Jan 01, 2025

Strategy Bulletin Vol.371

Happy New Year!

We wish you all the best in this New Year filled with impressive expectations.

New Year's Day, 2025

Musha Research Co.

(1) Why a strong U.S. is necessary and inevitable

Two Forces Driving a Historical Transformation

Looking ahead 10 years from now, the world system and economic actors will not continue to exist as they do today. Two forces will sweep everything away. The first is the establishment of a world order that eliminates tyrannical states, and the second is the international division of labor and the transformation of each country's economic and industrial structure due to the irreversible progress of the AI revolution.

An International Order that Eliminates Tyrannical States Will Come into View

Regarding the first power. At some point, the construction of a world order that exclude tyrannical states will accelerate. Tyrannical states such as China, Russia, North Korea, and Iran are on a cul-de-sac. Following the collapse of Assad's Syria, the economic decline of Russia and China is inevitable. On the other hand, the resuscitation of capitalism is progressing in the U.S., and the U.S. presence must be increased both economically and geopolitically. The capitalist world order will be rebuilt under the leadership of the United States. Other countries will have no choice but to follow Trump's self-serving “rebuilding of a strong America” because they have no other choice. It is wrong to view Trump's diplomacy as a return to U.S. isolationism and nationalism. The revival of a strong America is an essential condition for the reconstruction of the world order.

Unprecedented AI Revolution Further Strengthen U.S. Economic Dominance

Let me turn to the second fundamental force. The unprecedented AI revolution will inevitably cause a restructuring of the international division of labor (interdependence among nations) and a major transformation of the economic and industrial structure of each country. The speed of the technological revolution is phenomenal. We are keenly aware that Moore's Law (the fact that semiconductors have continued to improve in terms of integration (=productivity) by a factor of two in 18 months for 40 years) has fundamentally changed the framework of the modern economy. However, the basic structure of AI underway today, the neural network, is said to be causing exponential productivity growth (=loss reduction) at a pace faster than Moore's law. This is called the scaling law, and it is assumed to cause similar dramatic changes in all areas where AI is applied. Almost 100 billion neurons (brain cells) connected by 10,000 synapses per neuron have dramatically increased human intelligence, and AI devices are formed by linking computational elements in a network like the human brain, enabling parallel processing and high speed. Unlike semiconductors, AI implementations can be implemented in all human brainwork scenarios, so productivity gains are likely to be realized in a wide range of fields. This will automatically increase supply capacity and raise potential growth rates.

There are three channels: (1) government tax increases on corporations and the wealthy and fiscal support for the socially vulnerable, (2) forced wage increases and higher labor share and (3) return of corporate profits through the stock and capital markets. The first two can be summarized as government intervention and the third as redistribution through the market economy. The clear point of contention in the recent U.S. presidential election was the conflict between Harris's Democratic Party's “big government, tax hike policy that favors the weak” and Trump's Republican Party's “small government, tax cut policy based on entrepreneurial support.” The victory of the Trump Republican Party set the direction of the United States.

NVDIA's Stock Price is not a soaring Bubble, and Why not?

Much of this AI high-tech technology is a U.S. monopoly, and other countries will be dependent on a unipolar supply from the U.S. As long as they continue to depend on the U.S. for this essential basic technology and supply capacity (= as long as the U.S. is the exclusive supplier of cutting-edge high-tech), they cannot afford to back down on the international division of labor. Trump's campaign rhetoric of anti-globalism should not be taken seriously.

If AI technology is scarce and there are no alternative suppliers, the relative prices of AI technology goods and services will increase. The bubble-like rise in NVIDIA and M7 stock prices reflects the rising price of their intellectual products and is not unfounded optimism; the AI revolution will overwhelmingly favor the US. In addition, labor in developed countries is mainly brain labor, so AI can be applied to a wide range of fields, and broad productivity gains can be expected. On the other hand, in emerging economies where labor is plentiful, labor is mainly physical or manual labor, and the fields in which AI can be applied are narrow. Many emerging economies have surplus labor, so productivity gains may cause social unrest by depriving them of jobs. In other words, motivation to implement AI is low, and productivity growth is likely to remain low compared to developed countries. The emerging economies in the BRICS grouping, which now are gaining momentum, will see their economic presence decline.

The AI Revolution Will Change the Position of Countries in the Global Division of Labor

The AI revolution will significantly change the international division of labor in various regions of the world.

1) The U.S. will continue to have a monopolistic advantage in digital fields such as AI and NETs, as well as in finance. Japan, Europe, and other countries will continue to pay digital-related costs to the US.

2) East Asia (Taiwan, South Korea, China, Japan) is the dominant supplier of high-end manufacturing, especially semiconductors. Because the East Asian ecosystem is the strongest, it is difficult to replace it and will continue to be dependent on East Asia for supply. However, the supply structure within East Asia will gradually shift to Japan. The shift to Japan as a safe region will intensify due to the further containment of Chinese products by the U.S., political instability and declining competitiveness in South Korea, and the growing risk of concentration of cutting-edge high-tech products, such as TSMC products, in Taiwan.

3) Many emerging economies, including ASEAN countries and India, will continue to have an advantage in manufacturing apparel and low-end machineries. However, there is competition among emerging economies with abundant labor, and China has a potentially huge surplus of production capacity. It will be difficult to maintain price dominance, and terms of trade cannot be improved. In addition, the provision of capital from China, which is going well now, will be debilitated by the bursting of China's bubble economy.

4) Europe is strong in high-end consumer goods and services. However, due to the failure of the green energy and EV industries, and the failure of its strategy toward China and Russia, it lacks competitive international products. The European position in the international division of labor is likely to decline.

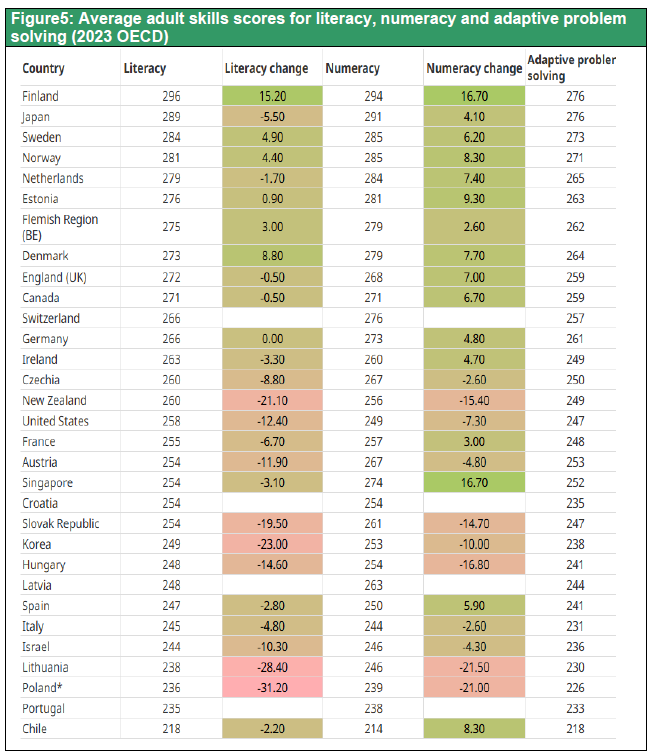

How the AI Revolution will Change the U.S. Industrial Structure, Manufacturing Revival Limited

How will AI technology transform the U.S. industrial structure? Under the Trump administration, the U.S. economy is expected to experience robust demand and job creation under the stimulus package of tax cuts. The service sector will continue to be the center of job growth. The dollar will continue to appreciate due to the strong confidence in the U.S., large surpluses in the digital sector (digital services exports and overseas profits of US digital companies), and increased foreign investment in the U.S with higher interest rate. Under these conditions, the U.S. trade deficit will not improve. The revival of U.S. manufacturing will be limited to a selected high-end and military-related sectors. The division of labor with Mexico and Canada will be adjusted but not significantly, because the U.S. trade deficit with Mexico and Canada has not decreased at all despite the change from NAFTA to USMCA. The U.S. aims to cut off China's rerouted exports and crack down on illegal immigration, and negotiations will probably be settled after obtaining these concessions.

|

Figure1: U.S. Employment by Sectors (1995=100) |

|

|

The U.S. will be the Driving Force of the Global Economy in 2025

With strong U.S. domestic demand, declining imports from China, and the strong dollar, exports to the U.S. from Japan, South Korea, Taiwan, ASEAN, and Europe will increase, and this may be a year of global economic recovery led by the U.S. instead of China.

The U.S. and Japan have Established Strategies and Positions

Japan's position is clear and favorable in the face of turmoil in Europe, China, and South Korea. BRICS nations, Latin America, and Africa may also potentially make misjudge to underestimate the U.S.

Factors such as Japan's tough stance against tyrannical regimes, China, Russia, North Korea, and Iran; the small influence of sentiments that deny economic rationality, like DEI (diversity, equality, and inclusiveness) and PC (political correctness); the “new capitalism” line promoting more transparent and liberal finance that has been followed by the Abe, Suga, Kishida, and Ishiba administration are convincing to global investors.

(2) Trump will Revive U.S. Capitalism

U.S. Public Opinion Supports Strengthening Capitalism under Disparity and Divide

While the reality of inequality and division can easily lead to anti-capitalism, anti-market economy, and socialism in other countries, it is worth noting that the U.S. has converged on a path of strengthening markets and capitalism. The AI revolution has caused the corporate sector (especially the giant high-tech firms such as the Magnificent Seven) to accumulate excessive profits (i.e., excess savings), while at the same time increasing inequality by stagnating the distribution of profits to the workers.

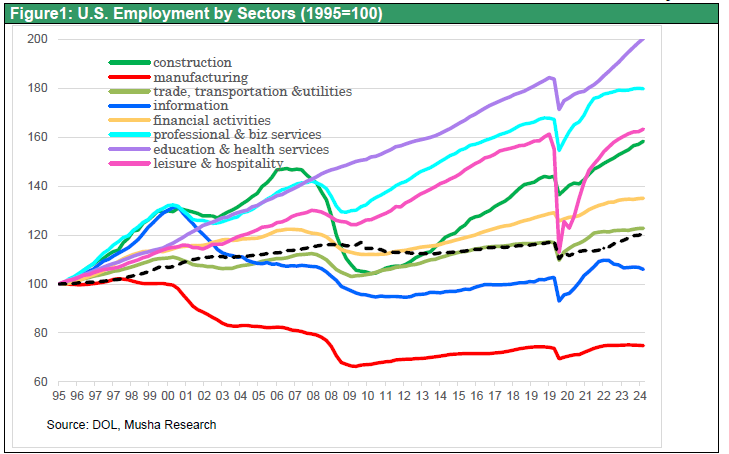

The most critical issue facing the U.S. economy is how to return the excess profits accumulated in the corporate sector to the economic system and link them to growth (= new demand and job creation). As shown in Figure 2, corporate internal funds (net income plus depreciation and amortization) have remained at 10-12% of GDP from the 1960s to the 1990s. Recently, however, it has been hovering between 14% and 16% of GDP. On the other hand, corporate capital investment has remained at around 10% of GDP for a prolonged period, indicating a significant surplus of funds in the corporate sector. How can this corporate surplus be redistributed to generate new demand and employment?

|

Figure2: U.S. Corporations (Non-Financial) Increasingly Ample Internal Funds (Net Income + Depreciation/Amortization) vs. GDP

|

||||

|

Return of Ample Corporate Profits, Whether by the Government or by the Market

There are three channels: 1) government tax increases on corporations and the wealthy and fiscal support for the socially vulnerable, 2) return of corporate profits through the stock and capital markets, and 3) forced wage increases and higher labor share. The clear point of contention in the recent U.S. presidential election was the conflict between Harris's Democratic Party's “big government and tax hikes to favor the weak” and Trump's Republican Party's “small government and tax cuts to support entrepreneurs,” and it was a question of national choice over this core issue. The victory of the Trump Republican Party set the direction of the United States.

Getting Ahead on AI Technology Implementation

Trump nominated Elon Musk to head the Department of Government Efficiency (DOGE), which has no organization or building, but Musk will take charge of the existing Office of Management and Budget (OMB) to make government more efficient and cut budgets. Musk took a major record when he bought Twitter in 2022, cutting 80% of its workforce. The rocket launch company SpaceX also cut rocket launch costs by 80% and won the contract. They were achieved not through labor intensification but through operational efficiency and the use of the most updated technology. Mr. Musk believes that the same is possible in the administrative apparatus.

The advances in AI are astounding, and if we equip ourselves with the latest technology, incredible efficiency will be possible. What stands in the way are vested interests and conventions. These vested interests include human rights, protection of minorities, and other entities that wear liberal garb, recognizing that the very pretext of DEI (Diversity, Equality, and Inclusion) is an impediment to economic development.

Even in its current state, the U.S., the least regulated, most innovative nation with the most fluid labor and capital, would be a frightening prospect for competitors if it were to become more efficient. There is ample technical and economic justification for Trump and Musk's insistence on deregulation and overthrowing vested interests.

Elimination of Vested Interests, thorough Deregulation, and Liberalism

The thoroughly anti-authoritarian, self-reliant, pioneering spirit shared by Mr. Trump and Mr. Musk has appeared occasionally in U.S. history to steer the economic and social course, as exemplified by Presidents Andrew Jackson in the 1820s and Ronald Reagan in the 1980s. They were realists and followers of power (Anri Morimoto, “Anti-Intellectualism,” 2015 Shincho Sensho).

Put in this way, we realize that Trump-Mask's economic revolution is not the neoliberalism that both the left and right condemn, but a more intense ultimate liberalism (=libertarianism), accompanied by a great revolution of ideas. It stems from a strong faith in markets and capitalism: the AI revolution has increased cost transparency and made markets function more efficiently. It has significantly strengthened the “invisible hand of God,” so to speak. That justifies the libertarianism of the Trump-Mask style.

(3) Japan's Role in the Reconstruction of U.S. Hegemony

The Third Opening of Japan, which Support the Restructuring of the World Order by the U.S.

The rise of modern Japan has always been with the United States. The first opening to the world by the black ships, the second by Japan's defeat in World War II, and now the third opening to the world is about to be realized through the acceptance of U.S.-style stock capitalism.

Japan's role in world history in the modern era has been to serve as a bridge for the spread of Western democracy and capitalism around the world. Japan is the only country in the non-Western world that has indigenized and developed modern capitalism and democracy. Only three East Asian countries (Korea, Taiwan, and China (Hong Kong)) have developed modernization and industrialization in the non-Western world and raised the standard of living of their citizens to the level of advanced nations, but the development of Korea, Taiwan, and China has largely imitated and followed the Japanese model of economic development. The three East Asian countries of Korea, Taiwan, and China (Hong Kong) achieved dramatic economic growth by introducing technologies from the U.S. and developed countries and by capturing market share in the U.S. market based on a transplanted market economy.

Contrasting Stances Toward the U.S. between Japan and China, which is the Good?

The starting point is the Nixon Shock of 1971. As the dollar broke free of its gold fetters, the U.S. sharply increased its external debt by increasing imports, first from Japan and finally from China. The starting point for the high growth of the East Asian economy can be said to have been the dissemination of the dollar. China's over-presence in the world economy, with a share of just under 40% of global manufacturing production and a high share of 80-60% in high-tech products such as PCs and smartphones, and in clean energy fields such as solar panels and EVs, was truly the result of the Nixon Shock.

The U.S. supported the development of East Asian countries, but when it recognized them as threats and adversaries, it turned its hand against them. First, it recognized Japan, which had dramatically increased its industrial competitiveness, as an opponent that would destroy the foundation of U.S. industry, and it launched Japan bashing. The U.S. has been tying Japan up in trade friction, an extraordinarily strong yen, and involvement in domestic politics using the Structural Impediments Initiative talks. And now, it has begun to impose severe sanctions on China, which has made its will to challenge U.S. hegemony overtly clear.

Here, a crucial difference has emerged between Japan and China, which have developed along the same path. Japan, which is militarily subordinate to the U.S., has capitulated to the U.S., while China is strengthening its rivalry with the U.S. When I talk to the Chinese people about this, they show a look of contentment, but the U.S. is not so lenient.

Japan's Acceptance of U.S. Demands Was the Right Decision

Japan's acceptance of the U.S.-style business model was the right thing to do. During the lost 30 years, Japan has become a preferred business partner, having adapted to U.S. values and business practices to a substantial extent.

This concession to the US has resulted in corporate governance reform in Japan, which is preparing the way for higher Japanese stock prices and a prosperous stock capitalism in the future. In Japan, where vested interests are strong, U.S. external pressure was important for governance reform to be successful.

China, on the other hand, is trying to make the wrong choice of national strategy by viewing an unwinnable opponent as an adversary. Japan's national fortunes will flourish if it plays its role as a co-executor of the U.S. restructuring of the world order in an unobtrusive manner.

(4) Key Wards for Japan's Revival in 2025: Industrial Renaissance and Barbarian at the Gate

The Delayed J-curve Effect will emerge, the Virtuous Cycle will begin as Real Wages rise

The positive side of the J-Curve effect of the yen's depreciation, which has been postponed until 2025, is certain to emerge. The time lag until the positive effects of the yen's depreciation will begin to emerge is quite long because1) Japan's industrial base has weakened substantially ,2)it took time for production to recover due to the yen's depreciation, and3) time to recover from the decline in real household income caused by inflation, but we can expect the positive effects of the yen's depreciation to emerge from here.

In 2025, wages will continue to rise by 5% for the second year in a row, and real wages will rise around 2%. Real consumption will also emerge to a positive 1-2%, with the expected contribution of permanent tax cuts due to the efforts of the Democratic Party for the People (DPP). The benefits of the yen's depreciation have already been linked to higher corporate profits and tax revenues through a sharp increase in the nominal growth rate due to inflation and higher overseas income. To return this increase in corporate profits and tax revenues to households, Ishiba's LDP's status as the minority ruling party is a positive development, as it forces the LDP to make concessions to the DPP, which advocates permanent tax cuts. With an eye on next year's Upper House election, permanent tax cuts may pop up as the centerpiece policy, which would be good news for stock prices.

Industrial Renaissance triggered by Economic Security of US-Japan Alliance

The year 2025 will be the first year that Japan's fundamental strength as an industrial base will be reevaluated as TSMC's Kumamoto plant begins operation. As seen in the words of TSMC founder Maurice Chang, who was astonished by the splendor of Japan's industrial base, there will be reminders of Japan's overwhelming strength as a production base. TSMC, the world's sole supplier of the most advanced semiconductors, produces all its products in Taiwan, which is a major geopolitical risk for its clients. Therefor TSMC will focus on Japan as a key supply base outside of Taiwan. Following Kumamoto (JASM) phases 1 and 2, a third phase of construction of a most advanced plant is being considered. For the first time in the past 30 years, a virtuous cycle triggered by capital investment is taking place in Japan, including Rapidus in Chitose, Hokkaido, and the creation of research centers for foreign semiconductor companies.

All these semiconductor projects originated from the U.S. request for Japan's cooperation in economic security under the U.S.-China conflict, and there is no conclusion that they will fail. In other words, the government will continue to fund them until they succeed. There are commentators who criticize and poke fun at the huge amount of state support for semiconductors, but such people do not understand the seriousness of economic security.

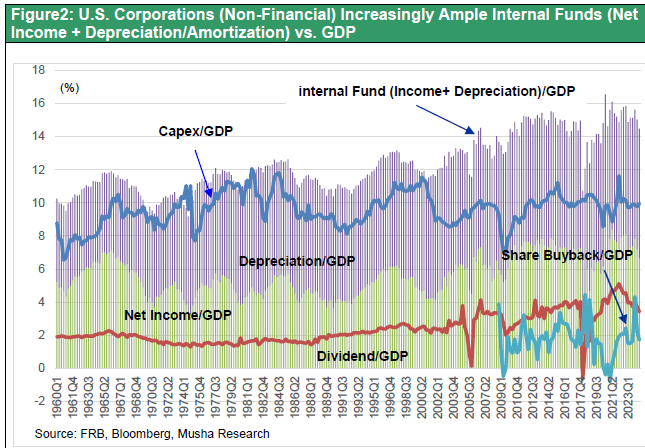

It should be noted that Japan is consistently ranked number one in the world in the Economic Complexity Index (ECI) compiled by Harvard University. This ranking is based on export data from countries around the world, evaluating and ranking (1) the complexity and diversity of export products and (2) their uneven distribution (degree of exclusivity). Higher complexity indicates higher value-added industries, greater industrial diversification, and greater degree of monopoly in the global market (as introduced in “Management of Japan’s Nwe Era: Eliminating Pessimism Bias,” by Professor Ulrike Schaede, University of California, San Diego, Nikkei BP).

|

Figure3: Economic Complexity World Ranking (Harvard University) |

|

|

Taking smartphones as an example, the assembly of a finished smartphone product is large in scale, but the process itself is simple. On the other hand, materials, components, and manufacturing machinery each have their own processes and technical black boxes. In this complexity ranking, the larger the number of unique processes and black box parts, the higher the rank. Although Japan has a small share of smartphone production, it can be said that Japan has the largest number of necessary technologies leading to the final finished smartphone product in the world. This basic capability will be a major force in promoting a return to production in Japan.

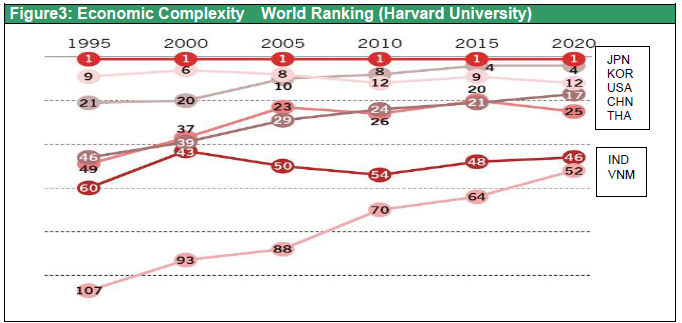

It is common knowledge to international businesspeople that the homogeneity, prominent level, and labor integrity of Japan's workforce (although not genius) is outstanding. The OECD's Adult Competencies Survey of Countries (OECD 2023) revealed that Japanese adults rank second only to Finland in reading comprehension and numeracy, and first with Finland in problem-solving skills (Figure 5). Japan's superiority as a business center will be highlighted in comparison with the U.S. and Germany, where semiconductor factories are being built at the same time. Japan will be revived as a global manufacturing base for advanced industries. Japan's industrial renaissance is just around the corner.

The Era of Equity Capitalism originated by the Takeover Boom

In an era of historic technological developments such as the AI revolution, corporate profits have risen, and excess profits have accumulated in the corporate sector on a regular basis. Equity capitalism, which took root in the U.S., played a significant role in channeling these corporate profits back into the economic system. The ecosystem that attracts enormous amounts of investment capital to ventures has been the driving force behind the long-term prosperity of the U.S. economy and long-term stock market appreciation.

U.S. equity capitalism has been established as 1) financial efficiency = appropriate allocation of resources, 2) concentration of technology in the U.S. and formation of a high-tech ecosystem, and 3) return of profit to the public (voters), and is also recognized as a policy platform for the incoming Trump administration.

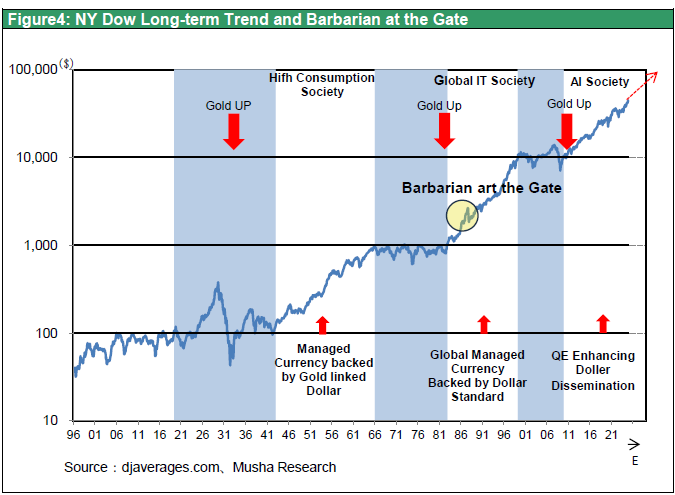

The starting point for this equity capitalism was the U.S. takeover boom symbolized by KKR's acquisition of RJR Nabisco in 1988 (see Figure 4). It prepared the way for the stock market rally that led to the formation of the dot-com bubble in 2000 and more strong bull market after the GFC in2008.

A similar trend is occurring in Japan today. The change in Japanese policy and corporate society's receptivity to M&A is astonishing, with the TSE and FSA demanding that companies with P/B ratios below 1x be corrected, and the appearance of KKR founder Henry Kravis (who 30 years ago was considered a barbarian even in the US) in the Nikkei's “My Biography” section for 30days. The proposed acquisition of Seven & I by Canadian firm Alimentation Couche-Tard (ACT) would be a major shock to the Japanese stock market, which has neglected capital efficiency and allowed low stock prices to persist. The Nissan-Honda business merger is also foreshadowed by Taiwanese manufacturer Hon Hai's intention to acquire Nissan. Nidec Corporation announced a TOB for Makino Milling Machine, a long-established machine tool manufacturer, and Nidec founder, Mr. Nagamori, said in his press conference, “We cannot take time in the face of the Chinese threat.” Japan is rapidly shifting to equity capitalism, which the U.S. is advancing. This will drive a revolution in valuations of Japanese stocks, which have been abnormally undervalued, through purchases of Japanese stocks by foreign investors and share buybacks by corporations.

|

Figure4:NY Dow Long-term Trend and Barbarian at the Gate |

|

|

|

Figure5: Average adult skills scores for literacy, numeracy and adaptive problem solving (2023 OECD) |

|

|