Sep 15, 2010

Strategy Bulletin Vol.30

A Change of Direction (3)

The Speculative Rise of the Yen Nearing the End

Forex market intervention demonstrates international understanding of the need to

The Japanese government and Bank of Japan have at last reached the decision to intervene in foreign exchange markets. But Japan is acting alone. The consensus view is that stopping the yen’s climb will be difficult because the U.S. appears to want the dollar to fall. However, we believe that Japan’s intervention will succeed with the strong support of the U.S. As a result, the yen has most likely reached its peak.

establishing an economic recovery cycle. As stock prices climb, consumer sentiment will improve, which will fuel a rebound in spending, a recovery in production and finally an upturn in jobs. Since there is no outlook for extremely bad economic statistics, the additional monetary easing that is expected from the Fed will be preventive rather than supplementary actions. It should be obvious to anyone that the goal is to improve expectations (sentiment), which means push up stock prices. The objective of additional monetary easing is primarily to stop financial markets from shifting to a stance of risk avoidance and encourage investors to resume risk-taking. So the U.S. should welcome the positive effect on market sentiment as sales of the yen support a rally in U.S. stocks.

establishing an economic recovery cycle. As stock prices climb, consumer sentiment will improve, which will fuel a rebound in spending, a recovery in production and finally an upturn in jobs. Since there is no outlook for extremely bad economic statistics, the additional monetary easing that is expected from the Fed will be preventive rather than supplementary actions. It should be obvious to anyone that the goal is to improve expectations (sentiment), which means push up stock prices. The objective of additional monetary easing is primarily to stop financial markets from shifting to a stance of risk avoidance and encourage investors to resume risk-taking. So the U.S. should welcome the positive effect on market sentiment as sales of the yen support a rally in U.S. stocks.

Reason 1: Unwinding short U.S. stock positions and long yen positions will push U.S. stock prices higher

As I have reported before, speculation is the reason that the yen has strengthened to a point well beyond its true economic value. Driving this speculation is the global deflation scenario. This scenario appears to be prompting speculators worldwide to sell assets with risk and buy the yen with the proceeds of these sales. And U.S. stocks are the most prominent category of assets with risk exposure. This explains why the yen’s appreciation has been accompanied by falling U.S. stock prices. Consequently, once the yen stops climbing, we should see a powerful rally in U.S. stocks as investors unwind positions linked to the global deflation scenario.Reason 2: Stopping the yen’s appreciation is also beneficial to the U.S. as it fights deflation

U.S. government agencies are doing everything possible to fight deflation. Boosting stock prices is vital to establishing an economic recovery cycle. As stock prices climb, consumer sentiment will improve, which will fuel a rebound in spending, a recovery in production and finally an upturn in jobs. Since there is no outlook for extremely bad economic statistics, the additional monetary easing that is expected from the Fed will be preventive rather than supplementary actions. It should be obvious to anyone that the goal is to improve expectations (sentiment), which means push up stock prices. The objective of additional monetary easing is primarily to stop financial markets from shifting to a stance of risk avoidance and encourage investors to resume risk-taking. So the U.S. should welcome the positive effect on market sentiment as sales of the yen support a rally in U.S. stocks.

establishing an economic recovery cycle. As stock prices climb, consumer sentiment will improve, which will fuel a rebound in spending, a recovery in production and finally an upturn in jobs. Since there is no outlook for extremely bad economic statistics, the additional monetary easing that is expected from the Fed will be preventive rather than supplementary actions. It should be obvious to anyone that the goal is to improve expectations (sentiment), which means push up stock prices. The objective of additional monetary easing is primarily to stop financial markets from shifting to a stance of risk avoidance and encourage investors to resume risk-taking. So the U.S. should welcome the positive effect on market sentiment as sales of the yen support a rally in U.S. stocks.

Reason 3: Intervention to buy dollars is directly linked to U.S. monetary easing

A stronger yen means that money is flowing from the U.S. to Japan. This is why halting yen speculation and returning funds from Japan to the U.S. is vital to stopping the negative cycle that leads to global deflation. Let’s assume that Japan spends ¥30 trillion for foreign exchange intervention and buys $350 billion of U.S. Treasury securities. These actions would greatly support the additional monetary easing measures that the Fed is considering. Creating a joint international program to prevent the yen from strengthening would benefit the world rather than Japan’s ego. Japan spent the enormous sum of ¥30 trillion in 2003 for interventions to stop the yen from climbing. The resulting supply of liquidity to the world from Japan is viewed as having revitalized the global economy but was also the source of another asset bubble. Currency interventions by Japan can therefore be regarded as a contribution from Japan to international monetary easing. This time as well, currency intervention by Japan may cause the yen to decline, which would yen-denominated liquidity and cause Japanese stocks to rally. If this can be achieved, Japan will probably play a major role in helping prevent global deflation.Reason 4: Criticism of China’s currency manipulation

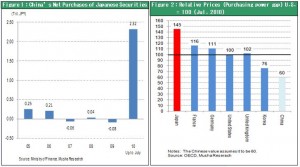

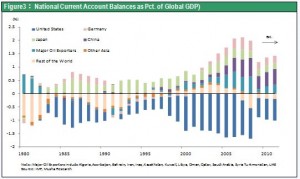

Tension between Japan and China was the top story last Friday in the Asian editions of both The Financial Times and The Wall Street Journal. The Financial Times looked at the real reason for the rapid increase in Chinese investments in Japan as tension between the two countries increases. The Wall Street Journal focused on Japan’s criticism of China as the yen continues to strengthen. China’s use of foreign currency reserves to buy Japanese government bonds is viewed as a major cause of the yen’s strength. In global financial circles, there is growing criticism of China’s manipulation of foreign exchange rates, which is a stance that is sympathetic to the problem of the yen’s appreciation. If China is keeping its markets closed while buying Japanese government bonds to push the yen higher, this would be a classic example of a beggar-my-neighbor policy. The environment has matured to the point where people think it is natural for Japan to use foreign currency intervention to offset sales of dollars by China as it reduces its dollar holdings.Reason 5: The yen’s strength cannot be justified by fundamentals

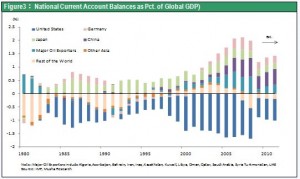

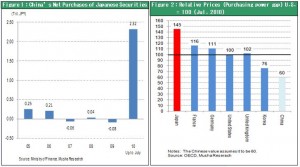

The current strength of the yen is not warranted and is very harmful to Japan. According to OECD relative price comparisons, the yen is overvalued by 45% in relation to the dollar (June 2010). Looking at two countries that compete with Japan in export markets, Germany has a currency that is 11% overvalued and South Korea’s won is 24% undervalued (June 2010). Due to the yen’s appreciation since June, the yen is currently estimated to be overvalued by 50% in relation to the dollar. This extreme overvaluation is the result of speculation based on the belief that the global deflation scenario will create problems for the entire world. Every country should be able to agree that a correction is needed.