May 16, 2023

Strategy Bulletin Vol.332

The era of low interest rates is not over

The highest inflation in 50 years, the firstest rate hikes in 40 years, and the decline in elevated asset prices have led many to believe that the era of disinflation and low interest rates is over. The focus of financial markets over the past year has been to determine whether the regime has changed. Musha Research has been following this point closely and is concluding that the regime has not changed, and the era of low interest rates is not over. The BOJ's policy shift will be delayed significantly under the return of low global interest rates. Neither the administration nor public opinion will accept a change in monetary policy of BOJ that could lead to the future appreciation of the yen.

Over the past year, the following points have become almost certain.

- Inflation is transitory and will return to normal in two years.

- The trend of low interest rates will not change. The role of tightening monetary policy to prevent inflation from taking root has ended. The negative influence of the largest inversed yield curve in the past 40 years will worsen.

- If the era of low interest rates is not over, asset prices are not in a bubble

- The new industrial revolution continues.

Investment positions based on the assumption that an era of inflation and high interest rates has arrived should be corrected.

(1) Inflation is transitory and will return to normal

Primary inflationary factors have been completely eliminated

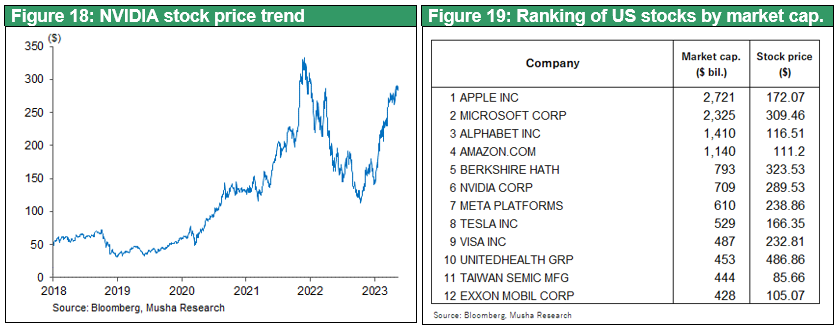

The transitory resource price and supply chain disruption inflation did not take hold due to the Fed's quick response. In another year, inflation will be noticeably lower. Figure 1 shows the contribution trend of the U.S. CPI by items. The energy factor (green) and the supply chain disruption factor (gray), which were the main causes of inflation a year ago, have completely disappeared.

Core service prices driven by higher wages, and food products are the main drivers of inflation now, but these will slow significantly over the year. The rise in food prices is due to higher raw material and energy costs, but that is already an issue of the past.

Wage growth has started to slow under tight labor market. Cause of wage hike was supply side problems

Average hourly earnings has peaked out(Figure 2).The reason why wage inflation has slowed in the absence of deteriorating labor supply and demand and rising unemployment are: 1) Wages tend to be reflection of cost of living, and inflation of last year was automatically passed; 2) The labor shortage in the truck driving and hospitality industries as a part of the supply chain disruption is being resolved, and 3) AI is replacing labor in high-wage sectors such as finance and the information industry, which is putting downward pressure on wages (Figure 3). Labor supply and demand should ease due to monetary tightening and stricter lending due to the banking crisis. A marked decline in upward pressure on wages is expected.

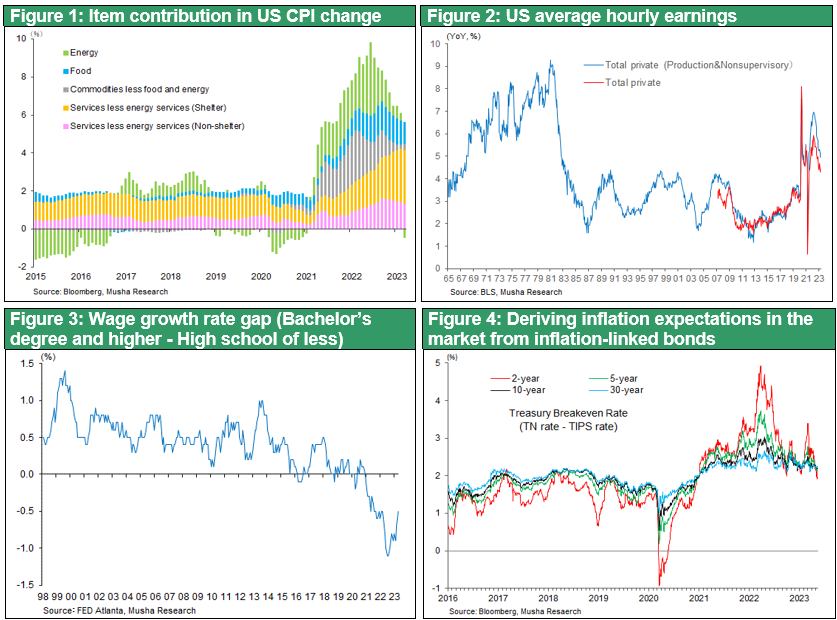

Housing cost inflation, which currently account for 56% of the price increase contribution, will be less than halved in a year's time, as home prices have fallen significantly due to higher interest rates. However, U.S. housing is in short supply, and the vacancy rate is declining significantly. The dilemma is that if new housing construction continues to be restrained by tightening monetary policy, the housing shortage and price hikes may be accelerated (Figure 5). From this point of view, it can be concluded that raising U.S. interest rates will not be effective in controlling inflation.

Inflation returning to the 2% level, which is already factored in by the financial markets

The above-mentioned subduing of prices has already been factored into the financial markets. The expected inflation rate, calculated from the yield on the inflation-linked bond, has fallen to 1.9% in two years, 2.1% in five years, and 2.2% in 10 years, at the pre-corona pandemic level (Figure 4).

The difference in temperature between the Fed and the financial markets, which persistently insist on price warning signals, is debated, but the Fed has been tightening on a precautionary basis to prevent inflation, which is transitory in nature, from taking root. Currently, it has a strong bias to emphasize inflation risk over substance, and the Fed will turn its stance sharply at some point.

(2) The era of low interest rates has not ended, and interest rate cuts will lead to a decline in real interest rates, which have remained high

Greenspan's Conundrum revisited

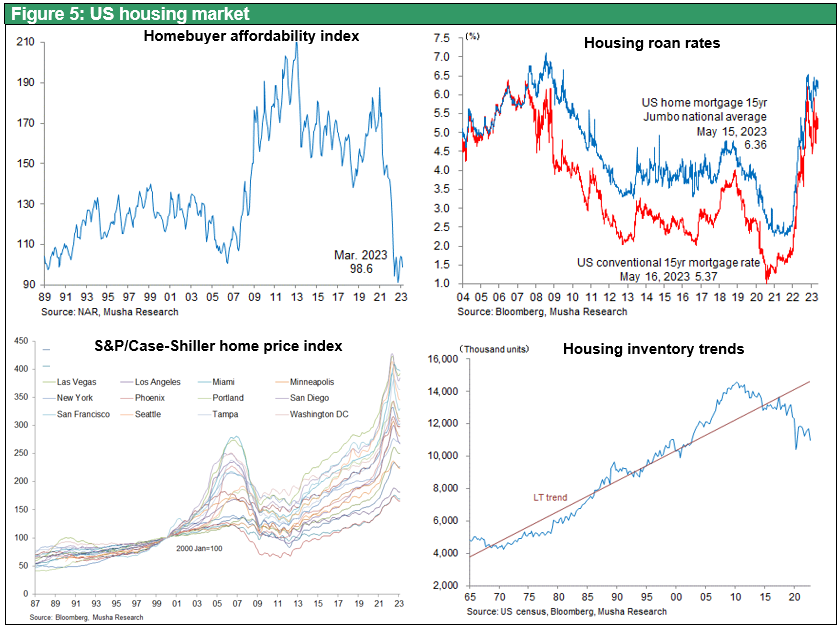

Despite a hike in short-term interest rates to 5.0%, the yield on the 10-year U.S. Treasury note has fallen to around 3.3-3.5%, indicating that there is still ample global investment capital available. This is less than half of the nominal economic growth rate of 7.1% (20231Q) and is still at an accommodative level (Figure 6). The money glut is also making the effects of monetary tightening disappear. For many, the fact that ample investment capital is still available despite the historic rate hikes is completely unexpected. This is precisely the kind of situation that former Fed chair Greenspan described as a mystery in 2005 (Figure 7), and it is replicated with even greater intensity.

Large room for interest rates to fall

Nevertheless, if inflation is transitory, long-term interest rates are not factoring it in.10yeras TIPS(real interest rate) are currently running between 1.2% and 1.5%,which is the highest level since the 2010s (Figure 8). This elevated level is likely to be driven by the Fed's hike in short-term interest rates; once the Fed's policy shift becomes clear, real interest rates are likely to fall markedly, which would provide an incentive to invest in riskier assets.

Continuous money surplus in the background

If ample liquidity has not changed despite the sharpest monetary tightening in 40 years, what is the cause? We can only assume that the main causes are the high profits generated by the new industrial revolution and excess savings in the corporate sector. Although the softness of orders for durable goods and the restrained investment due to economic uncertainty must also be the reason, this alone cannot explain the abundant liquidity.

Fifty years ago, the leading companies in the U.S. were GM and GE. When these companies made money, they expanded their factories and increased employment, triggering the next cycle of economic expansion. However, today's leading companies, such as Apple and Google, do not invest in facilities and do not increase employment much even if they make money. Their enormous corporate profits are not linked to demand creation and the expansionary cycle of the economy. As a result, corporate surpluses remain in the financial markets, causing extremely low interest rates.

Figure 9 shows that the U.S. corporate (non-financial) sector's free cash flow (= free cash flow) has changed from a continuous deficit to a continuous surplus since around 2000. At the same time, U.S. long-term interest rate has been consistently lower than the nominal economic growth rate, indicating a strong correlation between the two.

In its most recent World Economic Outlook (April 2023, Chapter 2), the IMF also states that the factors that have lowered real interest rates (≒ natural rate of interest) over the long term have not changed, therefore, once inflation is under control and central banks in developed countries will ease monetary policy real interest rates will return to their pre-pandemic levels. In other words, the IMF concludes that the recent rise in real interest rates is temporary. The IMF, however, assumes that the long-term decline in real interest rates is due to the decline in total factor productivity, which I doubt, as it underestimates the decline of deflator.

(3) Venting of asset bubbles is over

Bubble-like asset prices have already adjusted, and stock prices are remarkably recovering

Last year, there was growing criticism that the extreme monetary easing under the Corona disaster had triggered speculation in real estate, luxury brand goods, stocks, and other assets. Based on these observations, many experts warned that monetary tightening would lead to a widespread bubble burst. However, ample liquidity has not changed, and global demand for high-technology and high-end consumption, such as luxury goods and tourism, remains strong. Although some have characterized stock prices as a bubble, if the era of low interest rates is not over, stock prices are not a bubble in comparison to government bond yields.

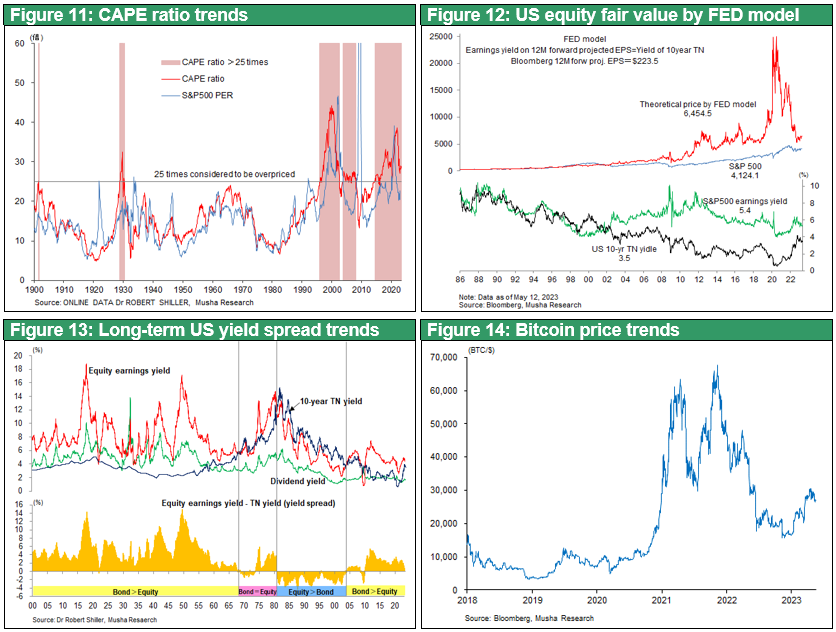

Figure 11 shows the CAPE ratio (the ratio of stock prices to inflation-adjusted 10-year moving average earnings), on which U.S. stock market bubble theorists rely. As of the end of April, the CAPE ratio stood at 28.9 times, which tends to be regarded as a bubble. However, of the 315 months since February 1996, when the CAPE ratio exceeded 25 for the first time since the Great Depression, the ratio has only been below 25 for a total of 104 months, thus 67% of the period CAPE ratios have been above 25. In other words, bubbles have become the norm. If stocks are financial assets and long-term interest rates (10-year government bond yields) are the yardstick for measuring the value of financial assets, it is indisputable that falling interest rates raise reasonable P/E ratios. Historical fact is that when the long-term interest rate was 15%, the earnings yield was 15% (1980-1981), so it is natural that PER has been rising since 1995, when the long-term interest rate fell significantly, and high PER should be considered the new normal. The reasonable stock price calculated using the correlation (FED model) that continued from 1980 to around 2000, where expected earnings yield (expected profit/stock price) = 10-year government bond yield, is 6,546 points for the S&P 500 index if the 10-year treasury yield is 3.5%, and the actual stock price is undervalued by 30% (Figure 12). We would like to emphasize that the bubble theory, which ignores interest rate arbitrage, is a weak argument. This is evidenced by the yield spread over the past 100 years, as shown in Figure 13.

After the outbreak of the Corona pandemic in 2020, a boom in smartphone-based stock speculation through online brokerages for individuals such as Robin Hood was triggered, and speculation has intensified in crypt currencies and meme stocks. The P/E ratio of GAFAM, an Internet platform company, exceeded 40x, indicating that the market was overheated. However, the bubble has almost disappeared in the process of the sharp decline of stock prices in 2022.

(4) Monetary tightening now becoming harmful A sharp turnaround in the second half of the year

The side effects of the strong monetary tightening have surfaced with the chain of bank failures. The biggest inverse yield (inversion of long/short interest rates) in the past 40 years has made the deposit and loan business models of banks unviable.

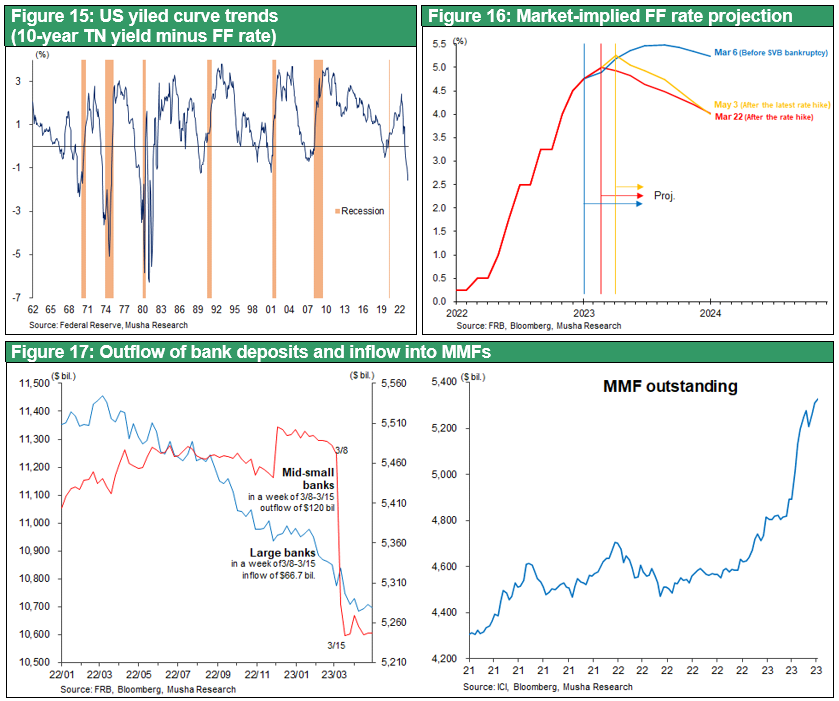

- The traditional business model of commercial banks is to accept deposits at short-term interest rates and earn interest by lending at higher interest rates or investing in long-term bonds, but the sharp rise in interest rates has resulted in the largest inverse yield in the past 40 years (Figure 15).

- The gap between deposits, for which interest rates are rising at a slower pace, and market products such as MMFs, which offer higher interest rates, has been causing a rapid outflow of deposits via smartphones (digital bank run), resulting in a shortage of funds (Figure 17).

- Bonds invested in place of loans experienced price declines and losses in value

Although the Fed's full protection of deposits, the Fed's emergency loan (BTFP), and the support of major banks such as JPM have brought about a lull, if the inverted yield condition shown in Figure 15 continues for a year, it is very likely to cause a serious financial crisis and a major recession.

Interest rate cuts are also desirable from the standpoint of curbing inflation. As mentioned earlier, the best way to restrain wage hikes is not to restrain aggregate demand, but to eliminate supply-side disruptions and to increase productivity and supply through innovation and investment. Clearly, a cut in interest rates is desirable to strengthen the supply side.

In addition, housing costs are currently the largest source of inflation, and since housing shortages are causing housing prices and rents to rise, it is desirable to increase the supply of housing by lowering interest rates.

As we have seen above, monetary tightening become harmful, the Fed will have no choice other than change (Figure 16) .

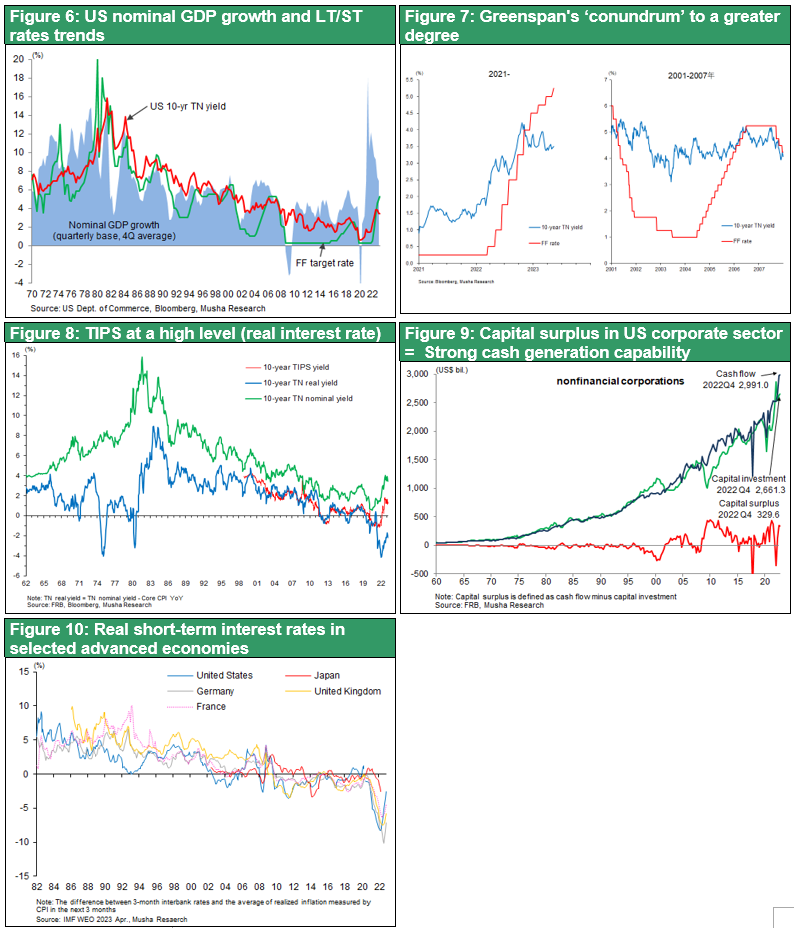

(5) The new industrial revolution takes on new dimension, unwavering animal spirit

The reason why, despite such tight monetary policy, liquidity is abundant and stock prices and the economy have not been seriously affected is due solely to the power of the new industrial revolution. There are two explanations. First, the corporate sector has generated tremendous amounts of cash, and the savings surplus has not wavered; corporate cash surpluses have become the norm. Second, confidence in technological evolution is unwavering, and investors' animal spirits are alive and well. Confidence is strong that AI technologies such as Chat-GPT will trigger a new dimension of innovation, as evidenced by NVIDIA's rapid stock price growth.

High-tech companies are during a correction phase, as especially strong IT demand under pandemic period has run its course, demand for smartphones has peaked out, and excessive inventories are adjusted. Companies are embarking on restructuring. However, the market seems to think that these adjustments are short-term and cyclical and will soon be over.