Nov 21, 2022

Strategy Bulletin Vol.318

Urgent necessities of corporate strategic change in 3 fields

From strategy that overcame deflation w/strong yen to one that'll prevail under weak yen & inflation

Q) Musha Research is claiming that 2023 will be the year of a major economic turnaround in Japan, and that companies must drastically change their strategies.

Musha) 2023 is the year of major transformation, which is why we must make a major change in management strategies based on past successes.

Q) Musha Research claims that 2023 is a bright year that will be a turning point for Japan's great revival.

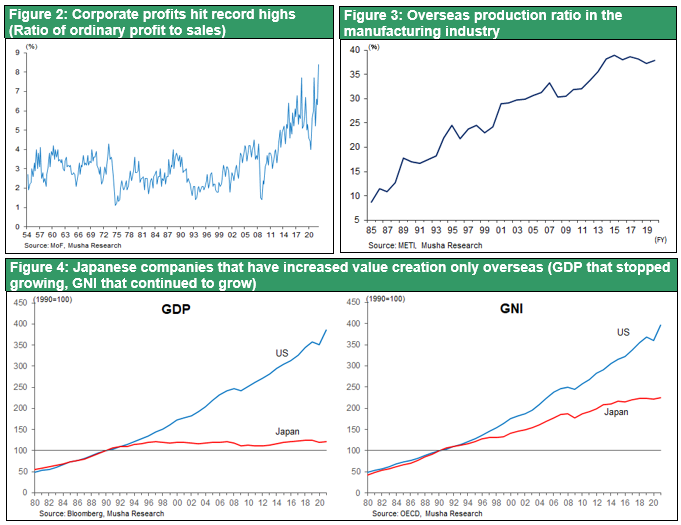

Musha) The rapid depreciation of the yen has changed the major framework of the economy. The era of deflation caused by the strong yen is over, and 2023 will be the brightest year for the Japanese economy since the collapse of the bubble economy. Factories, capital, business opportunities, and jobs that fled Japan to overseas due to the strong yen will return to Japan with the sharp depreciation of the yen. The U.S.-China conflict will also accelerate the return of factories to Japan. The weak yen will also cause a dramatic increase in inbound tourism, which will stimulate local domestic demand in every corner of Japan. Cross-border e-commerce (EC), in which individuals and small- and medium-sized companies purchase extremely undervalued Japanese products and sell them overseas via the Internet, is also increasing rapidly. Thus, global demand will be concentrated in Japan, the world's low-cost country, and this will invigorate the domestic economy. The IMF forecasts that Japan will have the highest growth rate among developed countries in 2023 (1.6% in Japan, 1.0% in the U.S., and 0.5% in the Eurozone).

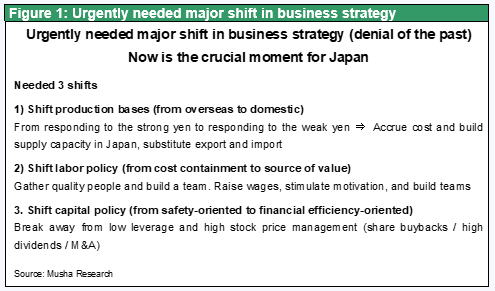

Q) The weak yen has made Japanese costs significantly cheap. If this takes hold, companies will have to change their strategies to take advantage of this.

Musha) Japanese companies responded to the strong yen by relocating factories overseas where costs were lower and survived. Even in the long period of stagnation in the Japanese economy, with zero nominal GDP growth, zero inflation, and zero interest rates, corporate profits have made great strides, and thanks to this, we can now envision a bright future for Japan. Many highly competitive companies have emerged, and they will drive the Japanese economy. This increase in corporate profitability is, in part, the result of a successful corporate shift overseas. However, if the depreciation of the yen makes costs cheaper in Japan, then the system must now be changed to a domestic production system. The supply chain portfolio must be radically transformed.

Q) Many company managers have told me that it is difficult to establish a domestic production system now. I hear them lamenting that they can't attract people, that they don't have engineers.

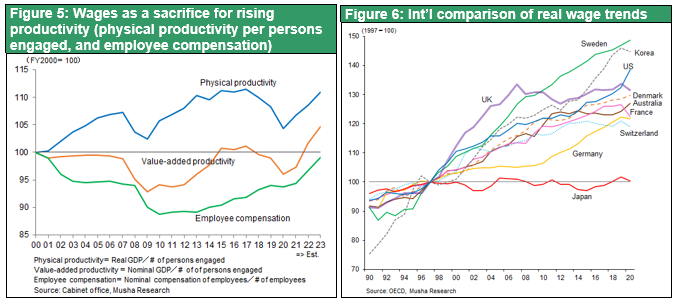

Musha) It is difficult to rebuild a production system that has once been lost but doing so will make the difference between winning and losing. To do so, labor policies must be fundamentally reexamined. Under the strong yen and deflation, the labor policy of companies was to hold down costs. The doubling of the yen made it impossible to compete unless wages for Japanese workers were cut in half, which pushed companies to cut bonuses and overtime pay and to relocate factories overseas. Chart 5 shows the per capita physical productivity, value-added productivity, and labor compensation of Japanese companies. Japanese companies have benefited from global technological development and have achieved a reasonable increase in physical productivity. Despite this, the strong yen and falling sales prices due to deflation meant that companies were not left with the fruits of productivity growth, and value-added productivity remained unchanged. However, the link is clear: labor remuneration was suppressed to a greater extent, thereby ensuring corporate profits. Japan's real wages have not risen at all over the past 30 years, and the country has fallen into deflation (Figure 6), but this can be largely attributed to the efforts of companies to maintain price competitiveness in the face of the strong yen.

From now on, however, a shift in the perception that labor is the source of value is necessary. We must hire good people, even at high wages, and motivate them to build competitive teams. A major shift in thinking is needed, from the perception that labor is a cost to the perception that labor is a source of value.

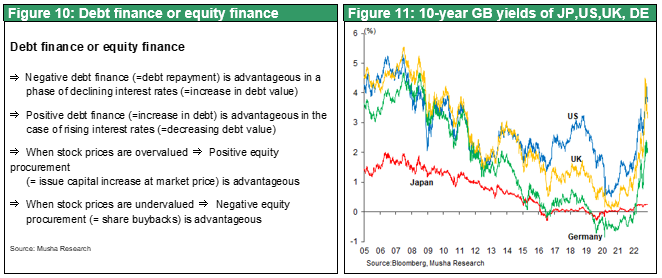

Q) Musha Research argues that a major change in corporate financial and capital policies is also needed. The mainstay of such a change is high stock price management through share buybacks.

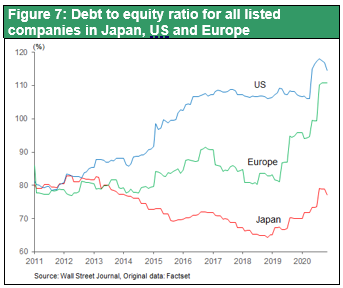

Musha) Since the collapse of the bubble economy, Japanese companies have followed a conservative financial strategy. They have reduced their debt, suppressed outflows of profits, increased their equity capital, and significantly increased their financial cushion to be prepared in the event of a crisis. Chart 7 shows the debt to equity ratios of listed companies in Japan, the U.S., and Europe, and the extreme conservatism of Japanese companies stands out. This deleveraging financial strategy is unbalanced, ignoring capital efficiency and focusing only on safety. Nowadays, low-leverage management is a losing corporate strategy because it makes it easier to be acquired due to low stock prices, while at the same time it ties up the company's foothold for the future, such as acquiring other companies or investing in new fields.

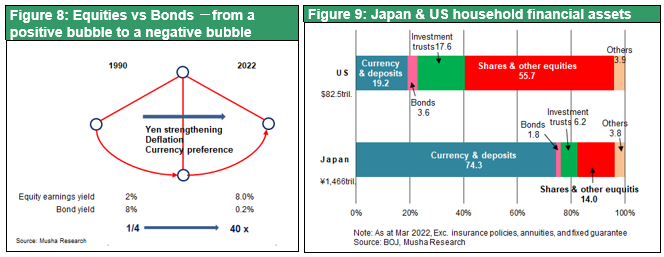

Q) Japanese stocks are extremely undervalued today, so buying stocks by borrowing money (or putting down deposits) will give you a big profit. Musha Research argues that this is not only limited to individuals, but companies also have the same opportunity, right?

Musha) In Japan today, the yield on 10-year government bonds is 0.25%, so it is calculated to take 400 years to recover the invested capital. On the other hand, stocks yield 8% (earnings per share/price), so it would only take 12.5 years to recover the invested capital. This shows that stocks are extremely undervalued compared to bonds, at a ratio of 1:32. This extreme price differential between bonds and stocks is unprecedented in the world or in Japan's history. It is needless to explain that the money from selling bonds (or withdrawing deposits) can be used to buy stocks to gain tremendous advantage.

The opportunity (or risk of a disparity) presented by this extreme undervaluation of equities is thought to be even greater for corporations than for individuals. Deleveraged management (= high capital adequacy ratio management) means that the ratio of debt, which has low cost, is extremely small and the ratio of stock, which has significantly high cost, is very high in its finance. If a company borrows money at 0.5% interest and buys its own stock (assuming a dividend rate of 2.5%), the difference in yields will be 2%, and the tax savings will generate a marginal gain of about 2.2%. In addition, the stock price will rise as ROE increases and supply and demand improves.

Q) It has been pointed out that the biggest risk to the Japanese economy in 2023 is the possibility of a sharp rise in interest rates, which have been kept at 0.25% by the yield curve control (YCC). How should companies respond? Can this be a positive thing financially?

Musha) Japan's long-term interest rates, which have been kept significantly lower than those of other major economies, will rise sooner or later, and there are two ways in which the YCC will end: either the BOJ will achieve 2% inflation, which would be a "win-win" outcome, or the BOJ will not achieve its desired target and the yen will weaken to the point of speculation, which would be a "loss" outcome. (Musha Research believes that a "winning end" is very likely, which will be discussed in detail later.) This clear future trend can be positive or negative, depending on how it is handled. Since the market value of the principal of the debt will depreciate as interest rates rise, debt should be increased now. If the stock price is undervalued now, there is a strong possibility that the stock price will rise in the future, and the value of the shares acquired will increase, so the company should increase its investment in stocks. We would like to emphasize that share buybacks are one of the most advantageous equity investments for companies. If many companies agree with Musha Research's view, share buybacks, which are already approaching 10 trillion yen in 2022, will increase even more significantly, giving momentum to the rise in Japanese stock prices in 2023. Re-leveraging to take advantage of the current low interest rates and stock prices will provide companies with significant financial benefits.

Q) Musha Research has been arguing for the past decade that stock prices are ridiculously undervalued, and we are reminded of just how big the opportunity is at this time.

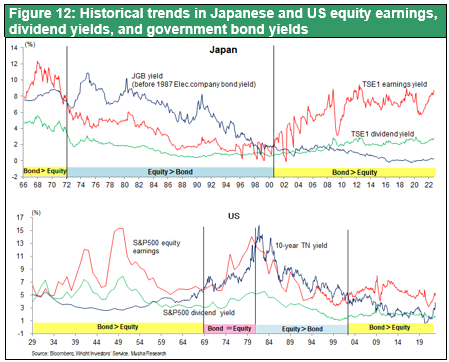

Musha) Looking back at the trends of government bond yields and stock yields in Japan and the U.S., Chart 12 shows that periods of overpriced stocks (underpriced bonds) and periods of underpriced stocks have come alternately. The current relative prices of Japanese equities are so undervalued as to appear absurd. In 1949, W. Buffett's mentor, Benjamin Graham, wrote his famous book, "The Intelligent Investor," and in Chapter 20 (the last chapter), he argued that there is a Margin of Safety, an area of investment that is considered safe no matter what the future holds.

From 1949 to 1950, the U.S. stock earnings yield was 15% and the government bond yield was 2.7%, when U.S. stocks valuation were at historic lows. Compared to that time, the current valuations of Japanese stocks are more extreme. Benjamin Graham would probably describe today's Japanese equities as a historical "safe haven," and five or ten years from now, we will look back and realize that this was an era of unprecedented equity investment opportunities.