May 16, 2025

Strategy Bulletin Vol.378

The True Picture of the Trump Administration

~It May Be Aimed at "U.S. Capitalism's Prosperity

U.S. Stocks Recover from the Crash During the Tariff Shock

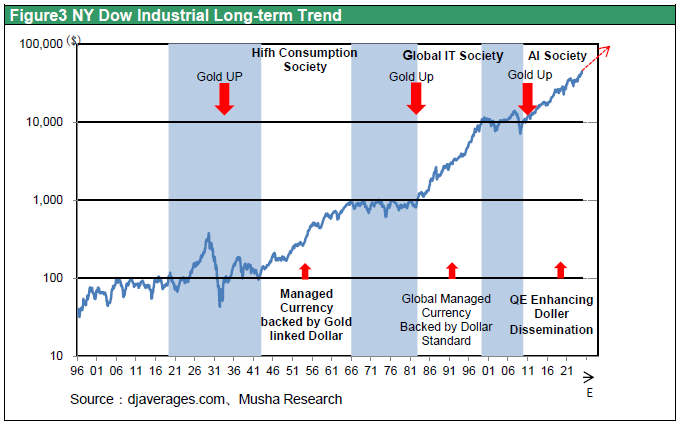

Stocks of major countries that plunged in shock due to the Trump administration's surprise announcement of large, reciprocal tariffs on 4/2 have completely returned to normal with the tentative agreement on tariffs between the U.S. and China on 5/12. The U.S. S&P 500 Index plunged 19% from an all-time high (6144) on February 19 to a major bottom (4982) on April 8 but rose 18% to 5866 on May 14 from the major bottom and is now in positive territory compared to the start of this year. The worst-case scenario of a collapse of the international trade order and the plunge into a major recession, which had been in the works at the time of the tariff announcement on April 2, appears to have been largely ruled out.

Figure 1 Stock Prices of Major Countries since the Beginning of the Year (2025/1=100)

Figure 2 Stock Prices of Major Countries (2009/3/9=100)

At the time of the sudden announcement of reciprocal tariffs, four objectives were considered: 1) to restore manufacturing, 2) to reduce trade deficits, 3) to increase tax revenues, and 4) to provide a means of seeking concessions from partner countries. The nightmare that crossed the minds of investors was the nightmare: whether to deny the international division of labor or to destroy the dollar hegemony system. With more than 80% of its manufacturing products dependent on imports and with no domestic supply capacity in the U.S., cutting off imports would make it impossible for U.S. citizens to survive. There are also concerns about inflation due to tariffs being passed on to consumers and supply shortages. In addition, since the U.S. import bill (= deficit) is the supply of the world's reserve currency, the elimination of the U.S. deficit would mean the cessation of the supply of growth currency to the world economy. Both factors would shake the global economic system to its very foundations.

Tariff Policy Flexibility, Nightmare Scenario Averted

This worst-case scenario has been negated by the series of developments leading up to the tentative U.S.-China tariff agreement. It turned out that what the U.S. wanted to secure was advanced high-tech and military equipment, pharmaceuticals, and other lifeline-related manufacturing, and that it had no intention of bringing everything back. Moreover, aiming to reduce the U.S. deficit by weakening the currency is a path of contractionary equilibrium that will immediately lead to lower capital inflows to the U.S. and higher U.S. interest rates, resulting in a recession. Treasury Secretary Bessent has repeatedly stated that the Trump administration will not take that path, dispelling market doubts.

Trump's Three Steps to Economic Growth

If the aim of reciprocal tariffs is 3) tax revenues and 4) a negotiating tool to gain concessions from the other side, a scenario emerges in which Trump's tariffs could also be a factor in stock market appreciation. Looks like a model of the three arrows of Abenomics, Bessent presented Trump's Three Steps to Economic Growth: 1) Bring back large numbers of manufacturing jobs by renegotiating international trade deal; 2) Make the Tax Cuts and Jobs Act of 2017 permanent, reinstate 100% immediate depreciation of capital investment and extend incentives to new plant construction to accelerate re-industrialization; 3) Accelerate deregulation in semiconductors, power plants, AI (artificial intelligence) data centers and other future technologies, energy development, regional financial institutions and other small banks, etc. Hopefully, these will open the possibility that the U.S. economy will continue to grow, dependence on China will decrease, energy prices will fall, the budget deficit will decline, and a weaker dollar will be avoided.

Excessive concern about Trump's economic policies, two reasons

Nevertheless, the wild swings in stock prices since April and the underlying underestimation of Trump and his administration's policies among the media and pundits have gone too far. There are two reasons for the pessimism and alarm about Trump's economic policies. The first is that the media and many experts have been Democrat-leaning and anti-Trump from the start, so a bias exists that Trump policies should and must fail in the first place.

Second, however, there are also reasons for concern within the Trump administration, as the arguments of groups that support the administration contain elements that are not in line with economic rationale and that will drive down stock prices.

The first concern is the stubbornly anti-globalist philosophy. While globalism has caused the rise of China and made it a disaster, it is a leap to say that the international division of labor is the whole problem. There is a win-win situation in which the U.S. specializes in the most productive high-tech products and relies on overseas suppliers for lower value-added products. U.S. companies themselves are the beneficiaries of this global supply chain. The next concern was the anti-Wall Street, anti-international finance view. The policy of being willing to accept a second agreement to weaken the dollar, similar to the Plaza Accord (the Mar-a-Lago Accord), is also a rhetoric that would lead to the abandonment of the privileges of dollar hegemony that the U.S. has enjoyed for so long.

Diverse groups rally in support of Trump, conservative nationalists, techno-libertarians, and international investors

Indeed, Oren Kass, the brain behind the Trump administration (and head of American Compass, a conservative think tank close to Vice President Vance and Secretary of State Rubio), has argued that post-Reagan neoliberalism has led to the decline of U.S. manufacturing, He calls for the introduction of industrial policies, including tariffs, the revival of manufacturing, and the weakening of the dollar. However, Cass himself also states that these are long-term strategies and that it is important to take the stairs slowly (Chuo Koron, June 2025).

Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, both Wall Street financiers who could be seen as globalists, oversee fiscal and monetary policy, maintaining market stability and financial order while steering economic growth. In addition, a group of wealthy techno-libertarians, including Elon Musk, head of the Department of Government Efficiency (DOGE), are involved as Trump supporters and are wielding a heavy hand in reforming the executive branch, reducing fiscal costs, and deregulating the economy. These groups have a globalist side that differs directly from conservative nationalists such as Oren Cass, who are not necessarily in favor of tariffs or restrict immigration. For example, the conflict between Elon Musk and Peter Navarro, a senior advisor to the president, who led the tariff hike, was widely reported.

Trump's leadership to change policies depending on market reactions

Thus, Trump's stance shows that he is flexible, skillfully maneuvering between several support groups with different claims, and conducting major reforms while sustaining economic growth. It is necessary to take the perspective that the Trump administration's policies will change and grow as we observe the reactions to its policies.

There were three events that shocked the world during the first 100 days of his presidency.

The first was Vice President Vance's speech to the Munich Security Conference on February 14. Vice President Vance criticized the leaders of the European Union (EU), pointing out that freedom of speech and democracy are in retreat. He also sent Europe into a tizzy with his appeasement of Russia, saying that Ukraine has greater constraints than Russia and that, realistically, the only way to end the war is through negotiations. This speech was a shock to allies, but markets remained calm.

The second was the White House meeting between President Trump and Ukrainian President Zelensky. The scene of the meeting, in which Trump forced Zelensky to accept the de facto Russian occupation of Ukraine and to impose a ceasefire, was reported around the world. The major shift in U.S. support policy toward Ukraine shocked the world, but markets remained calm.

The third shock was the April 2 proposal of reciprocal tariffs, which was perceived as a tilt toward U.S. protectionism and punishment of its allies, and shocked the world and markets, causing a triple depreciation of stocks, bonds, and currency exchange rates. In the first and second of these cases, when the markets were calm, no policy change was made, but in the third case, when the markets crashed, the policy was immediately changed. The above clearly shows that Trump's stance is that maintaining stock prices is essential for success and that he will change policies that the market does not approve of, in other words, his market-first policy.

Trump's unshakable core policies may be the pursuits of the prosperity of U.S. capitalism

There emerges that the Trump administration has an unshakable policy crux, even though it is supported by such diverse support groups with different claims. Musha Research surmises that it is the "prosperity of U.S. capitalism. If we were to venture a guess at Trump's mindset, we would say that he believes that "capitalism-first, democracy without capitalism is fiction.

Even though there are many uncertainties involved in each of his attempts, we can conclude that the Trump administration is an administration that aims to sustain long-term stock market appreciation. Pessimisms that are dominating the world, such as “The failure of Trump's policies” and “The end of the U.S. century,” must be said to be an essay with little scientific basis.