Sep 04, 2023

Strategy Bulletin Vol.339

Investing in Japanese Stocks, the Autumn Bull Season Has Begun

Shelved U.S. Stock Crash Scenario

A sense of relief is returning to the markets after the high-profile August 2023 Jackson Hole meeting, where Chair Powell's hawkish comments in 2022 caused major-country stocks to plunge about 10%, but this year's event was not a major disturbance this year. A common concern of pessimists was that a U.S. recession would be inevitable if interest rates were raised, but the message from Jackson Hole was that this is the final phase of rate hikes and that the Fed can successfully overcome inflation while avoiding a recession. The scenario of a U.S.-originated stock market decline appears to have been largely dismissed. The gradual slowdown of the economy has become clear, inflation has steadily subsided, and we are in the final stages of what may or may not require one more rate hike. Now that the possibility of a credit crunch due to a banking collapse or asset price collapse has been contained, the only risk is a sudden economic stall for whatever reason, which would immediately trigger expectations of a sharp interest rate cut, pushing stock prices higher. It is time for pessimists to raise the white flag.

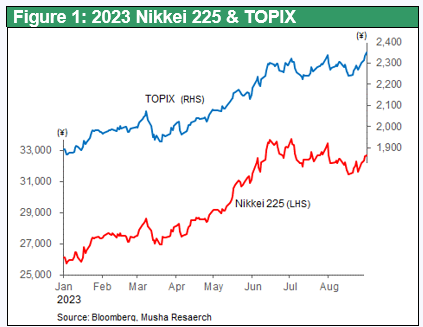

There are two divergent views on the fall market for Japanese stocks. The first is whether the sharp rise in stock prices of close to 30% in the three months from March to June is the product of a short-term cycle or the beginning of a long-term trend. The fact that TOPIX hit a post-bubble high ahead of the Nikkei 225 shows the strength of the market tone.

Economic White Paper Marks a Turning Point of the Era, Declares Victory over Deflation

The times are changing dramatically, and this year's White Paper on Economic and Fiscal Affairs, released at the end of August, is subtitled "Prices and Wages Begin to Move," a declaration of victory that deflation, which has tormented Japan for more than 20 years, is over. Economic white papers sometimes go down in history for their periodic analysis, the most famous being the 1956 white paper. Its subtitle, "No Longer Postwar," was a ringing declaration that Japan had entered a period of rapid economic growth, and the Nikkei Stock Average rose 77-fold in 35 years from the 500-yen level at the time to 38,900 yen 35 years later. This postwar revival of Japan occurred because the U.S., the hegemonic power, greatly favored Japan as a bridgehead against the Communist bloc during the Cold War, and similar changes are now occurring under the current U.S.-China confrontation.

Geopolitics is thoroughly encouraging Japan's resurgence

In the U.S.no matter left or right, Republican or Democrat, have unanimously agreed that China poses the greatest threat to the nation, and deterrence against China has become the most important national agenda. And that changed Japan's fate. The deterrence measures initiated by the Trump administration against China were first launched with the Japan-U.S. Joint Statement at the Suga-Biden summit in April 2021, and have continued through decoupling from China and Japan-U.S. semiconductor cooperation to the present day. In October 2021, TSMC, the world's most powerful semiconductor manufacturer, decided to build a plant in Kumamoto, Japan, with an investment of 1 trillion yen, and a second phase of the plant is scheduled to be built before the completion of the first phase. In addition, Rapidus, a leading-edge semiconductor manufacturing company funded by the public and private sectors, is promoting a cumulative investment of 5 trillion yen in Chitose, Hokkaido. Kumamoto is experiencing a boom, with land prices and salaries for semiconductor-related engineers soaring. This trend is expected to spread nationwide. Japan holds an overwhelming 56% share of the global market for semiconductor materials and 32% for semiconductor production equipment, making it the most important base for Japan to break away from its dependence on China. Especially in the back-end process (assembly), which is the key to future technological innovation, Japan's technological accumulation is at a world-class level, and it appears that semiconductor manufacturers have begun paying a visit to Japan. Once completely defeated, Japan's high-tech industry clusters are now running for a major revival.

A weaker yen trigger volume driven economic growth in 2023

In line with this high-tech decoupling from China, the yen is plummeting from the 100-yen level in 2021, the dollar has plunged more than 30% to 146 yen in recent days. The period of Japan Bashing by the US from the 1990s to around 2010, the Japanese yen continued to outperform its purchasing power parity by more than 30%, which made Japan the world's most expensive country and severely weakened its industrial competitiveness. Manufacturers closed domestic factories, cut jobs, and relocated overseas. Banks redirected Japan's ample savings to overseas loans. The strong yen caused people, money, factories, and business opportunities to leave Japan, leaving the Japanese economy stagnant. Japan's high-tech industry lost out to South Korea, Taiwan, and China.

As a result of the yen's depreciation, Japan suddenly became the world's least expensive country, with the OECD's purchasing power parity for the yen in 2022 being 95 yen, while the actual exchange rate is currently 146 yen, making the yen nearly 40% cheaper than it is. Global demand, which had been away from Japan due to the strong yen, is now rapidly concentrating in Japan due to the weak yen. It is clear from various circumstantial evidence that the acceptance of the weak yen by the U.S. is at the center of this trend.

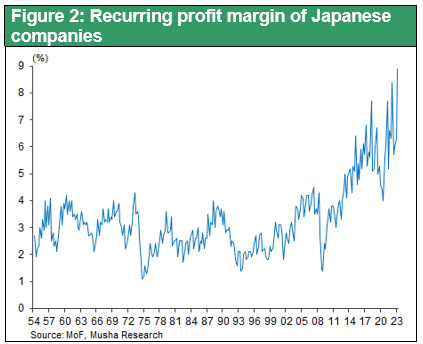

The Japanese economy in 2023 will be the brightest year for volume growth since the burst of the bubble economy. As the first phase of J-curve effect when negative price impact of the yen's depreciation ends, the positive second phase when multiplier effect of volume growth arrives. The weak yen will strengthen Japan's price competitiveness and increase factory utilization rates. In addition, there will be substitution of domestic production for imports, which have become overpriced. According to various capital investment surveys, including the Bank of Japan's Tankan survey and the Nikkei Shimbun, capital investment is already expected to reach record high levels in 2023, following 2022. The weak yen is also increasing inbound tourism, which is stimulating local domestic demand in all regions of Japan. Global demand is concentrated through various channels toward cheap Nippon, which is beginning to stimulate the domestic economy. Deflation in Japan started when companies began to suppress wages to recover lost competitiveness due to the strong yen. Now, however, labor supply and demand are tightening, and companies must hire good people and build competitive teams, even if they have to pay high wages, in order to build domestic production systems. There is a shift in perception: "Labor is not a cost but a source of value creation." According to Japan Labor Union, the average wage increase in 2023 is 3.67%, the highest in 30 years. This is ensured by value creation in the corporate sector. According to the Corporate Statistics, corporate earnings rose 11% from April to June, and the recurring profit margin was 8.9%, the highest in history (Figure 2).

Panic buying of Japanese stocks will be seen repeatedly

In addition to this major turnaround in fundamentals, the supply-demand balance for stocks will improve significantly. Japanese households, which had an unusually high preference for cash and deposits, will take the opportunity of the NISA reforms to make a major shift to equity investments. Under the guidance of the Financial Services Agency and the TSE, companies are increasing their shareholder returns and share buybacks are surging. Foreign investors, who have been significantly underweight Japanese equities will be forced to significantly raise the weight of Japanese equities.

Over the past 30 years, the ratio of Japanese stocks to world stocks (MSCIAC Indexes) has declined from over 40% to almost one-tenth of today's 5%. The 30-year period in which investment in Japanese equities has been all about selling and only underweighting has completely entrenched a trend of disregarding Japan.

However, it is almost certain that the 30-year pendulum will reverse, forcing investors to increase their weighting of Japanese equities from this point on, but most investors are not prepared for this. It should not be underestimated that we have entered an era in which the panic buying seen between March and June of this year will come repeatedly.

It is now clear that the Bank of Japan will be able to normalize its YCC and other emergency policies without adversely affecting the market, which had been a concern. It can be said that the autumn season has begun, reminding all investors of the risks that Japanese equities do not carry.