Jun 27, 2022

Strategy Bulletin Vol.308

It's not yen carry, it's Buffett carry

-The final chapter of Japanese asset deflation

Hedge funds challenge BOJ YCC policy

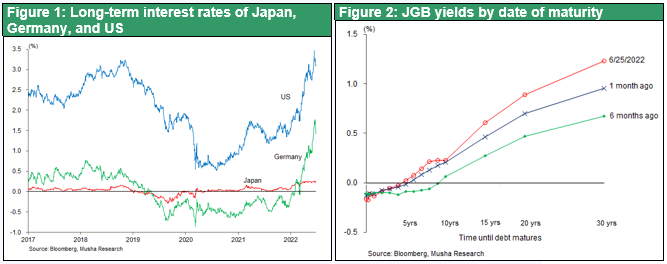

While central banks across the world are raising interest rates, the contrast is stark with the Bank of Japan, the only bank that has strictly adhered to an accommodative stance. The speculative positions of hedge funds, which claim that the BOJ's policy of yield curve control (YCC), isolated from this global trend, is unreasonable, are shaking up the market. UK hedge fund BlueBay Asset Management is selling Japanese government bonds on the reading that YCC, which keeps the 10-year JGB yield at 0.25%, will lead to a sharp fall in the yen, forcing the BoJ to abandon its YCC policy and allow the 10-year JGB yield to rise to prevent a weaker yen.

The hedge fund challenge to central bank policy is reminiscent of G. Soros' challenge to the Bank of England (BOE). This time, as in 1992, markets have been destabilized by speculation that the BOJ will be defeated by the hedge funds and forced to change its monetary policy. In fact, yields on very long-term bonds outside the BOJ's YCC have risen sharply, indicating a major distortion in market interest rates. If the BOJ, the anchor of global finance, is defeated by hedge funds and forced to change its policy, the chain of events will shake the global financial markets. Sell the yen, sell Japanese government bonds, sell stocks, sell Japan, sell the BOJ," the speculators are heard to say.

No dichotomy like the UK in 1992

The BOJ is not in the same dilemma as the BoE in 1992, when the UK was faced with the dilemma of either accepting a weaker currency or giving up on interest rate cuts as a countercyclical measure. The UK was a member of the European Exchange Rate Mechanism (ERM) in 1990, which obliges the UK to limit exchange rate fluctuations to +/- 2.25% of the base rate, so there was no option of cutting interest rates to cause currency depreciation. However, G. Soros read that the situation in which the UK's monetary policy was tied up by Germany, a leading member of the ERM, was unsustainable, so he sold the pound and the UK opted to cut interest rates and leave the ERM. Mr Soros reaped huge profits.

Activation and limits of the yen carry trade

The speculation that the BOJ would also lose out to speculators has triggered the yen carry trade, an operation in which funds are raised in low-interest-rate yen and invested in high-return foreign currency assets, triggering a cycle of selling JGBs and selling the yen. This has given impetus to the yen's depreciation, which may continue for some time. However, the double carry situation, which benefits from both interest rate and exchange rate differentials, will not last forever. Firstly, the dollar/yen rate is at an all-time low, 30% off its purchasing power parity, and is at a level that can trigger a fear of heights at any time; secondly, inflation, which is causing US interest rates to rise, has already peaked out and further expansion of the US-Japan interest rate differential may not occur. Thirdly, a weaker yen is inherently positive for the Japanese economy, employment and investment, and there is no reason why the BOJ, which is aiming for 2% inflation, should stop the yen from weakening, especially once the Upper House election is over, and the importance of inflation and a weaker yen as an election policy will decline. There is also a reasonable risk of a reversal to a stronger yen, and it is unlikely that a strategy of betting on a weaker yen will become a major trend here.

The power of the Buffett carry

The problem with BlueBay Asset Management's position is not that it is short JGBs, but that it carries the yen. The time will eventually come when the 2% inflation target is realized and the BoJ stops the YCC. If this is the case, the yield on 10-year JGBs is unlikely to fall much below the YCC ceiling of 0.25%, and in the longer term it is likely that the YCC will be changed and the yield will rise above 0.25%, making a position of shorting (=raising) 10-year JGBs at 0.25% not far off the mark.

The question is where to invest the funds raised by shorting JGBs. If the funds are invested in high-return assets in Japan, rather than foreign currency assets, there is the potential for significant gains. Let us call this Buffett carry (although there are differences in management style and investment period).

In August 2020, W. Buffett, who had been consistently reluctant to Japanese stock investment, invested approximately USD 6 billion (JPY 640 billion) to acquire 5% of five major trading companies (with a combined market capitalization of JPY 14 trillion). At the end of August 2020, the stock prices of the five major general trading companies ranged from 640-2724 yen. The current share price is between JPY 1,216 and 3,959. The value of the investment in the five major general trading companies is valued at over JPY 1 trillion, and it is estimated that the performance has almost doubled in less than two years since the investment was made.

Buffett's investments were funded by a total of JPY 625.5 billion yen-denominated bond issue in September 2019 and April 2020. The cost was an interest rate of 0.44% on 10-year bonds in the average zone, while trading companies were on an ultra-positive carry, with dividend yields of 4-6% alone. Add to this the gains in share price gains linked to the surge in resource prices, and the results were significant.

Buffett carry's next real estate target?

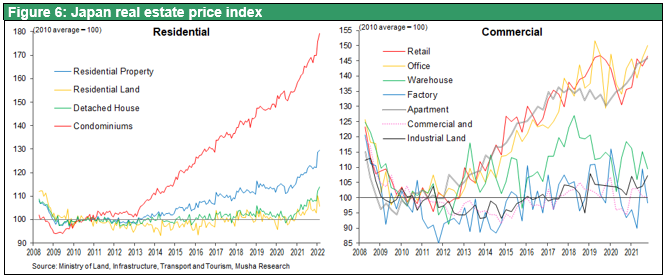

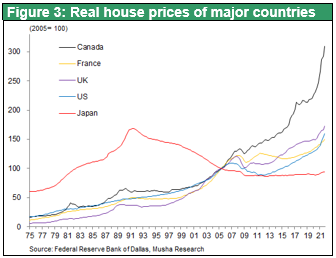

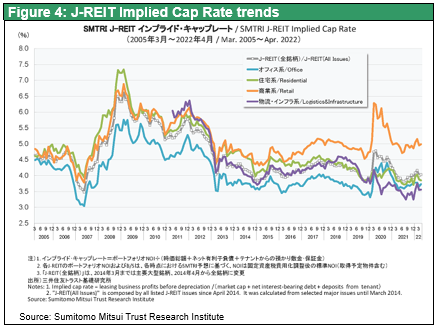

The effectiveness of the Buffett carry, which involves raising funds in yen and investing in yen assets, can be said to have been proved. The most promising targets for Buffett carry are real estate, J-REITs and Japanese equities (especially high-dividend value stocks). BlueBay Asset Management may decide to allocate funds raised through shorting Japanese government bonds to Japanese assets with high returns. Firstly, global investors are expected to invest in real estate using yen funding. Japanese property prices are far from the global trend and are significantly undervalued compared to other countries. In addition, even as interest rates have been falling since 2010, the cap rate (investment business profit/property prices) has remained high, widening the gap with interest rates and increasing the relative attractiveness of investment.

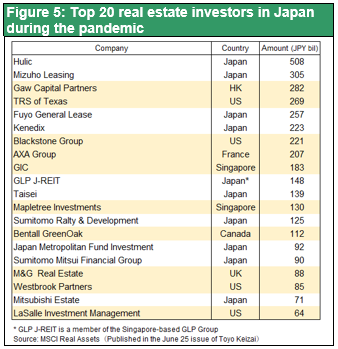

In fact, demand for property investment from overseas is increasing. Figure 5 shows total investment amount ranking of deals of over ¥1bn settled between October 2020 and March 2022, of which 10 out of 20 were by overseas investors (most of them funds). (Toyo Keizai, no. 6.25) It can be inferred that many of these were funded in yen.

The Buffett carry, which started with trading companies and is now about to take a big leap forward in real estate, will be the backbone of foreign investment in a wide range of Japanese equities. This would ensure the BOJ's long-sought exit from asset deflation through portfolio rebalancing.

Shorting JGBs by hedge funds is not a move to sell Japan, but to buy Japanese equities.