A new age of monetary easing ? The BOJ launches initiatives targeting asset prices

The BOJ has embarked on a full-scale, non-traditional monetary easing program that involves using the BOJ’s own balance sheet to invest in ETFs, REITs and other financial assets. In other words, the BOJ has started an attempt to influence prices of assets directly. People who still believe in textbooks of the past are convinced that central banks should never invest in assets that clearly include exposure to risk. However, there are a number of new realities today that include:

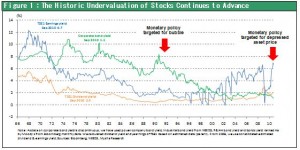

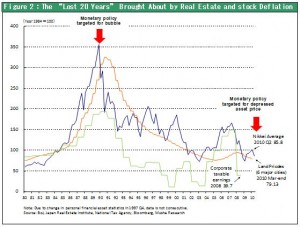

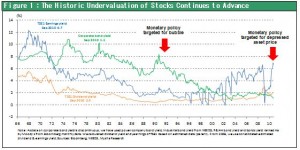

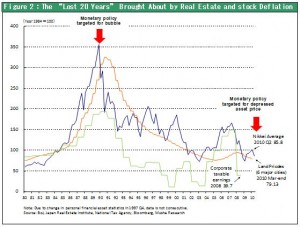

(1) There is a growing negative bubble (asset deflation) for asset prices in the U.S. and particularly in Japan (see Figures 1 and 2).

(2) The world is in an age in which the direct conversion of assets into financial instruments has created a strong link between the level of asset prices and the creation of credit.

(3) The negative bubble (asset deflation) is causing the yen to strengthen, which in turn is fueling even more irrational speculation that the yen will appreciate even more.

The BOJ is now taking steps to respond to these new realities the first time. Adopting this stance represents a historic shift in the BOJ’s policies.

Not the first time the BOJ has targeted asset prices with monetary policies

In 1990, the BOJ used monetary measures like a tight-money policy and restrictions on real estate loans for the purpose of eliminating an obvious real estate bubble. But the same BOJ that fought this positive bubble had abandoned the fight against the negative bubble (asset deflation) that took hold in Japan in the past decade and has recently become even more worrisome, an indication that the BOJ had lost its sense of balance.

Dissatisfaction remains

Of course, there are a number of problems concerning the BOJ’s investment plans. One is the relatively small 5 trillion JPY initial fund for making these purchases. Another problem is the lack of a clearly defined action program. That means the BOJ’s administrative departments are entrusted with making investment decisions. The exclusion of investments in foreign bonds (which are vital to ending the yen’s appreciation) is another problem. However, BOJ purchases of medium and long-term Japanese government bonds using this fund are not covered by the so-called “BOJ bank note rule.” This rule prevents the BOJ’s holdings of medium and long-term Japanese government bonds from exceeding the amount of bank notes outstanding. As a result, the BOJ can buy an unlimited amount of these bonds by simply increasing the size of the fund for investments. Using this capability will probably push up prices of all types of assets by using the portfolio rebalancing effect. The BOJ’s October 5 decision may be a key turning point in the fight to end Japan’s negative bubble (asset deflation). We must not underestimate the importance of the initiatives of the BOJ, which is now fighting side-by-side with the Bernanke-led U.S. Federal Reserve Board. This is why investors must keep in mind a mantra that the investment community has observed for many years: Don’t fight the Fed.