Oct 04, 2022

Strategy Bulletin Vol.314

Wage increases are needed to address the rise of right-wing and fall of the middle class in the West

Russia's difficulties in the war in Ukraine and the marked slowdown of the Chinese economy are notable setbacks for a group of despotic states. But even in developed democracies, domestic divisions are becoming more serious. Changes are taking place, such as the rise of populist forces seen as far-right in developed European countries, and in the US, where the Republican Party has completely changed its support base and policies from traditional

conservative policies to the Trump party.

Rise of right-wing populists in Europe

At the end of September, the right-wing Italian Brotherhood (FDI), which is descended from the Italian Socialist Movement founded by former fascists, became the leading party in the general elections for the Chamber of Deputies and Senate, with a phenomenal increase in the number of votes cast, from 4% to 26% four years ago. In Sweden, which has been described as a tolerant country, the ruling Social Democratic Labor Party secured the number one position, but the Sweden Democrats, a populist party with an anti-immigration platform, jumped to second place with 20% of the vote, and together with the Moderate Party, the third largest party, the right-wing forces won a majority of the vote, shifting from a left-wing coalition to a right-wing coalition.

The government is expected to shift from a left-wing coalition to a right-wing coalition. In France, Le Pen of the far-right National Coalition party, which challenged Macron in the presidential run-off in April, received 42% of the vote, up from 34% in 2017, the previous time.

The trend to the right, which had been expected to subside, was further accelerated by the war in Ukraine and the increasing difficulties in living due to high energy prices. These right-wing populist parties, whose support base is made up of low-educated blue-collar workers, blame globalization and immigration for their lost jobs and income, and are increasingly critical of the EU, making no secret of their dislike of the EU's internationalist orientation and its associated liberalism.

Both Democrats and Republicans have undergone major shifts in their support base.

This trend is also evident in the US. The Republican Party has been hijacked by Trump, who has policy commonalities with right-wing populists in Europe: opposition to the TPP, America First, xenophobic tendencies such as curbing immigration, respect for traditional family values, banning abortion, disregarding LGBT rights, and opposing gun control are expressions of broad discontent with current values.

In the United States, the support for both Democrats and Republicans has changed significantly in the last decade. The Democrats are becoming a party biased in favor of a wealthy elite with higher education. The Republican Party, on the other hand, has seen a significant increase in support not only from the less educated white working class, but also from Latin American and Black workers. It is reported that the working class across racial lines is trending towards support for the Republican Party.

Growing inequality and the fall of the middle class

Perhaps the biggest factor behind these changes in the Western industrialized world is the fall of the middle class, which had supported democracy. Globalization has led to the loss of manufacturing jobs to emerging economies, especially China. In addition, the digital net revolution has drastically changed the flow of income and capital circulation.

In the past, leading companies such as GE and GM built new factories and created new jobs as profits increased, which propelled economic growth. However, today's leading company GAFAM does not have that channel: although GAFAM generates huge revenues, the amount it needs to reinvest to stay in business is surprisingly small, leaving huge surpluses on its balance sheet. They are returned to the financial markets in the form of mergers and acquisitions and share buybacks, but they do not return to the real economy and have stagnated in the financial markets as a savings surplus, pushing interest rates down significantly.

High-pressure economy driving good wage growth

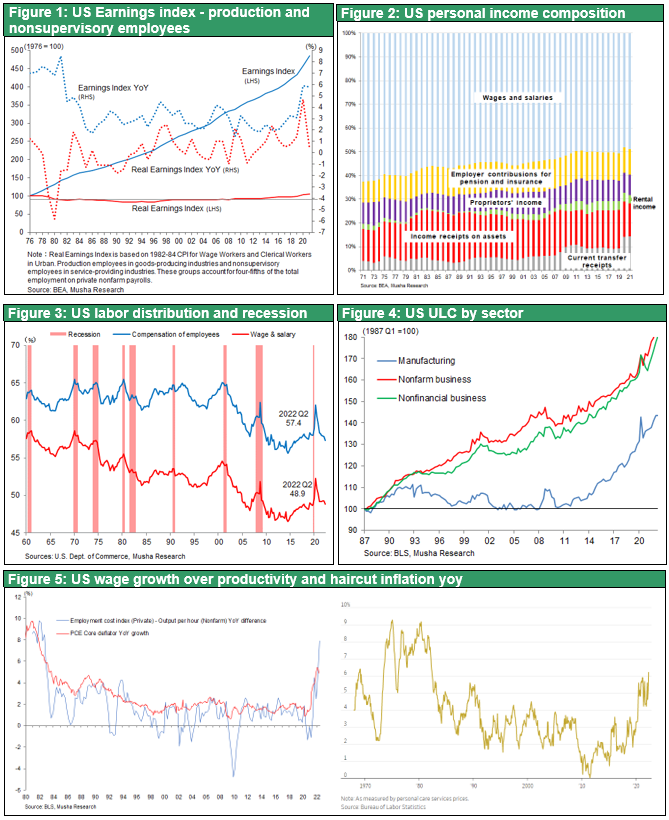

In the US, real wages of non-managerial workers have barely increased over the past 50 years. In terms of the composition of household income, labor income has fallen from 63% to 49% over the past 50 years, with rising stock prices and dividend increases

Asset income from rising stock prices and dividends, and government support such as social security contributions (transfer income) filled the gap. It was rising stock prices and increased government subsidies that supported vigorous US consumption over the past few decades.

To fundamentally resolve this excess profit in the corporate and wealthy sectors and excessive savings in the financial markets, economic growth needs to be boosted through higher wage growth and increased household consumption. The high-pressure economy advocated by US Treasury Secretary Janet Yellen aims to maintain tight labor supply and demand and keep pressure on wages to rise, thereby incentivizing firms to increase labor productivity and encouraging workers to spend. The labor share of US firms began to rise after bottoming out around 2015, and real wages of workers began to trend upwards along with it. This trend is positive, changing the distribution of national income and altering excess profits and excess savings.

Concerns about excessive tightening

From this perspective, the current trend of wages rising faster than productivity growth in the US is a desirable trend. The top priority is now to control inflation, and monetary policy is being tightened at a rapid pace. However, after the supply chain disruptions and the Ukraine war rooted energy price increases run their course, flexible monetary policy is required to avoid killing this necessary wage growth. If a fundamental shift in price growth is confirmed in 2023, a de facto increase in the Fed's inflation target of 2% could be on the agenda.