Sep 19, 2023

Strategy Bulletin Vol.340

Comparison of Japanese and Chinese Real Estate Bubbles and the Potential for Japanification in China

~ Japan's bubble was an expansion of book value, while China's bubble was an expansion of investment

The bursting of the Chinese real estate bubble has become one of the biggest concerns for the global economy. The collapse of the real estate bubble resulted in Japan's lost 30 years, and there is growing interest in whether China will follow in Japan's footsteps. The following comparison of the Japanese and Chinese real estate bubbles reveals the seriousness of the situation in China, even more so than in Japan. In the case of Japan, policy errors caused not only the bursting of the bubble (correction of excessive asset price appreciation) but also the formation of a negative bubble (decline in stock prices and real estate prices to below their intrinsic value), which amplified the damage to the economy. On the other hand, China has accumulated excessive investment using its land bubble as a source of funds, which is a serious problem that Japan does not have.

(1) Verification of the Scale of the Japanese and Chinese Real Estate Bubbles

We will examine the reality (FACTS) that China's bubble is more serious than Japan's in four respects.

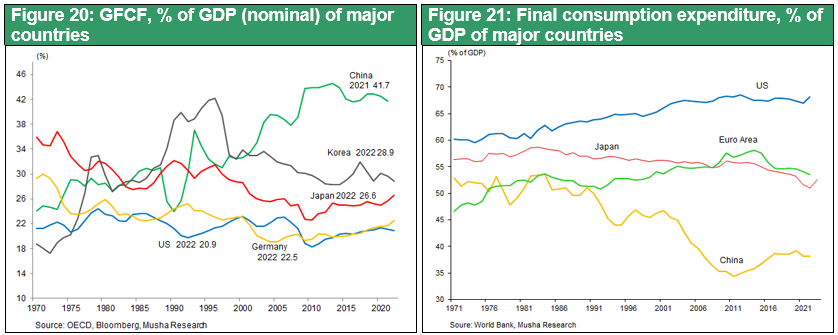

First, it is pointed out that in China, an extraordinary rise in real estate prices, the likes of which the world has never experienced in recent years, has occurred. Looking at the level of real estate prices compared to annual income, they have reached historically high levels: Shanghai 50 times, Shenzhen 43 times, Hong Kong 42 times, Guangzhou 37 times, and Beijing 36 times (NUMBEO survey for 2023) (Tokyo: 12 times, New York 10 times,). Compared to Tokyo's ratio of 15 during the bubble period, the severity of the situation in China is clear. Also, when housing prices are compared to annual rent, while they are 25 times in Tokyo and New York, the national median price in China is 58 times (China Real Estate Association, 2023). In China, where owning a house is a prerequisite for marriage, and in an environment where the youth unemployment rate is over 20%, these prices are extraordinary. The regime cannot ignore the growing social unrest as increasingly young people are unable to get married. President Xi's words, "Housing is for living, not for speculation," should be understood as a response to strong public dissatisfaction rather than an ideology, as in Japan around 1990.

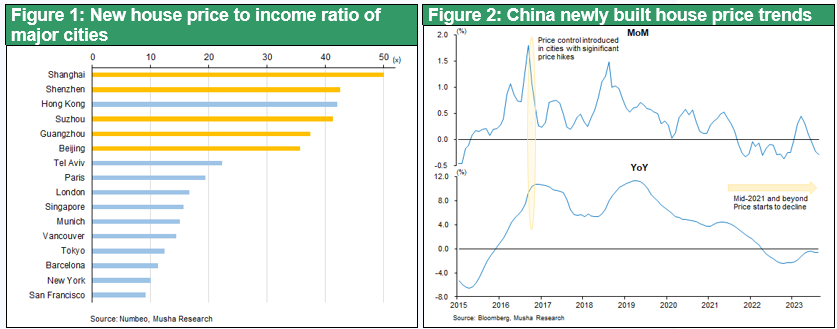

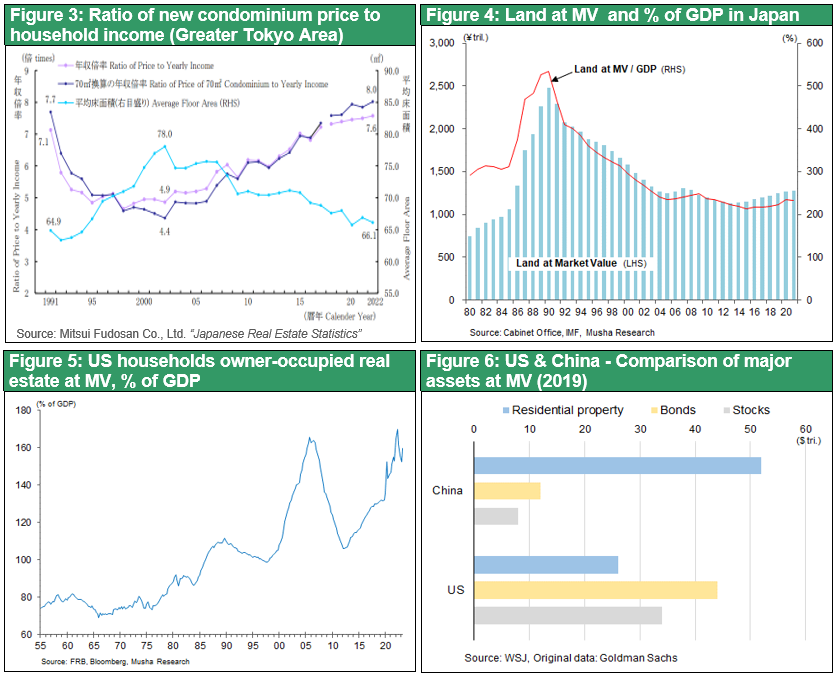

So, what is the macro scale of the real estate bubble? The total market value of land in Japan has been 1980 (745 trillion yen), 1990 (2477 trillion yen), 2005 (1252 trillion yen), 2013 (1135 trillion yen), and 2021 (1276 trillion yen). At its peak in 1990, the ratio to GDP was 581%. In contrast, China's housing market value in 2017 was estimated at 430 trillion yuan (Kenneth Rogoff, Yuanchen Yang (2020), "Peak China Housing"), which, when calculated based on a GDP of 79 trillion yuan, represents a ratio of 544% to GDP, equivalent to the Japanese bubble period.

The FRB's US housing market capitalization (household holdings) was $26 trillion (180% of GDP) at the peak of the bubble in 2007, $20 trillion (129% of GDP) in 2011, and $45 trillion (177% of GDP) in 2022, showing that the bubbles in Japan and China were also exceptionally large.

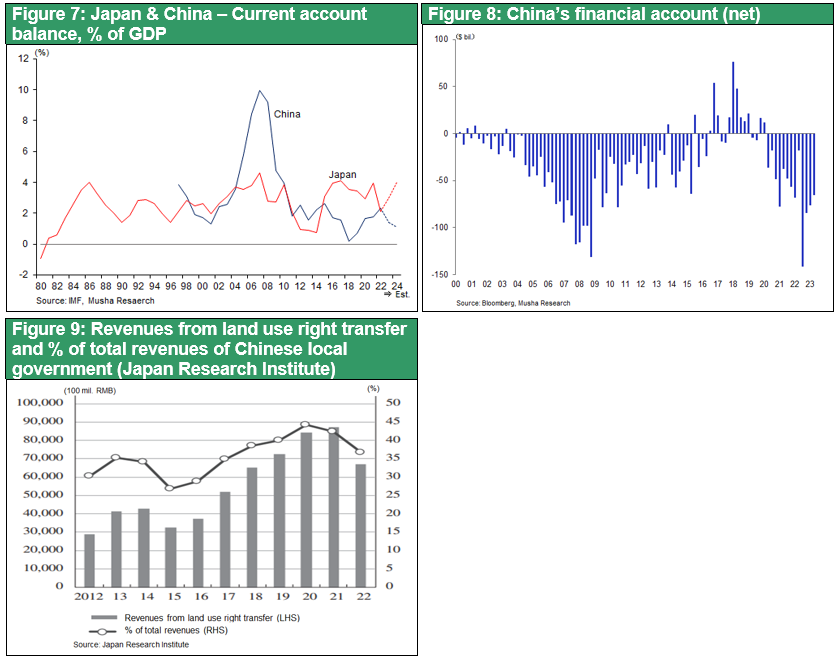

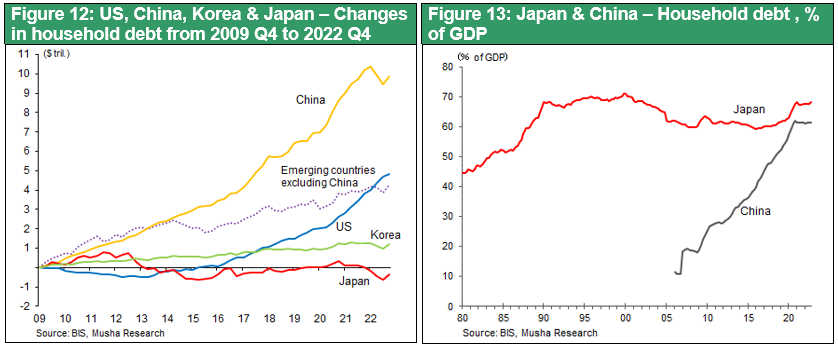

Second, in terms of the fundamental causes of the real estate bubble, China has active factors that Japan did not have. There are similarities and differences between the causes of the bubbles in Japan and China. The real estate bubbles in both Japan and China were triggered by the rapid increase in exports to the U.S. and the large current account surpluses that accumulated under the dollar-driven international division of labor after the Nixon Shock. Japan has had a current account surplus of 3-4% of GDP since the 1980s. China continued to run huge surpluses of 5-10% of GDP from 2006 to 2010, the period between the Beijing Olympics. This led to an oversupply of domestic currency, which in turn became the driving force behind the formation of a real estate bubble. In addition, China reintroduced restrictions on capital exports in response to the financial crisis of 2015-16 and the depreciation of the yuan, which resulted in excess savings being locked up domestically and triggered the real estate frenzy of 2016-17. Thus, external surpluses and excessive currency issuance are common causes of bubbles in the Japan and China.

In contrast to the passive bubble formation common to Japan and China, China had a major incentive for the formation of bubbles: its policies actively caused bubbles. China's national government finances are structured so that local governments are responsible for 85% of expenditures, and 40% of local government revenues are generated from the sale of land use rights. Local governments have continued to generate huge revenues from the sale of land use rights, which they have made more attractive through regulations, the development of peripheral infrastructure, and financial support. The power of this system was demonstrated during the RMB4 trillion economic stimulus package that was said to have helped the global economy during the 2008 GFC and the China Shock in 2015.

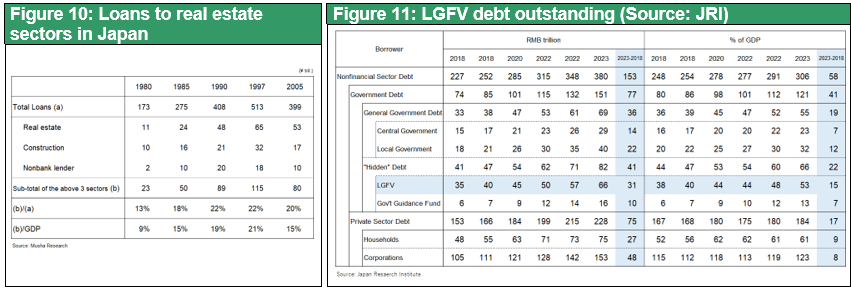

Third, in real estate finance, China's real estate-related debt is at a much higher level than in Japan. Japan's real estate finance was solely the result of excessive lending by the banking sector. In contrast, in China, the debt of the local government financing vehicles (LGFVs), which are separate units of local governments and are responsible for financing public infrastructure development, has been growing rapidly.

The scale of Japan's real estate finance can be viewed as bank lending to the three sectors (construction, real estate, and nonbanks) that were subject to restrictions on total lending in 1990: ¥33 trillion (13% of total lending) in 1980, ¥50 trillion (18%) in 1985, and ¥89 trillion (22%) in 1990, The ratio to GDP was 15% in 1985, 19% in 1990, and 21% in 1997.

In contrast, China's total debt in the LGFV alone will be RMB35 trillion (38% of GDP) in 2018, RMB57 trillion (53% of GDP) in 2023, and RMB102 trillion (over 60% of GDP) in 2027 according to the IMF's forecast, which is not comparable to Japan. The IMF calls this "hidden government debt," and if it is added, China's government debt will be 149% of GDP in 2027, making it the second most highly indebted country after Japan.

In addition, it is estimated that tens of trillions of yuan (several tens of percent of GDP) of financing through shadow banking (loan trusts, trustee bonds, notes receivable, letters of credit, profit rights, etc.) to developers and others, which did not exist when Japan's bubble economy burst, exists.

Fourth, China's share of the economic impact of the real estate bubble is significant. In the case of Japan, the construction and real estate industries were defined as bubble-related industries, and their combined GDP by industry was 21.0% of GDP in 1990 (construction: 10.1%, real estate: 10.9%) and 17.4% in 2021 (construction: 5.5%, real estate: 11.9%). In contrast, China is estimated to have 29% (construction + real estate) in 2016 (Kenneth Rogoff, Yuanchen Yang (2020), "Peak China Housing").

The above examination indicates that the scale of Chinese real estate bubble that has already formed is much larger than that of Japan in the 1980s and 1990s.

(2) The Collapse of the Chinese Real Estate Bubble is Only the Beginning

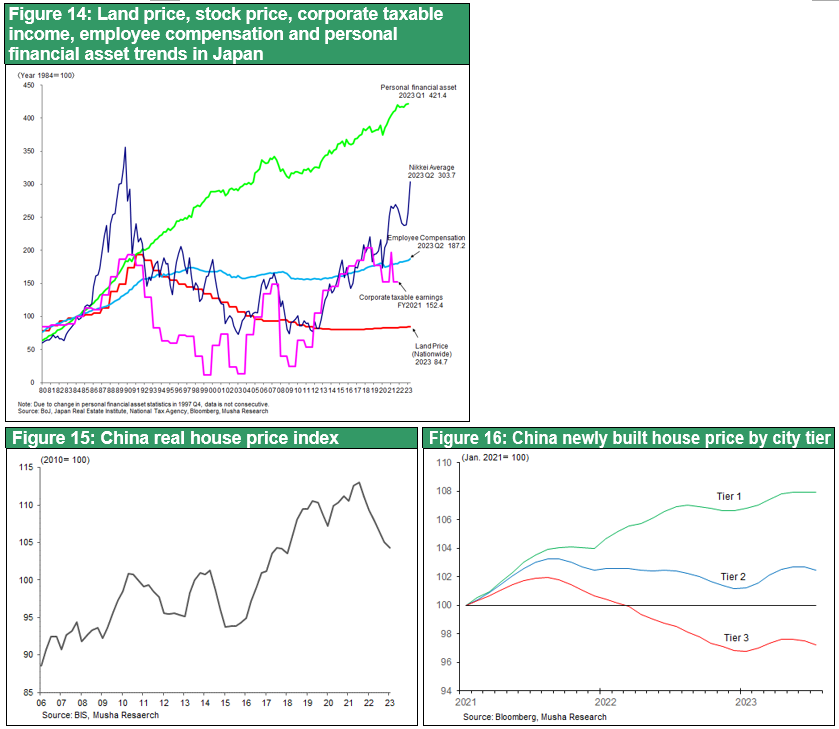

Comparing to Japanese bubble, current Chinese situation correspond to initial stages of the bubble burst the early 1990s in Japan. After increasing 4.2 times in 11 years, the land price index in Japan has bottomed out, declining 75% in 13 years from the bubble highs.

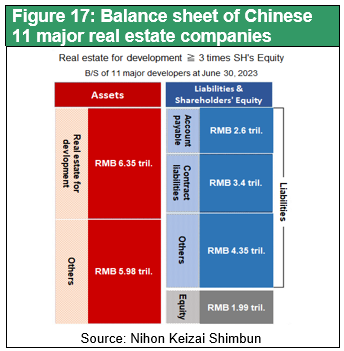

China's real estate price decline has only just begun, with the authorities reporting only a few percent drop. However, media reports have indicated that an existing property near Alibaba's headquarters is 25% lower than its high in 2021(Bloomberg), and brokerage data already estimates a 15-25% drop from the high. Rather, the most significant change currently taking place is the sharp decline in Chinese real estate sales. Sales by the 100 largest developers are down 70% from their peak in 2021 and have yet to bottom out. Household mortgages are also plummeting.

This means that China is only at the beginning of the process of generating and disposing of non-performing loans. The Nikkei Shimbun (August 31) published the balance sheet totals of 11 Chinese real estate developers. The balance sheets of the 11 major companies as of the end of June showed total assets of about RMB12.33 trillion (10% of GDP). The total debt is about 10.34 trillion yuan, while the total equity is about 1.99 trillion yuan. If the valuation of real estate for development, which accounts for about half of total assets, were to drop by 32%, the company would fall into insolvency due to a lack of capital. However, considering that the collapse of the bubble economy is likely to cause a significant decline in the valuation of real estate other than development-use properties, and that a substantial write-down is inevitable as prices are about to fall, it seems inevitable that almost all of the major real estate companies will fall into insolvency.

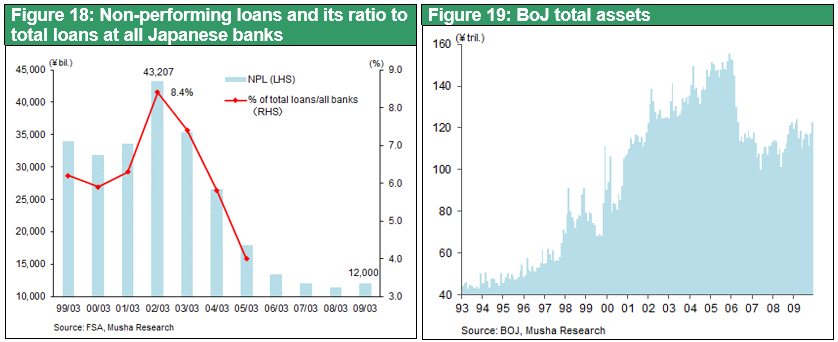

In the case of Japan, the peak of non-performing loans by the nation's banks was 43 trillion yen in 2001, and it is estimated that the cumulative total of bank disposals amounted to about 80 trillion yen, or about 20% of GDP. The BOJ responded to losses from bank real estate disposals with massive quantitative easing. Between 1998 and 2005, when the banks made progress in processing losses, total BOJ assets increased by almost ¥80 trillion. This means that the BOJ credit covered the entire amount of the banks' losses, and a contraction of the banks' balance sheets was avoided. Thus, looking back at the process of NPL disposal in Japan, it can be said that China has not even started to dispose of its NPLs yet.

(3) Will the collapse of the real estate bubble stop the balance sheet recession?

China has been an investment-driven economy for 20 years with a fixed capital formation to GDP ratio of over 40%, an unprecedented rate in its history. The reality of this investment-driven economy is a risky accounting practice that spending (i.e., creating demand) and then deferring the cost by capitalizing the cost. If the constructed facilities and structures cannot be effectively utilized, they will continue to create a mountain of non-performing assets, which entails a great deal of risk. The runaway growth with the astronomical investment assets, which are said to have consumed 100 years’ worth of U.S. cement in a little over two years, are not considered sound assets that create value, and potential bad assets are piling up.

The reason for the continued economic growth through fixed asset investment has been the alchemy of land. Local governments sold land use rights, and the proceeds from these sales accounted for 40% of local government revenues, making local governments extremely rich in income. They were able to channel these ample funds into infrastructure investment and support for high-tech companies. This growth pattern would become unsustainable once the bubble burst and revenues from the sale of land use rights by local governments ceased. And now the collapse has begun.

Contrary to investment, the consumption-to-GDP ratio has fallen 15% over the past 40 years, from 53% to 38%, making it unusual for consumption to continue to be lower than investment. The only way to compensate for the decline in investment is to increase consumption, but the bursting of the bubble and the Xi Jinping administration's ideology of condemning extravagance are likely to lead households to raise defensive savings, further depriving the economy of vitality. The government will try to cope with short-term difficulties by (1) postponing the bursting of the bubble, covering up bad debts, and providing additional loans, and (2) supporting consumption by cutting taxes for households, but these measures will have only a short-lived effect.

China's difficulties are different from the balance sheet recession that once plagued Japan. Japan's BS recession was a financial loss caused by falling asset prices, which took time to process and complete. China's fundamental problem, however, is the overproduction of real assets, excess housing, excess equipment, and excess infrastructure. Breaking away from this will lead to the contraction of the real economy. This could lead to serious Great Depression-type economic difficulties.

Therefore, the question of whether China will become Japanified is too naive. We should keep in mind that a more serious future awaits China.