Jan 23, 2023

Strategy Bulletin Vol.323

Closer to Victory, Fighting a "Deadly Disease"

~ YCC correction will raise inflation expectations and bring about a stock market rally

Japan is suffering from a "deadly disease," cash is king mentality

Deflation is the root of all evil in the Japanese economy, and deflationary mindset is the starting point of deflation. The extreme cash mentality of "it is better to hold cash because of deflation" has turned Japan into a country that cant’ do anything right . Money circulates and its value increases as it changes owners. This is capitalism.

However, due to deflation, people have come to share the illusion that holding on to money increases its value, and the circulation of money has come to a halt in Japan. Since money is the blood of the economy, if the circulation of money stops, the economy will die just like people. Deflation is the denial of the monetary transformation (G-W-ΔG) in Marxian economics. Since capitalism is an endless chain of value multiplication, the negation of the transformation of money is also the death of capitalism. It is important to recognize the essential fact that Japanese capitalism is afflicted with a "deadly disease" in which money is preserved as money. This justification for inaction has inhibited people's behavior not only in the economy but also more broadly, entrenching what psychology calls "learned helplessness" = apathy syndrome.

We have been far too insensitive to the severity of Japan's deflation. Former Bank of Japan Governor Shirakawa wrote, "Japan's deflation, which began in 1998, was a moderate one, averaging just under 4% for 14 years until 2012, or 0.3% per year compared with 1930’s one when price declined 20-30%within couple of years. The real challenge was not to end deflation" (Toyo Keizai, January 21, 2023, issue). Indeed, in the early 2000s, the mild decline in prices in Japan, unlike a deflationary spiral, did not seem serious. Looking back today, however, it is hard not to recognize that prolonged deflation has fundamentally changed the mentality of the Japanese people and destroyed their animal spirit entirely.

Dysfunctional Financial Markets

No matter how much wealth corporations create and how much the intrinsic value of stocks increases, as long as deflation continues, it will be more advantageous to hold on to cash. The profitability of Japanese companies has increased significantly, and profits are at an all-time high. Despite this, stock prices are stagnant and extremely undervalued. Japan's financial markets have become completely dysfunctional as a forum for capital allocation based on fair valuations.

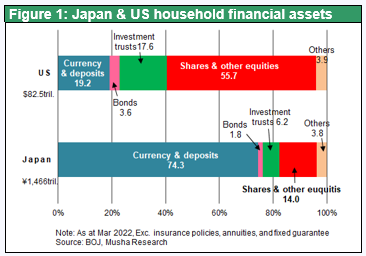

A comparison of the financial asset allocation of Japanese and U.S. households (excluding pension insurance reserves) shows that cash, deposits, and bonds with zero returns account for the majority (76%) in Japan, while stocks and investment trusts, which offer remarkably high returns of 2.5% on dividends and 8% on earnings yield, account for only 20% of the total. In the U.S., on the other hand, stocks and investment trusts account for 73%, while cash and bonds account for 23%. The reason why this disparity in returns has not been filled at all is that Japan's financial markets are broken.

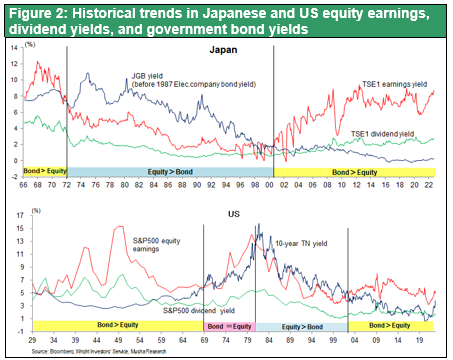

The degree of animal spirits can be observed by the yield gap between stocks and bonds. Looking back at the spread between the two in Japan and the U.S. according to Figure 2 below, we can see that the current gap in returns between stocks and bonds in Japan is unprecedented in history and comparable to the 1940s, just after World War II, when the YCC was introduced in the U.S. This is basic evidence that Japanese capitalism is suffering from a "deadly disease.

Inflationary Expectations Triggered by YCC Correction

From the perspective of combating this fundamental pathology in Japan, the BOJ's change in its yield curve control (YCC) policy last December (i.e., raising the upper limit on the yield on 10-year JGBs from 0.25% to 0.5%) is seen as a major turning point. This is the first de facto rate hike since the introduction of the YCC in 2016, and the first step for the BOJ to exit its extra-dimensional easing program. This can be seen as a sign that the extra-dimensional monetary easing is nearing victory.

The negative view, asserted by the majority of the media and economists, that the BOJ was forced into an unwilling rate hike by hedge funds selling JGBs, is mistaken. First, the BOJ raised interest rates on its own accord as the likelihood of achieving the 2% inflation target has increased, and second, while further JGB selling will continue to be a challenge, the BOJ can purchase as much JGBs as it wants to limit premature interest rate hikes. Unlike the BOE in 1992, which had to choose between the exchange rate and the domestic economy, the BOJ is not in a dilemma.

The "cash is king mentality" of investors and businesses will change radically

Now that the direction of rising interest rates has been suggested, we need to keep a close eye on what will happen down the chain. Investors and companies that have been strongly influenced by the "cash is king mentality" will be forced to change their attitude.

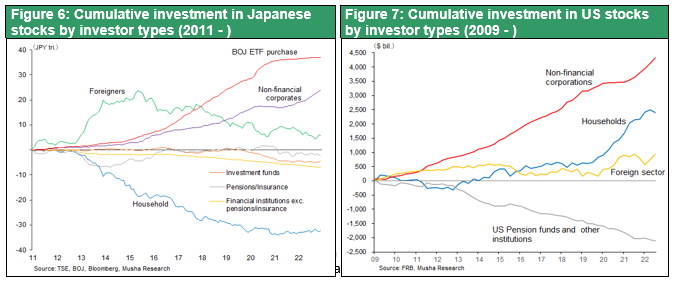

First, investors who had been relaxed about the prospect of continued zero-interest rates will have to change their attitude dramatically. Rising interest rates mean falling bond prices, and institutional investors such as pension funds, insurance companies, financial institutions, and individuals will need to shift their bond-oriented portfolios to equity-oriented ones.

Abnormally high capital adequacy ratios and low ROE will be corrected

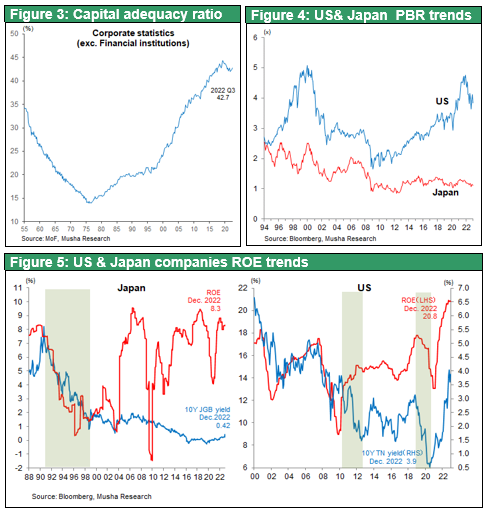

Corporations will also be forced to make a major shift in their financial strategies, which have placed an extreme emphasis on safety at the expense of capital efficiency. Since the collapse of the bubble economy, Japanese companies have followed a conservative financial strategy of reducing debt, controlling outflow of profits, and increasing capital adequacy. After bottoming out at 14% in 1975, the capital adequacy ratio of Japanese companies has risen consistently, reaching 43% in recent years, nearly double the ratios in Europe and the United States. This abnormally high capital adequacy ratio has reduced the profitability of Japanese companies and caused their stock prices to stagnate. P/B ratios are 1.1x in Japan and 3.9x in the U.S., four times higher. Both of these differences are caused by holding too much equity capital.

In the first place, equity capital is not cost-free , but responsible to pay a considerable amount to shareholders (2.5% dividend and 8% earnings yield on average on the TSE). Since equity capital costs are significantly higher than debt, which is currently around 1%, it is reasonable to reduce equity capital to lower the overall cost of capital. If they do not reduce their cost of capital by increasing their debt and reducing their equity capital now, they will not be able to compete. It is necessary to lower the cost of capital and aggressively pursue M&A and new investments. At first, they need to accelerate share buybacks, which are the quickest way to do so, and ensure high stock price management. In the U.S., share buybacks have long been the largest source of equity investment, and there is no doubt that share buybacks will increase significantly in Japan as ROE management takes root.

In this way, both firms and investors will be forced to sell bonds and buy stocks, triggering a massive shift of capital. The long-term trend of rising interest rates initiated by this policy change will dramatically improve the supply-demand balance for Japanese equities.

Turbulence at the beginning of the year, the true nature of the Japan sell-off, and misguided criticism of the Bank of Japan

Japan's economic outlook this year is the brightest among developed countries, with the IMF forecasting growth of 1.0% for the US, 0.5% for the Eurozone, and 1.6% for Japan in 2023 (as of October 2022) and the World bank forecasting 0.5% for the US, 0.5% 0.0% for the Eurozone, and 1.0% for Japan (as of January 2023). The Japanese economy is expected to rebound from the largest post-Corona economic decline among major economies due to overreaction to the pandemic and the consumption tax hike (the consumption tax hike in October 2019, just before the Corona disaster, is estimated to reduce aggregate demand in Japan by 1.2~3%, and (iii) the positive effect of the yen's depreciation.

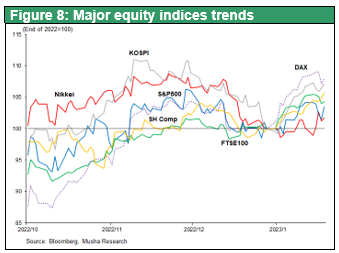

Nevertheless, at the beginning of the year, Japanese stocks started with a sharp decline amid the global stock market rally. This was because global investors widely believed that interest rate hikes were about to begin in Japan, while the U.S. and Europe were beginning to see an end to their rate hikes. However, the above explanation clearly shows that this is a misconception. Global investors are expected to re-evaluate Japanese equities.

Governor Kuroda's wise decision to trigger a major capital shift

The YCC "was a policy that had to be abandoned if 2% inflation was to be achieved" (Nikkei Shimbun, "Daiki-Koki January," January 21). Such unreasonable policies became necessary because of the extraordinary financial situation in which interest rates sank into negative territory and the yen appreciated. Now that concerns about the strong yen and negative interest rates had been dispelled, it was an opportune time for normalization.

At this juncture, Governor Kuroda unexpectedly changed the YCC, raising inflation expectations and suggesting a rise in long-term interest rates, thereby triggering a change in people's investment behavior. This could fundamentally change the supply-demand balance for stocks and trigger a massive shift of capital. The correctness of this decision will be proven by the Japanese stock market rally that is about to take place. It will be regarded by future generations as a historically wise decision.