Dec 19, 2022

Strategy Bulletin Vol.320

Economic Outlook for 2023, Inspecting Risk Scenarios

- Why you don't have to be pessimistic about next year

(1) Japan's Economy in the Global Bright Spot 2023

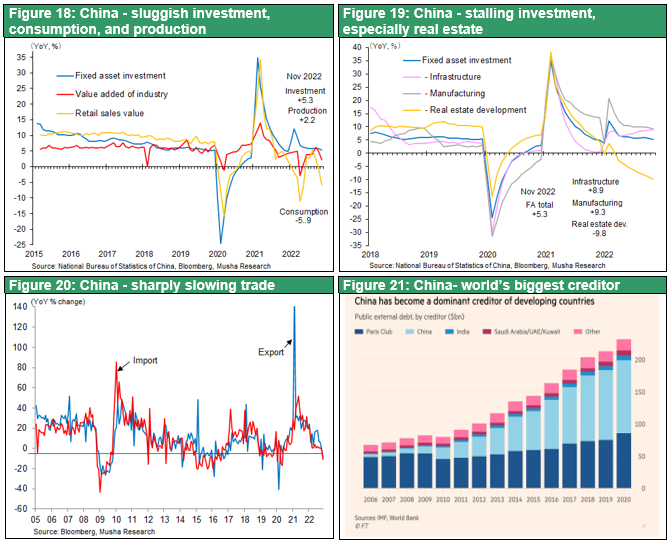

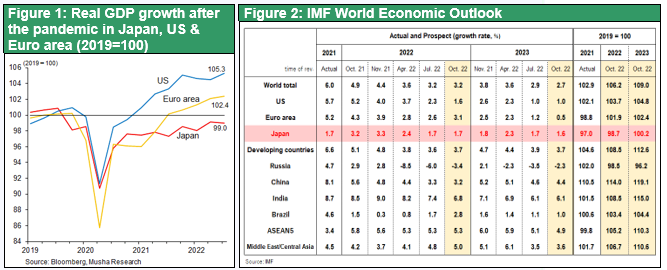

The global economy continues to slow sharply; the IMF sees the global economic outlook at 2.7% in 2023 after 6.0% in 2021 and 3.2% in 2022, but further downward revisions are inevitable. There are tremendous non-economic disturbance factors, including the Corona pandemic, the war in Ukraine, and the escalation of the U.S.-China conflict. Countries are tightening monetary policy in response to the first inflation in 40 years due to supply chain disruptions and soaring energy prices, and the effects of these tightening measures are expected to become apparent in 2023. Of particular concern is China's stalling due to the bursting of its real estate bubble and the lockdown of its corona response.

Japan's unique favorable factors to emerge

The IMF forecasts growth of 1.0% for the U.S., 0.5% for the eurozone, and 1.6% for Japan in 2023 (as of October), while the OECD forecasts 0.5% for the U.S., 0.5% for the eurozone, and 1.8% for Japan (as of November), the highest forecasts for Japan among developed countries. Japan's economy is expected to rebound from (1) being the only country to maintain an accommodative tone amid the global monetary tightening and (2) Japan's post-Corona economic decline, which was the largest among major economies due to overreaction to the pandemic and consumption tax hike, (the consumption tax hike starting October 2019, just before the Corona disaster, is Japan's aggregate demand has been suppressed by around 1.5%), and (iii) the positive effect of the yen's depreciation will emerge.

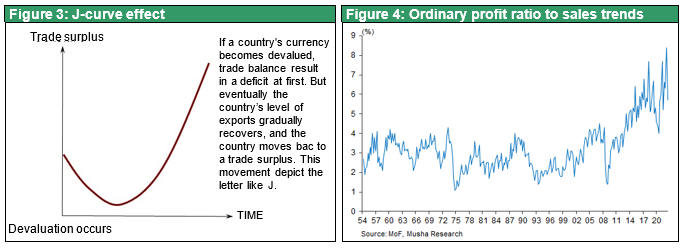

A shift to a weaker yen will change everything

The establishment of a significantly weaker yen has changed the major framework of the Japanese economy. The deflationary period caused by the strong yen is over, and 2023 will be the brightest volume boom year since the burst of the bubble economy. Factories, capital, business opportunities, and jobs that fled Japan overseas due to the strong yen will return to Japan with steep yon depreciation of the yen. The weak yen will also cause a sharp increase in inbound tourism, which will stimulate local domestic demand in all regions of Japan. Cross-border e-commerce (EC), in which individuals and small- and medium-sized companies purchase extremely undervalued Japanese products and sell them overseas via the Internet, is also increasing rapidly. In this way, global demand will be concentrated through various channels toward Japan's inexpensive products, which will stimulate Japan's domestic economy.

Change in corporate managers' behavior will be the last push to break out of long-term stagnation

The long-term stagnation of the lost 20 years was directly and entirely caused by the decisions of corporate managers. The past policies that were right for corporate survival, such as curbing domestic investment, lowering wages, repaying debts, and ensuring safe management, are now being forced to undergo a major change. The inevitable changes in strategy that corporate managers are being forced to make are (1) to move factories back to Japan, (2) to secure quality labor by raising wages instead of holding down wages, and (3) to change financial management from deleveraging which places the highest priority on safety to re-leveraging. Companies that do not change their behavior will be failing competition. Thus, a policy shift by corporate managers will be decisive in ending deflation with a strong yen.

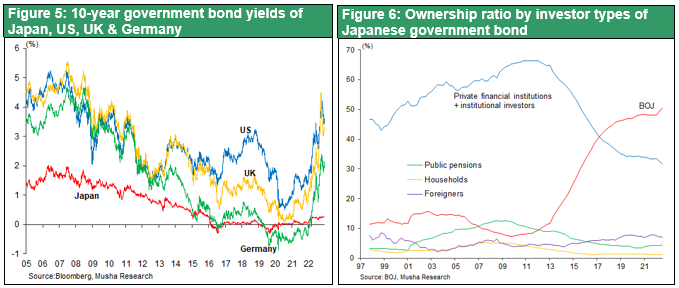

(2) Inspection of risk scenarios - i. Small risk of interest rate spike and economic stall in Japan

Two ways to end the YCC

The biggest concern shared by Japan's economy watchers is the outcome of the BOJ's ultra-easy monetary policy (YCC), the only policy in the world that controls long-term interest rates. A winning end would be one in which the BOJ achieves its desired goals of overcoming deflation and achieving 2% inflation, and then ends the YCC, a desirable end that is accompanied by a stock market rally. A losing end would be the path to the end of the YCC without overcoming deflation, which would result in a sharp rise in long-term interest rates, a bond market crash, an economic downturn, and a stock market crash at the same time, which could trigger not only an economic recession but also a financial crisis. If such a situation were to occur, it could easily lead to a global financial crisis, since Japan is the world's largest cross-border lender and the anchor of global interest rates.

The key will depend on whether a plunge in the yen is possible. In 1992, when the UK was hit by George Soros' speculative selling of the pound, it was in a dilemma of whether to stay the exchange rate (i.e., remain a member of the European Monetary System) or maintain monetary easing to give priority to the domestic economy. Foreign hedge funds, sensing the same weakness in Japan as in the U.K., have been trying to sell Japan from time to time. The success of that challenge will depend on the yen plummeting beyond the limits of what the Japanese government and the Bank of Japan can tolerate.

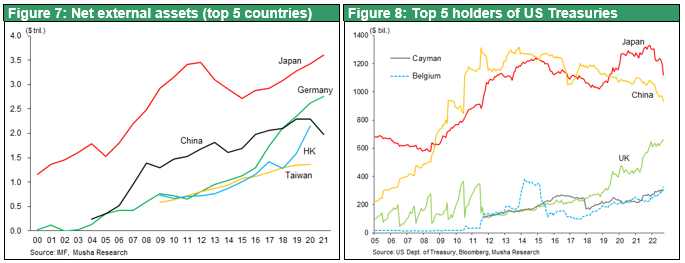

A weaker yen would bring huge gains to Japan at the ¥100 trillion level

Musha Research has determined that a collapse that takes the yen off its tag is completely unthinkable, and that there is no reason why Japan should stop the yen from weakening. Since Japan is the world's largest holder of dollars, a strong dollar will greatly boost the value of Japan's foreign currency assets. With the world's largest net foreign assets at $3.6 trillion and the world's largest holdings of U.S. government bonds at $1.2 trillion, a strong dollar will bring huge foreign exchange gains on the order of 100 trillion yen. which can be used to pay for corporate investment, high-tech and green investment by the government, and increased defense spending. In addition, the price competitiveness of companies will be dramatically enhanced. Although the yen's depreciation will have the negative effect of raising import prices, it will also promote the return of factories to the domestic market and the substitution of domestic products for imports, thereby increasing domestic production.

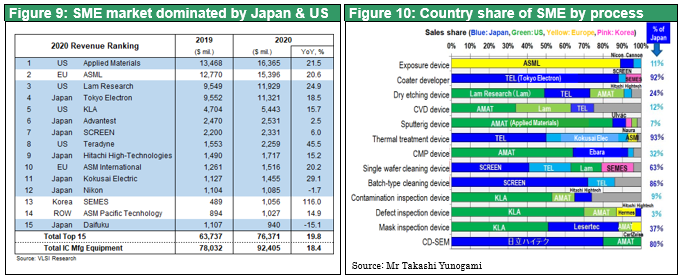

Japan-U.S. financial cooperation under military alliance

Japan-U.S. financial cooperation is also important when considering the Japanese yen. Under the U.S.-China confrontation, cooperation between the U.S. and Japanese governments has grown closer not only in military and diplomatic affairs, but also in a wide range of other areas. It is almost clear that the U.S. side (which has a substantial trade deficit with Japan of $62 billion) has accepted the sharp decline in the yen. The cooperation between the U.S. and Japan can be seen from the fact that the U.S. central bank provided huge emergency loans to Japanese banks when they had difficulty procuring dollars immediately after the outbreak of the Corona Crisis. The U.S. government would not tolerate the yen plummeting in the event of a crisis. On the other hand extremely weak yen would make Japanese companies too competitive that the US don’t like. The few manufacturing industries that have survived in the U.S. are automobiles and semiconductor manufacturing equipment, for which Japanese firms are the most formidable competitors.

Little room for the yen to weaken more than 150 yen; YCC to continue for the time being

Cyclical factors of dollar depreciation, namely the peaking out of U.S. inflation and long-term interest rates, are also becoming apparent. In this light, there is no way that the BOJ will be forced to tighten monetary policy to stop a weakening currency, as hedge funds are hoping. The BOJ can continue to ease monetary policy until it is confident that it can achieve its policy goal of overcoming deflation. The next BOJ governor can also wait to change unprecedented monetary easing until the inflation target is achieved.2023 dollar/yen rate is likely to be in the 150-130 yen range, the BOJ will continue to have a free hand, and the YCC will likely remain in place until the end of 2023.

(3) Risk Scenario Inspection - ii. Small risk of U.S. bubble burst and deepening recession

Strong U.S. fundamentals

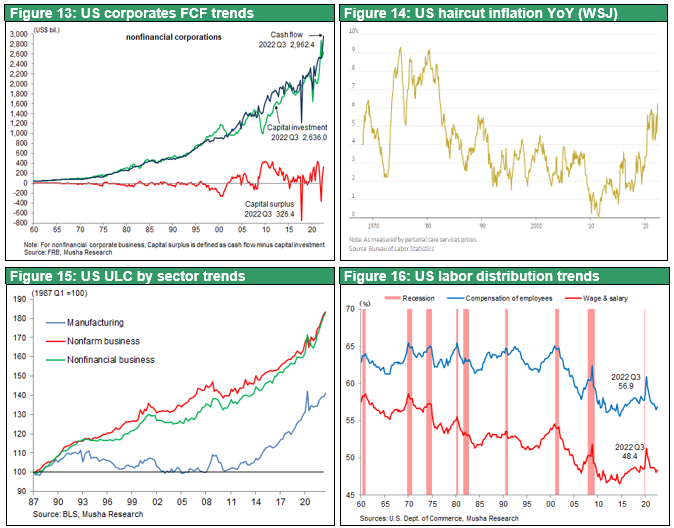

Inflation has peaked out and the Fed has capped the spiraling expansion of inflationary sentiment by decisively raising interest rates. The terminal rate will exceed 5%, but even under such conditions, the U.S. economy may have a soft landing with strong employment, investment, and corporate profits. Real wages are negative, but consumption will not easily stall due to savings, which have been enriched under the Corona disaster, a favorable employment environment (salaries and wages), and the contribution of fiscal policy. U.S. companies will continue to increase revenues by nearly 10%, wages will rise, but corporate pricing power will also remain strong, and profit margins will remain high, with no significant factors to reduce profit margins, except for a decrease in foreign profit conversion gains due to the strong U.S. dollar.

Examination of two conditions (long-term interest rates and command ideology) to see if overkill can be avoided

It is important to determine whether the Fed's priority stance on inflation control will lead to overkill or whether it can be avoided. Musha Research believes that (1) long-term interest rates are clearly trending lower due to the ample savings cushion and the strong dollar, and (2) the Fed and the U.S. Treasury Department commanders are essentially more aware of the risk of deflation (no matter what rhetoric Chairman Powell may use). We assume that a major shift in monetary policy will occur in the first half of 2023, and while it is important to keep in mind that a hike in the policy rate from 0 to 4% will lead to higher household and shadow banking debt costs and a chain of corporate and financial failures, if there is any indication that individual failures are likely to turn into systemic risk, the Fed will undoubtedly be capable of a paratrooper bailout. The catastrophe that bubble-burst theorists are waiting for is unlikely to occur.

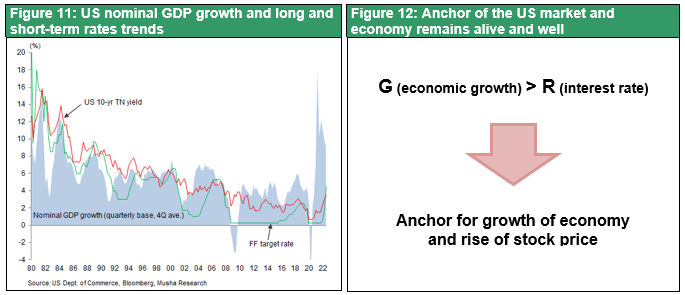

Long-term interest rate suppression = savings surplus = potential deflation risk

The fact that long-term interest rates are suppressed to the 3% level under the 6% core CPI suggests the existence of a potential savings surplus and deflationary risk. This allows for the use of monetary easing at any time. Treasury Secretary Yellen's strategy of maintaining high-pressure economic conditions may come into play. The continuation of relatively tight labor supply and demand and the maintenance of strong bargaining power for workers will provide incentives for firms to increase labor productivity, which will also strengthen the supply side. In that case, the Fed's market-friendly trend will not change, with the possibility of shifting the target to 3% inflation. Then 2022-2023 may not be a recession year, but a mini-dip year, like 2013 and 2016, which came every 3-4 years in a long-term economic expansion. U.S. equities may soar by the end of 2023, when a round of interest rate hikes and rate cuts are on the horizon.

Speculation on the Economic Philosophy of the U.S. Economic Command Post

Musha Research believes that the U.S. authorities will shift their focus to avoid overkill. This is because the biggest risk in the U.S. today is killing good inflation, and U.S. leaders, including the high-pressure economic theorist Yellen, are keenly aware of this.

The fundamental risk in the U.S. is that strong corporate profits are not sufficiently translating into economic growth and are stagnating in the financial markets, causing low interest rates. These low interest rates are a good thing for the time being, but if they go too far, they will cause deflation and a major recession. In order to avoid this, it is necessary to raise wages and labor participation rates in a healthy manner to curb excessive corporate profits and stimulate consumption on the other hand. This is even more necessary for Japan than for the US. It is necessary to maintain a "high-pressure economy" with excess demand and keep upward pressure on wages.

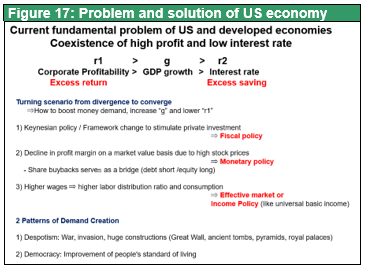

The recent decline in long-term interest rates in the U.S. has showed the continuation of basic contradiction in the U.S. and developed economies despite post-Corona inflation and monetary tightening, as shown in the inequality below.

R1 (profit rate)>G (growth rate)>R2 (interest rate)

We believe that this basic understanding has led to the perception that inflation is a good thing. Musha Research's view is that Chairman Powell's continued dismissal of inflation as "transitory" was based on this basic recognition, and that he was not mistaken in the main.

(4) The greatest risk is China, economic stall and Taiwan risk

Taiwan contingency that cannot be ruled out

Geopolitics will remain the biggest risk in 2023. As for the war in Ukraine, either Russia will be defeated or the stalemate will intensify, and the negative impact on the global economy will be limited. In the Far East, however, the possibility of a Chinese aggression in Taiwan is growing.

China's Economy Slowing Significantly

The Chinese economy is slowing further, and the bursting of the real estate bubble is proceeding slowly but extensively, accompanied by the authorities' attempts to patch things up. In analogy with Japan's past, the situation resembles that of 1994-5, when real estate scandals became apparent, but the actual state of financial non-performing loans was not yet known. This corresponds to several years before the financial crisis that began with the Yamaichi Securities bankruptcy.

The sharp drop in trade in November is also shocking. The year-on-year declines in Chinese trade of -8.7% for exports and -10.6% for imports compare with Japan (+20.0% for exports and +30.3% for imports in November) and the United States (+11.7% for exports and 13.0% for imports in October) and suggest a modulation. Even under the Corona lockdown, November consumption was also well below the previous year's level at -5.9%.

Tyrannical rulers faced with economic uncertainty often seek centripetal force by taking a hard line against the outside world. Since economic difficulties and a worsening long-term outlook are in sight, it can be hypothesized that action should be taken now, while economic strength is at its peak.

" The Ancient Regime and the Great Revolution" Suggests the End of the Learning Regime

The spontaneous outbreak and spread of protests against the Corona lockdown offered a glimpse into the limits of the surveillance state's ability to govern. When people are out of work and out of bread and into exile, coercion and surveillance lose their power. The poor, in search of bread, become a people who do not fear the censorship of a tyrannical government and the surveillance state. The strengthening of centralized power and dictatorial authority may have destroyed the venting and the receptacle of discontent. The panicked Xi administration has made concessions to the protest movement to ease the lockdown, which may give some confidence to the protests (even if they will be suppressed for a time).

In "The Ancient Regime and the Great Revolution," French historian and thinker A. Tocqueville is reputed to have pointed to (1) the centralization of power under Ancient regime and the loss of a discontent absorber, and (2) Louis XVI's pity for the people having the opposite effect, as the causes of the revolution, and the Xi Jinping regime may be entering into such a process. The Xi Jinping regime may be entering such a process.