Jul 14, 2022

Strategy Bulletin Vol.309

The U.S. Economic Recovery Theory You Haven’t Realized Yet

- The U.S. Bubble Burst Theory that is making too much noise...

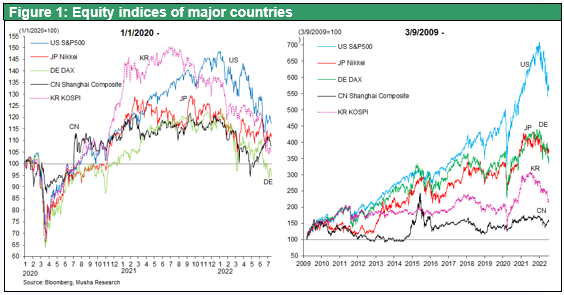

We ended the first half of 2022 on a high note. The first half performance was solid with TOPIX -5% compared to the S&P 500 -20%. However, on a dollar basis, TOPIX was -20%, a decline similar to that in the U.S.

Global stock prices may have almost bottomed out in the first half of this year. In the second half of the year and into 2023 U.S. stock market is expected to gradually firm up, although some turbulence will remain. The U.S. stock market is expected to decline mildly from -10% to 0% for the year. This may be a good time to invest.

Why are we hopeful? We can expect three positive factors going forward. 1) Inflation peeking out, 2) A sense that interest rate hikes have run their course, and 3) The Fed will not kill off good inflation.

(1) Inflation will definitely peak out

Inflation with complex fractures, precedents do not apply

Inflation is expected to subside. The current inflation is specific. that several varied factors have brought about high inflation in a multi-layered manner. It would be a mistake to apply the old theory of inflation in general. There is little likelihood that the stagflation of the 1970s and 1980s will reoccur. It is dangerous to apply the general theory that "wage increases caused by economic overheating are the cause of inflation and that the economy needs to cool down".

Supply Chain Factors will be a Factor in Falling Prices

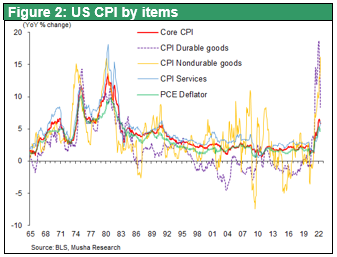

The primary cause of inflation is supply chain disruptions. Never has the CPI durable goods index risen 17% from the previous year. Durable goods in the U.S., as in Japan, have always declined over the long term. The typical example is the large production cutback of automobiles due to the shortage of semiconductors. The price of new and used cars skyrocketed due to supply shortages. In addition, the price increase was spurred by a sharp rise in demand for PCs, smartphones, and other high-tech equipment due to the Corona disaster. However, supply chain constraints will ease in the future. The congestion of vessels at ports is rapidly improving, and freight rates are falling. In addition, PC and smartphone production is being adjusted as demand for nest eggs has run its course. The price of semiconductors such as memory is beginning to fall. In addition, the strong U.S. dollar is expected to put downward pressure on the CPI.

The strong U.S. dollar is expected to exert downward pressure on the CPI

Core commodities (goods excluding food energy) have a 21% weighting in the CPI, 80% of which are imported. Annual imports amount to about $3 trillion. The dollar has already appreciated 10% year over year, and its contribution to core commodities consumption is a price decline of $300 billion. The contribution to the CPI is a $300 billion price decline, which lowers the overall CPI by about 1.5%.

The second reason for inflation is the surge in oil, gas, and grain prices due to the war, which is also likely to peak out. Alternative energy sources to replace the Russian embargo are being sought, and the increase in coal-fired power production in Germany, LNG imports, strengthening of nuclear power plant operations in the EU, and increased oil production in Saudi Arabia and other countries is being pursued. Biden's visit to the Middle East in July suggests a shift in U.S. energy policy toward an emphasis on supply. On the other hand, the supply of gas and crude oil from Russia has been greatly reduced due to the shift of export destinations to India and China. On the other hand, gas and crude oil supplies from Russia will not decrease significantly due to a shift in export destinations to India and China. Supply will increase and demand will soften as global growth slows. The U.S. CPI non-durable goods index, which is soaring now, will peak out.

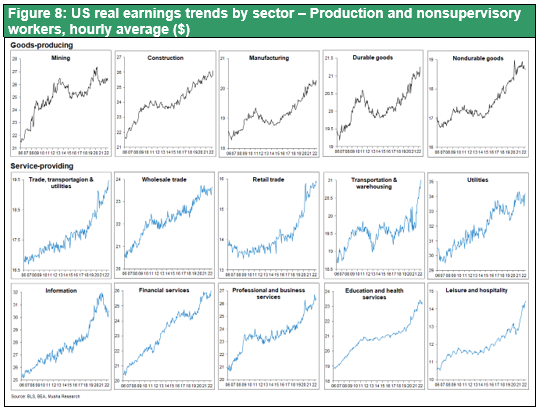

Wage growth rate to slow down

The third reason for inflation is rising wages. Wage growth has accelerated since late 2021 but has slowed on a month-over-month basis. The most widely observed average hourly earnings appear to have peaked out (except for construction). The month-over-month changes are: 21/ September (0.5), October (0.6), Nov (0.4), Dec (0.5), 22/Jan 2010 (0.6), Feb (0.1), Mar (0.5), Apr (0.3), May (0.4), and June (0.3). The deterioration in consumer sentiment and the decline in stock prices and other asset prices may have begun to have an effect. Stock prices have fallen 25% since their peak at the beginning of the year. The market capitalization has declined by $10 trillion from $42 trillion to $32 trillion. Similarly, the crypt currency market capitalization fell by $2 trillion, from $2.9 trillion to $0.9 trillion, for a total loss of $12 trillion in wealth. As the wealth effect (the impact of an asset price change on GDP consumption) is calculated to be 3.2%, the resulting reduction in consumption demand would be $460 billion, pushing GDP down by about 2%. In other words, the mere threat of an interest rate hike is enough to cause stock prices to fall, which can be seen as an automatic stabilizer. The extreme decline in the Michigan Consumer Confidence Index is a major projection of such deteriorating sentiment.

All these factors together should lead to a marked decline in the rate of increase in price data from the second half of this year onward.

(2) Financial markets anticipate a round of Fed tightening will be over

Inflation expectations and long- and short-term interest rates appear to have peaked out

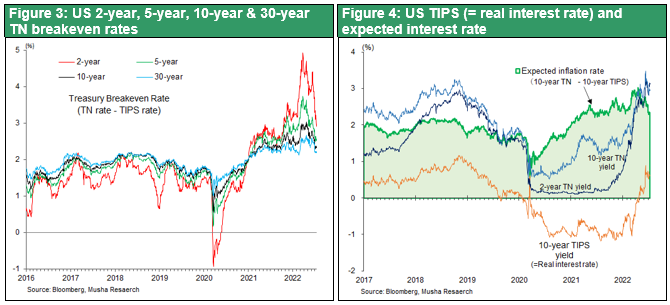

At the June FOMC meeting, the FOMC indicated that it expects the policy rate to be 3.4% at the end of 2022 and 3.8% at the end of 2023. The FOMC has raised policy rates to a cumulative 1.5% so far, and the FOMC has indicated that it will raise rates by another 1.65% to 1.9% by the end of the year and by another 0.4% in 2023. But the market does not believe it. The market, however, does not believe it. U.S. government bond yields have already peaked out at 2, 5, and 10 years. They are anticipating a marked quelling of inflation and a suspension of the Fed's interest rate hikes. The expected inflation rate, calculated as the difference between the Treasury bond yield and the TIPS, peaked at 4.9% for the 2-year and 3.0% for the 10-year at the end of March and has fallen sharply to 3.2% for the 2-year and 2.3% for the 10-year as recently as July 12.

Peak-out of the U.S. long-term interest rate is a unique good news

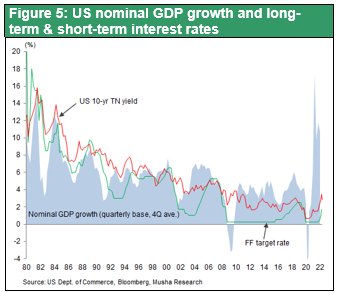

Some people think that the fact that U.S. long-term interest rates peaked at 3.5% at the end of March and have fallen to the 2% level foretells an economic stall. If the yield on 10-year Treasuries peaked below the FOMC's 3.8% final policy rate, that would be a positive thing. For a long time, the bearish camp argued that falling long-term U.S. interest rates were a harbinger of an economic "stall. This has been a misinterpretation for the past 40 years. As shown in Chart 5, the U.S. long-term interest rate (10-year Treasury bond yield) has been far below the nominal economic growth rate since around 2000. This is the root cause of the sustained economic growth and long-term stock market rally, which continues even under the inflation spike in 2022 and the stock market plunge in the first half of the year. This is the most important condition for being bullish on the economy and stock prices.

(3) Why the Fed is essentially dovish?

The more fundamental reason for being optimistic about U.S. equities is that the U.S. is experiencing healthy inflation and the Fed is not likely to overtighten to kill it.

U.S. Economic Command Center Confronts Fundamental Contradictions in the U.S. Economy

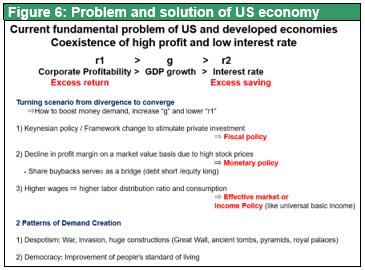

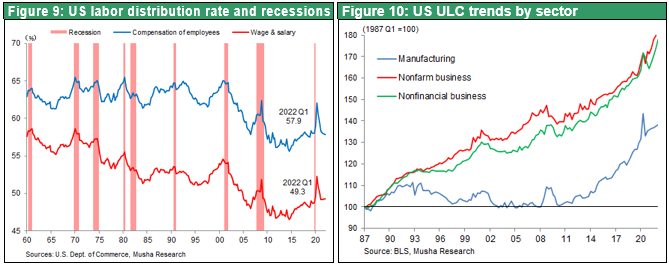

The U.S. economy faces a fundamental contradiction: r1 > g > r2 (profit rate > growth rate > interest rate). The excess profits of corporations have stagnated in the financial markets and caused historically low interest rates. So far, this combination of high profits and low interest rates has induced stock market rallies, however, if the divergence between the two becomes unlimited, the economy will plunge into a Depression. The substantial and desirable solution to this problem is to increase consumption through higher wages.

Why higher wages are a good thing

There are three characteristics that lead us to conclude that the current wage increase is a good thing.

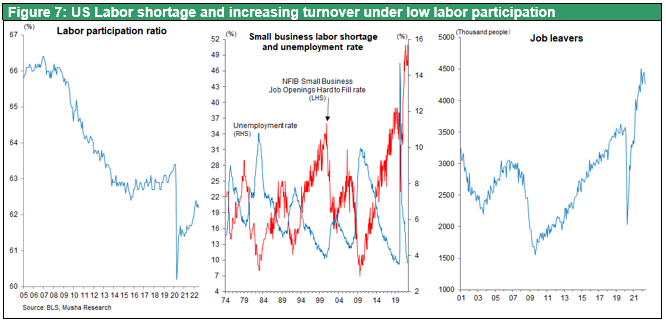

1. Wages are rising for low-wage muscle workers such as truck drivers but falling for higher-wage workers in the information, utility, and financial industries, indicating that the gap is narrowing.

2. The bargaining power of workers is increasing. While companies continue to have difficulty in recruiting new workers, the number of workers who have voluntarily left their jobs has reached a record high. This indicates that workers are choosing jobs, which means that

3. Strong Job opening means corporations have enough ability to absorb wage increase that enhance consumption

Since around 2016, the unit labor cost of firms has been rising and the labor share has bottomed out which continues up to now. Both trends have boosted household labor income, which is a positive development in the economy as a whole. The biggest problem of the U.S. economy is the accumulation of excess profits by the corporate sector and the wealthy, which are not easily linked to real demand. This is being corrected now.

The Fallacy of U.S. Bubble Burst and Other Sensationalism

The US economic commanders, the Treasury Department and the Fed, are aware of the above good inflation and are not likely to overkill the economy. The overkill is unlikely to be triggered by the above-mentioned inflation.

The sensationalist view that excessive monetary easing in the U.S. has created a bubble, the blame for which is the imminent collapse of the bubble and severe recession, is misguided.