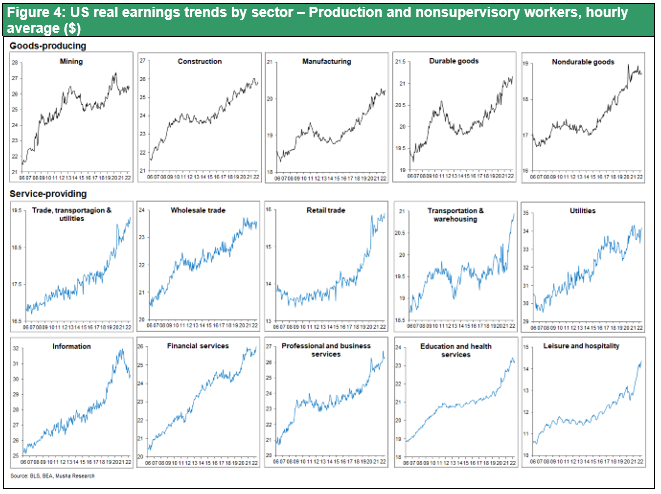

III. Good inflation in the U.S. = narrowing wage gap. Wages of hard-working truck drivers and hospitality workers are rising rapidly, but real wages of highly paid white-collar workers in the information, financial, and utility industries are declining, and the gap is narrowing.

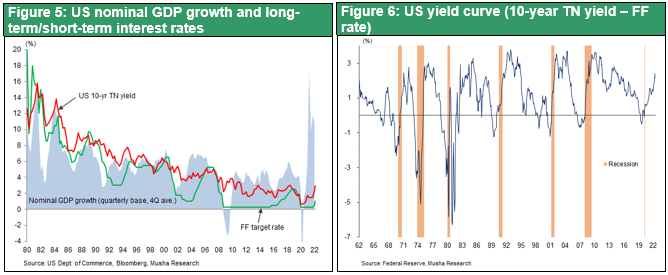

IV. Monetary tightening has been factored in, and U.S. financial market stability is strong. Financial markets foresee a successful soft landing in the U.S. The yield on the 10-year Treasury note seems to be peaking at over 3%, far below nominal GDP (over 10%), and the yield curve (10-year yield - FF rate) is far from negative, which is the best predictor of a recession. Long-term interest rates remain far below nominal growth, which Greenspan called a "conundrum" in 2005 and Bernanke called a "global saving glut”. This is the anchor of U.S. finance, and it is alive and well.

V. The era of unprecedented yen depreciation benefits has begun. The yen's depreciation to more than 30% below its purchasing power parity will stimulate domestic investment and employment growth.

VI. J-curve effect: The benefits of the yen's depreciation will become apparent in the future even though it seems to be negative short term. The biggest factor for stock market appreciation.

ⅥI. Japan has become the leader in tourism development ability. The number of visitors will increase rapidly under the weak yen.

VIII. Japan's housing boom (not a bubble!) has arrived and is accelerating