Oct 07, 2022

Strategy Bulletin Vol.315

Japanese investors' portfolios need a major overhaul

- Possibility of the eve of the start of the Japanese stock market explosion

Nothing could be more fitting than Churchill's quote when discussing current Japanese stock market.

- Kites rise highest against the wind - not with it.

- A pessimist sees difficulty in every opportunity. An optimist sees the opportunity in every difficulty.

- I am an optimist. it does not seem too much use being anything else.

(1) Bond Investment Risks Reminded

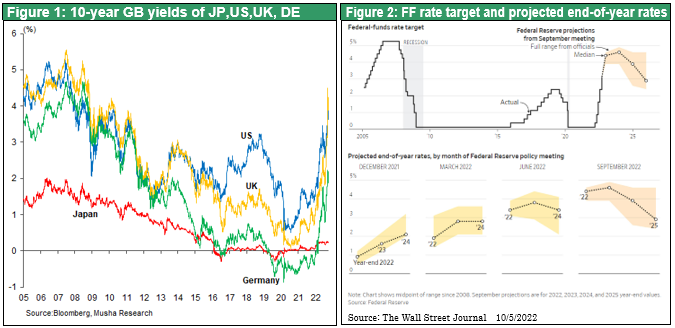

After Fed Chairman Jerome Powell's speech at Jackson Hole at the end of August, expectations of an early interest rate cut that had been spreading in the market rapidly receded. In particular, the FOMC's sharp hike in the terminal rate on September 21 was a decisive factor: the FF rate year-end forecasts (median forecast by participating members) were 4.4% at the end of 2022 and 4.6% at the end of 2023, up by as much as 1% each from the June forecasts (3.8% at the end of 2022 and 3.8% at the end of 2023).

This was a quite significant increase that removed the ladders of short-term buyers who had bought into the market with the aim of bottom fishing. Driven by the sharp rise in long-term U.S. interest rates and coinciding with the end of the quarter, global equities suffered seriously. Optimism seems to be on the wane.

UK Pensions' Leveraged Bond Investments Hit by Surging Interest Rates

Symbolic of this was the turmoil in the U.K. financial markets. At about the same time that the FOMC released its dot Figure and U.S. long-term interest rates rose sharply, the new Prime Minister Truss and the new Chancellor Kwarteng, announced a mini-budget that included a 45 billion pound tax cut. This sparked fears of a budget deficit, causing long-term interest rates in the U.K. to rise sharply, which was accompanied by a sharp drop in the sterling pound and a plunge in stock prices, resulting in a triple depreciation.

The sharp rise in long-term interest rates in the U.K. was triggered by pension funds' selling of government bonds. Defined-benefit pension plans in the U.K. have adopted a Liability-Driven Investment Strategy, a strategy to increase returns by using leverage while significantly reducing risky equities and increasing the proportion of bonds. Then, bond prices plummeted, causing a sharp decline in collateral values, the occurrence of margin call, and a chain of selling that led to more selling. The Bank of England took emergency evacuation measures and conducted emergency purchases of government bonds (in effect, a resumption of QE), and the panic subsided, but the situation was a reminder of the magnitude of interest rate risk.

Foreign Bond Investment Losses by Institutional Investors a Concern in Japan

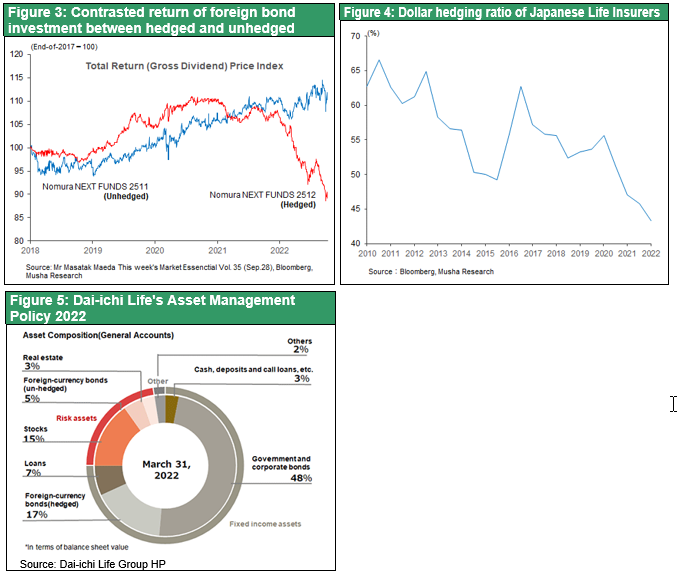

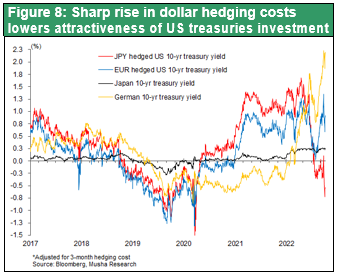

Losses caused by the sharp rise in long-term U.S. interest rates are also being felt by Japanese institutional investors. Long-term U.S. government bond prices have fallen 20% over the past year. This loss was fully covered by the foreign exchange gains from the yen's depreciation by more than 20% over the past year. However, investors who had hedged their currency exposure were directly hit by the plunge in U.S. government bonds. Figure 3 shows the total return prices of the Nomura NEXT FUNDS Foreign Bond and FTSE World Government Bond Index ETFs (with and without currency hedges) as reported in the weekly "Market Essentials No. 35" by Masataka Maeda, a former Nikkei editorial writer. While the prices of ETFs with currency hedges have fallen more than 20% since last year's highs, the prices of ETFs without currency hedges have remained positive year-on-year, showing an extreme contrast.

Although Japanese banks, life and non-life insurers, and other institutional investors are presumably reducing their hedge ratios due to the recent sharp decline in the yen and the sharp rise in currency hedge costs, as shown in Figure 4, about 40% of the ETFs are hedged. If this is the case, it is possible that each company is incurring substantial investment losses.

Figure 5 shows the asset management policy of Dai-ichi Life's general account for FY2022. 48% of the assets are public bonds, 17% are hedged foreign bonds, 7% are loans, 15% are stocks, 5% are open foreign bonds, and 8% are real estate and others. Two-thirds of foreign bonds are hedged against exchange rates. The assumption that hedged foreign bonds are safe assets may have caused a major miscalculation.

Japan's largest foreign bond player is Japan Post Bank, which invests funds collected from postal savings in domestic markets. 141 trillion yen of its 235 trillion yen (as of June 30, 2010) under management is allocated to securities, of which 76 trillion yen is in foreign securities (mostly bonds). If this investment in foreign bonds is made with currency hedging, the damage would not be negligible.

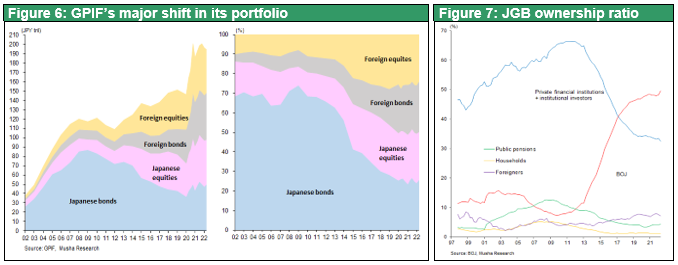

The real blow is the expected large drop in Japanese government bonds. - YCC lifting is just a matter of time

While the surge in interest rates in Europe and the U.S. is causing turmoil, the first concern when it comes to interest rate risk is the future of Japan's long-term interest rates, which are currently being held in check by the yield curve control (YCC). While we still do not foresee any policy change by the BOJ, there is a good chance that a surprise will occur at some point. The market may start selling JGBs in anticipation. A sharp rise in Japan's long-term interest rates and a bond plunge may become the main scenario in our medium-term forecast for the next two to three years.

(2) The last remaining promising risk asset, Japanese equities

Japanese institutional investors' portfolios are undergoing a major overhaul, and they are weighting Japanese equities

Given the rise in global interest rates and rising bond volatility, the portfolios of Japanese banks, life insurers, pension funds, and other institutional investors, which have been weighted toward foreign bonds, will probably need a major overhaul.

In the past assets management in Japanese institutional investors were purely focused on domestic bonds mainly JGBs. However, since the Bank of Japan's aggressive monetary easing and the GPIF's investment reforms in 2013-14, foreign securities have become a principal component of risk assets for pursuing returns. Figure 6 shows the GPIF's portfolio, which has been shifted to a one-fourth split of foreign bonds, foreign equities, Japanese bonds, and Japanese equities as a result of the GPIF reforms initiated as part of Abenomics.

The reforms have produced a high average annual return of 6.6% on total assets over the 10-year period from FY12 to FY2021, immediately prior to the reforms, with accumulated returns of 105 trillion yen, a favorable result that accounts for the majority of the assets under management (197 trillion yen). Looking at the rates of return by asset class, Japanese fixed income was 1.0%, foreign fixed income 5.6%, Japanese equities 10.8%, and foreign equities 15.4%, indicating that the reforms implemented in 2013-14 were successful. The BOJ's QQE program, the Bank of Japan's extraordinary monetary easing, played a key role in enabling these GPIF, Japan Post Bank, and other Japanese financial institutions and institutional investors to shoulder their holdings of JGBs and rebalance their portfolios.

However, it is not necessarily true that the composition of the portfolio should remain one-fourth each of foreign bonds, foreign equities, Japanese bonds, and Japanese equities. This requires deep strategic insight. To begin with, the substantial depreciation of the yen and exchange rate fluctuations, as well as the sharp decline in foreign equities, have suddenly intensified the problem of risk-taking by foreign-currency investors.

Investments in foreign currency assets and Japanese bonds have suddenly become riskier

The following three points are almost certain.

- Foreign currency assets are too volatile to aim for stable returns, and the constant prohibitive cost of currency hedging has made them unaffordable.

- Interest rate risk on Japanese domestic bonds will increase as people become more aware of the exit from the YCC.

- The superiority of domestic equities in terms of valuations and earnings momentum will become prominent.

The time may be coming when banks and institutional investors will be forced to place Japanese equities as a primary investment of their fund management. Although capital requirements for banks and solvency margin requirements for life insurers make it difficult to invest in high-risk equities, there may still be room for a strategic response. The Basel capital rule that stipulates zero risk-weighting for government bonds is not in line with reality and should probably be revised.

Corporate Earnings Trend Uptrend Only in Japan

Japanese stocks are expected to be the world's best performers through 2023. First, Japan's economy and corporate earnings are expected to be the strongest in the world, with Japan expected to have the highest economic outlook among developed countries in 2023, according to the IMF (1.0% for the US, 1.2% for the Eurozone, and 1.7% for Japan) in July and the OECD (0.5% for the US, 0.3% for the Eurozone, and 1.4% for Japan) in September.

Three factors such as (1) monetary policy is expected to remain accommodative in the midst of the global monetary tightening, (2) big rebound (revenge consumption, etc.) from the largest economic decline due to overreaction to the Corona pandemic, and (3) the positive effect of the yen depreciation is expected to emerge. In particular, the ripple effects of the yen's depreciation will be enormous. The super depreciation of the yen has transformed Japan from the highest-cost country in the world to a low-cost country on par with emerging economies, and global demand is beginning to gravitate toward Japan as a low-cost country. First, export competitiveness will increase and export volumes will begin to rise. In addition, imports will be substituted for domestic products. In the past, when the yen was extremely strong, Japanese companies moved their factories overseas, and domestic demand was being eroded by cheap Chinese goods, but now the opposite is happening. Cross-border e-commerce, in which goods are procured in Japan at a discount and resold overseas, is booming. This concentration of demand in Japan has only just begun, and there is no doubt that it will grow in strength like a torrent.

Domestic Capital Investment Begins to Surge

Signs of a surge in domestic capital investment are evident in the Bank of Japan's September Tankan survey of capital investment plans for FY2022, which showed record growth of 16.4% for all industries and 21.2% for the manufacturing sector. Growth is led by nonferrous metals (mainly silicon wafers), chemicals, electrical machinery, machinery, and other high-tech industries benefiting from the yen's depreciation. The construction of TSMC's Kumamoto plant, which will cost a total of 1 trillion yen, has also begun. In addition, a new EV production building is to be built at Subaru's Oizumi plant for the first time in 60 years, Renesas Electronics restarted its Kofu power semiconductor plant, SUMCO built a new Imari plant, Sumitomo Metal Industries constructed a new nickel electrode material plant in Niihama, Iris Oyama transferred part of its Chinese home appliance production to the domestic market, Kyocera built a new semiconductor packaging plant at its Kagoshima Sendai plant. Daikin Industries, Ltd. is transferring part of its supply chain from China to Japan; Canon Inc. is building a new semiconductor exposure system plant in Utsunomiya for the first time in 21 years; Yaskawa Electric Corporation is returning to domestic production of key components and building a plant in Yukuhashi, Fukuoka, Fujifilm Corporation is constructing a plant in Toyama to produce biopharmaceuticals on a contract basis. As the depreciation of the yen becomes more pronounced, the return of factories to the domestic market will intensify, and investment growth is expected to increase further.

In terms of employment, the resumption of economic activity has led to a growing sense of labor shortages in all sectors, with the September Tankan survey showing that the DI for all industries, calculated by subtracting the percentage of firms that answered that they have "insufficient" labor from those that answered that they have "excess" labor, fell 4 points to minus 28, and the outlook is for further labor shortages to continue at minus 31. Further upward revisions to corporate earnings, which are already at record highs, are inevitable, partly due to the effect of the yen's depreciation.

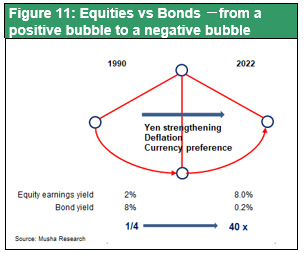

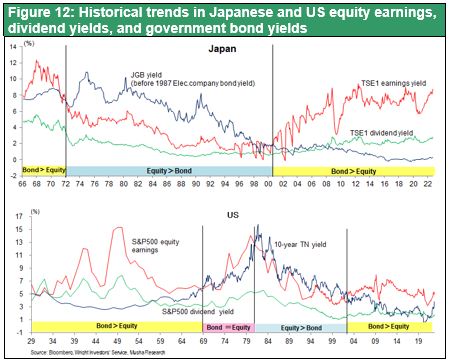

Historically favorable valuations and extreme undervaluation of Japanese stocks

Prices of stocks, bonds, and other financial assets can be inferred from their yields, and the prices of two major financial instruments, bonds and stocks, have historically experienced large swings in value. Since the yield on 10-year Japanese government bonds is 0.2%, it is calculated to take 500 years to recover the invested capital. On the other hand, stocks have a yield (earnings per share/price) of 8%, so it would take 12.5 years to recover the invested capital. This shows that stocks are extremely undervalued compared to bonds, at a ratio of 1:40. This extreme price differential between bonds and stocks is unprecedented in the world or in Japan's history. In the U.S., government bonds yield 3.8%, so it takes 26 years to recover the principal of a bond. In contrast, stocks yield 7%, so it takes 14 years to recover the principal. The price gap between stocks and bonds is 1:1.8, which is quite smaller than in Japan.

Figure 12 shows that the Japanese and U.S. bond yields and earnings yield on stocks have alternately been in periods when stocks were overvalued (and bonds undervalued) and periods when stocks were undervalued. And the current relative price of Japanese equities is so undervalued that it appears to be the negative extreme. Looking back five or ten years from now, we will see that this was an era of unprecedented equity investment opportunities.

Favorable supply and demand, share buybacks, and the participation of Japanese institutional investors in addition to individuals and foreigners

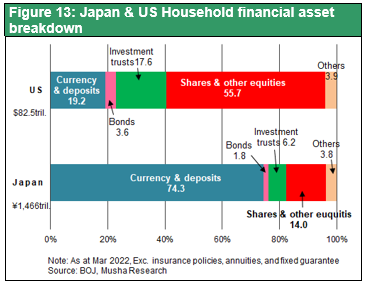

The money from selling bonds (or withdrawing deposits) can be used to buy stocks, making it possible to invest with tremendous advantage. Cash deposits and bonds, which pay next to zero interest, account for 74% (1,089 trillion yen) of Japan's household financial assets, while stocks and investment trusts, which offer lucrative returns of 8%, account for only 20% (295 trillion yen) of the total (the percentage excludes insurance, pensions reserves). The huge amount of capital stored in significantly overvalued bonds and cash deposits is about to start flowing toward equity investments.

With the Kishida administration's NISA reforms, which have steered the country toward a policy of doubling asset income, the movement to "build assets through stock investment" is spreading nationwide. The number of NISA accounts is increasing rapidly, and the amount of purchases from NISA accounts is growing at an exponential pace. The amount of purchases from accumulation NISA accounts continues to grow at a doubling pace, and is expected to reach the 2 trillion yen level by 2023. When combined with purchases from general NISA accounts (¥2.7 trillion in 2021 and ¥1.4 trillion in January-March 2022), it is not long before individual stock accumulation investments exceed ¥10 trillion annually and emerge as a major investment entity.

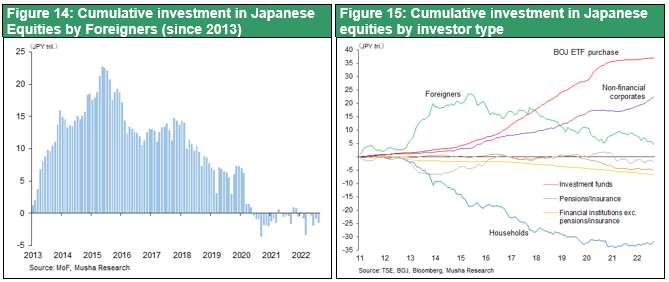

In addition, corporate share buybacks have been increasing rapidly, reaching a record high of 8 trillion yen in FY2021, and are expected to rise to the 9 to 10 trillion yen base in FY2022. Furthermore, foreign investors, who have bought ¥23 trillion since Abenomics, will sell all of it in 2020, leaving them underweight Japanese equities. They will no longer be able to ignore Japan's brilliance by process of elimination as stocks in the U.S., China, Europe, South Korea, and other countries have their own problems.

Under these circumstances, Japanese institutional investors, who have long been reluctant to invest in Japanese equities, will enter the fray. It is safe to say that the Nikkei 225 is within range of 35,000 yen in 2023 and 40,000 yen in 2024.