Nov 15, 2023

Strategy Bulletin Vol.344

Enjoy the Weak Yen!

~The weak yen will ensure a dramatic revival of Japan's manufacturing industry.~

Rampant arguments for Japan's failure

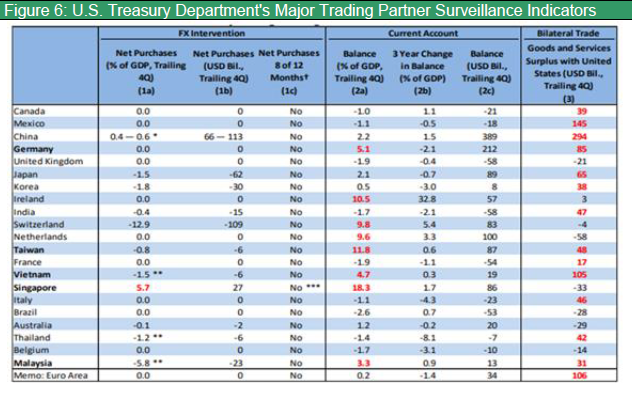

The yen has plunged, with the dollar at 151.6 yen, the weakest in almost 33 years since 1990. The decline in the yen's real effective exchange rate (2020=100), which indicates the strength of a currency, has been even more extreme, falling to a historic low of 72.4 as of the end of September 2023, a 13% depreciation compared to 83.6 during the Smithsonian era (1971-1973), when the dollar was 308 yen to the dollar. Bad yen theory began to be discussed in the media and among economists. The Sankei Shimbun reported that Japan's nominal GDP is expected to fall to fourth place in the world, overtaken by Germany and India. The Nikkei, in an article full of self-mockery, called this an era of yen weakness, citing Japan's weaknesses that cause the yen to weaken. It interprets the yen's weakness as an argument that capital will flee Japan's weak growth potential and cause the yen to weaken. However, Japan's low growth potential is not a new story; since 2010, when the yen has been strong, massive amounts of capital have flowed out of Japan to other countries with high growth rates, yet the yen has remained strong. The argument that the yen is weakening because Japan is failing does not hold water.

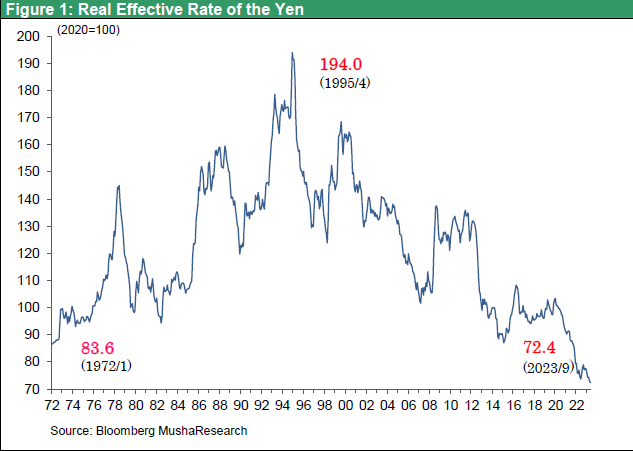

Interest Rate Differential Hypothesis and Current Account Balance Hypothesis Cannot Explain Yen Weakness

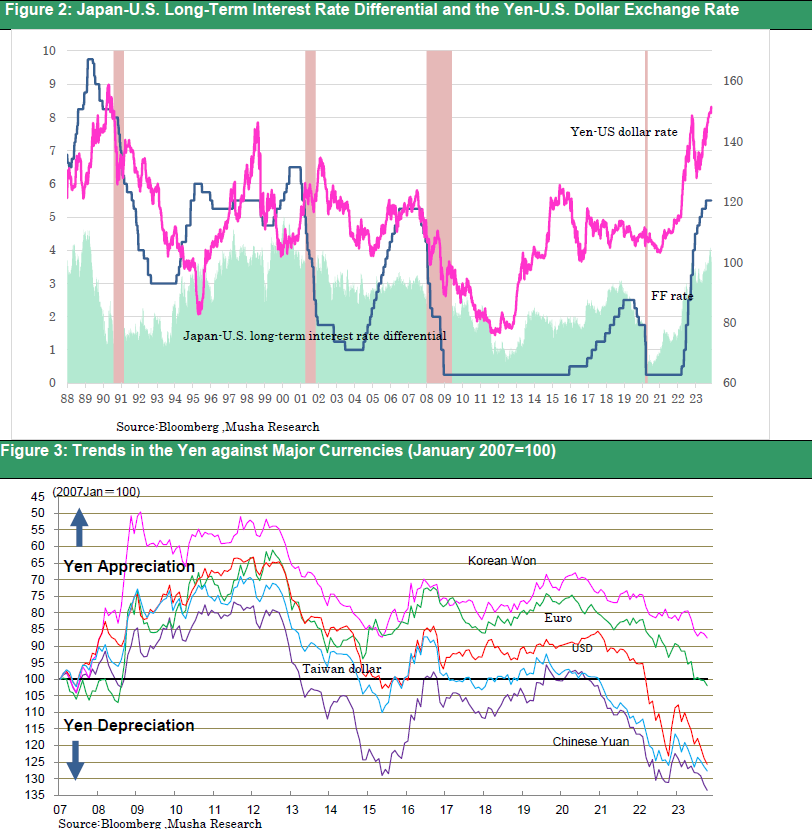

There is a theory that the increase in the yen carry trade is due to the interest rate differential. Japan, with the world's lowest interest rates, is certainly attractive as a funding currency, especially with the rapid rise of interest rates in Europe, including Germany, which until two years ago had negative interest rates below Japan's. However, the carry trade can result in a significant foreign exchange loss when the yen appreciates: if one were to borrow $1 at ¥150 per dollar and repay it at ¥100 per dollar, one would need to borrow $1.5 to repay ¥150. At a time when the yen is at 151 yen per dollar, the weakest it has been in 33 years since 1990, are people betting on a further depreciation of the yen? If so, it is a significant gamble. To begin with, the yen has been weakening even as the Japan-U.S. interest rate differential has been narrowing over the past few days. The yen has been weakening not only against the dollar, but against almost all currencies. The yen has weakened even against the Chinese yuan, which has been cutting interest rates, and the South Korean won, which has been retreating from its hawkish stance.

Yen depreciation beyond the BOJ's defenses

We are beginning to see comments calling for something to be done about this unidentified depreciation of the yen. If the strong yen is the source of the soaring prices that are depriving people of real income, the BOJ must turn to monetary tightening. BOJ's Ueda probably took a preemptive action against critics of the yen's depreciation. He surprised the market by recalibrating the YCC (allowing the upper limit of long-term interest rates to break through the 1% mark) at the end of October, following the end of July, but this came up empty. Since the foreign exchange market no longer responds to a narrowing of the interest rate differential, it must be said that the current depreciation of the yen has exceeded the BOJ's defense.

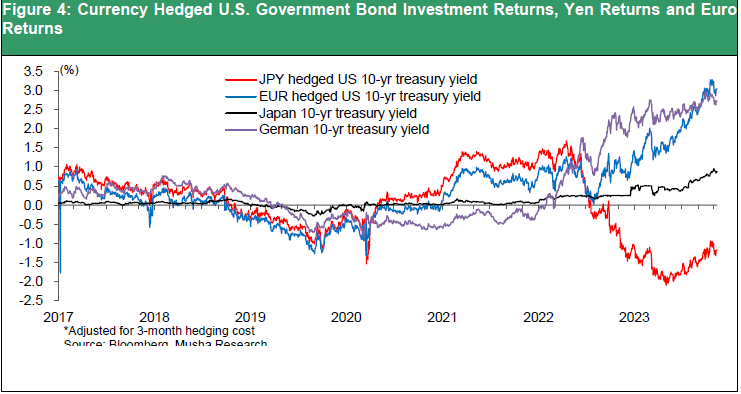

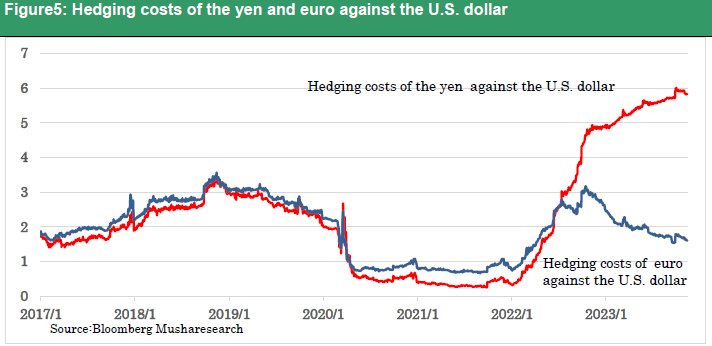

Figure 4 shows the return on 10-year U.S. government bond investments with currency hedging and shows that Japanese investors have been losing more than 1% for more than a year due to hedging costs that significantly exceed the interest rate difference when hedging against the dollar. Chart 5 shows the dollar hedging cost of the yen and the euro. Since the latter half of 2022, the hedging cost of the Japanese yen has risen to an extremely elevated level of 6%. The two had been in tandem until then, but they have diverged significantly, with a 4% gap in the latest figures. Since the hedging costs can be explained as the mirror of market general expectation, market participants have suddenly become very bearish towards Japanese yen.

The true nature of the yen's depreciation, geopolitics, invisible to market participants

The yen is now being perceived as undervalued for reasons other than interest rate differentials, economic strength, the trade balance, or the capital account balance. Where does this view of the yen's future depreciation come from? It is the will of the U.S. authorities, as Japan (with the fifth largest trade surplus with the U.S.) was once again removed from the U.S. Treasury Department's foreign exchange watch list (China, Germany, Malaysia, Singapore, Taiwan, and Vietnam) in November. One cannot help but think that the super depreciation of the yen is a means of implementing the national strategy of the hegemonic US, which has no choice but to relocate its industrial clusters of high-tech manufacturing industries, which are concentrated in the geopolitical danger zones of China, Taiwan, and South Korea, to the safety of Japan. Treasurer Kanda and Treasury Secretary Yellen are on the same page, saying, "The level itself is not the determining factor, but volatility is the issue.

The exchange rate does not project economic reality, but rather creates economic reality.

Market participants and economists alike must reverse the cause-and-effect relationship regarding exchange rates. They must know that exchange rates are not the result of economic realities, but the cause of them. In the past, many economists argued that Japan should accept the reality of a strong yen because deflation was strengthening the purchasing power of the yen. However, the appreciation of the yen has eroded Japan's competitiveness, encouraging the outflow of companies, business opportunities, jobs, and capital overseas, and has hurt Japan's domestic demand, which in turn has caused further deflation. The vicious cycle of a strong yen and deflation was broken by Abenomics and Kuroda's other-dimensional easing, which attempted to achieve reflation by inducing a weaker yen as a starting point.

We should not forget that the exchange rate is one of the most important indicators that will determine the future economy. The U.S., eager for Japan's industrial revival, is inducing the yen to weaken. As South Korea dramatically strengthened its competitiveness and knocked out Japan's high-tech firms during the remarkable depreciation of the won from 2008 to 2013, the persistent depreciation of the yen will prepare Japan for a dramatic reemergence. Japan will re-emerge as a manufacturing powerhouse and a services (tourism) powerhouse. This will revive Japan's strong yen over the long term. Japan should take advantage of the fortuitous depreciation of the yen and should not waste its time in trying to induce the yen to appreciate.