Sep 30, 2024

Strategy Bulletin Vol.365

Stock Prices are the Referee

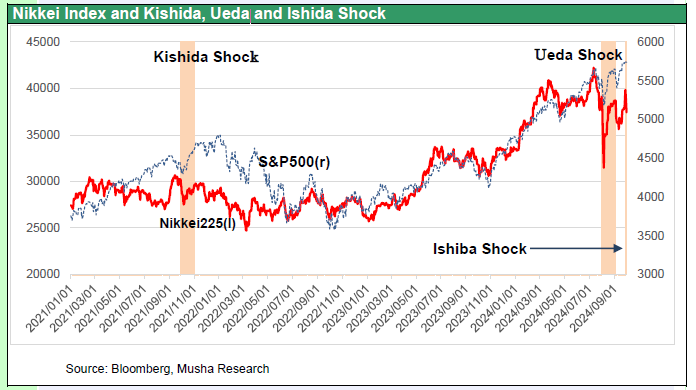

~ What the Kishida, Ueda, and Ishiba shocks mean~

Ishiba Shock may Cancel Austerity Path and Stabilize Markets

Japanese stock prices were hit again by a shock on the grounds of policy choices.

In the LDP presidential election on September 27, Ishiba, who came in second in the first round of voting in the runoff election, defeated the leader of the first vote, Takaichi, to win the election and secure his position as the next prime minister of Japan. In the first round of voting, Takaichi, who advocates the continuation of Abenomics and a high-pressure economy, was ahead of Ishiba in both party and Diet member votes. The closing price of the Tokyo market at 3:00 p.m. on Friday, September 27, surged to 39,8929yen, just short of 40,000 yen, confident of Mr. Takaichi's victory. Immediately after that, however, the winning of Mr. Ishiba caused a sharp drop in the Nikkei Stock Average on the futures market, with the CME Nikkei 225 futures price falling 2,467 yen to 37425 yen, making a sharp drop in stock prices on Monday inevitable. The market is watching anxiously to see how Ishiba's party executive, his cabinet, and his new commitment to economic policy will play out.

Let us look back at past stock market shocks. The first was the “Kishida Shock” on September 26, 2021, when Mr. Kishida, who had proposed the taxation of financial income, became LDP president, and the Nikkei plummeted (from 30183 yen just before his inauguration to 27678 yen in one week, a drop of 2500 yen or 8%). Shortly thereafter, the suspension of the financial income taxation proposal brought stock prices back to their pre-decline levels.

The second was the “Ueda Shock” triggered by the Bank of Japan's interest rate hike on July 31 of this year and Governor Ueda's hawkish comments, which sent the Nikkei Stock Average tumbling 7600 yen, or 20% within three business days from 39101 yen (July 31) to 31458 yen (August 5). However, the following week, Deputy Governor Uchida stated that the BOJ would not raise rates when the market was unstable and that there was plenty of time to do so, and the market rose 20% in eight days, almost back to its pre-crash level.

Ishiba also has no choice but to switch to a policy of market appeasement

The current “Ishiba shock” may also reassure the market if Mr. Ishiba follows Mr. Kishida's new capitalism and expresses his intention not to hike interest rates too fast or pursue a course of fiscal rehabilitation. Since Mr. Ishiba has already proposed a general election in October, and an election amid falling stock prices is unthinkable, a reworking of policy would be inevitable. Katsunobu Kato, who was part of the implementation team for the Abenomics path in the Abe-Suga administration, has been unofficially appointed as next Finance Minister, with Suga taking over as Deputy Governor of LDP. It is almost certain that he will shelve the austerity course of fiscal consolidation and monetary normalization that he had been advocating before the election.

This is the third time that the market has plunged, and the policy has been revised, meaning that the market has leaped to become the arbiter of policy. In the U.S., the “Greenspan put” and “Bernanke put” were frequent examples of central banks easing monetary policy to support the market when the market plunged, and Japan is entering such an era as well, where stock capitalism has spread to Japan and economic policies that lead to stock market declines are not tolerated. In particular, now that NISA has induced individuals to invest their money in stocks, investment trusts, and other price volatile investment products, stabilizing the market must become the top priority economic issue. We are entering an era in which the rationality of the market will determine whether a policy is acceptable or not.

Mr. Kishida: From Anti-Abenomics to Pro-Abenomics

The Kishida administration, which emerged in opposition to Abenomics three years ago by advocating “no growth without distribution” and proposing “financial income taxation,” has cancelled its original policies and comprehensively replaced the content of its own “new capitalism. Rather, it further deepened Abenomics' expansionary monetary and fiscal policies, corporate governance reforms, and market reforms, which increased the confidence of global investors and led to the Nikkei Stock Average reaching a new all-time high. This policy evolution of the Kishida administration must be followed by the coming Ishiba administration. Otherwise, the Ishiba administration will have to be short-lived due to economic failure.

In this light, we believe that the basic lines of argument that (1) Japanese stocks are in a long-term uptrend, (2) the Japanese economy is in a short-term cyclical recovery phase, and (3) the risk of not holding significantly undervalued Japanese stocks will cause a favorable supply-demand balance for Japanese stocks will continue under the Ishiba administration.