Jul 11, 2023

Strategy Bulletin Vol.336

Bidenomics and the Death of Laissez Faire

~ The First Regime Shift in 40 Years Caused by the U.S.-China Conflict

(1) Preparing for the Rapidly Developing Taiwan Contingency

The war in Ukraine has changed the values of the world's democracies and is causing a major shift in national policy regimes. Until 2021, we in the G7 countries believed in the myth of a safe order governed by law. But Putin's invasion of Ukraine has reminded us that the law of the jungle still prevails in this world, where the weak fall prey to the strong.

The Probability of an Invasion of Taiwan

As the irreconcilable conflict between despotism and democracy intensifies, the United States, the leader of the democracies, has begun to build up its readiness for China, a far formidable than Vladimir Putin, at maximum speed. On deeper consideration, Xi Jinping's invasion of Taiwan is a much lower hurdle than Mr. Putin's invasion of Ukraine. China has (1) overwhelming superiority in terms of population, economic strength, and military power, (2) moral legitimacy in that both the United States and the United Nations recognize that Taiwan is part of China while Ukraine is an independent state, and (3) China, with its one-party dictatorship and concentration of power in the hands of individuals, has far greater domestic governing power than Russia, which has a parliamentary democracy (albeit only in form). In addition, if China's international presence has peaked now due to its declining economy and population, there is a strong probability that Xi Jinping believes that now is the last chance to realize his country's long-held dream of reunifying Taiwan. The only factor that could dissuade Xi is the willpower of the United States to intervene. At least that is what the U.S. leaders must be thinking, and the U.S. begun to implement emergency policies in response.

(2) Establishment of Bidenomics, the First Regime Shift in 40 years

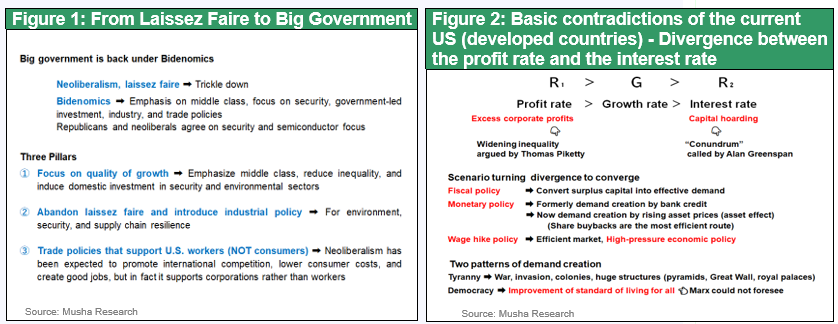

As a form of this emergency policy, the first regime shift in 40 years since the advent of Reaganomics is being realized in the U.S., with the rejection of laissez faire and the shift to big government.

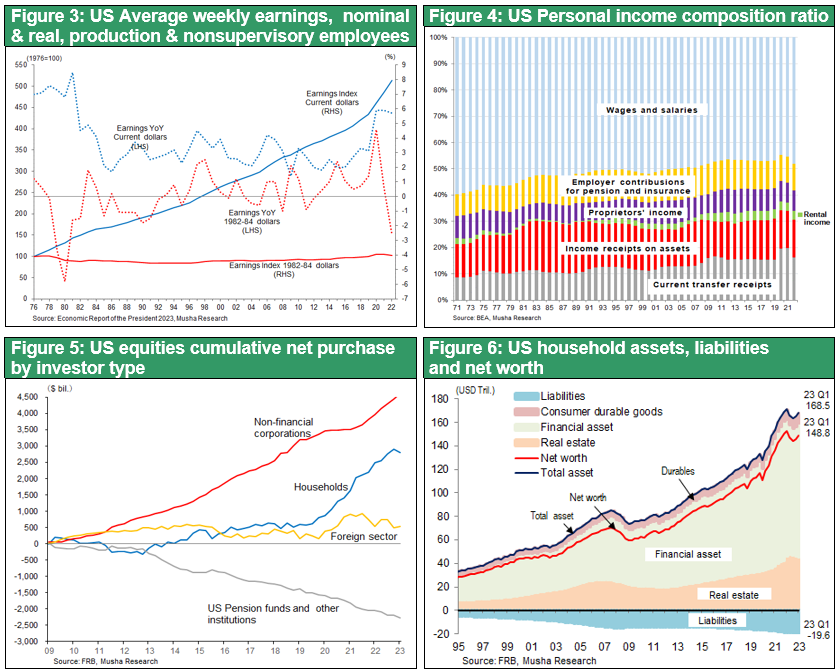

Limitations of Laissez Faire, Trickle-Down Fails to Work in the New Industrial Revolution

In developed economies, the limits of laissez faire were clear. The reality is that while wealth is concentrated in the hands of corporations and the wealthy, the middle class is weakening, leading to widening inequality and social division. As Musha Research has long noted, the current U.S. economy is facing three clogging problems. First, the new industrial revolution has created excess profits and savings surpluses for corporations, second real wages for workers have barely grown, and household income has become dependent on non-labor income (asset income and government subsidies), and third although 80% of corporate profits are returned to shareholders and wealth is distributed to households (in the form of increased household net worth and increased household asset income), this is not sufficient and not without bias. It can be said that the trickle-down expected by laissez faire is not functioning.

The War in Ukraine Justified Government Intervention in Industry and Trade

The moderate Democratic Party and the Biden administration proposed a laissez faire amendment consisting of three pillars: That is, (1) an emphasis on the quality of growth (narrowing inequality and higher distribution to the middle class), (2) the introduction of industrial policy, and (3) a trade policy that prioritizes domestic employment (not consumer priority). On the other hand, the Republican group, which favors small government and laissez faire, was opposed to these policies.

However, with the outbreak of the war in Ukraine, there was a shared recognition of the need of emergency policy, a strong industrial policy was established. In addition, trade restrictions have been tightened, including trade sanctions against China inherited from the Trump administration and nonparticipation in the TPP, which is believed to lower U.S. import barriers and adversely affect domestic employment.

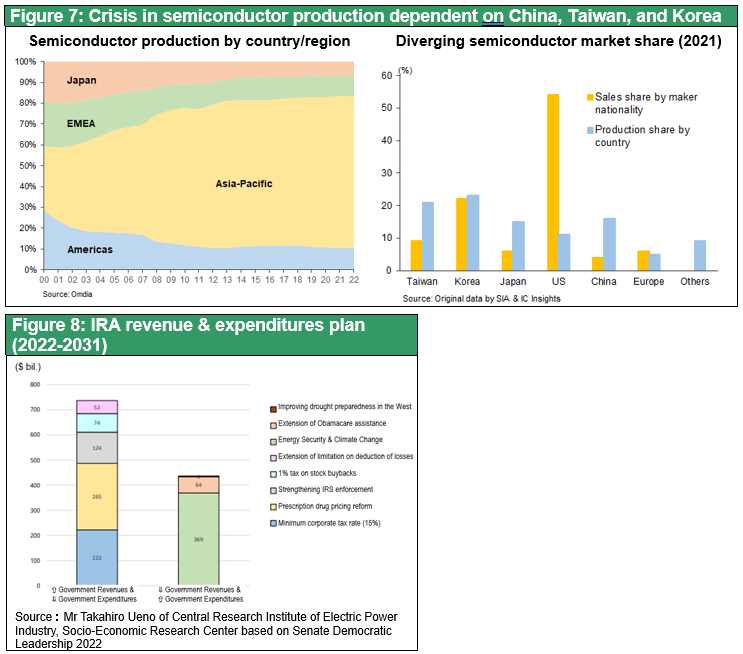

CHIPS Act to Reduce Semiconductor Dependence on China, Korea, and Taiwan

Two industrial policies are at the heart of Bidenomics. The first, the CHIPS and Science Act (enacted in August 2022), aims to reduce dependence on China, Tiwan, and South Korea for semiconductor production, and will provide $52.7 billion (7.4 trillion yen) over next five years to subsidize semiconductor-related manufacturing companies in the United States. The Semiconductor Industry Association of America (SIA) estimates that more than 40 new semiconductor and related factory expansion projects will be announced, creating a total of approximately $200 billion (28 trillion yen) in private investment and 40,000 new jobs in 16 states.

IRA (Inflation- Reduction Act) Blocks China's Clean Energy Dominance

The IRA (Inflation Reduction Act - enacted in August 2022) will subsidize 369 billion (¥52 trillion) for clean energy and national security-related industries, while raising $737 billion in revenue over the 10-year period by increasing corporate taxes (introducing a 15% minimum tax rate) and reducing the Medicare budget by prescription drug reform. The difference of $300 billion is expected to reduce the budget deficit. The tax credits for clean power ($160.3 billion), clean manufacturing ($40.3 billion), clean buildings ($45.3 billion), clean automobiles ($15.5 billion), and clean fuels ($23.4 billion).

(3) Urgency of De-China Dependence Supply Network

China's Overwhelming Presence in Clean Energy

The IRA appears to be heavily weighted toward environmental investments, but it is structured to block clean energy-related products, which China is now overwhelmingly strong in. China has a dominant presence not only in electronics products such as smartphones and PCs, but also in the environment, green energy, and EVs.

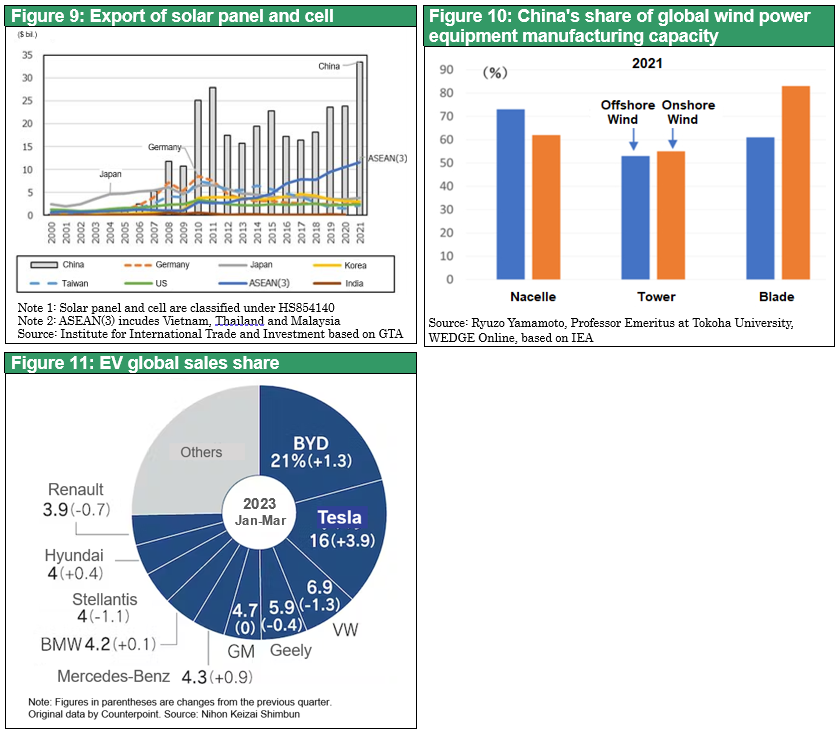

China has the world's largest installed base of solar power generation equipment by country, with a 96% share of the global market for wafers, the material used in solar panels. It also has a 78% share of the cell market. The share of modules is 73%, and most of the world's solar panels depend on components made in China. For wind power equipment, China is still the world's largest installer, with a global share of 50-70% of China's manufacturing capacity for wind component nacelles, towers, and blades." (Prof. Emeritus Ryuzo Yamamoto, Wedge online June.22)

China's Dominance in EVs Is Even More Overwhelming

Anticipating that EVs would become the mainstream, China was one of the first countries to provide subsidies for electric vehicles and has been the most active promoter of EVs in the world. According to the IEA (International Energy Agency), EV (BEV+PHEV) sales in 2022 was 5.9 million in China (up 80% from the previous year), 2.6 million in Europe (up 15%), and 0.99 million in the US (up 55%), with China accounting for nearly 60% of global EV sales.

As a result, except for Tesla, China now accounts for most of the world's major EV makers, and BYD, the largest EV maker, sold 617,000 BEVs (up 90%) in the January-June period of 2023, close to Tesla's 889,000 units.

In the first quarter of 2023, China surpassed Japan to become the world's largest exporter of automobiles. Not only Chinese companies such as SAIC and BYD, but also other foreign manufacturers such as Tesla and BMW are beginning to use China as a manufacturing base for export EVs. Tesla's Shanghai Gigafactory produced 710,000 vehicles in 2022, while VW has also announced 1 billion euros (about 147 billion yen) investment to build an EV development and procurement center in China. With the cumulative initial investment in EV China developed the most advanced EV ecosystem in the world.

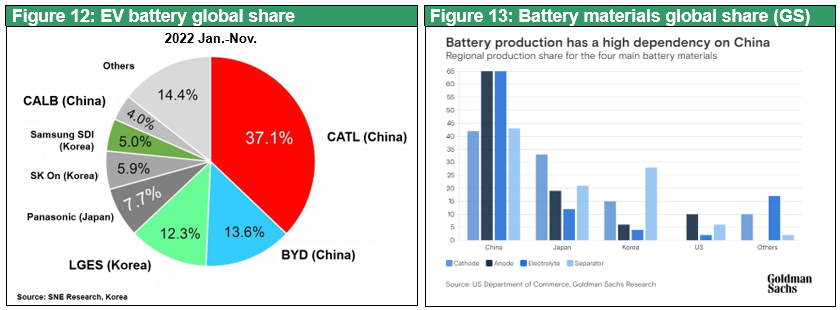

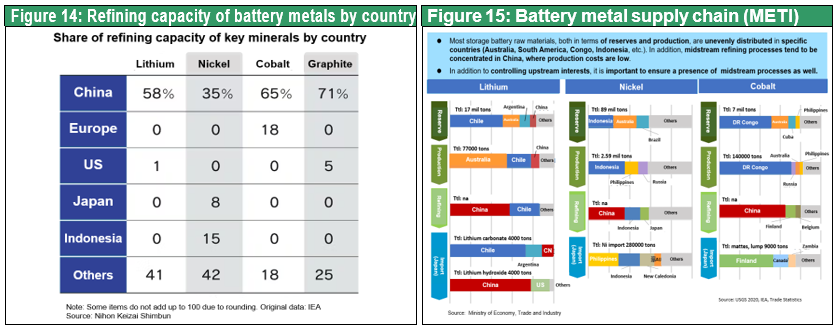

EV Ecosystem Formed in China

China also holds a majority share in the upstream areas of the EV ecosystem, including the production of batteries battery components, and the securing and refining of battery metal resources. Battery metal reserves are concentrated in Chile, Argentina, Congo, Indonesia, Australia, Brazil, and other countries, but China was quick to seize upstream interests and has secured an overwhelming share in refining. Against this Chinese advantage of scale merits in EVs, the possibility arises that Japanese, German, and U.S. automakers will fall far behind.

In Europe, where the shift to EVs is rapidly advancing, initial goal of 100% EVs by 2035 has been modified in order to curb China's rapid penetration. In this trend, the U.S. IRA, which subsidizes only U.S.-made EVs and batteries, will be a major block to Chinese automakers entering the U.S. market.

(4) Industrial Investment Wave Starting to Occur in the U.S.

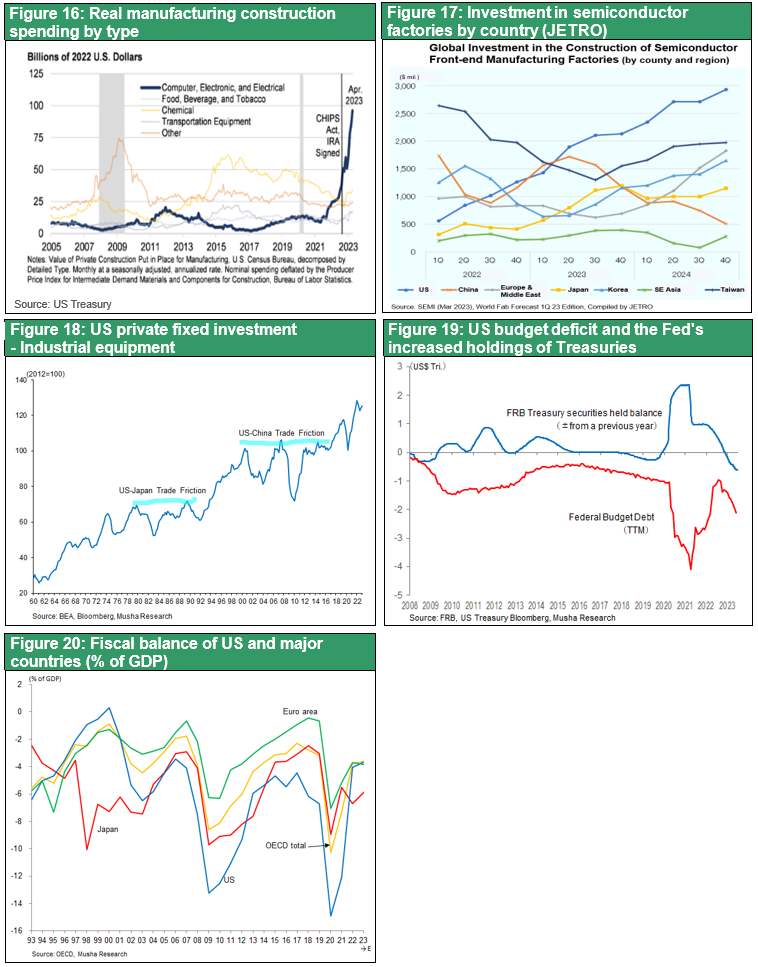

The implementation of the CHIPS Act and the IRA has brought about major changes in U.S. industry. As shown in Figure 16, investment in manufacturing construction in the U.S. is increasing rapidly from 2023. Figure 17 shows semiconductor capex by country, based on estimates by SEMI (Semiconductor Equipment and Materials International). While China is expected to see a large decline after peaking in the first half of 2023, the U.S. is expected to show outstanding growth. It is possible that the U.S. industrial machinery market, which has been held back by foreign products, has entered a phase of great leap forward (see Figure 18).

Aggressive fiscal spending as described above may be one of the reasons why the U.S. economy remains buoyant despite the severe monetary tightening (see Figures 19 and 20).