Aug 03, 2022

Strategy Bulletin Vol.311

Abenomics' historical achievements and Japan's future - The sophistry that Abenomics has failed

Lecture notes of the memorial seminar for former Prime Minister Abe (2)

Musha Research held a memorial seminar for former Prime Minister Abe on July 21.

Previous issue of Strategy Bulletin Vol. 310 carries "Shinzo Abe, Japan, and the World" by Yoshihisa Komori, Washington correspondent for the Sankei Shimbun. The following is Musha Ryoji's lecture notes titled "Abenomics' historical achievements and Japan's future - The sophistry that Abenomics has failed”.

-----------------------------------------------------------------------------------

Since Mr. Komori has given us an overall picture of former Prime Minister Abe and his politics, diplomacy, and security, I will focus on what Abe's politics has brought about from the economic aspect.

(1) The great achievements of Abenomics

Unfair criticism of Abenomics

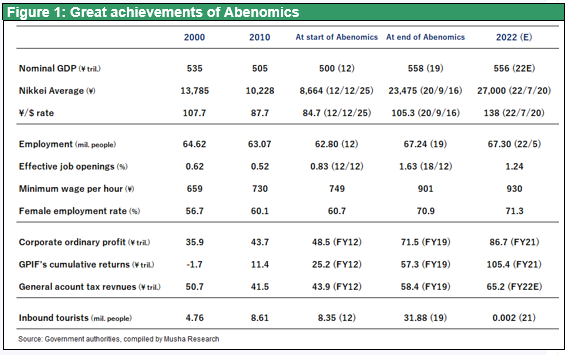

When Abenomics was launched, there was a lot of skepticism about whether it would deliver the kind of results we are seeing today. But in those seven years and eight months, the Japanese economy has changed dramatically. And many Japanese do not know this, or the media hardly report it, which is unfair. So, I made the table below to explain how much the Japanese economy has changed during the second Abe administration.

Firstly, in terms of nominal GDP, from around 2000 until the second Abe administration came to power at the end of 2012, Japan's GDP was almost 500 trillion yen, which was completely flat, but by 2019, just before the end of the Abe administration, it had increased by 10 per cent to 558 trillion yen. This is an annual growth rate of 1.2%, which makes it a low-growth group in the world, but it is safe to say that the country has broken out of its past stagnation. Stock prices, however, as is well known, have increased 2.7-fold, from 8644 yen at the birth of the Abe administration to 23475 yen when he left office, a 2.7-fold increase in the Nikkei 225. This is one of the highest growth rates in the world, except in the US. The exchange rate has dramatically weakened from 84 yen/dollar at the time of his birth to 105 yen/dollar in September 2020 when he left office, and to 136 yen/dollar today. Many have coldly assessed that Abenomics has achieved only a weaker yen and higher stock prices, but this is not true.

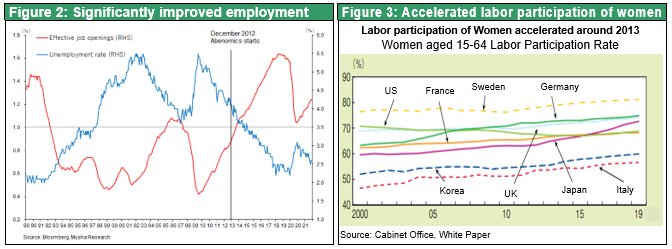

Significant employment growth and women's entry into society

The most important result of Abenomics has been employment: the number of people in employment, which stagnated at around 63 million from 2000 to 2012, increased by 4 million to 67 million when the Abe administration left office. The unemployment rate improved dramatically from 4.3% to 2.2% and the effective opening‐to‐applicants ratio went up from 0.83 to 1.63. The minimum wage also broke out of its long-term stagnation, from 749 yen in 2012 to 901 yen in 2019. Many point to the lack of increase in average wages, but the tight labor supply and demand just before the outbreak of the Corona disaster shows that wages were on the verge of rising. Another striking trend is the entry of women into society: in 2012, the labor force participation rate of women(aged15-64) was 60.7%, which was quite low among developed countries, but seven years and eight months later it has risen to 70.9%, a level much higher than in the United States.

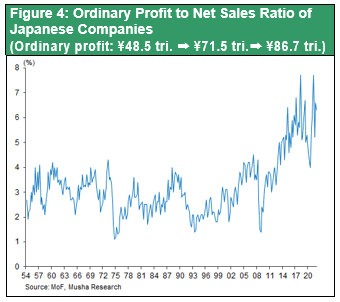

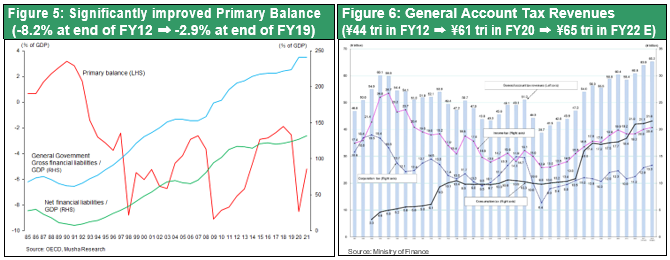

Dramatic improvements in corporate earnings and tax revenues

The more significant result of Abenomics, however, has been corporate profits, which have doubled from ¥40 trillion from 2000 to 2010 and up to 2012, when Abenomics began, to ¥71 trillion in FY2019 and ¥87 trillion in FY2021.

The government's fiscal balance has also improved significantly. The primary fiscal balance rose from -8.2% just before Abenomics began to -2.9% at the end of the Abe administration, an increase of about 6 percentage points, due to two consumption tax hikes and an increase in income tax due to economic expansion. Noteworthy is the remarkable increase in tax revenues: in FY12, Japan's general account tax revenues were JPY 44 trillion, but they increased to JPY 58 trillion in FY 2019 and JPY 65 trillion in the FY2022(expectation), a 50 % increase over a decade ago.

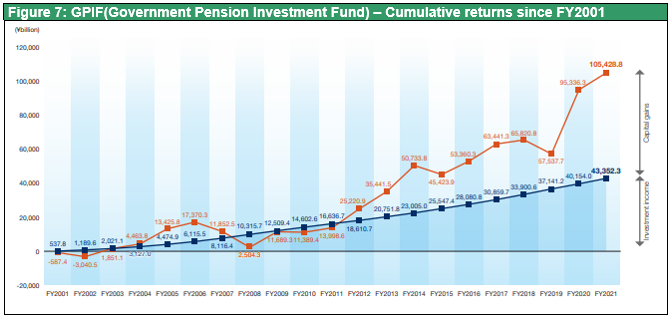

Pension finances have improved markedly, from investment gains of JPY 25 trillion to JPY 105 trillion

Furthermore, pension finances have improved significantly due to increased investment income. The GPIF's assets under management as of the end of FY2021 were 197 trillion yen, of which ¥105 trillion was accumulated investment income. Since the reform of the GPIF under Abenomics since 2013, assets under management have increased by JPY 77 trillion and accumulated investment income by JPY 80 trillion, so the improvement in pension finances has been solely due to the increase in investment income.

An overview of the GPIF's portfolio shows that domestic bonds, which accounted for a majority of 62% in 2012, were reduced to 24%, and the proportion of domestic stocks (15% ➡ 24%), foreign stocks (12% ➡ 25%), foreign bonds (12% ➡ 25%) ware increased significantly. The expansion of accumulated investment returns of ¥80 trillion from the end of FY2012 to the end of FY2021 consisted of ¥27 trillion in domestic equities, ¥41 trillion in foreign equities and ¥9 trillion in foreign bonds, and was due to the 2013 reform of the GPIF. The revision of the basic portfolio that have reduced domestic bonds from 60% ± 8% to 35% ± 10% had a decisive impact.

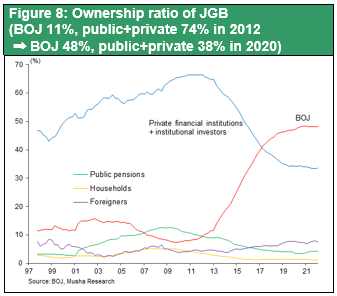

In line with this, the BOJ has taken over the JGB holdings of the GPIF, private financial institutions and postal savings with Quantitative Monetary Easing. The BOJ's JGB holdings of total JGB outstanding rose from 11% at end-2012 to 48% at end-2020. By having the BOJ shoulder, the responsibility for JGBs that do not generate any returns or could become unrealized losses, the GPIF and private financial institutions have been freed up to invest their funds to a large extent, enabling them to generate high investment returns.

Many people claim that even though stocks have risen, and investment income has increased dramatically in this way, only the wealthy have been rewarded and the public has not been made happy, but this is also completely off the mark.

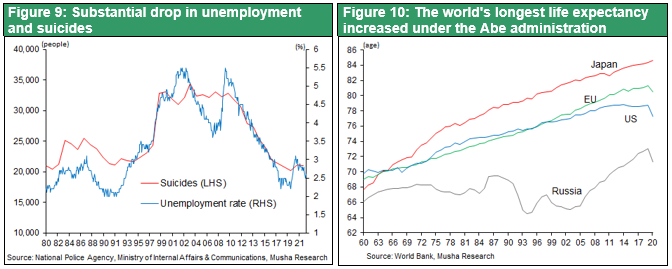

Heightened sense of well-being, sharp decline in suicides and increased life expectancy

Looking at wellbeing in terms of the number of suicides and life expectancy, there has been a marked improvement before and after Abenomics. The number of suicides rose sharply after the outbreak of the financial crisis and the deflation since 1997, along with a sharp rise in the unemployment rate, and stayed at around 32000, but has fallen significantly to around 20000 in 2019. In addition, life expectancy, the longest in the world, has increased further under Abenomics.

In this light, the claim that Abenomics has not been successful because the 2% inflation target has not been achieved is not only a weak argument, but can even be called sophistry, which includes white as black.

(2) The geopolitical follow winds blowing in Japan and the Abe administration

Geopolitics has defined Japan's modern history

Musha Research has consistently argued that the most important thing when considering the economy and markets from a long-term perspective is "geopolitics, or in other words, the relationship with the superpowers that govern the world". This geopolitical environment has changed dramatically with the advent of the second Abe administration.

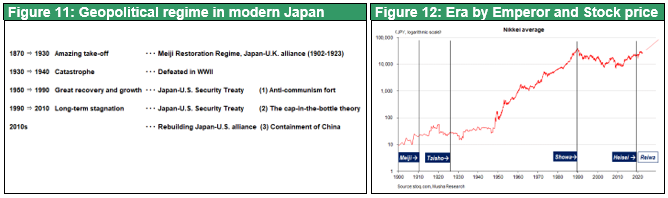

Figures 11 and 12 show Japan's geopolitical regime and stock market trends. The prosperity of the modern Meiji and Taisho eras was supported by the Anglo-Japanese alliance. However, after losing the war against the US and the UK, it was not until the Korean War in 1950 and the outbreak of the Cold War that Japan made another great leap forward. Under the US-Japan alliance after the San Francisco Peace Treaty (1951), the Nikkei Stock Average rose by 400 times (16% per annum) in the 40 years between 1950 and 1989. Behind this great prosperity was the continuous economic support of the US for Japan as a bastion of liberalism in Asia.

However, with the end of the Cold War around 1990, Japan's role as a bastion of liberalism in Asia was lost, and for more than two decades from 1990 to around 2010, the US saw Japan's remarkable rise in economic and industrial power as a threat and pushed ahead with a campaign to bash Japan. As a result of this US attack on Japan and the super-strong yen to achieve it, Japan entered a prolonged period of stagnation known as the 'lost 3decades '. During these 30 years of the Heisei era, Japan's share price declined by more than 20%, while in the US and other countries the share price rose by about ten times, making it clear that Japan was the sole loser. Behind this lost 30 years was the transformation of the relationship between Japan and the US. In other words, it was the era that US-Japan security treaty is assumed to be the cap of bottle, which restrain an unusually strong Japan by US military presence.

However, Japan-US relations are now undergoing a major change once again. The Sino-American confrontation has become decisive, and we are now entering the third phase of the Japan-US alliance, an alliance to deter China. China is the biggest threat to the US, and Japan is the most important shield to suppress China. Japan has become the most important ally of the most powerful country in the world, the US. The major tailwind from this is likely to boost the Japanese economy in the years to come. The steep depreciation of the yen is symbolic of this.

Abe Government policy in the era of Sino-American confrontation and the Indo-Pacific concept

It was former Prime Minister Abe who foresaw the Sino-American confrontation and lobbied the US to build a 'free and open Indo-Pacific' concept. At the beginning of the second Abe administration in 2012, China, which was at odds over the Senkaku issue, pointed the finger at Abe as a nationalist who denied the post-war world order and tried to criticize him by collaborating with the US. However, the Obama and Trump administrations became more aware of the dangers of China and came to respect Abe's foresight.

Mr Abe was the most visionary of all world leaders in foreseeing the era of confrontation between tyrannical and liberal states, and in putting forward the idea of strengthening relations with the US, an ally of liberalism.

The US, which had demanded a super-strong yen in order to build a global supply chain that excludes China, is now accepting a super-weak yen. This is expected to revive Japan's price competitiveness in high-tech and semiconductors, and to start raising wages in Japan, which have become significantly undervalued.

Long-term prosperity in the US economy; technology, innovation, and demand creation alive and well

In looking ahead to the global economy, I would like to focus on the US, China and the eurozone red by Germany. This is because the validity of the Abe Government's strategy of strengthening the US-Japan alliance, cooperation between liberal states and increased pressure on despotic states such as China, North Korea and (Russia) will depend on the future assessment of the US, China, and Germany’s economy. Even if they are seen as desirable partners in terms of values and strengthen their cooperation, the relationship will not be sustainable if it is not accompanied by economic prosperity.

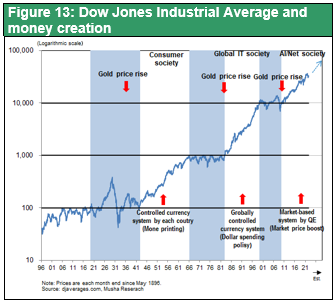

Will the US economy, with which Mr Abe has worked so hard to strengthen relations, really strengthen in the future? Figure 13 shows the upward trend in US stock prices over the past 120 years. It is important to determine whether such 100 years of long-term growth in the US can be sustained. The first condition for long-term economic prosperity is the development of technology and innovation and the sustainability of the resulting productivity gains. In this respect, it can be said that the conditions are now being met in the US. The second condition is sustained demand growth. Technological development and productivity growth are synonymous with an increase in the power of supply, and if demand does not keep pace with the increased power of supply, the widen deflationary gap, leads to a Great Depression.

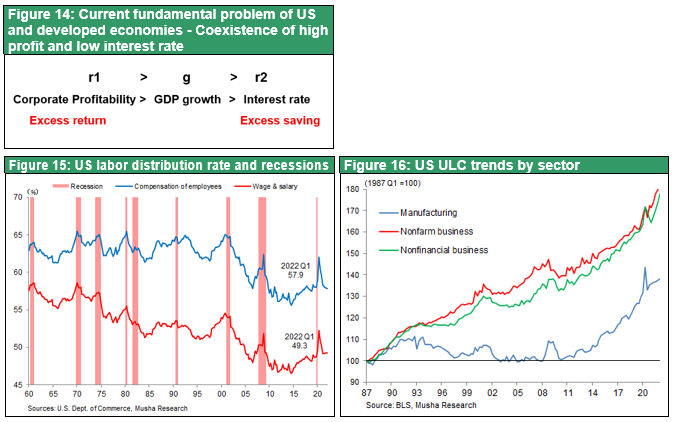

Fifty years ago, the leading companies in the US were GM and GE, and when these companies became profitable, they expanded their factories and increased employment, triggering the next cycle of demand expansion. However, today's leading companies, such as Apple and Google, do not invest in plant and equipment or increase employment much when they make money. Their huge corporate profits are not linked to demand creation and the expansionary cycle of the economy. As a result, corporate surpluses have stationed in the financial markets, causing markedly low interest rates.

Good inflation for demand creation

The right solution would involve raising labor wages above productivity and sustainably increasing household consumption. This requires moderate inflation, which is happening in the US right now: after bottoming out in 2015 or so, the labor share has risen, and unit labor costs have also started to rise. These developments are desirable from the perspective of increasing consumption through higher wages, narrowing inequality and eliminating capital surplus.

Monetary policy is currently being tightened in the US to control inflation. At the same time, however, the US government and central bank will work hard to avoid overkill and ensure that good inflation continues, and we can expect the US economy to turn around in 2023. This point will be elaborated on at other occasions.

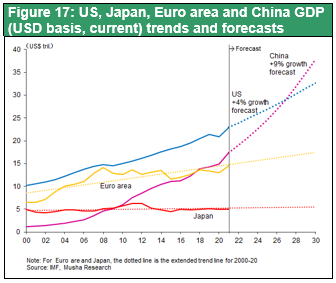

Chinese economy entering long-term stagnation

In contrast, China's economy will face increasing difficulties: the IMF has lowered its forecast for China's GDP in 2022 to 3.3%, and this will be the beginning for China to slip into long-term economic stagnation. It is inevitable that China will continue to suffer from the triple burden of (1) reduced investment, (2) reduced exports by slowing global demand and trade friction with the US. and (3) consumption difficulties, by rising unemployment, less room to increase household debt. The slow process of bursting real estate bubble and deterioration of financial assets quality will continue.

There have been suspicious developments in the foreign currency market: despite a huge current account surplus of USD 317.3 billion in 2021, net foreign assets fell by USD 303.5 billion. A total of USD 620.8 billion in 2021 external net worth disappearance is taking place. Whether it is an underground outflow of funds, huge investment losses or falsification of books, it is a matter of caution. The One Belt, One Road initiative has led to a surge in Chinese investment and loans to emerging economies, with China owing almost 50% of the $230 billion in emerging country debt, which is at risk of becoming a non-performing asset.

The year 2022 will be the first year in which the gap between the US and China will widen in terms of nominal economic growth, due in part to a slowdown in the Chinese economy, inflation in the US and a strong US dollar. The Chinese economy is increasingly likely to fall into the middle-income trap, and the possibility may emerge that it will not be able to catch up with the US forever.

Eurozone economies heading for difficulties

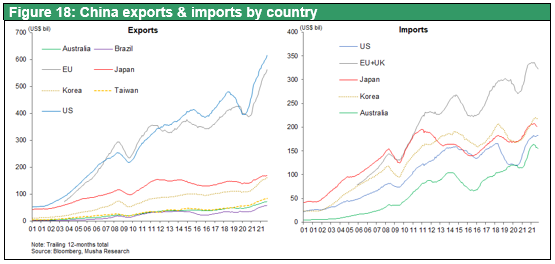

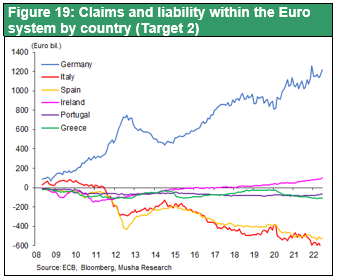

Another critical point is the changes in Europe. The unification and growth of the eurozone has been driven by Germany, and Germany's leap has been made possible by strengthening its tie with China and Russia. The shift towards greater dependence on Russia for energy and on China for trade was behind the eurozone's prosperity. Figure 18 shows China's imports and exports by country, and while China's imports from Japan, the US and South Korea remained almost flat over the decade from around 2011, it is imports from the eurozone, particularly Germany, grew significantly during that period. This pattern of Germany building up huge trade surpluses and financing its surpluses to southern Europe (Spain, Italy, Greece) through the ECB's euro system laid the foundation for the growth of the eurozone.

Such German-led eurozone prosperity is unlikely to be sustainable. First, relations with China will deteriorate. Also, the energy-dependence on Russia, was broken by the war in Ukraine. In other words, the growth scheme of the eurozone is coming under a big question mark.

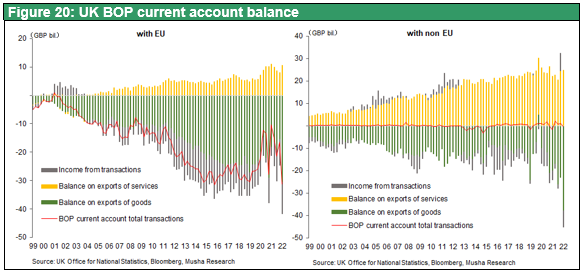

However, the UK is the only European country that is free from such constraints. As soon after the UK left the EU through Brexit, its trade deficit with the eurozone fell significantly.

Thus, the medium- to long-term outlook is US prosperity, Eurozone difficulties and ever-greater stagnation in China. In this context, I think it is fair to say that Japan is trying to promote cooperation with the US and the UK, which is indeed an appropriate strategy from an economic perspective.

The Abe Government's diplomatic initiatives are likely to lead to significant economic results as well. These are the reasons why Musha Research rates Abe's politics as historic.