Mar 18, 2024

Strategy Bulletin Vol.351

Time of Heaven, Earthly advantage, and Harmony of People" Driving the Revival of Japan's Semiconduct

~Not Just Geopolitics~

Surviving from Despair, Japan's Semiconductor Industry

Until a few years ago, everyone thought that Japan's semiconductor industry was only a minor player in the world. There were no engineers, advanced technology had been lost long ago, there was no demand to support semiconductors, and semiconductor companies lacked the spirit to take on new challenges. Now, however, there is a huge investment boom that no one could have dreamed of.

The driving force behind this is the startup of the Kumamoto plant by TSMC, the world's largest Taiwanese company in the contract manufacturing of semiconductors. Following the completion of its first plant in February, a second plant to produce 6-nanometer advanced semiconductors has been decided, and a third plant is in the works. The total investment decided so far is 3.4 trillion yen, and the Japanese government has pledged 1.2 trillion yen in subsidies. In Kumamoto Prefecture, the rush to invest has caused land prices to rise, wages to rise due to a shortage of labor, and traffic congestion to boom.

In Chitose, Hokkaido, Rabidus has begun construction of a plant to produce advanced semiconductors domestically, and government subsidies of 4 trillion yen have already been decided for Kioxia Western Digital (Kitakami and Yokkaichi), Micron Technology (Hiroshima), Samsung (Yokohama), and other companies. The scale and speed of this investment is leading the way in the support of the semiconductor industry being promoted by the governments of the United States, China, South Korea, Germany, and other countries. With government support as a tailwind, not only semiconductor manufacturers, but also equipment manufacturers, materials manufacturers, and other related companies are expanding their investment, creating a virtuous cycle of industrial linkage.

Public Opinion Welcomes Government-Initiated Projects Caused by the U.S.-China Conflict

As we have explained for some time, this semiconductor boom has its starting point in the changing geopolitical environment of the Cold War between the U.S. and China. The resurgence of Japanese industry is proceeding according to the U.S. plan to eliminate China from the global supply chain. The hub of high-tech manufacturing in East Asia moved from Japan to China, South Korea, and Taiwan 30 years ago. The image of this returning to Japan is almost certain. The current semiconductor boom can be seen as a harbinger of this.

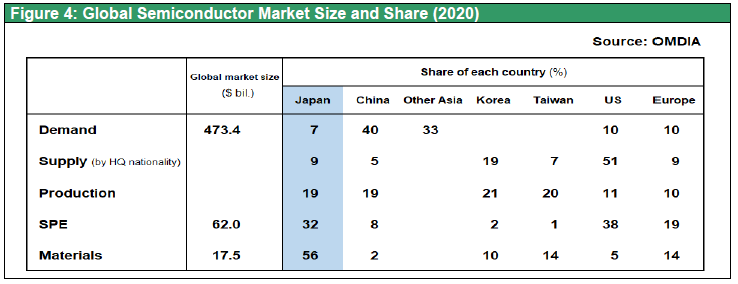

Figure 1 Semiconductor Share by Company Nationality

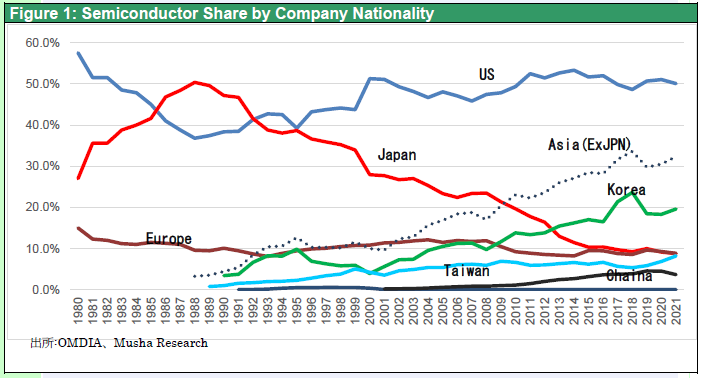

Figure 2 Semiconductor Consumption Share (=Electronics Industries Production) by Country/Region

Figure 3 Semiconductor Maker Share by Nationality, Production Share (2021)

Will this Japanese government-led forceful semiconductor development work? Although it is too early to tell, three factors suggest that it has a good chance of success. First is Japan's determination and hidden financial ability. The Japanese government has huge reserves of unrealized profits. The BOJ's ETF investment returns have exceeded ¥30 trillion due to rising stock prices. There are also huge foreign exchange gains from holdings of U.S. Treasury securities. Assuming that the BOJ holds $1.1 trillion in U.S. Treasury securities at 110 yen to the dollar, this translates into a huge foreign exchange gain of 44 trillion yen at 150 yen to the dollar. With a single political decision, these funds can be used immediately as funds for a national project to revive the nation. In the U.S., Germany, and other countries, the construction process has not been smooth due to criticism of state support for the semiconductor industry, but Japanese public opinion, eager to regain lost ground, enthusiastically supports the government's initiative. If this government and the public opinion that supports it are considered "harmony of people," then the "time of heaven" and the " earthly advantage " are also likely to be on the side of the revival of Japan's semiconductor industry. Since there is a saying in Chinese folklore that when the time of heaven, the earthly advantage, and the harmony of people are in place, great things can be accomplished.

The "Time of Heaven" means that global demand for semiconductors has entered an acceleration phase.

Time of Heaven" means that global semiconductor demand is entering a period of acceleration. Akira Minamikawa of Omdia expects the global semiconductor demand growth trend to shift upward from the past 7% to 10%.The background for this is that global demand for semiconductors is expected to accelerate due to massive government support for DX/GX-related investment, which is expected to total 750 trillion yen (250 trillion yen for DX and 500 trillion yen for GX) by 2030. This is the backdrop for accelerating global demand for semiconductors. This will be compounded by the demand crunch caused by the AI revolution, including chat GPT. GPUs, that NVIDIA is sole supplier, are in short supply and prices are skyrocketing. Sam Altman, CEO of OpenAI, has called for government and investor cooperation to meet this demand, saying that an astronomical investment of $5-7 trillion (5-7 times the total semiconductor investment in the past) is needed. It is estimated that the computing capacity of data centers will need to be tripled over the next three years. This will strain the supply and demand of electricity, so there will be further demand for semiconductors to save power.

Demand for PCs and smartphones will also recover.

From a short-term cyclical perspective, the semiconductor mini recession is clearly ending in late 2023, with the Semiconductor Industry Association (SIA) predicting that global sales will recover from $52.68 billion in 2023 (down 8.2% from the previous year) to $60 billion in 2024 (up 13%). In addition to the growth of automotive semiconductors, replacement demand for PCs and smartphones, which has been stagnant for a long time, is expected to increase due to the functional improvements brought about by AI.

Earthly Advantage: Japan has accumulated breakthrough technologies for the next generation

Another key factor is Japan's earthly advantage, which is likely to make it a key location for global semiconductor investment. This is because breakthroughs in semiconductor technology are shifting from the planar miniaturization of wafers in the front-end process to 3D and assembly technology in the back-end process, which is Japan's forte. Moore's law refers to the increase in the level of integration that has continued for the past 40 years, doubling in 1.5 years, but planar miniaturization is reaching its physical limit. From now on, multiple chips with different functions will be combined into a single package. This is called a chiplet, and the key to this lies in the back-end process. Japan is strong in back-end manufacturing equipment such as probing, dicing, bonding, and molding, and accounts for 50% of the world's share in materials, making it the country with the most accumulated technological elements required for chiplet production. TSMC is the only overseas company to have a development base in Japan (Tsukuba) because of its focus on Japanese back-end process technology. Samsung is building a research center in Yokohama with the aim of establishing back-end technology accumulated in Japan. Japan's growing potential to become the world's back-end technology hub is triggering a rush of high-tech investment in Japan.

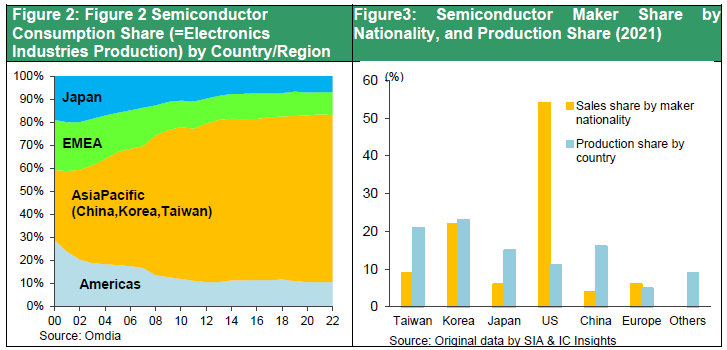

Figure 4: Size of Global Semiconductor Market and Global Share

Structural Changes in Demand Often Cause a Shift in Leading Roles

In the past, leading companies in the semiconductor industry have changed as their products have evolved. Japan, which was the leader when semiconductor demand was for consumer electronics and large mainframe computers, was completely left behind in the PC and smartphone-driven era. However, in the future, AI, IOT, and DX/GX will be the main demand for semiconductors, and we have entered an era in which ASICs (application-specific semiconductors) will be needed instead of an era in which a large volume of general-purpose products is required. Intel and Samsung, which is the winners in the ear of PCs and smartphones, can no longer rest on their laurels. This new era is a favorable condition for Japan, which is seeking to re-enter the market for advanced semiconductors, and it is a condition for which we cannot wish.

The Gift of 30 Years of Hard Work

The revival of Japan's semiconductor industry can be expected not only because of the confrontation between the U.S. and China, but also because of the "time of heaven" and the "earthly advantage. I would like to pay tribute to the efforts of everyone involved over the past 30 years of hard work.