Jan 01, 2023

Strategy Bulletin Vol.322

Why 2023 is the Year of Great Transformation

Happy New Year!

The year 2022 was dominated by major currency fluctuations. The global and Japanese economies in 2023 are likely to unfold over what a strong dollar and a weak yen will bring about. Exchange rates are often thought to be a result (i.e., they follow what has happened in the past). However, many historical examples show that the exchange rate has functioned as a cause of major changes after the fact. Currencies have been the means by which God (the providence that governs markets) and policy makers to accomplish their will.

Despite wars and serious geopolitical conflicts, the world economy, people's lives, and markets have not been seriously disrupted and markets are absorbing the difficulties without major disruptions. The real surprise may be the resilience of the global economy, which has been brought about by the movement of exchange rates.

I expect that the exchange rate, which has provided resilience to the global and Japanese economies, will create more significant trends in 2023.

We wish you a happy and prosperous New Year.

(1) Surprises in 2022: The magnitude of the crisis and the resilience of financial markets

Emergence of a new Cold War and enduring warfare

Looking at Russia's invasion of Ukraine, the establishment of China's personal dictatorship, the rise of despotism in North Korea and Iran etc., the world seems to have entered a state of Cold War once again. However, the Cold War between the East and West and the current Cold War are not the same. The Roman historian Curtius Rufus said, "History repeats itself. Karl Marx added it as, "History repeats itself, the first time as tragedy, the second time as farce. The Cold War was a serious struggle between East and West, as for a considerable period, the superiority of the two sides was not at all clear. Now it is clear which side is superior and which side is inferior, and both Putin and Xi Jinping are facing a challenge that they cannot win economically. In other words, it is not a crisis of the capitalist-democratic world system.

But we must not push them into a corner. Considering the lesson of Japan, which started the war against the U.S. without any prospect of victory, it is possible, and not unlikely, that a despotic state with no hope of winning will take a gamble that could trigger World War III. The only way out is to wait for economic exhaustion and endurance warfare. The policy challenge is how to manage this stalemate.

The surprise is the resilience of the economy and the market

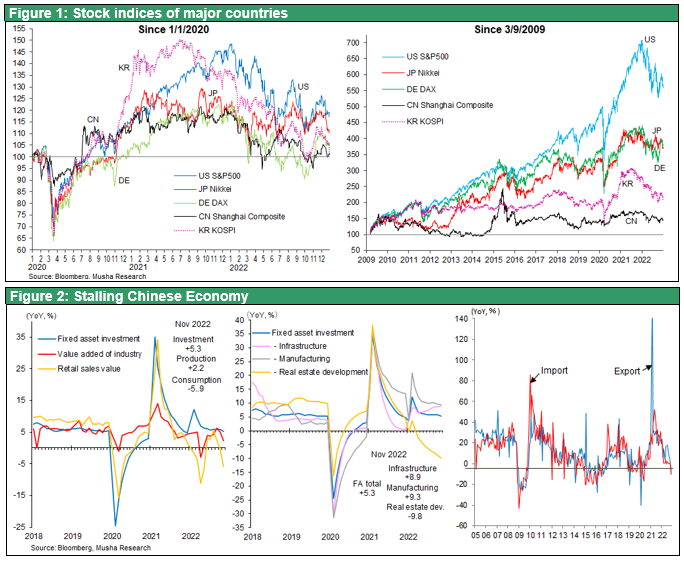

The surprise was the resilience of global markets under the difficulties of the new Cold War. Inflation has occurred. U.S. CPI growth peaked at 9.1% (June), averaged 8.1% per year (IMF forecast), and core CPI rose 6.2%. The Fed responded with an unprecedentedly fast rate hike (7 hikes in 10 months, from 0% to 4.25%, 425bp). This was unimaginable at the beginning of 2022. The S&P 500 index fell 25% from its high at the beginning of the year and was still 20% lower at the end of the year, while the New York Dow Jones was down 22% at its maximum and 10% below its’ historical peak at the end of the year. Both indexes stayed about 10% above its pre-Corona peak, indicating that the long-term uptrend has not been broken. Aside from the -58% decline during the GFC, the S&P 500's decline was -22% during the Greek Crisis in 2011, -15% during the China Shock in 2015, -22% at the outbreak of the US-China conflict at the end of 2019 (Vice President Pence's declaration against China), and -36% during the Corona Shock in 2020. Current decline is the average of the five declines that have occurred over the past decade and can be considered a movement within the cyclical range. It is unlikely that we will see a collapse of the bubbles or the collapse of equity capitalism (Figure 1).

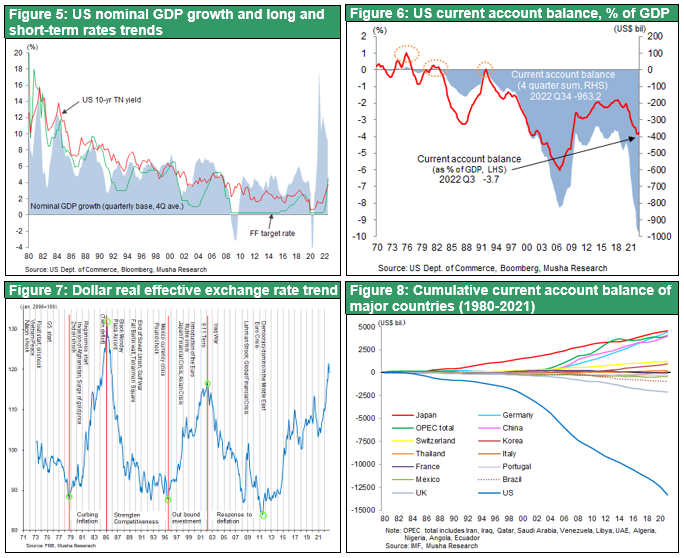

Despite Tighter Monetary Policy, Strong Dollar Averts U.S. Recession

Despite rapid interest rate hikes, the U.S. economy remains strong, leaving only the possibility of a soft landing. The US economy remains strong despite rapid rate hikes, leaving the possibility of a soft landing open. It is important to note why financial markets have been so resilient and robust. First, consumption, which accounts for 70% of U.S. GDP, is strong and continues to grow at 1-2% due to strong labor supply and demand, rising wages, and the reversal of the huge amount of savings accumulated during the Corona pandemic. Secondly, corporate earnings are solid, and employment is not deteriorating much because nominal GDP (≒corporate sales) growth at a pace of 8% exceeding long term interest rate of just below 4% have not been restrictive.

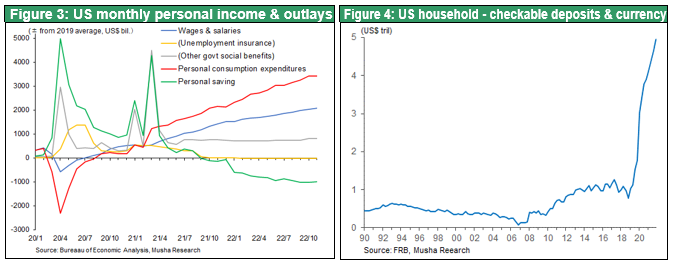

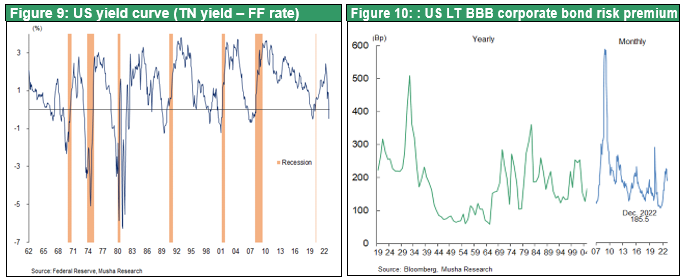

The foundation of this stability is the strong dollar. The strong dollar, at more than 10% year-on-year, has encouraged global capital inflows into the U.S. and kept long-term U.S. interest rates below half the growth rate of nominal GDP. In addition, the suppression of U.S. import prices is supporting U.S. consumption. This strong U.S. consumption is driving the global economy through increased exports to the U.S. The U.S. current account deficit is at an unprecedented level of $1 trillion (3.7% of GDP).

The chain of events triggered by strong dollar is supporting the global economy, compensating for the slowdown of the Chinese economy. The mysterious rationale of a huge debtor country supporting the world economy while running a high currency deficit can be called the global flow of funds under the Dole regime.

Strong dollar → Reverse yield steepening → Financial turbulence → Possibility of prompting U.S. interest rate cuts

Since U.S. inflation has already peaked out, interest rate hikes will stop in the first half of 2023 at a terminal rate of just over 5%. However, dollar appreciation based on the superiority of U.S. business confidence will take hold, and this is likely to exert downward pressure on U.S. long-term interest rates. This may steepen the inverted yield curve to an extreme degree, which could hurt the operations of financial institutions and non-banks and trigger a local financial panic. There could be a temporary plunge in stock prices. If the Fed cuts interest rates early, it is likely to be in response to financial market instability rather than to the real economy. If the U.S. interest rate is cut earlier than expected, the economic recession will be minimal and the U.S. economy will be able to recover. The Fed may raise its inflation target to justify a rate cut.

(2) In 2023, the entrenchment of a weak yen will force a radical change in management strategy

The Weakening of the Yen Will Force a Fundamental Shift in Management Strategies

Musha Research argues that 2023 will be a year of major change for Japan because all the economic actors that have caused the economic stagnation to date will all make major changes in their policies and actions. The yen's persistent weakness is forcing business managers, investors, and the Bank of Japan to make the necessary changes in their behavior. Policies that have been rational and necessary for corporate survival under a strong yen will become misguided under a weak yen. See Figure 11 for details.

Global demand will be concentrated in Japan, forcing companies to expand their domestic supply capacity

The initial negative phase of J-curve effect of the yen's depreciation when import price hike hurt Japanese real income going to be over soon. We will see second positive phase of J-curve effect when chain reaction of volume growth accelerates. The weak yen will make Japan's prices more competitive and factory utilization rates will increase. In addition, there will be an increase in substitution of domestic production for imported goods, which have become more expensive. The weak yen will also increase the number of inbound tourists, who will stimulate local domestic demand in all regions of Japan. The number of cross-border e-commerce (EC) activities is also increasing rapidly. Individuals and small- and medium-sized enterprises purchase Japanese products, which have become extremely undervalued, and sell them overseas via the Internet. Global demand is concentrated through a variety of channels toward low prices country, Japan. This will stimulate the domestic economy. To respond to this trend Japanese corporations must move its factories from overseas to domestic locations. In addition, employment policies must be fundamentally changed.

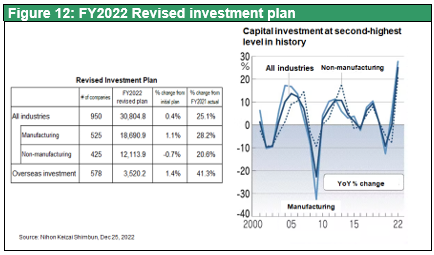

Change is already underway. Companies' appetite for capital investment in Japan is growing rapidly. Various capital investment surveys by the Policy Board of Japan, the Bank of Japan's Tankan survey, and the Nikkei Shimbun have already indicated that capital investment will reach a record high level in 2022. In 2023, when the yen's depreciation is expected to take hold, companies are expected to invest more seriously in the domestic market.

Increased capital investment and wage hikes due to labor shortage

To build a domestic production system, it is necessary to hire good people, even at high wages, and motivate them to build a competitive team. It will be difficult to rebuild a production system once it has been lost but doing so will make the difference between victory and defeat. The starting point of Japan's deflation was the loss of competitiveness due to the strong yen. The starting point of Japan's deflation was the suppression of wages by companies that had lost competitiveness due to the strong yen. However, from now on, it is necessary to change the perception that "labor is not a cost but a source of value creation”. Nippon Life has announced that it will raise wages for salespeople by 7%. The competition to secure quality labor may lead to a race to raise wages.

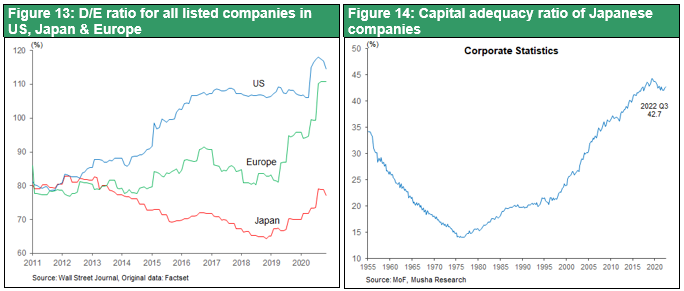

Re-leveraging and significant increase in share buybacks

A major change in corporate financial and capital policies is also needed, and one of the pillars of this change is the management of high stock prices through share buybacks. Since the collapse of the bubble economy, Japanese companies have followed a conservative financial strategy. They have reduced debt, reduced outflows of profits, increased capital adequacy, and significantly increased their financial cushion to prepare for a crisis should one occur. Figure 13 shows the debt-to-equity ratios of listed companies in Japan, the U.S., and Europe and Figure 14 shows the capital adequacy ratios of Japanese firms (Corporate Statistics). Both data tell the extreme conservatism of Japanese companies stands out. This deleveraging strategy is unbalanced, ignoring capital efficiency, and focusing solely on safety. Nowadays low leverage management can lead to low stock prices and make a company vulnerable to takeover bids, the high cost of capital can also make it difficult for a company to acquire other companies or invest in new business areas. This is a losing strategy. The company needs to maximize shareholder returns by increasing debt, lowering the cost of capital, and promoting investment, M&A, share buybacks, and other measures.

Behavioral changes are already underway, such as a sharp increase in share buybacks. The above-mentioned drastic changes in corporate behavior will melt the frozen deflationary mindset in Japan.

(3) The BOJ's gradual shift from YCC in 2023 will inspire risk-taking

Allowing interest rates to rise will inspire risk-taking.

The BOJ's YCC change policy, which surprised the market at the end of last year, will also encourage risk-taking by investors and firms and will contribute to overcoming deflation.

Three Interpretations of the YCC Modification

There are three main views on the YCC modification expressed in the market and media.

1. The theory that the BOJ going to be defeated (as asserted by most of the media, including the Nikkei and WSJ) ⇒ Challenged by global hedge funds BOJ will be forced to Interest rate hikes without overcoming deflation. Negative for stock prices.

2. Unprecedented easing has not changed at all (Explanation by Governor Kuroda, former Cabinet Office Counselor Etsuro Honda) ⇒ Economic fundamentals remain the same. Neutral to stock prices

3. BOJ offensive theory (Musha Research) => The Bank of Japan effectively raised interest rates which is the first step toward the exit of YCC. Changing policy in accordance with economic recovery and achieve sustainable 2%inflation target will be a factor for higher stock prices.

The prevailing interpretation is that the BOJ will be forced to raise interest rates further by the challenged by hedge funds, even fundamentals do not improve. The stock market has been stagnant in an environment where this pessimistic interpretation cannot be ruled out. 2. is a distressing explanation. The fact that Governor Kuroda is adamant that the easing policy will remain unchanged may be due to his caution to prevent speculators from taking him at his word.

There is a strong possibility that the BOJ will win and the YCC will be over

Musha Research believes that the change in YCC is positive in that it signals a long-term trend of rising interest rates and encourages investors to change their actions, i.e., risk-taking. The Nikkei Shimbun reported, "BOJ backed into a corner by speculators; Blue Bay Asset's JGB sale successful" (Dec. 22). The Nikkei painted the picture as if the BOJ had lost, but that is not the case at all. The BOJ wants investors and companies to function as hedge funds do. JGB shorting is the same meaning as "borrowing while interest rates are low". We assume BOJ expect that raising interest rates will promote risk-taking. The YCC was originally introduced to prevent the yen from appreciating, and now that concerns about the yen's appreciation disappear and there is no fear of the yen plummeting, the time is ripe for a normalization process.

(4) Unprecedented favorable supply and demand for stocks in 2023, all investment entities to buy stocks

Investors need to overhaul their portfolios to prepare for a sharp rise in yen interest rates

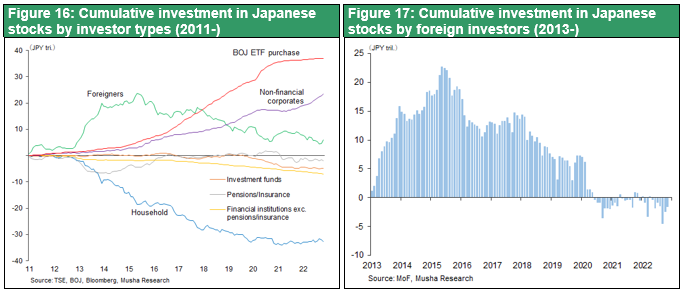

With the BOJ signaling a long-term upward trend in interest rates, investors will be forced to change their risk-taking actions. As a result, all entities (corporations, pension funds, insurance companies, foreigners, and individuals) will turn to buying stocks.

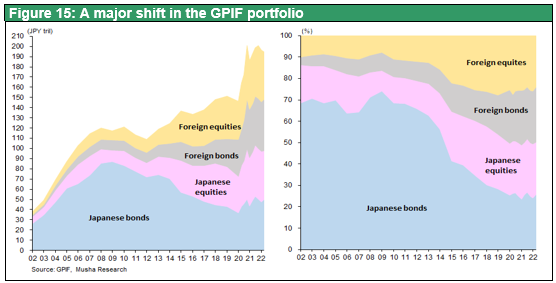

In the past, Japanese banks and institutional investors have invested in JGBs. However, since the Bank of Japan’s unprecedented easing and GPIF's investment reforms in2013-14, foreign securities have been placed at the center of risk assets in pursuit of returns. Figure 15 shows the GPIF's portfolio transition. The GPIF reforms initiated as part of the Abenomics program have resulted in a shift to a composition of 1/4 each of foreign bonds, foreign equities, Japanese bonds, and Japanese equities. However, this composition may not remain unchanged in the future. The substantial depreciation of the yen and exchange rate fluctuations, the sharp decline in foreign equities have reminded us of the dangers of foreign-currency portfolios. The time may be coming when banks and institutional investors will have no choice but to place Japanese equities at the center of their investment portfolios. With the capital requirements for banks and solvency margin requirements for life insurers, it is difficult to invest in equities with a high-risk weighting, but there may be room for a strategic response.

The Basel capital regulation, which requires homelands government bonds to have a zero-risk weighting, is not in line with reality and should be revised.

Households, foreigners, and share buybacks to join the fray

The Kishida administration's NISA reforms, which have steered the nation toward a policy of doubling asset income, have been encouraging the "asset-building through stock investment" movement among the Japanese public. The number of NISA accounts and the amount of purchases from NISA accounts are increasing at an exponential pace.

The amount of purchases from NISA accounts has been growing at a pace of 50% and is expected to reach just under 1 trillion yen by 2022. General NISA purchases (¥2.7 trillion in 2021 and ¥2.3 trillion in the January-September period of 2022) are added together, the reform of NISA includes combining two NISAs, setting the 18-million-yen tax exemption limit (based on book value balance), and the indefinite tax-exempt holding period, are expected to create a large flow of funds from deposits to stocks.

The condition of huge out-flow of funds from deposit seems to be matured since Japanese household are dominated extremely risk-averse manner in asset management that create huge opportunity loss. The breakdown of personal financial assets (excluding pension insurance reserves) is as follows. Japan has 74% of its financial assets (excluding pension insurance reserves) in cash and deposits, which earn almost zero interest, and only 20% allocated to equities and investment trust which provide 8.0% of earnings yield and 2.5% in dividends yield alone. In the U.S., the ratio is 73% for stocks and investment trusts and 19% for cash and deposits. It will not be long before households' stock accumulation investments exceed ¥10 trillion per year and emerge as a major investment entity.

In addition, corporate share buybacks are increasing rapidly, reaching a record high of 8 trillion yen in FY2021, and rising to a 10 trillion yen in FY2022. As to foreign investors, who have bought 23 trillion yen since Abenomics, sold all of it in 2020, leaving Japanese equities underweighted. However, equities in the U.S., China, Europe, and South Korea having their own problems foreign investor no longer be able to ignore Japan's brilliance.

The Nikkei 225 at 35,000 yen is not a stretch.

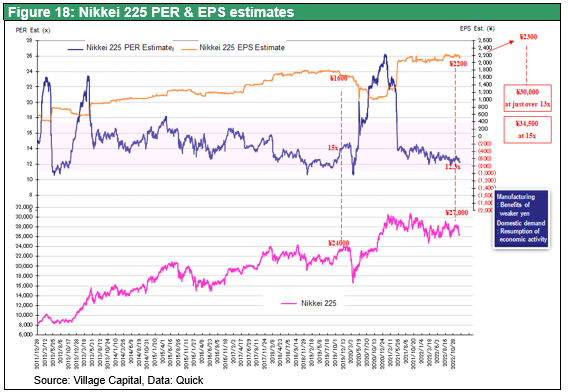

Figure 18 shows Village Capital's Ichiro Takamatsu's estimates of the Nikkei 225, expected EPS, and expected PER. The PER is 11.8 times based on the latest forecasted EPS of 2,200 yen and the Nikkei average of 26,000 yen. If EPS is expected to increase by 5% to 2,333 yen in 2033, the Nikkei 225 is expected to reach 30,000 yen at a P/E ratio of 12.8x, and 35,000 yen at P/E ratio of 15x. Considering the strong domestic economy under the weak yen, the forecast of 5% increase in profit seems to be a conservative assumption. The P/E ratio of 15x, last decade average is also reasonable considering the favorable supply-demand balance mentioned above.

A Japanese stock boom is expected in the second half of the year, when the mood in the U.S. market will change drastically. If we look ahead to 2024, the Nikkei 225 will reach a new all-time high of 40,000 by 2024.

(5) Musha Research's 10 Surprises for 2023

- Japan to be the world's driving force, inflation to settle at 2%, and YCC breakout to begin

- Wage growth to 3.5% in 2023

- Japan stock market boom: Nikkei 225 at 35,000 yen, all investors buying

- Dollar/yen rate settles at 130-150 yen

- China's slowdown becomes more pronounced and riots break out

- U.S. stock prices reach all-time highs, NY Dow to 38,000

- Fed stops raising interest rates, dollar rises again

- Nuclear power plants restarted one after another

- Withdrawal of Russia from Ukraine, Putin's fall from power

- Major shift in fiscal policy to tax cuts, special gain of 60 trillion yen from sale of U.S. Treasury securities held in the special account for foreign exchange