A V-shaped market recovery ? There was no Armageddon

In 2010, the global economy and financial markets staged a rapid recovery after reaching the brink of a depression. Emerging countries were largely responsible for the recovery of the global economy. In addition, financial markets have returned to normal after standing on the precipice of a total collapse. During this crisis, there were periodic surges in pessimistic views. A number of mini-shocks also fanned the flames of market instability from time to time. There was the “false dawn belief” in June 2009, the “Dubai debt shock” in November 2009, the “Volcker shock” in January 2010, the “Greek debt shock” in May 2010 and “expectations for U.S. deflation” in August 2010. With each mini-shock, pessimists predicted another economic crisis and drop in stock prices. They were convinced that the effectiveness of stopgap measures that merely pushed problems into the future had ended. Despite this pessimism, stocks continued to stage a V-shaped recovery that propelled prices back to the pre-Lehman-shock level. Furthermore, there was a sharp drop in the risk premium for corporate bonds (the probability of bankruptcy factored in by the market), which had skyrocketed to an unprecedented point. Just as with stocks, this risk premium also returned to the normal level that existed prior to the Lehman shock. As a result, the pessimistic scenario of an Armageddon (a catastrophic economic downturn) did not happen.

The pessimists’ mistake is clear but there is still a strong pessimistic bias in Japan

Figure 3 is a list of pessimistic and optimistic stances that we prepared in March 2009 when global stock prices were at their lowest point. Adopting the optimistic view, we stated that this once-in-a-century financial panic represented a once-in-a-century investment opportunity. (See “The Big Recovery of Japanese Stocks” by PHP Research for more information.) Pessimists thought that the financial crisis was the sign of a serious disease in the economy. They concluded that there was no hope for a recovery. But we stated that the financial panic had little relationship with the actual economic situation. We therefore concluded that prices of stocks and credit instruments would quickly rebound as markets returned to normal. One and a half years later, there is no doubt which side was correct. At this point, embracing the beliefs of the pessimists once again leads to the conclusion that it is impossible to take on any risk. But we believe that now is the time for the pessimists to resume risk-taking after recognizing their mistake. Fortunately, among the world’s stock markets, only Japan has not yet experienced a correction in the pessimistic view. In other words, there is still much room for a major stock market recovery that is fueled by a correction in the pessimistic bias of investors.

The unusually strong yen explains why only Japan is a loser

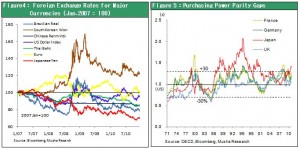

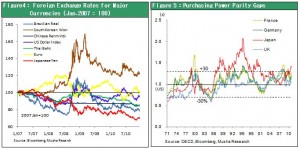

Only in Japan has stock market performance demonstrated that the beliefs of pessimists were not completely wrong. By the end of November 2010, global stock market capitalization (denominated in dollars) had rebounded by 91% from the March 2009 bottom. Japanese stocks lagged far behind this rally by staging only a 40% rebound. Japan was the only loser in the world. Primarily responsible for this was the rising value of the yen alone among the world’s currencies. Since the outbreak of the subprime loan financial crisis in 2007, the yen has surged by 47% in relation to the dollar. South Korea, a major competitor in world markets, saw its won fall 21% against the dollar during the same period. Germany, which also competes with Japan, benefited from a 20% drop in the euro against the dollar because of the debt crisis in Greece. Japan ended up with an enormous disadvantage. Based on September 2010 OECD data, the yen is 51% overvalued in relation to its purchasing power parity while the euro (Germany) is 11% overvalued and the won is 20% undervalued. These disparities mean that Japan has much higher wages compared with these companies. The result was strong deflationary forces and downward pressure on wages. The abnormal strength of the yen restricted Japan’s exports and brought about significant deflation. Japan’s ability to achieve recoveries in its economy and corporate earnings was severely limited as a result.

The yen’s abnormal strength will end along with pessimistic views

Actions of investors were consistently determined by the “cash is king” sentiment. Investors worldwide were convinced that deflation was imminent. This was the primary cause of the yen’s excessive valuation, which in turn eroded Japan’s competitive edge and prevented the economy from expanding. But the real cause was nothing more than the inflow of capital to Japan, which had the world’s lowest long-term interest rates because of long-term deflation. With little demand for investments in the world, there were no effective ways to use the large volume of idle funds. Due to the deflation scenario, investors gave up on earning any income from their money. They pursued a self-fulfilling stance based on the belief of “buying the yen because the yen is appreciating because everyone is buying the yen.” Consequently, short-term speculative investments flowed into Japan. Why was everyone buying the yen? First was the effective increase in Japanese interest rates linked to deflation. Both the yen and dollar had interest rates that were basically zero. But the difference in inflation meant that Japan offered an effective interest rate of 2%. Japan’s weak economy led to deflation that made the yen stronger. The result was a negative cycle in which a stronger yen made the economy weaker, thus increasing deflationary forces even more. The belief that the Bank of Japan was not averse to deflation was another reason to buy the yen. However, the Bank of Japan’s decision in October to start buying assets with risk shows that this stance is beginning to shift. The third reason is experience. Yen speculation has consistently yielded profits because the yen has been the world’s strongest currency for the past two decades. This explains why investors worldwide have developed the conditioned response of buying the yen whenever there is a severe global financial crisis.

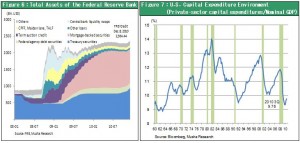

The time has come to abandon the deflation scenario

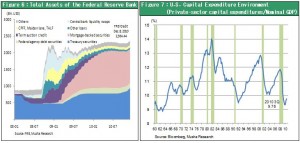

Today, the economic environment is completely different. In 2011, investors will probably abandon the global deflation scenario as the United States enacts more monetary easing and achieves a recovery in the real economy. These events will most likely end the yen’s appreciation, which was closely linked to expectations of deflation. A global economic rebound and decline in the yen’s value will be two sources of good news for Japanese stocks. The U.S. economy is the key factor. Once a stagnant phase following the initial recovery comes to an end, we expect to see the U.S. economy enter a period when it slowly gains momentum. Two economic measures at the end of 2010 will be the decisive actions. First is the second stage of quantitative easing (QE2), an experiment on a scale never before seen in financial history. Second are fiscal measures that include a two-year extension of the Bush tax cuts and a one-year tax reduction of $120 billion. Providing a continuous impetus for investments and consumption is the objective of QE2. The Fed intends to directly stimulate the animal spirit of investors by directly buying assets. Buying assets and cutting taxes will probably generate U.S. economic growth of at least 3% in 2011. Moreover, there is an increasing possibility that these actions will lead to long-term economic growth that lasts for at least the next few years. In the United States, there has been a capital expenditure cycle of approximately 10 years. Economic peaks and troughs occur when capital expenditures as a percentage of GDP reach a high or low point, respectively. Currently, we are in a period that immediately followed a historic low of 9.3% in the ratio of capital expenditures to GDP in the first quarter of 2010.

A major stock market rally in Japan is about to begin

The events that we have just outlined indicate that 2011 will probably be the beginning of a long-term decline in the yen’s value. Investors are closely watching the U.S. economic recovery and the shift in the Bank of Japan’s stance. The Bank of Japan has moved ahead of the Fed in enacting new financial initiatives aimed at preventing a further rise in the yen’s value and pushing up prices of assets. Taking these steps should prevent the yen’s appreciation by making Japanese investors willing to take on risk again, thereby increasing Japan’s overseas investments. As this process unfolds, investors will retreat from their massive speculative positions that anticipate a further increase in the yen’s value. This speculation is precisely what produced the extreme overvaluation of the yen to more than 50% above its purchasing power parity. One more reason to expect a decline in the yen is the growing desire of the United States to cooperate with Japan as a partner in holding China in check.

The cash-is-king era is over

Japanese stocks posted the worst performance in the world in 2010. But once the U.S. economy starts recovering and the yen starts to decline, we expect to see a dramatic reevaluation of Japanese stocks. During the past decade, Japan suffered from a persistent negative bubble and unusually undervalued stocks, real estate and other assets with risk. A correction in all these areas is probably about to begin. Valuation metrics for Japanese stocks are low. Illustrations include a dividend yield of 2%, an earnings yield of 6.6% and a PBR of 1.1 times. With Japanese government bonds yielding only 1%, stocks in Japan have never been this undervalued. Furthermore, Japan has the largest gap between expected returns on real estate and interest rates among the world’s major countries. Naturally, this gap is creating considerable interest in Japanese real estate among overseas investors. In addition, investments in the assets of emerging countries have excellent prospects for high returns. A massive migration of capital is about to begin from safe assets to stocks, real estate, foreign currency-denominated assets and other assets with risk that can provide high returns. Increasing talk about the insolvency of the Japanese government and plunge in government bond prices will further encourage investors to flee from safe assets. This is why we believe that 2011 may mark the end of deflation and of the cash-is-king era that began 20 years ago.