Aug 21, 2023

Strategy Bulletin Vol.338

U.S. Prosperity and China's Debilitating, Bipolarity Has Begun

The significant strength of the U.S. economy

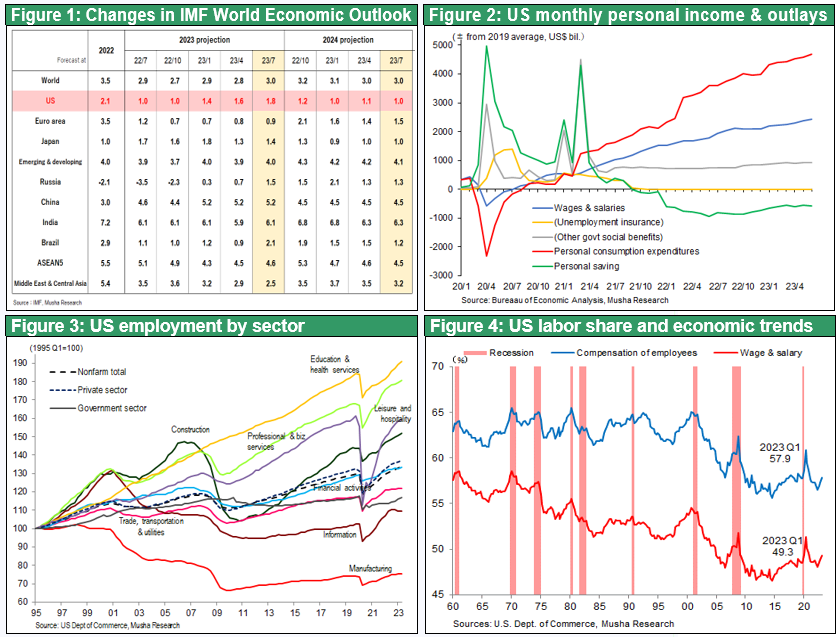

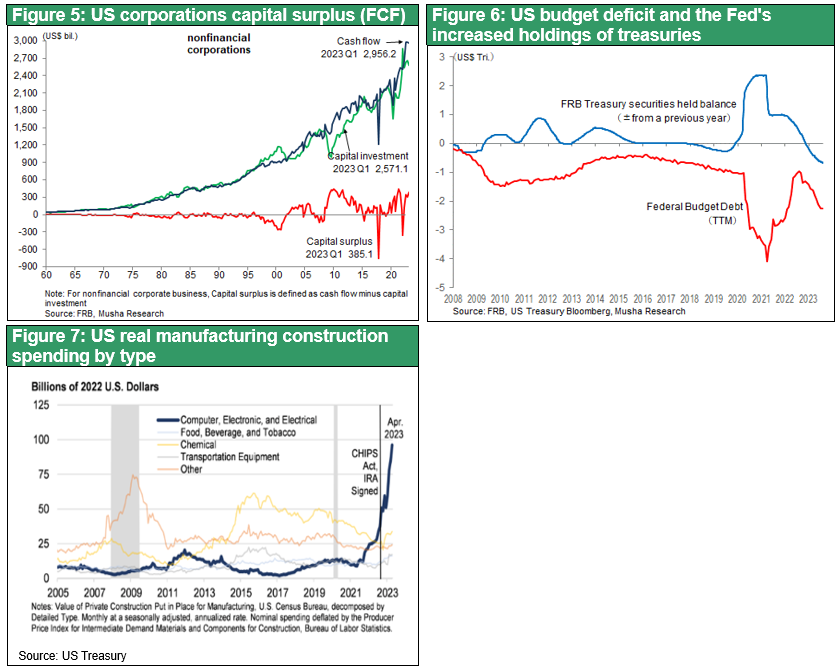

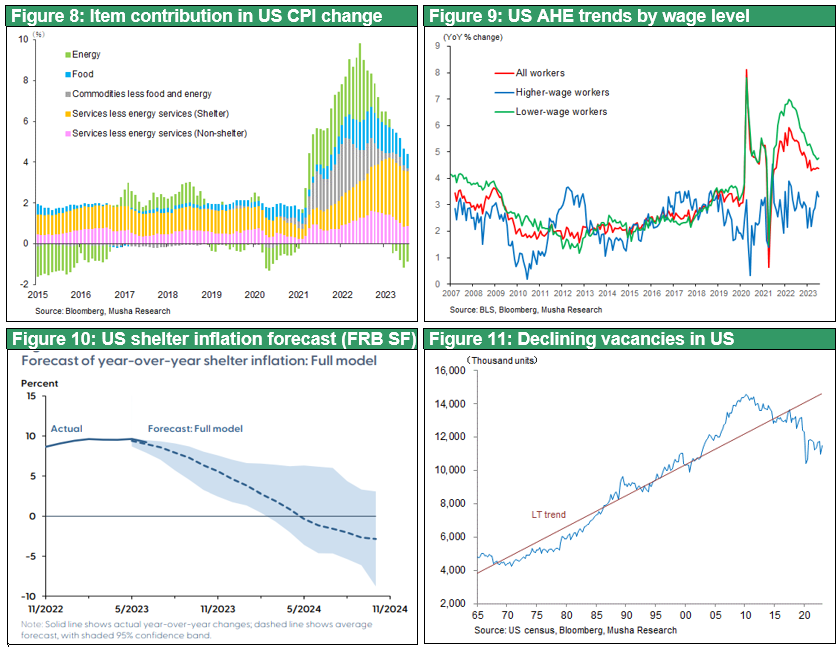

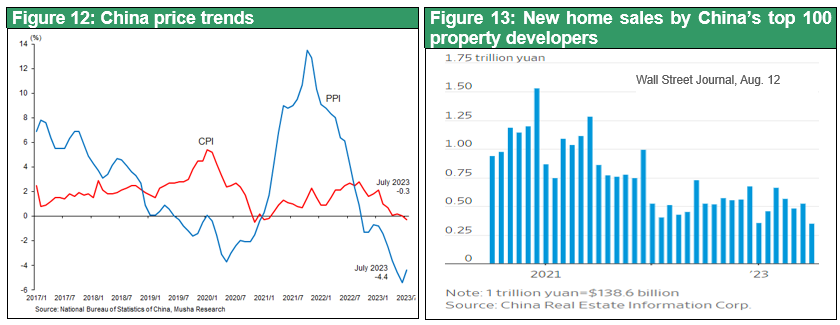

The surprising strength of the U.S. economy deserves special mention: despite the largest tightening in 40 years, there is no sign of a recession. (See Figure 1). In fact, however, the results for the first and second quarters of 2023 exceeded prior expectations, at 2.0% and 2.4%, respectively, and the 3Q forecast by the Atlanta Fed's "GDP Now" economic forecasting model is expected to accelerate further to 5.0%. The biggest driver is strong consumption, which accounts for 70% of GDP. Consumer confidence is improving and consumer demand, including retail sales, is strengthening. While some of the factors behind strong consumption include the utilization of abundant savings accumulated during the Corona disaster period and increased government spending on social insurance, the most significant factor is the continued increase in household wage income due to strong employment (see Figure 2). Employment has been increasing strongly in all industries except information technology (see Figure 3), which differs significantly from the past interest rate hike phases, such as the bursting of the IT bubble in 2000 and the GFC in 2008. It appears that an unprecedented virtuous cycle of "increased consumption ⇔ increased employment" has been established. This is supported by strong corporate profits, a suppressed labor share (Figure 4), and free cash flow in the corporate sector that continues to increase (Figure 5). Increased fiscal demand, including social insurance support by the government and industrial subsidies through the Chips Act and IRAs (Inflation Reduction Act), has also contributed to the increase (Figures 6 and 7).

Inflation is calming down, interest rate cuts are on the horizon, and long-term interest rate hikes may have peaked by now

As for inflation, the CPI fell sharply from 9.1% in June 2022 to 3.2% in July this year (Figure 8). An analysis of inflationary factors shows that energy goods and food inflation due to supply chain disruptions have largely subsided, and housing costs (imputed rent), which are currently at their highest, are expected to converge below 2% in a year, as housing prices, which precede by about 12 months, have begun to decline (Figure 10). The pace of wage growth is worrying the Fed, with average hourly earnings (AHE) falling at a slow pace of 4.4% y/y. However, the three factors such as (1) the wage growth of low-wage workers (production and non-management workers) that have been driving recent increases, is slowing sharply, (2) the wage growth of high-wage workers (professional and management workers) is low, and restructuring due to mechanization is expected to halt the rise (Figure 9), and (3) productivity gains from the new industrial revolution may halt pushing up the price not as much as wages. The Fed will probably hold off on raising interest rates any further.

If this is the case, a rate cut will eventually be on the horizon. One aspect of a rate cut is that it will increase investment in supply capacity and reduce inflationary pressures. The channel through which interest rate cuts increase housing supply is effective in restraining housing prices. Also, the channel through which interest rate cuts create labor substitution and downward pressure on wages through increased capital investment is expected to be effective in restraining wages. The rationale for interest rate cuts may also emerge as a topic of discussion at the Jackson Hole conference. U.S. long-term interest rates may have peaked at 4.26% nominal and 1.93% real at the end of last week since slowing economic growth, weakening inflation pressure, and ending monetary tightening. The situation may be such that a stock market rally starting with a rate cut could be expected through 2024.

Excess supply from the new industrial revolution has been avoided

Unlike the Great Depression of the 1930s, when excess supply was left unchecked, the current U.S. economy is beginning to experience a virtuous cycle in which productivity gains from the new industrial revolution (i.e., increased supply) are being offset by robust demand creation.

China's real estate bubble collapses as the long-term debilitating process may begin

On the other hand, China's economy has begun to show signs of weakness: GDP slowed sharply to +2.2% y/y (+4.5% y/y) in 1Q and +0.8% y/y (+6.3% y/y) in 2Q. June retail sales are stalling at 0.2% m/m, and 5% growth target of the government seems to be difficult. In addition, the pace of price declines is accelerating July CPI -0.3%, PPI -4.4%, a deflationary plunge that stands out amid global inflation (Figure 12).

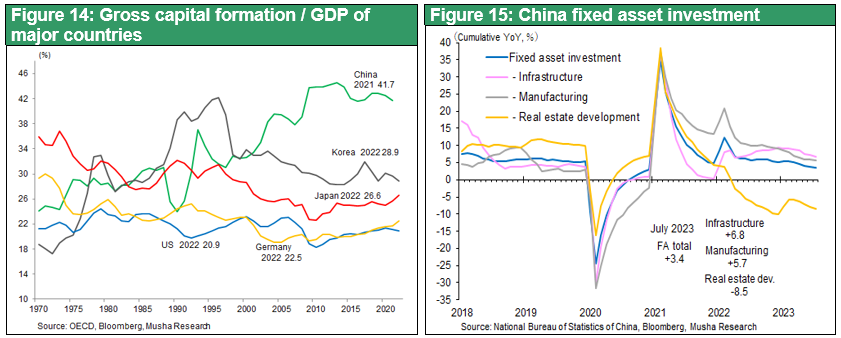

The Great Real Estate Recession has begun. Sales of the top 100 real estate companies fell 21.2% y/y in May, 28% y/y in June, and 33% y/y in July, with no end in sight to the decline. Compared to their peak year of 2020, they are down by one-third (Figure 13). Following Ever Grande Group, Country Garden, the second largest developer in China, has been forced to suspend interest payments, raising concerns that it may default on its debt. The scale of the assets being built is unimaginable, as China, with only 17% of the world's population, produces 60% of the world's steel and cement and has consumed most of it domestically. The outstanding feature of China's economic growth to date is that it has been significantly investment-oriented for more than 20 years, with the ratio of fixed capital formation to GDP at 42%, nearly double that of major countries such as the US (21%), Japan (26%), Germany (23%), and Korea (29%). China is the only country in the world where investment has continued to outpace consumption, which is extremely unusual and unhealthy. Now, it can be said that China has entered a stage where it is finally being forced to pay the cost of this trend (Figures 14 and 15).

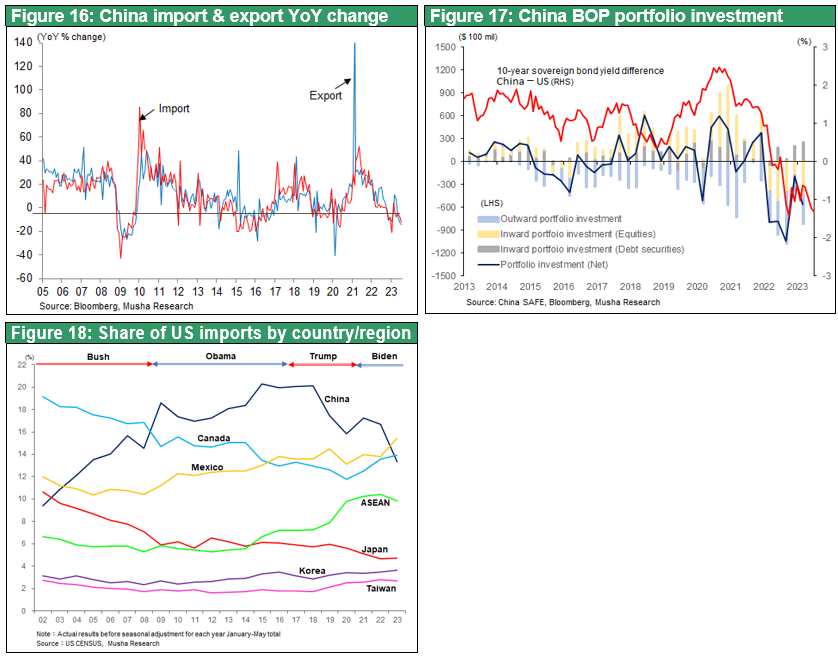

The external economy is also entering a contractionary cycle

In addition, the contraction in trade has been unstoppable, with exports down 12.4% y/y in June and 14.5% y/y in July, and imports down 6.8% y/y in June and 12.4% y/y in July. Foreign direct investment in China has plummeted by one-fifth to $20 billion in 1Q2023 compared to $100 billion in 1Q2022. Securities investment in China has also begun to significantly exceed outflows since 2022 (Figure 17). China's presence in the global economy is expected to decline significantly in the future. The past two decades have been an era in which the Chinese economy has been the sole winner. China has secured an overwhelming share of the global market not only in basic materials such as steel, cement, and chemicals, but also in high-tech and clean energy industries such as smartphones, EVs, solar panels, and wind power generation equipment, thereby grabbing growth opportunities from other countries. However, as China's share of the global market declines, growth opportunities will return to other countries and regions. Japan, the U.S., ASEAN countries, India, and other countries that have been deprived of opportunities by China will benefit from the reversal. This is already evident in the significant decline in China's share in the U.S. imports, the world's largest consumer market (Figure 18).

Long-term trends will outpace short-term cycles in the U.S.-China economy

Most economists are wrong about the economic outlook for the two largest economies, the U.S. and China, in 2023. At the end of last year, most believed that a recession in the U.S. was inevitable due to monetary tightening as the collapse of U.S. bubbling stocks. On the other hand, China's economy was expected to normalize and rebound as the lockdown caused by the Corona disaster was lifted, and expectations were high. However, the results in both the U.S. and China were the opposite of what was expected.

The main reason for the mismatch in expectations can be attributed to the strong structural pressures in the U.S. and Chinese economies, which are beginning to outweigh short-term pressures in the opposite direction. The structural strength of the U.S. economy is "rising productivity due to the new industrial revolution" and "vigorous demand creation due to fiscal policy and animal spirits (i.e., rising stock prices)," while the structural weakness of China is "dead deflation (= balance sheet recession) due to the bursting of the bubble economy" and "the end of the era of China's solo victory and the start of an era of solo defeat. The structural strength of the U.S. economy and the structural weakness of the Chinese economy will be amplified through 2024.

A 2015-style China shock will not occur

Although the stock market is adjusting for the time being, a serious decline is not likely to occur. In2015 the removal of capital control for China to become an IMF SDR member currency country and deterioration of the domestic economy led to massive capital outflows, falling stock prices, and a sharp decline in the renminbi, which raised fears of a global financial crisis originating in China (The situation was calmed by the subsequent introduction of restrictions on capital flow). However, now that China's capital controls and government and central bank intervention in domestic finance have been significantly strengthened, a global spread of the financial crisis is unlikely. In addition, the U.S. economy is surprisingly strong, and the Japanese economy is also gaining strength.