Dec 20, 2024

Strategy Bulletin Vol.370

Can Japanese Stocks be a Substitute for American Sole Winner in 2025?

We are now faced with two historical realities: the unprecedented AI revolution and the inability of the existing world order to function. Mr. Trump-Mask is poised to bring about a sea change in this era of stagnation. The year 2025 will be the dawn of such a revolutionary era. Under such a scenario, U.S. equities will soar to the point of a stock market bubble. Japanese stocks, along with U.S. stocks, will attract the world's attention as one of the most secure investment targets. The U.S. stock market will go into a bubble, the long-term upward wave of Japanese stocks will continue, Japanese and U.S. interest rates will remain high, the U.S. dollar index will strengthen, and the dollar/yen will move in a range.

(1) Clear U.S. dominance: Why can we expect a bubble-like stock market in the U.S. in 2025?

Economic policy implications of the Trump victory

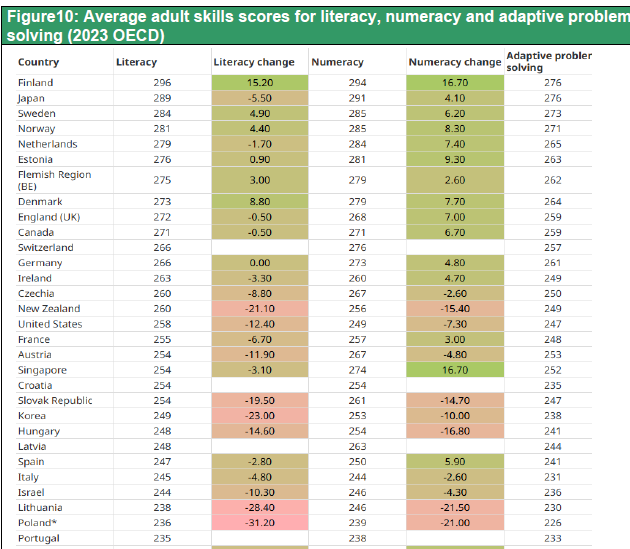

The AI revolution has caused a dramatic increase in productivity that has given the corporate sector (especially giant high-tech companies such as the Magnificent Seven) significant excess profits (i.e., excess savings), while at the same time increasing inequality as the distribution of profits to workers has stagnated. The most critical issue facing the U.S. economy is how to return the excess profits accumulated in the corporate sector to the economic system and link them to growth (= new demand and job creation). As shown in Figure 1, corporate internal funds (net income plus depreciation and amortization) have remained at 10-12% of GDP from the 1960s to the 1990s. Recently, however, it has been hovering between 14% and 16% of GDP. On the other hand, corporate capital investment has remained at around 10% of GDP for a prolonged period, indicating a significant surplus of funds in the corporate sector. How can this corporate surplus be redistributed to generate new demand and employment?

Figure 1: U.S. (non-financial) corporations' internal funds (net income + depreciation and amortization) as a percentage of GDP

There are three channels: (1) government tax increases on corporations and the wealthy and fiscal support for the socially vulnerable, (2) forced wage increases and higher labor share and (3) return of corporate profits through the stock and capital markets. The first two can be summarized as government intervention and the third as redistribution through the market economy. The clear point of contention in the recent U.S. presidential election was the conflict between Harris's Democratic Party's “big government, tax hike policy that favors the weak” and Trump's Republican Party's “small government, tax cut policy based on entrepreneurial support.” The victory of the Trump Republican Party set the direction of the United States.

Figure 2: AI Revolution's Productivity Rise Will Widen the Supply-Demand Gap ➡Demand Creation Becomes Urgent

As shown in Figure 1, so far, shareholder returns have increased markedly as companies have increased dividends and bought back their own shares, and ample corporate savings have flowed back into the economic system. This prominent level of shareholder returns has supported the U.S. stock market rally, and Trump's policies will further strengthen this trend. The fact that deregulation has been focused on the financial sector and that the Trump trade has been centered on financial stocks is a testament to this. Trump has also nominated Elon Musk to head the Department of Government Efficiency (DOGE) to improve administrative efficiency and cut the budget, which is also a consequence of the small government line.

The “Rebuilding Capitalism” Revolution Begun by Trump-Mask

While the reality of inequality and division can easily lead to anti-capitalism, anti-market economics, and praise of socialism in other countries, it is worth noting that in the U.S., the two have converged on a path that strengthens markets and capitalism. Put in this way, one realizes that the Trump-Mask economic revolution is not the neoliberalism that both the left and right condemn, but rather a more violent ultimate liberalism (=libertarianism), accompanied by a major ideological revolution. It stems from a strong faith in markets and capitalism: the AI revolution has increased cost transparency and made markets function more efficiently. It has significantly strengthened the “invisible hand of God,” so to speak. It has made possible the ultimate libertarianism of the Trump-Mask style.

In 2025, the U.S. is GOing into a bubble.

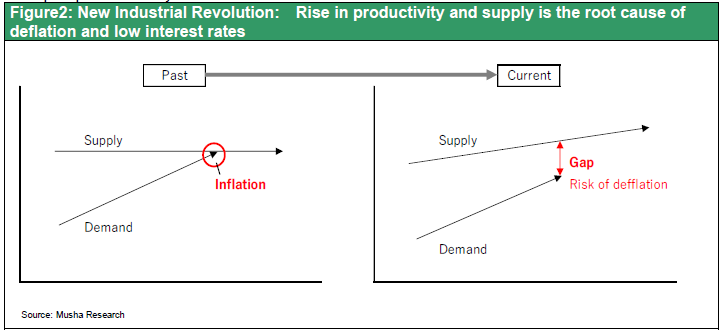

Turning to the stock market, the present resembles 1995 in many ways: 1995 was the starting point of the upswing that led to the Dot com bubble of 2000, after the Irrational Exuberance of December 1996 (Chair Greenspan). Similarities include: (1) high real interest rates were maintained after the end of interest rate hikes, (2) long-term interest rates were also suppressed and the yield curve flattened for a prolonged period, (3) the dollar continued to appreciate, and (4) technological innovation (then the Internet revolution, now the AI revolution) drove vigorous investment.

Currently, U.S. equities are not cheap, with a P/E ratio of 23 times and an earnings yield of 4.3%, almost the same level as the yield on 10-year government bonds. In addition, the Fed, wary of inflation and the possibility of a bubble in stocks, is trying to limit the extent to which it will cut rates in 2025. This stance will in turn keep long-term interest rates in check, which will lead to a prolonged flattening of the yield curve, as has been the case since 1995. In this environment, the AI revolution and Trump-Mask's libertarian revolution will make people more bullish. U.S. equities are expected to soar higher, with bubble-like tones.

Figure 3: Financial environment similar to 1995 (interest rates remain high, yield curve flattening, stock market rally)

(2) Attractiveness of Japanese stocks, ultra-low valuations, favorable supply and demand, and the dawn of an M&A boom driving a stock price revolution

Japan well-positioned, attractive valuations

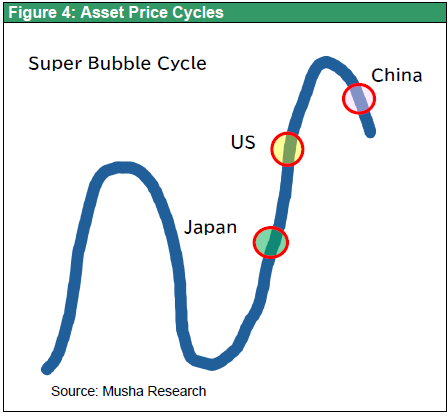

Japanese stocks are no less attractive than U.S. stocks. These are attractive valuations and favorable supply and demand. Asset price cycles (super bubble cycles) are important for long-term asset allocation in international diversification. The cycles of rising and falling asset prices can be observed to have a unique cycle of 10 to several decades for each country. Fortunately for investors, these asset price cycles vary widely from country to country. Therefore, selling assets in countries at the high end of the cycle and buying assets in countries at the low end can enhance long-term investment results.

Figure 4: Phases of Long-term Asset Price Cycles by Country

The asset price cycles of major countries are illustrated figure4: China's red light, the U.S. blue to yellow border, and Japan's blue light. China has just passed the peak of its unprecedented bubble cycle, and real estate prices are far from bottoming out. Investment in assets should be curbed, and cash is King. The Chinese government has announced that it will shoulder RMB10 trillion in hidden debt, but this will be little more than a drop in the bucket considering the scale of the bubble. The amount of final disposal of non-performing loans required in China is enormous with facts such as (1) 66 trillion yuan (=1,300 trillion yen) of outstanding Local Government Financial Vehicles, (2) $10 trillion (=70 trillion yuan) of accumulated household debt (2009-2022), and (3) The inventory of unsold new buildings in China is 90 million units (estimated at 20 million yen per unit, or 1800 trillion yen = 90 trillion yuan). So even a rough estimate of 60 trillion yuan, or about 60% of GDP, needs to be processed. (Incidentally, in the case of Japan, land prices have bottomed out after falling 80% from their peak. During this period, non-performing loans amounted to 100 trillion yen, or 20% of GDP, and were disposed of).

In the U.S., asset prices are generally in a state of fair value and are on the verge of a yellow light, which would immediately turn into a bubble if interest rates were to spike. This is a situation that calls for caution in risk-taking. In Japan, on the other hand, asset prices are undervalued, although it has been some time since the bottom out after the burst of the bubble economy. The investment risk in Japan is the risk of not owning Japanese stocks, and almost all investors will be forced to persistently buy Japanese stocks.

Money will continue to flow toward high-return Japanese equities

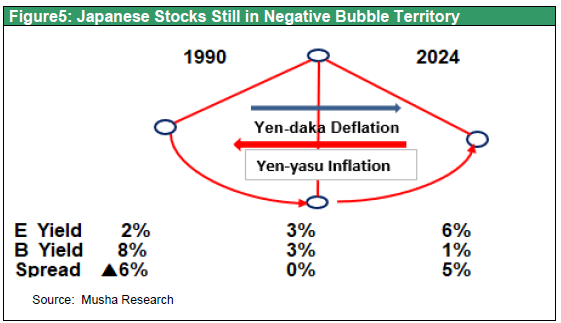

Japanese stock prices are severely undervalued and are almost certain to rise further in the future. The purest and most accurate measure of stock prices is the yield on government bonds, and Japanese equities are currently offering remarkably high returns relative to government bonds, with yields on equities of 6% and on government bonds of 1%. In 1990, stock prices were significantly overvalued (= positive bubble), while they are currently significantly undervalued (= negative bubble).

Figure5: Japanese Stocks Still in Negative Bubble Territory

However, the asset allocation of Japanese households is extremely irrational. 71% of their financial assets, excluding pensions and insurance, are in savings accounts with almost zero interest. On the other hand, stocks, and investment trusts, which return 2% from dividends alone and 6% if retained earnings are included, account for only 27%. In the U.S., by contrast, stocks and investment trusts account for 77%, while cash and deposits account for 17%, exactly the opposite composition. The net worth of U.S. households has grown from $59 trillion in March 2009, just after the GFC, to $156 trillion by the end of 2023, a massive asset formation of $97 trillion (3.5 times GDP) over 14 years, which has led to strong consumption. In Japan, the Kishida administration's expansion of tax breaks for individual stock investment (NISA reform) will trigger a furious shift of funds from cash and deposits to stock and investment trusts, accelerating the stock market rally.

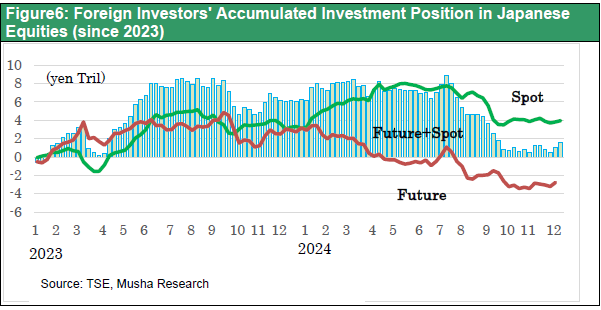

All investors are now forced to seriously consider the risk of not holding Japanese stocks. First, foreign investors are the biggest buyers, but they have sold almost all their holdings of Japanese stocks, which have risen the most in the world's major markets since last year, rather than increasing their holdings, and are once again underweight Japanese stocks. We expect that they will once again increase their purchases in the future.

Figure 6: Foreign Investors' Accumulated Investment Position in Japanese Equities (since early 2023)

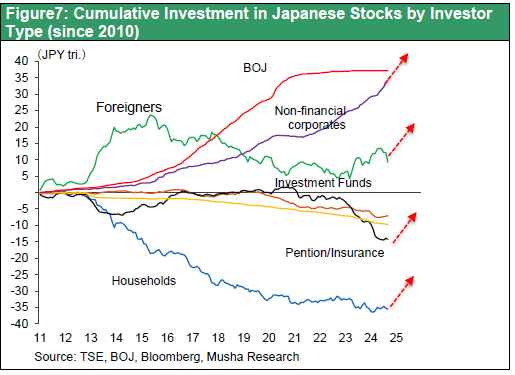

Domestic investors, who have been reluctant to buy Japanese stocks, have been forced to significantly increase their purchases of Japanese equities. For individual investors, 10.1 trillion yen was purchased in January-June 2024 since the NISA reform began. For the year, this amounts to ¥20 trillion, a four-fold increase over the previous year. At present, many of these purchases are foreign investment trusts, but a shift to Japanese equities is likely to occur. Companies are buying back their own shares in response to FSA and TSE demands the correcting measures for companies of P/B ratios below 1x, and the pace is continuing at 20 trillion yen per year, double the pace of the previous year. Furthermore, institutional investors such as pension funds are under pressure to reduce their investment ratio in JGBs, which had been their largest investment item, as inflation takes hold and interest rates rise, forcing them to shift to stocks.

The government has begun officially announcing that it will expand GPIF’s investment policy, which has been extraordinarily successful in stock investment, to the area of public pension fund management, such as KKR. Thus, domestic investors in Japanese equities, which had been quiet until now, are now buying Japanese equities at a pace of tens of trillions of yen. The rapid recovery in stock prices following the Ueda and Ishiba shocks was driven by such investors' buying spree. As the domestic investor base grows in depth, the market, which has been at the mercy of short-term foreign investors, is likely to become more stable.

Figure 7: Cumulative Investment in Japanese Stocks by Investor Type (since 2010)

M&A Boom in Japan, Driving Force for Correction of Stock Price Levels

The U.S. takeover boom symbolized by KKR's acquisition of RJR Nabisco in 1988 prepared the way for the stock market rally that led to the formation of the dot-com bubble in 2000, and a similar trend is occurring in Japan today. The change in Japanese policy and corporate society's attitude toward M&A is astounding, as evidenced by the TSE and FSA's demand that companies with P/B ratios below 1x be corrected, and the appearance of KKR founder Henry Kravis (who 30 years ago was considered a barbarian even in the US) in the Nikkei's “My Resume”. The proposed acquisition of Seven & I by Canadian firm Alimentation Couche-Tard Inc. (ACT) would be a major rebuke to the Japanese stock market, which has neglected capital efficiency and allowed low stock prices to persist. The Nissan-Honda business integration is also influenced by Taiwanese manufacturer Hon Hai's intention to acquire Nissan. Japan is rapidly shifting toward equity capitalism, a trend that is being driven by the United States. This will drive a revolution in Japanese stock valuations, as foreign investors buy Japanese stocks and companies buy back their own shares.

(3) Why did the Nikkei Stock Average stall at 40,000 yen in 2024? Can the shackles be loosened in 2025

Why did the Nikkei Stock Average stall on the verge of 40,000 yen in 2024? Two factors were decisive: first, the economic reality was sluggish, and second, concerns about inappropriate policies were reaped on the upside.

Stalling in 2024, damage from weak yen inflation concentrated on households

The year 2024, which began with lofty expectations due to rising stock prices, ended with the stalling of the Japanese economy. The main cause was a decline in real personal consumption, which peaked in January-March 2023 due to a fall in real wages caused by rising prices. Although the fixed-rate tax cut from June 2024 made up for it, the amount was only 3 trillion-yen, half of the 6 trillion yen decline in real consumption, and the consumption level did not get out of the slump.

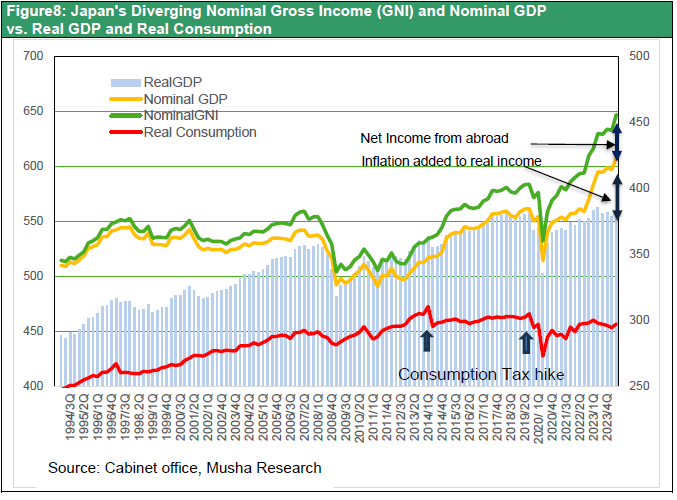

As shown in Figure 8, real personal consumption expenditures peaked at ¥310 trillion in the January-March 2014 period, just before the consumption tax hike (5➡8%) in March 2014, and have never exceeded that level in the past 10 years. Although it showed a slight year-on-year increase in the most recent July-September 2024 period, it is still 4% below the peak of 10 years ago.

In addition, the automobile production cutback due to the type-certification fraud at the beginning of the year and sluggish exports due to the slumping Chinese economy have offset positive factors such as an increase in inbound travel due to the weak yen and an increase in capital investment. The time lag between the positive effects of the yen's depreciation and the actual recovery was prolonged because Japan's industrial base has been weakened and it has taken time for production to recover due to the yen's depreciation, and it has taken time to recover from the decline in real income caused by inflation.

Japan's potential growth rate will increase due to a virtuous cycle of rising real wages, increased investment and production, and inbound tourism

In 2025, however, the J-curve effect of the yen's depreciation, which has been postponed, is certain to become more pronounced. 2025 will be the second consecutive year of 5% wage increases, and real wages will rise to a positive level of more than 2%. Real consumption will emerge to a positive 1-2%, thanks to the expected contribution of the permanent tax cuts due to the efforts of the Democratic Party for the People (DPFP).

In addition to the increase in inbound travel, production is expected to be boosted by increased capital investment, such as the starting the operation of TSMC's Kumamoto plant, etc. The OECD's economic outlook for 2025 projects steady growth of 1.5% in Japan, compared to 2.4% in the US and 1.3% in the Eurozone.

Figure 8: Japan's diverging nominal gross income (GNI), nominal and real GDP, and real consumption

Japan's policy risks will fade

Concerns about the launch of inappropriate policies, which hampered stock prices in 2024, will fade significantly in 2025. In 2024, after reaching an all-time high in July, two policy shocks, the “Ueda shock” and the “Ishiba shock,” caused an unusually high volatility in Japanese equities. The Bank of Japan's aggressive monetary tightening stance by Ueda took the market by surprise in August, when the market plunged as much as 20% in three days. However, a subsequent revision of the BOJ's monetary policy stance restored stock prices to their previous levels.

There is a sense that the worrisome risk of stonewalling may be converted into an advantage of stonewalling. Ishiba, who had been advocating a sound fiscal policy and monetary discipline, has changed his tune, and has reversed almost all his positions.

The benefits of the yen's depreciation have been a sharp increase in the nominal growth rate due to inflation and an increase in overseas income, resulting in higher corporate profits and tax revenues. To return this increase in corporate profits and tax revenues to households, Ishiba's LDP's status as the minority ruling party has been a positive factor, as it has forced the LDP to make concessions to the Democratic Party for the People (DPP), which advocates permanent tax reductions. With an eye on next year's upper house election, raising the permanent tax cut may be the decisive factor in prolonging the life of the Ishiba administration.

An overview of international politics reveals that Japan's attractiveness has become even more pronounced. Japan's policy framework, including its tough stance against tyrannical regimes such as China, Russia, North Korea, and Iran; its low susceptibility to the influence of sentiments that reject economic rationality, such as DEI (diversity, equality, and inclusiveness) and PC (political correctness); its “new capitalism” line promoting more transparent and free finance, which has been followed by the Abe and Kishida administrations The framework of Japan's policies, such as the “new capitalism “are extremely convincing to global investors.

2025 will be the first year of Japan's industrial renaissance

The year 2025 will be the first year that Japan's fundamental strength as an industrial base will be reevaluated as TSMC's Kumamoto plant begins operations. As seen with TSMC founder Maurice Chang, who was astonished by the splendor of Japan's industrial base, there will be many reminders of Japan's overwhelming strength as a production base.

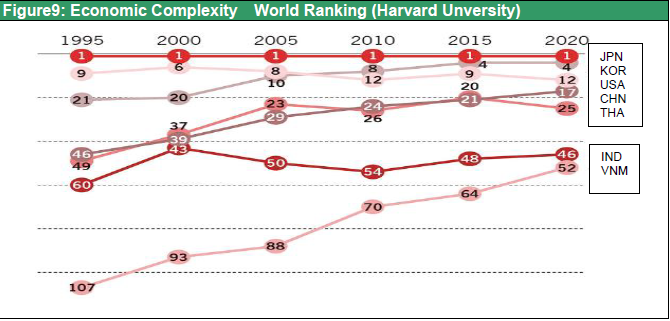

Figure 9 shows the “Economic Complexity Ranking of the World” (ECI) compiled by Harvard University, and it should be noted that Japan is consistently ranked number one in the world. This ranking is based on export data from countries around the world, evaluating and ranking (1) the complexity and diversity of export products and (2) their uneven distribution (degree of exclusivity). Higher complexity indicates higher value-added industries, more diversified industries, and greater degree of monopoly in the global market (as introduced in “Management of Shin Nihon: Eliminating Pessimism Bias” by Professor Ulrike Schade, University of California, San Diego, Nikkei BP).

Taking smartphones as an example, the higher the rank, the greater the technological black box portion of materials, components, and manufacturing machinery over and above the assembly of finished smartphone products. Although Japan's share of smartphone production is low, it can be said that Japan has the largest number of necessary technologies leading to the final finished smartphone product in the world. This means that “almost everything necessary is available in Japan.

Figure 9: Economic Complexity, World Ranking (Harvard)

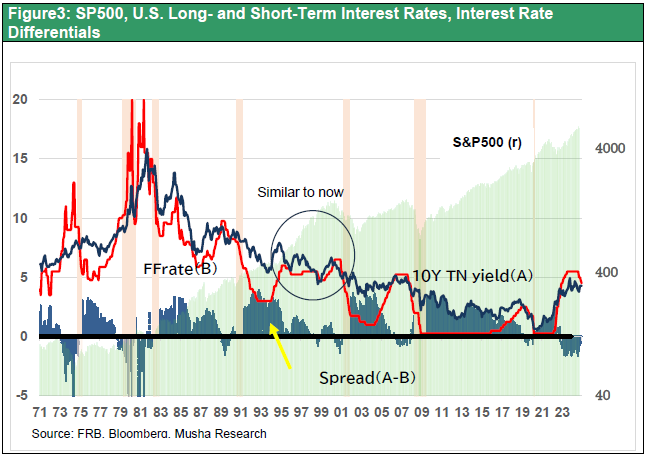

It is not new to international businesspeople, but the OECD's survey of adult capacity has revealed that the homogeneity, high level, and labor integrity of Japan's workforce (although not outstandingly talented) is outstanding (Figure 10). Japan's superiority as a business location will be highlighted in comparison with the U.S. and Germany, where semiconductor factories are being built at the same time. Japan will be revived as a global manufacturing center for advanced industries. Japan's industrial renaissance is just around the corner.

Figure 10: International Ranking of Adult Power (OECD 2022)