Jul 03, 2023

Strategy Bulletin Vol.335

China's declining economy, India's rising economy, and slowly advancing encirclement against China

(1) Chinese economy stalling, investment funds leaving China

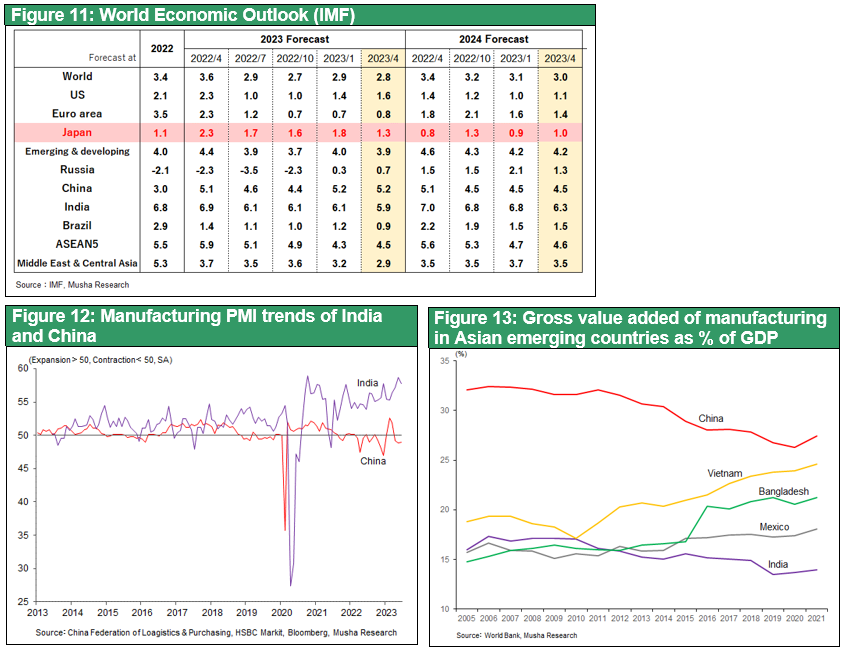

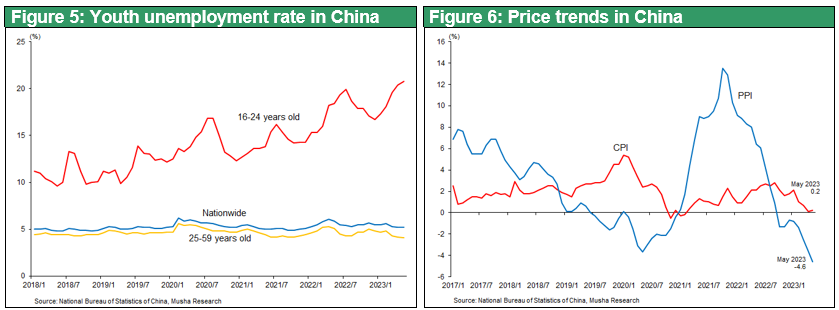

China's economic slump has become conspicuous. This is clearly shown by the slump in stock prices. A comparison of stock price appreciation rates in the first half of this year shows that China is far behind Japan (30%), the U.S. (17%), South Korea (15%), Germany (15%), and India (8%), while China is far behind (2%). Foreign investment funds, which until the beginning of this year had been flowing into China in anticipation of a post-Corona pandemic economic recovery, have rapidly begun to leave the country.

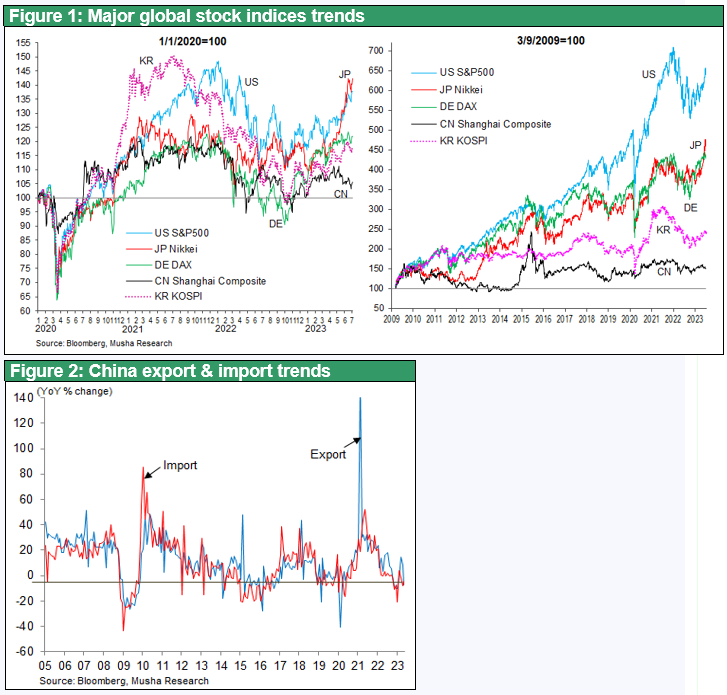

Imports, a clear indication of the strength of domestic demand, fell 6.7% from January to May of this year and have been on a negative trend for the past year. Retail sales are strong, up 9.3% from the previous year's 0.2% decline in the January-May period, but this is a reaction to the large decline due to last year's lockdown and will rapidly run out of steam in the future. Fixed asset investment also slowed from the 5.1% growth of the previous year to a 4.0% increase from January to May this year, and real estate investment is lagging significantly, down 7.2% from the previous year.

Risks of Deflation and Liquidity Trap

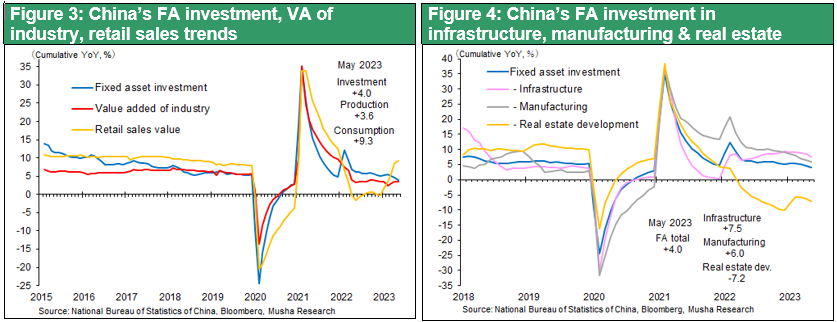

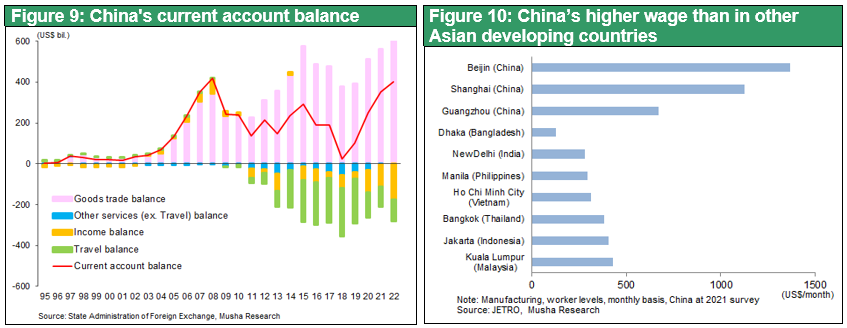

Particularly serious are employment and prices. The average youth unemployment rate, which was stable at around 10-11% before the Corona disaster, jumped to 20.8% in May of this year and is expected to rise further after the graduation season in June. In addition, while inflation is rising worldwide, China is the only country where the rate of price inflation is notably declining; the CPI had been hovering around 2% y/y until January but fell sharply to 0.2% y/y in May. While interest rates have been cut and the money supply(M2) continues to grow at an annualized rate of 12%, business conditions and price conditions are deteriorating. China may be falling into the same deflationary trap that Japan once found itself in. The possibility of a liquidity trap, where monetary policy becomes ineffective in the face of deflation, has intensified, and the RMB 1 trillion stimulus package (support for debt-ridden local governments and businesses, mortgage subsidies) is expected to be not effective, according to many observers. Although China's exports have been slowing sharply, a marked drop in imports has resulted in a trade surplus of $877.6 billion and a current account surplus of $401.9 billion (in 2022), the highest pace ever, and massive capital inflows are continuing. However, this has not contributed in any way to the domestic economic cycle, making it difficult to achieve the government's 5% GDP growth target.

(2) Weakness caused by excessive investment dependent economic growth

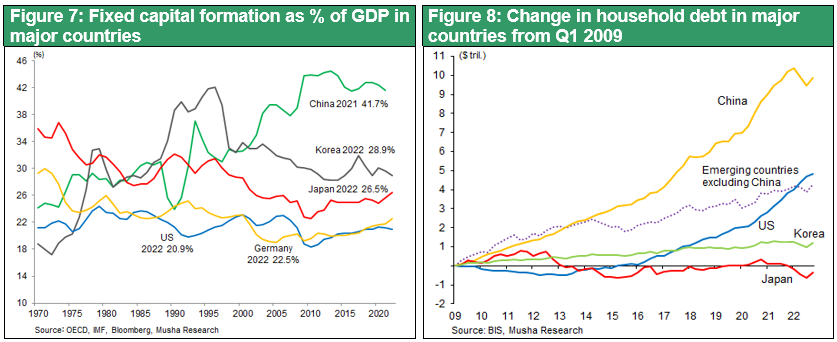

China may finally be entering a process of decline due to the triple burden of (1) the bursting of the real estate bubble and the decline in investment, (2) high unemployment and sluggish consumption, and (3) declining exports and imports. The outstanding feature of China's economic growth to date is that it has been markedly investment-oriented for more than 20 years, with the ratio of fixed capital formation to GDP at 42%, nearly double that of major economies such as the US (21%), Japan (26%), Germany (23%), and Korea (29%). China is the only country in the world where investment has continued to outpace consumption, which is extremely unusual and unhealthy.

Increased investment is an immediate and extremely convenient way to boost growth. Increasing investment immediately creates demand, and there is no need to pay a cost at that point. The costs are recovered in the form of rent (real estate), profits (corporate facilities), and usage fees (infrastructure) as the assets formed are put into operation. The problem is that when economic growth becomes a self-interested goal, people create assets that are not fully utilized or not generate revenue. This accumulated excess investment has affected Chinese economy substantially. In 2022, household debt which had been rising sharply began to decline, as real estate prices fell, and real estate investment began to fall sharply. China, with only 17% of the world's population, produces over 50% of the world's steel and cement, most of which is consumed domestically, so the scale of the assets being built is unimaginable. It can be said that China has now entered a stage where it will be forced to pay the cost.

Crisis of dual contraction, not dual circulation

In addition, the current account surplus which is now surging, will rapidly deteriorate in the future due to the following factors: (1) China is the highest wage earner in Asia and its factories continue to flow out of the country, (2) the rapid shift of high-tech production away from China due to the U.S.-China conflict and decoupling, (3) the end of special demand for corona pandemic, which surged between 2020 and 2021, (4) the increase in outbound Chinese tourists, which is currently being restrained, and (5) the deterioration of the income balance (external payments and write-offs of bad debts).

Tracing Japan's Lost 3 Decades

The domestic-international dual circulation advocated by the Xi Jinping administration appears likely to become a dual contraction. China may have begun to follow the trajectory of Japan's lost 3 decades in a more serious way.

3 steps of Japanese economic history have been followed by China exactly as follows;

First dramatic increase in competitiveness due to absorption of technology from developed countries and inexpensive foreign exchange and labor created substantial trade surplus, second currency intervention to avoid currency appreciation and massive issuance of domestic money resulted in surplus of funds and rapid increase in bank loans third households' accelerated purchase of real estate made a real estate bubble.

The following sequence of events such as the bursting bubble resalt in huge nonperforming assets, domestic investment declined, and trade friction and declining competitiveness will invite Chinese deflation as Japan. The collapse of the traditional family, late or non-marriages may decline birthrates. Based on the above, China will almost certainly fall into the trap of being a middle-income country and will never surpass the U.S. in terms of economic scale.

(3) The growth center will shift from China to India

Indian manufacturing is on the verge of taking off

While China is weakening, India's economy is beginning to show signs of strength, with its economic growth rate consistently outpacing that of China at 6-7% from 2022 onward. In addition, India has begun to make progress in building a supply chain that is no longer dependent on China. Apple currently manufactures 90% of its smartphones in China, but it is reported that it will switch 25% of its production to India by 2025. Micron Technology has also decided to expand into India. Tesla has announced that it will produce in India as well. A comparison of manufacturing PMIs shows that China has been below 50, which signifies recession, since the third quarter of 2021, while India's business conditions have continued to improve, which is a favorable contrast.

Figure 13 shows the ratio of manufacturing to GDP in emerging economies according to the World Bank survey. Among these countries, India's share of manufacturing has been declining. India's economic development to date has been driven by the services sector, such as computer services, and goods have been heavily dependent on imports from China. This high degree of dependence on imports indicates the large demand for import substitutes that is expected in the future. In the current "China plus one" trend, the willingness of companies from various countries to invest in India is increasing significantly. The industrialization of India is about to begin.

The Modi Administration Turning to a Pro-U.S. Policy

Prime Minister Modi's first state guest visit to the U.S. in June was a landmark event. India, which had maintained its neutrality in the camp confrontation, is now seen to be making a major shift to the side of the West and the democracies. It can no longer continue to rely on Russia for arms procurement, nor can it import from China, with which it has been at loggerheads over border disputes. It can be said that the country has no other option but to approach the United States. In exchange for the favorable conditions of joint development of fighter jet engines, China will probably shift to a pro-U.S. line.

In retrospect, the declining of China and the rise of India in 2023 may be seen as a watershed in the international order and the international division of labor.