Feb 26, 2024

Strategy Bulletin Vol.350

Record-high, reasonable stock prices will take off thanks to a major revival of the high-tech ind.

~The key is Taiwan-Japan industrial cooperation~

Q) The Nikkei 225 reached an all-time high last weekend on February 22. Musha Research has been saying that it will easily exceed 40,000 yen this year. What does this all-time high mean and what will happen next?

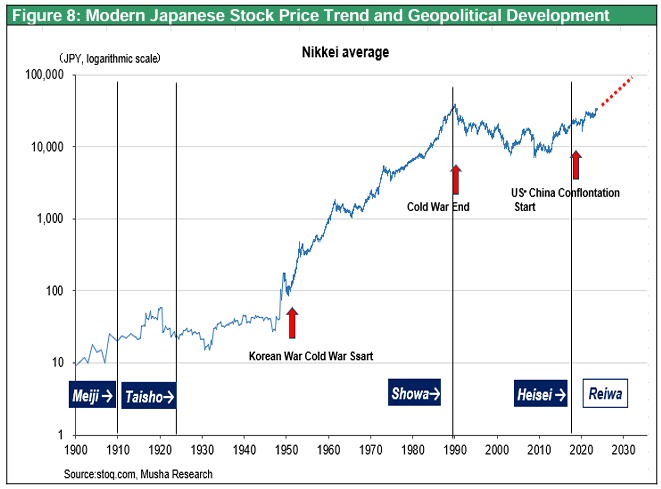

A) Stock prices are the leading indicator of the economy. The fact that these have reached new highs can be considered the start of a new era and new prosperity for Japan. This is not the peak of the climb. Rather, a spectacular rise in stock prices is about to begin. Perhaps soon it will reach 50,000 or 60,000, and within five to ten years it could reach 100,000 yen. With the highest price, market participants no longer have a yardstick by which to measure a reasonable share price.

Q) How do you measure a reasonable stock price? How does Musha Research calculate it?

A) For the 10 years since the advent of Abenomics in 2013, the PER of the Nikkei 225 has ranged between 12 and 18 times. The middle value of 15 times (earnings yield of 6.7%) is a reasonable stock price based on the consensus. If this is the case, the reasonable share price would be 40,000 yen, based on this year's forecasted EPS of 2,500 yen. However, reasonable P/E ratios have changed significantly throughout history. Over the long term, the appropriate P/E ratio for both Japan and the U.S. may be "the same level as the yield on long-term government bonds.

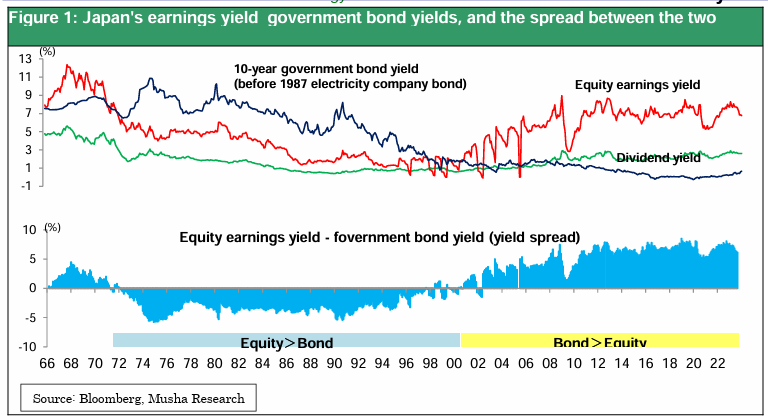

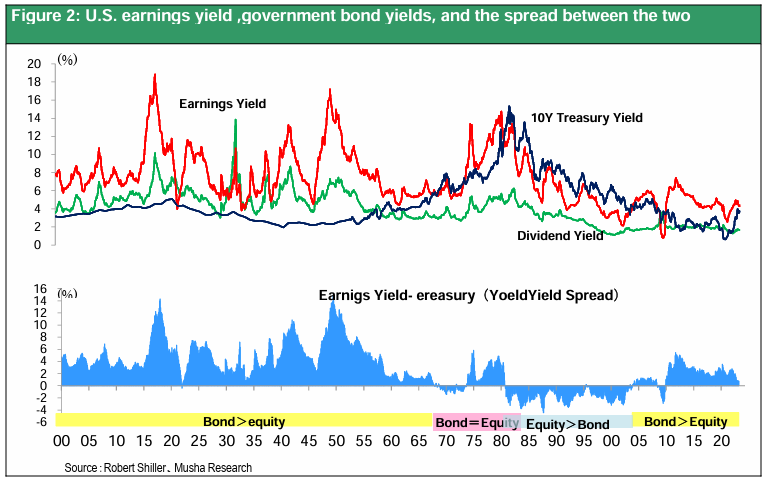

Figure 1 and 2 show that the spread between earnings yields and government bond yields in Japan and the U.S. rose sharply during the period of risk aversion following the Great Depression and the bursting of the bubble economy, and then declined as market sentiment recovered, remaining negative when risk-taking strengthened. In the case of the U.S., the large spread that existed immediately after the GFC has almost disappeared, and the yield on long-term government bonds is now at the level of "earnings yield = yield on long-term government bonds,". The Fed used to calculate a fair value model in which "earnings yield on equity = yield on long-term government bonds,” and the U.S. is now back there.

In Japan, the yield on Japanese equities was consistently lower than the yield on bonds during the period of strong risk-taking from the 1970s to the 1990s. In the 2000s, however, risk aversion became more serious, and now, as in the U.S. immediately after the Great Depression, earnings yields are extremely high, exceeding yields on government bonds. As market sentiment improves, yields on stocks will decline toward the level of yields on long-term government bonds, as in the U.S., and at some point, they will probably reach an equilibrium level where equity yields = yields on long-term government bonds. Let us assume that the long-term interest rate in Japan rises to 3% when 2% inflation takes hold and the BOJ's ultra-easy monetary policy comes to an end. Then, earnings yield of 3% and a P/E ratio of 33 times would be appropriate. In this way, even with the current corporate earnings (EPS), a reasonable stock price would be justified at the level of 80,000 yen for the Nikkei average. If the Nikkei Stock Average breaks through the all-time highs, and the market throws away its frozen market price scale, Japanese stocks may soar like a kite with a broken string. The Nikkei average of 100,000 yen may not be a distant future, but a reality that is there now.

Q) It is hard to imagine a new era of prosperity for Japan, but what form will it take?

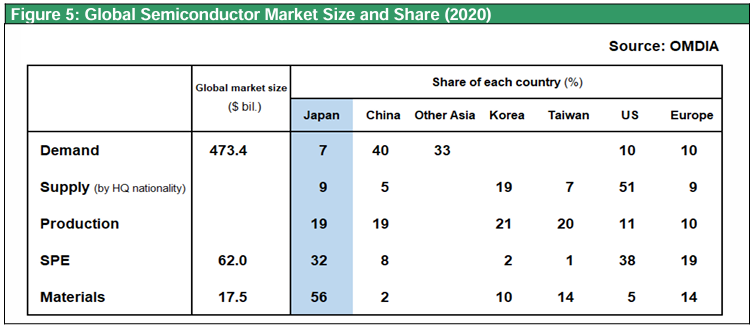

A) Japan will become a high-tech manufacturing powerhouse. The hub of high-tech manufacturing in East Asia shifted from Japan to China, South Korea, and Taiwan 30 years ago. The image of this returning to Japan is almost certain. The current semiconductor boom can be seen as a harbinger of this. As we have long explained, the semiconductor boom and the weak yen that have brought about the current improvement in Japan's business climate would not be possible without changes in the geopolitical environment of the Cold War between the U.S. and China. The elimination of China from the global supply chain as planned by the U.S. government and the resurgence of Japanese industry are now underway.

Q) Even if the U.S. government's scenario is correct, will the private sector, which acts based on profitability and economic rationality, follow suit?

A) Economic rationality will follow. Government subsidies and the weak yen will facilitate this. Taiwanese and South Korean high-tech companies are investing heavily in Japan, believing that investment in Japan will determine the future of their business. Taiwan's TSMC, Korea's Samsung, SK Hynix, and Taiwan's Powerchip Semiconductor Manufacturing Corp (PSMC) have already announced their investments. In addition to the generous subsidies from the Japanese government, Japan has a strong presence in the back-end process (assembly process), which is expected to lead to breakthroughs in semiconductor technology in the future. TSMC has its only overseas development center in Tsukuba Japan, and Samsung is building a research center for advanced packaging technology in Yokohama. We can expect a virtuous cycle of investment as global semiconductor investment begins to concentrate in Japan, and investment attracts investment.

Q) If production must be moved out of China to safer locations, the choice of Japan becomes even more important for Korean and Taiwanese companies, doesn't it?

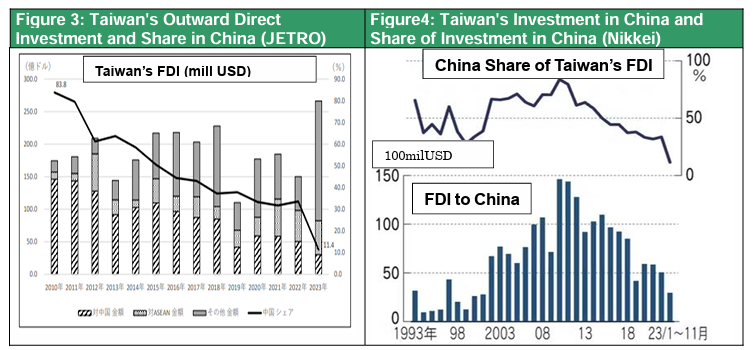

A) We can expect a big swell of investment in Japan, especially from Taiwanese companies. According to a survey by the Japan External Trade Organization (JETRO), investment in China, which used to account for the majority of Taiwan's outward direct investment, has plummeted. On the other hand, Taiwanese investment in Japan is increasing rapidly. Taiwan's direct investment in China declined 39.8% in 2023 from the previous year to $3.04 billion (456 billion yen). In contrast, according to Japan's Ministry of Finance, Taiwan’s direct investment in Japan surged 46.9% from the previous year to 269.7 billion yen.

The reason for the sharp decline in Taiwanese investment in China is that, in addition to the slowdown in the Chinese economy, the U.S.-China conflict is in full swing, and the U.S. is steadily closing the outer moat to eliminate China. Starting with the Trump administration's tariffs on Chinese products, the export restrictions on advanced semiconductors against Huawei and other companies have completely changed the business environment for Taiwanese companies in mainland China. Trump, who is said to be the closest to becoming president-elect, has said that he will raise import tariffs on Chinese goods to 60% across the board. Trade barriers between the U.S. and China, which are now limited to certain cutting-edge products, will rise dramatically and eventually deal a devastating blow. Companies must act before that happens.

China's high-tech manufacturing industry has been nurtured by Taiwanese companies such as Hon Hai, which has been the sole producer of Apple's smartphones. 2010 saw almost $15 billion in direct investment in China by Taiwanese companies, accounting for 83.8% of total out bound direct investment of Taiwan. By 2023, however, as the amount of FDI of Taiwan surged to $27 billion, investment in China had plummeted, falling to 11.4% of total investment. As an alternative to this shift away from China, investment is now coming to Japan.

Tectonic shifts in Taiwanese companies' investment in Japan have begun to be seen. Taiwan Semiconductor Manufacturing Corporation (TSMC) has completed the first phase of its Kumamoto plant (1.29 trillion yen with 467 billion yen in government subsidies) and has decided on the second phase (2.08 trillion yen with 732 billion yen in government subsidies). Founder Maurice Chang announced at the opening ceremony on February 24 that "the Kumamoto plant will be a renaissance of the semiconductor industry in Japan. In the past, Maurice Chang expressed his unwillingness to make progress on the construction of the Arizona plant in the U.S. "The U.S. is trying to expand semiconductor production in its own country, but the U.S. already has no manufacturing talent. The cost is 50% higher than that of Taiwanese products, and it is impossible to go back to the old days (of strong semiconductor production)" (April 2022). This fact, combined with his high expectations for Japan, is evident.

Other companies include Powerchip Semiconductor Corporation (PSMC) that have decided to invest 800 billion yen in Ohira, Miyagi Prefecture (jointly with SBI), Alchip Technologies Corporation (a designer of custom semiconductors for different applications), Global Unichip Corporation (a design company in which TSMC holds a 35% stake), and, eMemory Technology (which supports the design and development of memory semiconductor circuits), and others have decided to enter the Japanese market. Many more Taiwanese companies are considering starting operations in Japan. Alchip, which had most of its engineers in China as of 2022, has begun to move them out of China, with many of them moving to Japan. The Japanese government is actively supporting post-5G, AI, and other projects, and "new projects are being created one after another, expanding business opportunities," a source close to the matter commented, according to Reuters.

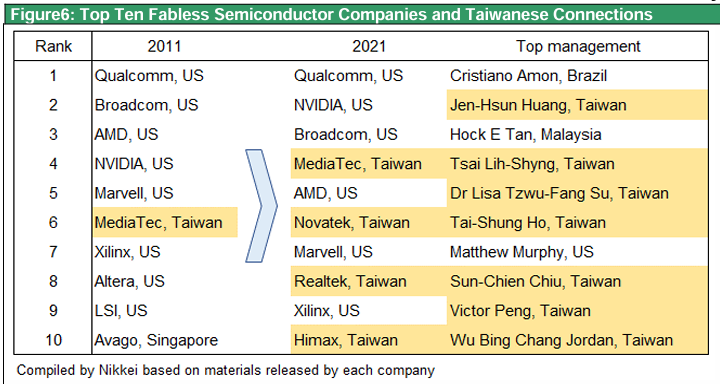

There are expectations of stronger cooperation with Taiwanese high-tech network. The fabless semiconductor companies with the greatest growth potential today, such as NVIDIA, Broadcom, Qualcomm, and MediaTek, owe their competitiveness to TSMC's superior production capacity. The majority of these fabless companies are managed by Taiwanese (Figure 6), and the significance of Japan's involvement in the Taiwanese semiconductor industry pyramid with TSMC at the top can be imagined to be significant. Sharp, which is now under the umbrella of Hon Hai, is also expected to strengthen its role as a production base. (Strategy Bulletin No. 305, May 6, 2022, "TSMC's Strengthening of its Japan Base and Taiwan-Japan Industrial Cooperation Will Be Key: The Japanese Industry Revival Kamikaze, the Weak Yen, Has Arrived! See also.

https://www.musha.co.jp/short_comment/detail/305

Q) Even so, the Japanese government's support for entrepreneurship is very generous. You are promoting massive industrial support, but how can the Ministry of Finance approve it?

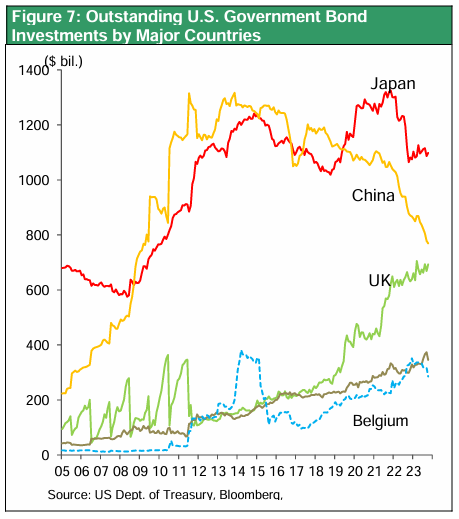

A) The Ministry of Finance is also suddenly more generous when it comes to requests from the U.S. or when it comes to national security matters. In addition, the Japanese government has huge reserves of unrealized profits. First, the BOJ's ETF investment returns have exceeded 30 trillion yen. Second, there are huge foreign exchange gains from its holdings of U.S. Treasury securities. Assuming that the $1.1 trillion in holdings was acquired at 110 yen to the dollar, at 150 yen to the dollar, there would be a huge foreign exchange gain of 44 trillion yen. These can be easily invested as funds for national revival projects.

Q) So, we can see Japan once again becoming the center of the world's advanced high-tech industry. Do you think that the current stock market rally is a sign of such a bright future?

A) A prior example of geopolitics clearly becoming the starting point of economic vitality was the Korean War, which was not merely special procurement but later led to an increase in Japan's position in the international division of labor. This time is similar. In the first place, the decline of Japan, once the world's leading semiconductor powerhouse and boasting a concentration of cutting-edge high-tech industries, was also due to the U.S.' efforts to knock Japan off its perch and its means of doing so, namely, the super-strong yen. The significance of this reversal may be comparable to the outbreak of the Korean War.