Jun 05, 2023

Strategy Bulletin Vol.333

Japanese Stocks Outstandingly High, U.S.-China Confrontation and Super Weak Yen Turned the Tide

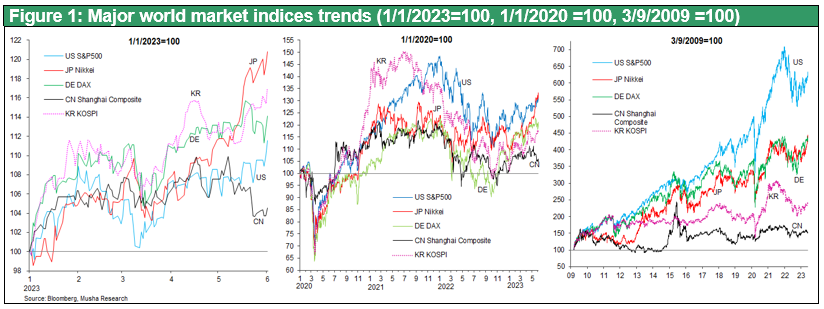

Japanese stocks have leapt to the center of global equities. Musha Research has been claiming that 2023 will be a year of profound change for Japan, a year in which Japan will become the center of global investment, and this is now evident. Japanese equities are now the best performing in the world. Since the beginning of the year, the Nikkei 225 has been the best performer, +22%, ahead of the US (SP500) +11%, Germany (DAX) +14%, and South Korea (KOSPI) +17%. The increase since January 2020, just before Corona pandemic, is+34%, also the highest increase among the world's major markets.

This dominance of Japanese equities is solely due to the inevitable confrontation between the U.S. and China and the persistently weak yen. If the U.S.-China conflict had not occurred and the yen had remained strong, Japan's economic slump would have continued, and Japanese stocks would be in a completely different world than they are today. In the U.S., however, the left and right, Republican and Democrat alike, have unanimously agreed that China poses the greatest threat to the nation, and deterrence against China has become the most important national agenda item. It is fair to say that this changed the course of Japan's destiny.

It All Began with U.S.-Japan Semiconductor Cooperation

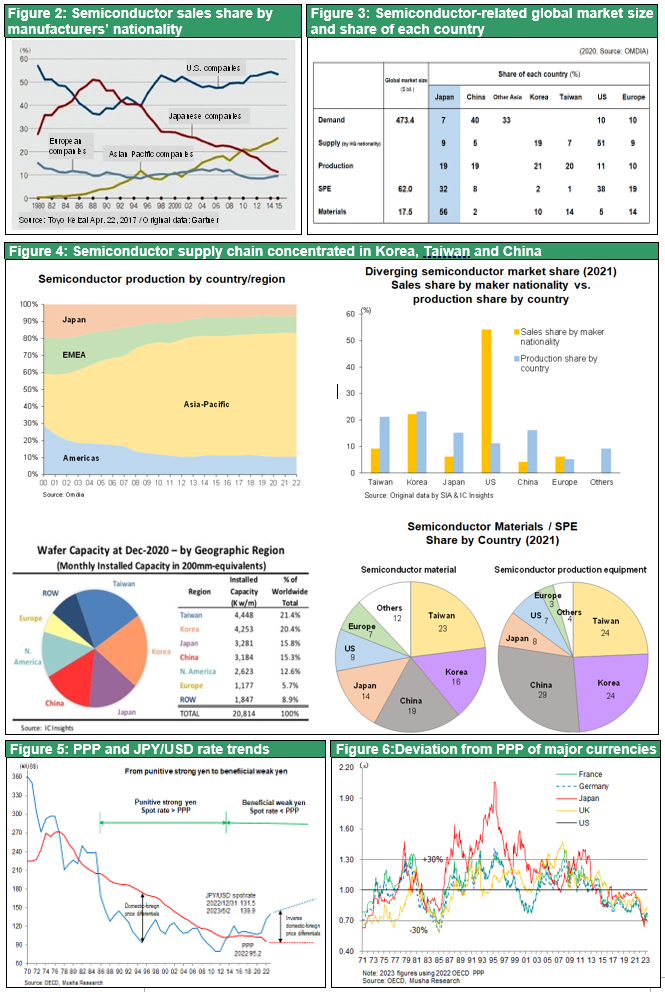

The deterrence measures against China initiated by the Trump administration were given initial impetus by the Japan-U.S. joint statement at the Suga-Biden meeting in April 2021, and the flow of events leading up to today has been created from the decoupling of Western world from China and Japan-U.S. semiconductor cooperation. One month after the Suga-Biden meeting, the LDP's semiconductor council, headed by Triple A (Amari, Abe, and Aso), was established and decided to promote investment on the scale of 10 trillion yen. In October 2021, TSMC, the world's most powerful semiconductor manufacturer, decided to build a factory in Kumamoto, Japan, with an investment of 1 trillion yen, and a second phase of the construction has been informally decided without even waiting for the completion of the first phase. Rabidus, a leading-edge semiconductor manufacturing company funded by the public and private sectors, is promoting a cumulative investment of 5 trillion yen in Chitose, Hokkaido. In connection with the Hiroshima Summit, the leaders of the world's major semiconductor companies, including TSMC, Intel, Samsung, and Micron Technology, gathered in Japan and announced a series of semiconductor investments in Japan. In Kumamoto, a boom state is occurring as land prices and salaries of semiconductor-related engineers’ soar. This trend is expected to spread nationwide. Japan holds an overwhelming 56% share of the global market for semiconductor materials and 32% for semiconductor production equipment, making it the most important base for Japan to break away from its dependence on China. In particular, Japan's accumulated technologies in the back-end process (assembly), which is the key to future technological innovation, are at a world-class level, and semiconductor manufacturers have begun to take advantage of investing in Japan. Japan's high-tech industry cluster, once completely defeated, is now on the verge of a major revival.

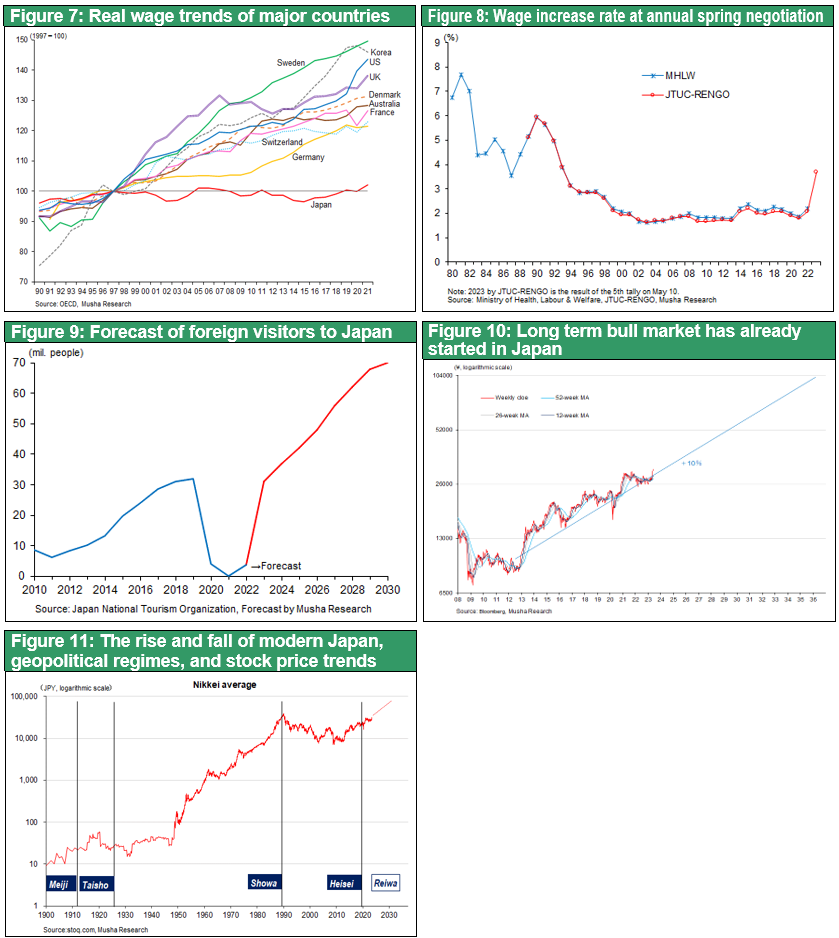

The U.S. Acceptance of the Weakening of the Yen Determined Japan Rise

In tandem with this high-tech decoupling from China, the yen plummeted from the 100-yen level in 2021 to 150 yen by mid-2022, a plunge of more than 30%. From the 1990s to around 2010, the yen remained more than 30% above its purchasing power parity, which was designed to suppress Japan's strong industrial competitiveness, resulting in Japan becoming the world's most expensive country and severely weakening its industrial competitiveness. As a result, Manufacturers closed domestic factories, cut jobs, and relocated overseas. Banks redirected Japan's ample savings to overseas loans. The strong yen caused people, money, factories, and business opportunities to leave Japan, leaving the Japanese economy stagnant. Japan's high-tech industry lost out to South Korea, Taiwan, and China.

Global Demand Floods into Cheap Japan

As a result of the yen's depreciation, Japan suddenly became the world's low-cost country: the yen's purchasing power parity is 95 yen in 2023, while the actual exchange rate is 138 yen, making the yen nearly 40% cheaper than its actual value. Global demand that has moved away from Japan due to the strong yen is now rapidly coming back to concentrate in Japan due to the weak yen. It is clear from a variety of circumstantial evidence that the U.S. acceptance of a weaker yen is at the heart of this trend.

The Japanese economy in 2023 will be the brightest year for volume growth since the bursting of the bubble economy, as the J-curve effect will end the negative price impact of the yen's initial depreciation and usher in a period of volume growth multiplier effects. The weak yen will strengthen Japan's price competitiveness and increase factory utilization rates. In addition, there will be substitution of domestic production for imports that have become overpriced. According to various capital investment surveys, such as those conducted by the Development Bank of Japan, the Bank of Japan's Tankan survey, and the Nikkei Shimbun, capital investment in 2022 is already at a record elevated level. The weak yen will also increase inbound tourism, which will stimulate local domestic demand in all regions of Japan. Global demand is concentrated through various channels toward cheap Nippon, which is beginning to stimulate the domestic economy.

Deflation in Japan began in the first place when companies lost competitiveness due to the strong yen and began to suppress wages. Now, however, labor supply and demand are tightening, and companies are forced to hire good people and build competitive teams, even at high wages, to build domestic production systems. There is a shift in perception: "Labor is not a cost but a source of value creation." According to RENGO, the average wage increases in 2023 is 3.67% (as the result of the 5th tally on May 10), the highest in 30 years.

Japan's Valuable Geopolitical Position Showed at the Hiroshima Summit

The Hiroshima summit was a remarkable success as a forum for uniting the democracies in their confrontation with China, and it served as an opportunity for Japan to show the world its valuable international role. Japan is the most powerful ally of the U.S. against tyranny; Japan is the only country bordered 3 tyrannical states Russia China and North Korea; Japan maintains the world's top position in high-tech industrial strength and technology, including materials, components, and equipment; Japan is an integral link in the high-tech supply chain; Japan is the only non-white country in the G7 that advocates diversity, and has a strong relationship with the Global Japan is the only non-white country in the G7 that advocates diversity and has contacts with the Global South (developing countries), and Japan is a pacifist country that seems to be self-sufficient.

History's favorable winds are in Japanese equities' favor

These circumstances are beginning to trigger a virtuous cycle in the economy and markets, but only in Japan. If this is the case, the current high stock prices in Japan may not be a sign of economic recovery, maintenance of ultra-loose monetary policy, correction of undervaluation, or other petty things, but rather the beginning of an era in Japan, the starting point of a period of prosperity in Japan.

We have entered an era in which we can even say that Japan's defeat in the past war and its lost 30 years were a period of preparation for the coming era of prosperity.