Nov 06, 2023

Strategy Bulletin Vol.343

Brightness of Japanese Stocks to Become More and More Clear by 2024

Japanese Stocks, the World's Brightest Spot

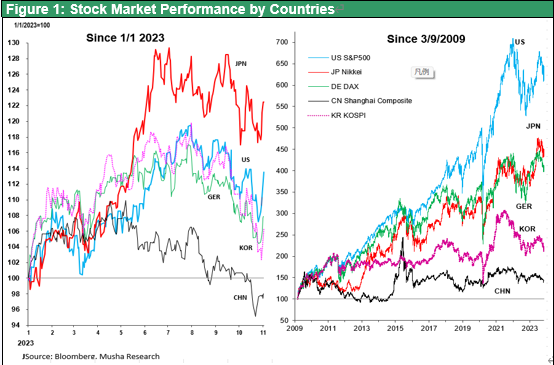

Japan may be the brightest of the major economies, both in politics and in the economy and stocks. Even though the Kishida administration's approval rating has declined significantly, its base of power is solid, aided by a weak opposition party. In the economy, the IMF revised its October global economic outlook (2023) for Japan upward to 2.0% from 1.3% in April. The robust performance of the Japanese economy stands out amidst the downward revisions in China and the Eurozone. This is also reflected in the performance of equities over the first 10 months of the year. The +23% performance of the Nikkei Stock Average stands out among the major countries' stock markets: US SP500 +14%, Germany DAX +8%, UK FT100 0%, China Shanghai Composite -2%, South Korea Composite +6%, Taiwan Kwai Kwan +17%.

Geopolitical Situation Becoming More Chaotic

Looking around the world, however, the stock investment environment is far from favorable. First, the geopolitical situation is becoming increasingly chaotic. The postwar international order based on democracy and international law has been greatly shaken by the confrontation between the U.S. and China, the growing possibility of a Chinese invasion of Taiwan, Russia's invasion of Ukraine, Hamas's attack on Israel, and Israel's counterattack. The decline of the U.S. presence is significant. The Obama administration said that the U.S. could not stand to be the world's policeman, and the Trump administration has increased its disregard for alliances by advocating MAGA. While China is building up its military at an exceptionally fast pace, the U.S. defense budget has halved from 7.7% of GDP in the Reagan era at the end of the Cold War between the U.S. and the Soviet Union to 3.6% of GDP in 2022

Social Divisions in Developed Countries, with Historical Issues at the Roots

The political climate within each country is also marked by increasing fragmentation and populism. In Europe, right-wing populist parties that are anti-immigrant are on the rise. In the United States, the fall of the middle class, the left-right divide, the decline of centripetal force within the Republican and Democratic parties, and the dysfunctional Congress are all contributing to the growing political uncertainty ahead of the presidential election in 2024. Behind this domestic division in the advanced Western nations lies the negative legacy of each country's domination of the world through slavery and colonial rule, a historical problem. In Japan, historical issues have been a source of friction with neighboring countries such as China and South Korea, which have questioned how to deal with past wars and colonial rule. This is now becoming a constraint on political stability and economic growth in the West. The seriousness of this problem may be even greater than in Japan.

On the economic front, the bursting of the bubble in China, the world's factory, is inevitable, and there are fears of a sharp slowdown. The economy is falling into a typical liquidity trap in which monetary easing is ineffective. The eurozone economy is also facing increasing difficulties, including a fragile energy supply that has made it too dependent on Russia and a rapidly widening trade deficit with China. The U.S. economy, which is enjoying unexpected strength for the time being, will inevitably slow down as the effects of the Fed's sharp interest rate hikes become apparent.

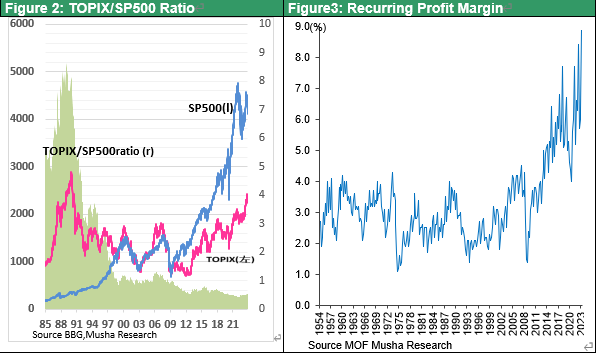

Japan's Brightness Stands Out Amid Global Turmoil

This is a rare situation in which Japan's brightness emerges as the seeds of global unrest grow larger. For the past 30 years, Japan has been the world's underachiever. It was the only country in the world to suffer from long-term deflation, and its nominal GDP remained flat at just over 500 trillion yen for 30 long years. It was the only country in the world where wage growth stopped for 30 years and was overtaken by South Korea. Japan's share of the MSCIAC Index, a basket of global equities, fell from over 40% to 5%, almost one-tenth. During this period, global investors continued to sell Japanese stocks, and by reducing the ratio of Japanese stocks, they were able to win the investment competition. Not only the Japanese but also investors around the world have developed an attitude of neglect and disregard for Japan. Suddenly, Japan is becoming the world's brightest spot. Chart 2 shows the multiple of TOPIX vs. the SP500, which peaked at 8.3x in 1990 and then declined sharply, hitting a bottom at the beginning of 2022 when it dropped to .042x. Since then, it has rapidly increased and currently stands at 0.54x. Investors around the world are closely watching to see if this change in Japan can be sustainable.

|

|

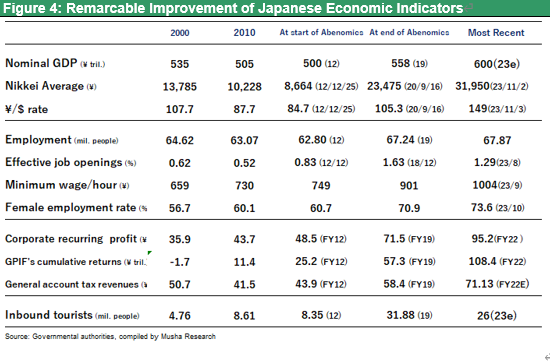

Two factors behind Japan's brightness: (1) Initiative-taking change

What has happened to Japan? Two major changes should be noted. The first is an initiative-taking change: Japanese companies and the economy have improved during the Abenomics era since 2013. Through reforms and the creation of new business models, companies have doubled their profit margins and continue to post record profits. Public pension fund (GPIF) investment income has quadrupled to 108 trillion yen. Tax revenues have increased 70% over the past 10 years. Wage growth, which had been lagging, has begun, and 2% inflation is on the horizon.

Many Japanese companies have developed creative business models that are not copycats, have made great strides in corporate governance reform, and are now profitable enough to meet the demands of their shareholders. The value created by these companies is currently being stored in the form of ample retained earnings. In order to circulate this retained earnings to whole sectors in the economy , the Kishida administration is implementing a new capitalist policy that will trigger a virtuous cycle from savings to investment. The supply-demand balance for Japanese stocks will be greatly improved by (1) promoting higher wages, (2) requiring companies with P/B ratios below 1x to take corrective measures, encouraging them to buy back their own shares, increase dividends, and otherwise return profits to shareholders, and (3) promoting equity investment by household through NISA reform.

|

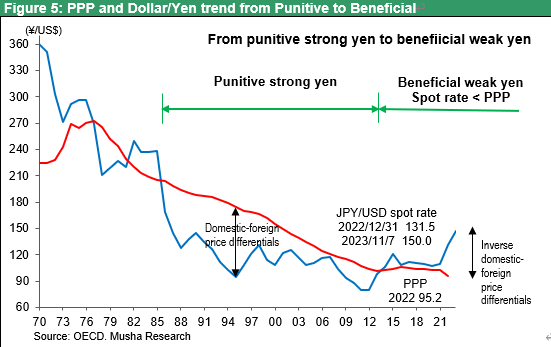

Two Factors Behind Japan's Brightness, 2) Major Changes in the Geopolitical Environment

The second factor is the external environment, the major change in the geopolitical environment surrounding Japan. The U.S.-China confrontation has worsened, and the U.S., which once went crazy in its efforts to bash Japan, now needs a strong Japan to decouple from China and has come to accept a weaker yen to achieve this. The establishment of a significantly weakened yen has changed the major framework of the Japanese economy. The deflationary period caused by the strong yen is over, and 2023 is the brightest volume boom year for the Japanese economy since the burst of the bubble economy, and 2024 will see an acceleration of this trend. Factories, capital, business opportunities, and jobs that fled Japan overseas due to the strong yen are returning to Japan due to the weak yen. The weak yen has also increased inbound tourism, and foreign tourists are stimulating local domestic demand in every corner of Japan.

Strong Japan Symbolized by Toyota's 60% Profit Increase

Symbolic of this rapid recovery of Japanese companies is the sharp increase in Toyota's profits. Toyota has announced an upward revision of its consolidated net income forecast for the fiscal year ending March 31, 2024, to 3.95 trillion yen (up 61% from the previous year), a 50% increase over the previous forecast. This is a 40% increase over the company's record-high profit and leaves room for further upward revision in view of foreign exchange assumptions and other factors. Increased production due to the resolution of the semiconductor shortage and price rise due to improved vehicle functionality contributed to the increase. The average sales price in the U.S. during July-September 2011 was $46,674 (approximately 6.1 million yen), a 19% increase in four years (Wards Automotive News). In contrast to China, where excessive competition is worsening profitability, the strength of the sales base and high brand loyalty in the U.S., where consumers have strong purchasing power, is a major factor. The significant depreciation of the yen has also spurred this trend. On a half-year basis, Toyota's net profit margin of 11.8% was higher than Tesla's 9.4%, which benefits from large subsidies. Toyota's profitability, which exceeds that of market darling Tesla, which has more than twice the market capitalization, is a sign of the improving earning power of Japanese companies.

The burden associated with EV investment will begin to take hold in earnest in the future. Toyota plans to invest 5 trillion yen in EVs alone by the year 2030. In the EV investment competition, which will be in full swing, the ability to generate sustainable cash will be the decisive factor for victory. This is an event suggesting that Japan's time has come.

|

|||