Nov 24, 2023

Strategy Bulletin Vol.345

Exchange Rates as a Means to Achieve the National Interest of the United States, the Hegemonic Power

~The End of the 1971 Regime, Is this the Beginning of the Era of the Dollar's Monopoly (2)

The end of the second postwar regime that began in 1971

The postwar system can be divided into the 36 years from 1945 and the 52 years from 1971 to the present. The framework of the current world political and economic order, which can be called the second postwar system, was formed by the two Nixon shocks in 1971. However, it could no longer be sustained due to the "Frankenstein" of China and its challenge to U.S. hegemony. The world is now entering an era in which a new order is being sought to replace the Nixon shock regime.

The restoration of US-China diplomatic relations and the expulsion of Taiwan from the UN. by Nixon create "Frankenstein"

The first Nixon Shock was the restoration of diplomatic relations between the U.S. and China. He severed diplomatic relations with the Republic of China (Taiwan), a permanent member of the UN Security Council, and invited Communist China into the world order. This policy, based on the expectation that economic development would promote democracy in China and that China would eventually become a leader of the world's liberal democratic order, proved to be a great mistake 50 years later. In his later years, Mr. Nixon recalled that he might have created a "Frankenstein" monster.

This decisions that passed Japan by unnoticed also left trail of bad luck on Japan's diplomatic alliance. 30 years later, according to the confidential minutes of Nixon's visit to China revealed in 2003, Nixon stated that "Our policy is to deter Japan as much as possible from economic expansion to military expansion," "to discourage Japan from supporting the Taiwan independence movement," "It is in the interest of peace in the Pacific to restrain Japan" and "Japan will not pay attention to the U.S. if there are no U.S. troops in Japan," etc. (10/3/2016 Yomiuri Shimbun, Jiro Deguchi). This overtly speaks of respect for China and caution toward Japan as an ally.

Floating exchange rate system that does not correct the U.S. deficit, essentially a dollar standard

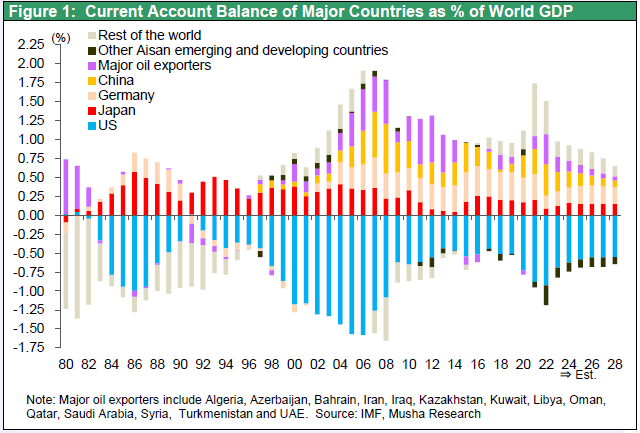

The second Nixon shock was the cessation of the dollar-gold exchange. The reserve currency, the dollar, lost its gold backing, and there was talk of fears of a major plunge. However, the value of the dollar did not fall as much as the dollar scattering by spinning a rotary press due to the departure of the gold backing. Figure 1 shows the ratio of the current account balances of major countries to the world's GDP, and only the U.S., as the largest debtor nation, has accumulated foreign debt single-handedly. The U.S. pointed to Japan's huge trade surplus with the U.S. in the 1980s and 1990s and China's huge trade surplus with the U.S. since 2005 blaming the undervaluation of its currencies but made no efforts to reduce its own deficit. This tells us that the floating exchange rate system under the dollar reserve currency regime was an asymmetric one.

Floating exchange rates are believed to be fair because they contain a mechanism for correcting imbalances. The mechanism was persuasive: the currency of a country with a trade deficit would reduce its deficit by weakening, and the currency of a country with a surplus would reduce its surplus by strengthening. The logic goes that a weaker currency for a deficit country will lead to higher import prices and lower imports, while a weaker currency will make the country more competitive and thus increase exports (the opposite is true for a surplus country). On this basis, the U.S. has monitored and sometimes sanctioned major trading partners suspected of currency manipulation. In the past, Japan and China accumulated their holdings of U.S. government bonds through foreign currency intervention to avoid sharp currency appreciation, but U.S.-led international public opinion condemned this as currency manipulation and dirty float.

Historical facts over the past 40 years, however, show that this logic has not been applied to the United States. Normally, the U.S. dollar, the currency of the U.S. with a large deficit, should have plummeted, putting a stop to imports by causing U.S. import prices to soar, but the dollar's decline was limited and did not function as a brake on U.S. imports.

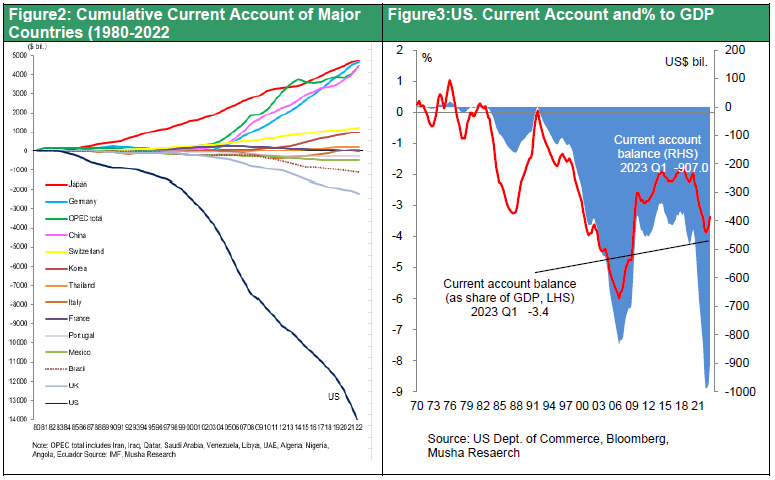

As a result, the U.S. current account deficit continued to increase, and 50 years after the Nixon Shock, the world accumulated huge claims on the U.S. and huge U.S. foreign debt (Figure 2 and 3). This was the very supply of the growth currency, the dollar, by the U.S. to the rest of the world.

Dollar Scattering Caused Asia to Take Off

The increase in the U.S. external debt, or in other words, the scattering of the dollar, was a blessing for the world economy: Japan achieved economic breakthroughs in the 1980s and 1990s through exports to the U.S., Asian NIES such as South Korea, Taiwan, and Hong Kong took off in the 1990s and 2000s, and China achieved high growth after the Beijing Olympics in the late 2000s. The starting point for all of this growth was the dissemination of the dollar. The over presence and "Frankensteinization" of China, which is responsible for almost half of the world's manufacturing production, was indeed the result of the two Nixon Shocks. This dollar-dripping system is the essence of modern globalization.

Dollar Dripping is the Distal Cause of the Japan-China Real Estate Bubble

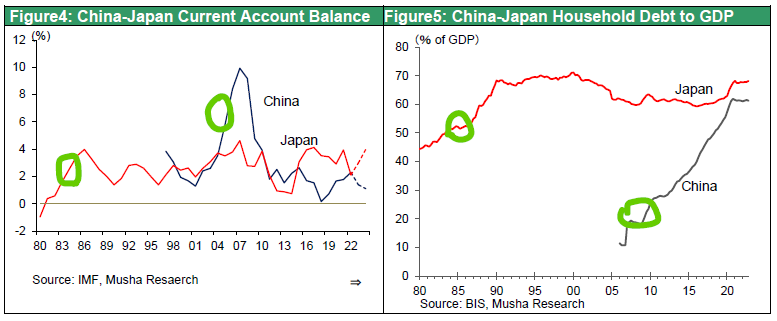

It should also be noted that the accumulation of surpluses with the U.S. led to an oversupply of currency in Japan and China, which in turn led to the formation of the subsequent real estate bubbles. Figure 4 and 5 show the trends of Japan and China's external current account surpluses (vs. GDP) and household debt (vs. GDP), and the linkage between the two can be seen in both Japan and China.

Dollar Spending Boosted U.S. Consumption and Upgraded Industrial Structure

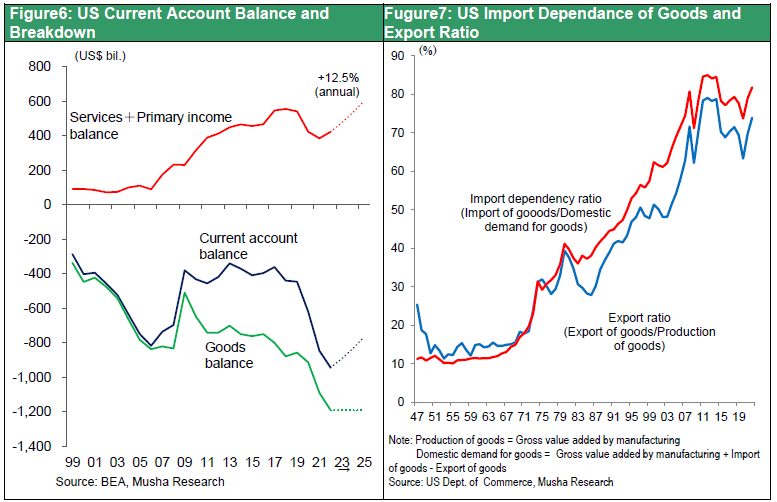

The dollar disbursement also worked within the U.S. Figure 7 shows the trend in U.S. import dependence, which had remained at 10% until the Nixon Shock in the early 1970s but has reached 80-90% since 2010. The U.S. economy, which used to be self-sufficient, producing most of its clothing, TVs, and automobiles domestically, has been greatly opened. This has led to the hollowing out of the manufacturing sector, but this has been compensated for by the emergence of new industries and employment, such as IT and services. From another perspective, the hollowing out of the U.S. manufacturing industry has promoted the upgrading of the U.S. industrial structure.

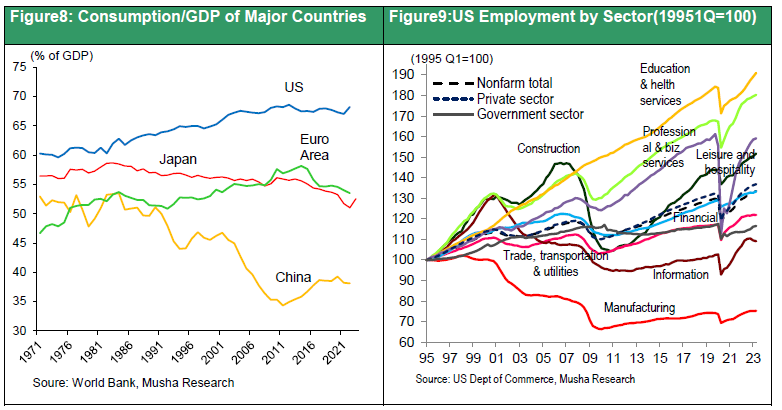

In the early 1970s, the ratio of U.S. consumption to GDP was 60%, but 50 years later, in 2023, this ratio will be a whopping 68%. This is because cheap imports have boosted the real purchasing power of U.S. consumers (Figure 8).

The U.S. Current Account Deficit Will Shrink

Modulations began to appear in the dollar supply under this Nixon shock regime. First, the dependence of the U.S. on imports of goods has reached 80-90%, and the goods trade deficit has reached its limit. Future U.S. imports will be very mild, in line with economic growth. Second, the U.S. services and income balance (i.e., international trade in invisible things) surplus is expected to increase significantly. Thus, the U.S. current account deficit will decline (see Figure 6). This will probably serve as a brake on the supply of dollars and shift the global supply and demand for foreign exchange from a dollar surplus to a dollar shortage, opening an era of dollar appreciation and dollar monopoly.

U.S. Dominant Presence in the Cyber World, the World's Largest Growth Market

The biggest bright spot in the global economy is not Asia or the Global South, but cyberspace without borders. In this rapidly developing mass of knowledge, cyberspace, the Internet, AI, and other fields, the U.S. has a near monopoly of global demand and is fishing for its use. Europe and Japan are trying to penalize the monopoly of Internet platform providers, but since there are no alternative suppliers in their countries, this is a futile attempt. Looking at the U.S. S&P 500 index GAFAM+NVIDIA and TESLA, which are named after The Magnificent Seven, have gained 50% since the beginning of the year. On the other hand, the share prices of the remaining 493 companies have remained almost flat. Do we see this as a bubble or the rise of companies driving a new industrial revolution? Given that the U.S. market is a mix of the brightest and the least bright sectors, this disparity is not surprising.

The resulting dollar appreciation will strengthen the financial power of the U.S

In addition to the improvement in the U.S. current account balance that we have been discussing, the economic growth rate of the U.S., the home of innovation, has begun to outpace that of other countries, and the resulting high interest rates are encouraging the concentration of capital in the U.S. The question then becomes how to supply the world with dollars, the currency of growth. In the future, the U.S. investment and loans are likely to replace import payments as channels for supplying dollars to the rest of the world. This will strengthen the position of the U.S. as the hegemonic power. It is hypothesized that the resulting dollar appreciation will strengthen the financial power of the U.S. as the hegemonic power and become a driving force for the restructuring of the world order.