Feb 06, 2023

Strategy Bulletin Vol.324

Global Economy and Markets on the Rise

- The possibility of a bull market is growing amidst skepticism

(1) Positive Surprise in the Midst of Pessimism

Upward revision by IMF

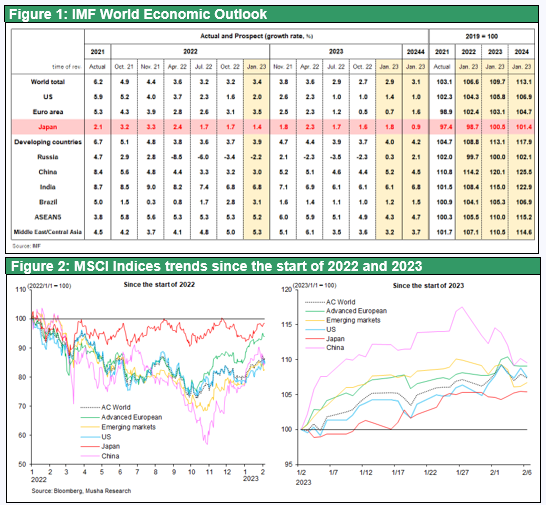

The year 2023 began amidst pessimism. The year 2023 began with a mountain of concerns, including the war in Ukraine, the U.S.-China confrontation, inflation for the first time in 40 years, and rapid monetary tightening, all of which caused investors to brace themselves. However, the developments in January came as a pleasant surprise. First, the IMF revised upward its global economic outlook for 2023, stating that the world economy will not fall into recession. 2023 global GDP growth will be 2.9%, slower than the 3.4% forecast for 2022, but 0.2 percentage points higher than the forecast as of last October. The revision was driven by an improved outlook for the two largest economies, the U.S. and China. China was revised upward from 4.4% to 5.2% as the economy is expected to normalize due to the lifting of its strict corona policy. The U.S. was revised up from 1.0% to 1.4%, mainly due to a more favorable financial environment as inflation peaked out. The growth rate for the Eurozone, which had been severely concerned, was raised from 0.5% to 0.7%, as price increases peaked out, driven by a plunge in natural gas prices due to a warm winter, and the government's policy to compensate for higher energy prices also contributed to the revision. In Japan, where a weaker yen and fiscal policy are expected to contribute, the forecast was revised from 1.6% to 1.8%.

Emerging markets and Europe led January's stock surge

Global equities also overturned the pessimism that had overshadowed the market, and began the month with a sharp rally, with the MSCI index, which covers the world, rising 8.2% in January(as of February 3) for the global index, 10.4% for developed Europe, 8.6% for emerging markets, 4.8% for Japan, and 8.1% for the U.S. All these indexes were significantly higher. China, South Korea, Taiwan, Germany, and the Netherlands, all of which had fallen sharply by more than 20% last year, rose by more than 10% in a single month, regaining almost half of their declines over the past year.

Is it too early to let down our guard?

People are wondering to what extent they can trust this sudden positive turnaround. Most are still holding to their grim view from last year and are still wary of the current recovery as an Indian summer on the road to winter. Indeed, it will be some time before monetary tightening has a real impact on the real economy. Although inflation has peaked out, it is still too early to be reassured, as it is still far from the 2% target for each country. Fed Chairman Jerome Powell has also indicated that the Fed will raise interest rates several times this year and that a rate cut is still not on the horizon. Also, the U.S. economy is firming and the unemployment rate fell to 3.4% in January, the lowest level in 53 years, suggesting that inflationary pressures through higher wages have not weakened. It is difficult to deny the caution that it is too early to be jumping to the conclusion that inflation and interest rate hikes have run their course.

(2) The possibility that a bull market is growing amidst skepticism

However, as John Templeton famously said, "Bull markets are born in pessimism, grow in skepticism, mature in optimism, and disappear with euphoria," the prevalence of pessimism and caution is an essential condition for a major bull market wave to begin.

Why ample investment capital under strong monetary tightening?

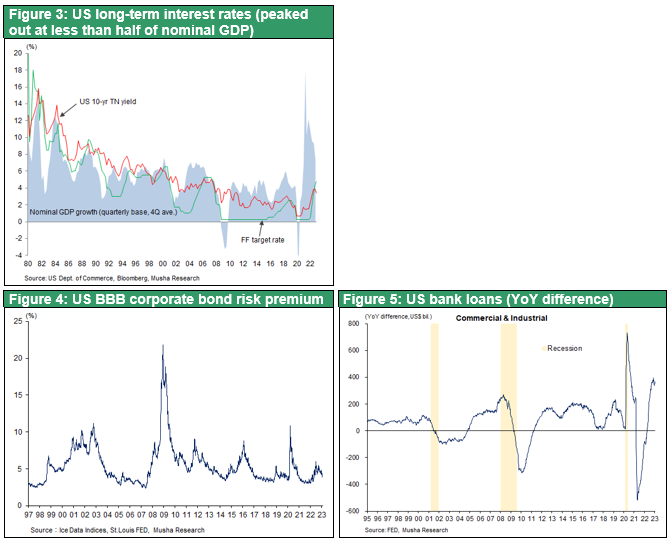

What elements, if any, has skepticism overlooked? The first is the existence of ample global investment funds and liquidity. For many people , it was completely unexpected that such an abundance of investment capital would remain in place despite eight rate hikes in the U.S. over the past year, for a total of 4.50%. Surplus funds have flowed into emerging market equities and lower-rated U.S. credit markets, and risk premiums have begun to decline. Most importantly, the yield on the 10-year U.S. Treasury note has fallen to around 3.5%, even though short-term interest rates have been raised to 4.5%. This is half the CPI and half the nominal economic growth rate, and based on the Taylor rule, it is still at an accommodative level. It could be said that the money glut is allowing the effects of monetary tightening to slip through the cracks. It is as if we are witnessing the same situation that former Fed Chairman Alan Greenspan described as a "conundrum.

If this is the case, what should we make of the rise in the prices of high yield bonds and stocks in emerging markets with higher risk, the increase in U.S. bank lending, and the rise in the copper market, which is highly linked to the global economy?

Innovation and increased capital productivity in the corporate sector

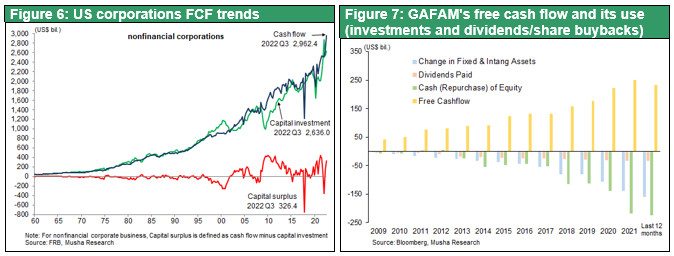

Just as the decline in long-term interest rates since 1980 was not a harbinger of an economic downturn, it is possible that the current decline in long-term interest rates is due to another factor. What it may be is that the value generated by the corporate sector is greater than the investment required by the corporate sector, and that a constant capital surplus is occurring. Behind this is the continuous increase in capital productivity. Prices for equipment, machinery, intellectual assets, etc. have fallen significantly, and this has led to lower reacquisition prices for equipment and other assets, thereby reducing the amount of investment required. In addition, restructuring is underway in GAFAM, where AI and robots are replacing the labor force, and the large productivity gains may be causing a money glut in the corporate sector. The existence of substantial free cash flow of U.S. companies, as seen in Figures 6 and 7, indicates that the corporate sector has an ample surplus of funds.

Deflation, not inflation, is the real enemy of U.S. authorities

The second factor that has been overlooked is determining what the real enemy of the U.S. policy makers is. We will leave the details for another time, but it is clear that the Fed's biggest threat is deflation, not inflation, and Japanification. We can assume that a rate hike that leads to overkill will not occur. The Fed is essentially fighting deflation. There is a consensus among U.S. economists and policymakers that deflation is the result of a potential failure to achieve growth potential, which implies policy sabotage and is by no means inevitable. The Fed will soon reverse its excessive and unnecessary tightening.

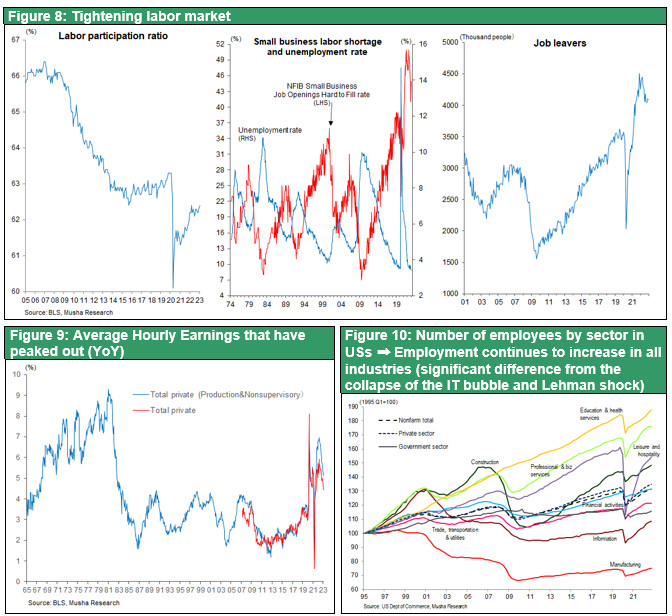

Efficiency of the U.S. labor market is restraining excessive wage growth

Third, what has been overlooked is the fact that labor supply and demand remain favorable even in the face of an economic slowdown and that the rate of wage growth has peaked out. The labor market is elastic and is reallocating resources. The labor shortage in truck drivers and the hospitality industry, including waiters, and waitresses, which was caused by the extraordinary labor supply-demand crunch under the Corona disaster, is easing, and the rate of wage growth is slowing. Low employment growth in the higher-paying sectors of finance and information has also slowed the growth of overall wage levels.

However, firms are strongly motivated to hire, and employment is increasing in all sectors (see Figure 10). The virtuous cycle in which strong consumption leads to broad employment opportunities has not been undermined at all: during the business process reengineering revolutions (BPR)of the early 1990s, white-collar workers who were replaced by machines lost their jobs, and a jobless recovery continued, leaving the labor market in a slump. There was a phase of jobless recovery. Compared to that time, the current situation shows how vigorous the creation of new job opportunities is.

If we take into account the underlying factors described above, we should keep in mind that the surprising global stock market rally in January 2023 may well be the initial stage of a major upward cycle. In the case of Japan in particular, the imminent departure of Bank of Japan Governor Kuroda, who has been thoroughly market friendly, is putting downward pressure on stock prices due to concerns about a shift in monetary policy. If Prime Minister Kishida were to nominate as the next BOJ governor the correct successor to Governor Kuroda’s monetary easing, this could be the start of a major rally.

(3) Psychology and supply/demand, tending toward pessimism, valuation adjustments are over

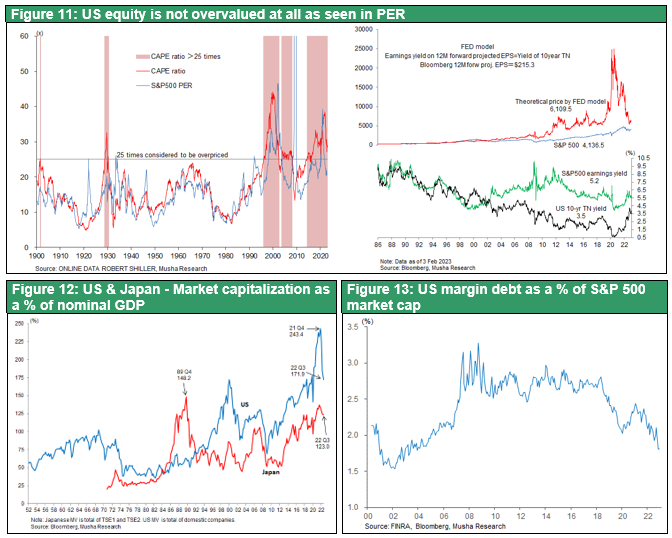

In terms of stock valuations, U.S. stocks are no longer overvalued at all. The GAFAM P/E ratio, which rose to just under 40x at its peak, has fallen to 25x, and the S&P 500 P/E ratio has returned to its historical average range of just under 18x, after falling from 23x to just under 16x last October. Based on the FED model (equity yield = 10-year Treasury yield) shown in Figure 11, we can say that the valuation adjustment is almost complete, given that a 4% long-term U.S. interest rate can justify a PER of 25x.

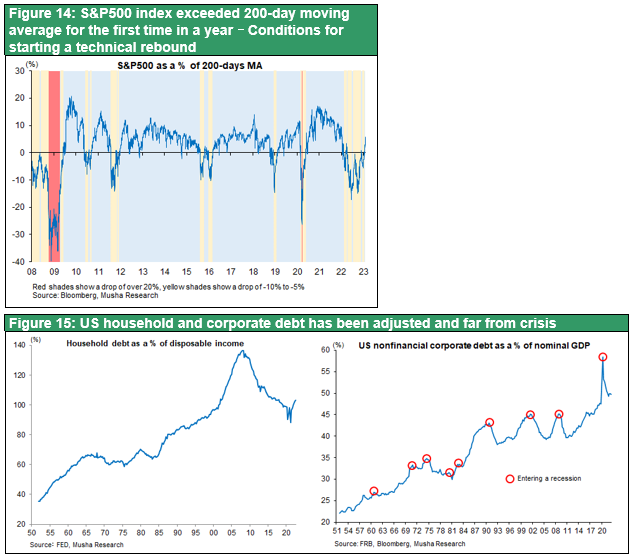

In addition, market sentiment has swung to extreme pessimism. It is undeniable that the global stock market has an excessive negative bias in terms of psychology, valuations, and supply and demand. The basis for many pessimists who have been strongly advocating the theory that the U.S. stock bubble will burst has collapsed. See Figures 11 through 15 below.