May 26, 2025

Strategy Bulletin Vol.379

Trump's Middle East Visit: A Plot to Cause a Reverse Oil Shock?

(1) Will Saudi Arabia and Trump cause a reverse oil shock?

Trump's trip to the Middle East, his first foreign trip since returning to power, was unusual even for many experts. Why did he visit the Middle East first amid a mountain of diplomatic issues? It was thought that the geopolitical importance of the Middle East had declined significantly in recent years due to the shale revolution, which has made the U.S. the world's largest oil producer, and the shift to green energy. The most important Middle East issue for the U.S. was considered to be the Israeli-Hamas war over Gaza. How do we interpret the visit without Israel at this juncture? Musha Research, even though it is not a specialist in this field, is compelled to consider the importance of this visit.

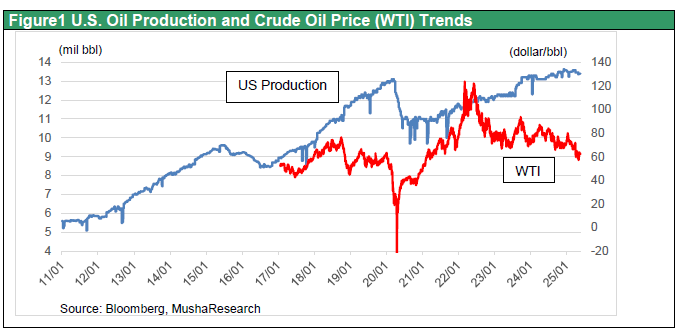

OPEC's oil production increase under sluggish demand and the possibility of a reverse oil shock? On May 3, prior to the visit to the Middle East, OPEC Plus, led by Saudi Arabia, decided to significantly increase oil production. The decision to increase production amid growing concerns about a global economic slowdown was in response to a request from the United States, according to Nikkei commentator Matsuo. Trump has been waving the flag for increased production of crude oil and natural gas to curb inflation, and he has asked OPEC to increase production as well. Saudi Arabia needs a huge amount of money to reform its economic structure to become less dependent on oil. If the price of crude oil falls, revenue will become even tighter. Even so, the Saudi decision to take a stand and meet the demand for increased production is a far more effective gift than the presidential plane being considered by Qatar. Matsuo suspects that in return, the U.S. may be considering licensing nuclear technology to the Saudi. The U.S. has conditioned the licensing of nuclear technology to Saudi Arabia on the establishment of diplomatic relations with Israel, but this condition was dropped just before Trump's visit," noted Hirofumi Matsuo of Deep Insight in the Nikkei Shimbun (May 22). In the same column, Matsuo also suggests the significance of the situation, stating that "Saudi Arabia's decision to increase production has triggered reverse oil shocks in the past.

Saddi’s bitter memory pf cutting oil production leading to a decline in market share

One can imagine that the background to the inexplicable Saudi production increase is also unique to Saudi Arabia. For Saudi Arabia, where crude oil costs are by far the lowest in the world, the dilemma is that if it attempts to raise crude oil prices by cutting production, it will increase the production share of other competing countries with higher costs. There is a bitter memory that maintaining high oil prices by cutting oil production has always led to a decline in market share. In fact, the Saudi-dominated OPEC-plus had a 52% share of the global crude oil supply in 2016, but it has recently fallen to the mid-40% range due to production cuts starting in 2022, due to 1) the U.S., which has been increasing production significantly since the shale revolution, 2) the withdrawal of Qatar, Angola from OPEC Plus, and. 3) the presence of member countries (Kazakhstan, Iraq, etc.) that do not adhere to quotas, and other factors that may have made the production cut disadvantageous to Saudi Arabia.

Figure 1 U.S. Oil Production and Crude Oil Price (WTI) Trends

Reverse oil shocks triggered by Saudi Arabia, a distant cause of the collapse of the Soviet Union

Reverse oil shocks triggered by Saudi Arabia have occurred three times in the past. In the first case, in 1985, the Oil Majors and OPEC fought for market share after two oil shocks caused the price of crude oil to plummet.

The second was in 2014, when Saudi Arabia increased production in response to increased U.S. oil production due to the shale revolution, resulting in a global oil oversupply and a sharp drop in oil prices. The third was in 2020, when Russia refused to cut production in response to a sharp drop in demand due to the Corona Pandemic, and Saudi Arabia responded by increasing production, resulting in the first negative oil price. In all cases have in common that they occurred immediately after Saudi Arabia, which had been supporting the oil price, abandoned its role as swing producer.

The reverse oil shock had its greatest geopolitical impact in 1985. The Soviet Union, which had been dependent on oil, ran into financial difficulties due to the collapse of oil prices. It was analyzed at the time that it was the reverse oil shock, along with President Reagan's arms race, which brought down the Soviet Union and ended the Cold War. In this light, the assumption that the U.S. and Saudi Arabia will conspire to increase oil production and cause a sharp drop in oil prices, resulting in a reverse oil shock, is becoming more realistic.

(2) The option of shelving decarbonization in order to become less dependent on China

Trilemma over new energy, de-“decarbonization” for growth and containment of China?

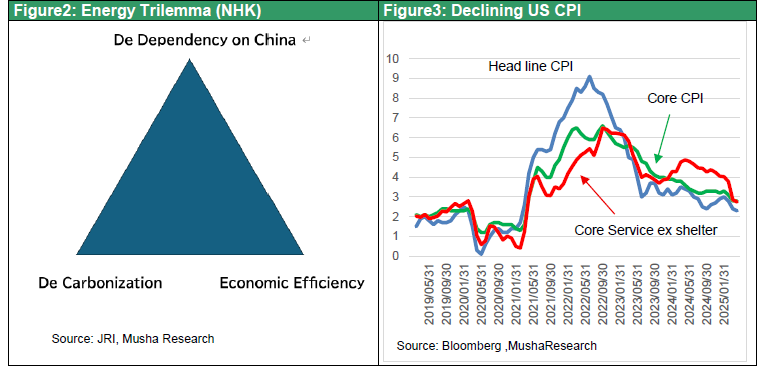

It has been said in the energy industry that there are three challenges to the global energy system, all of which are trilemmas that cannot be simultaneously met. The first is to ensure energy security (access to energy whenever needed and prepared for natural disasters, wars, and other emergencies), the second is to ensure energy economy (affordable and cheap energy for economic growth), and the third is to ensure energy sustainability (=global environmental protection = decarbonization).

By around 2022, the world was too focused on the decarbonization agenda, resulting in major challenges to security assurance and economics. Russia’s invasion of Ukraine has made the world acutely aware of its Achilles' heel here.

Minoru Nogimori, an economist at the Japan Research Institute (JRI), argues that today's energy trilemma is that it is virtually impossible to simultaneously achieve “de-dependence on China,” “decarbonization,” and “economic stabilization” (JRI Review, “Trilemma of Supply Chain Realignment in the New Energy Sector,” March 18, 2025). This is because today, China has gained an overwhelming share of the new energy sector supply. China has secured 80% of the global share of solar panels, 80% of wind power, and 60-70% of EV and EV batteries, and has established a system in which the world must rely on China to develop decarbonizing investments. This was reported through NHK.

Figure 2: Energy Trilemma (NHK)

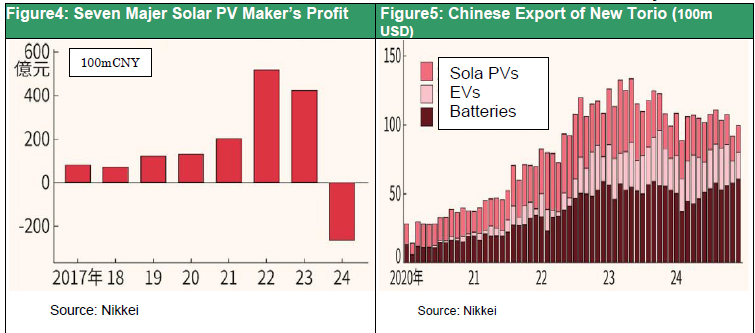

Figure 3: US CPI bouncing lower

Trump Administration Abandoning Decarbonization and Focusing on De-Dependence on China

Perhaps the Trump administration has taken the clearest stance on this trilemma. Trump has reversed all of the Biden administration's climate change-oriented policies and is pushing for a major shift in strategy toward a focus on economic security, including withdrawal from the Paris Accord, increased fossil fuel production, deregulation, and suspension of funding for renewable energy. It is likely that cooperation with Saudi Arabia has become essential to maximize the use of fossil fuels, which the U.S. has a geographical advantage in.

If this collaboration comes to fruition, two economic benefits can be envisioned. The first is the expose of China's accumulated excess capacity in the field of green technology and the reduction of China's presence in this field. The second is lower inflation in the U.S. due to lower oil prices. The U.S. CPI, which is currently falling sharply, could easily fall below the Fed's 2% target, setting the stage for further rate cuts. Lower oil prices will support U.S. economic growth through these two paths.

China's Overinvestment and Dumping Exports in Solar PVs

The Nikkei Shimbun reported (May 6, 2025) that the aggregated profit of China's seven major solar PV companies was in the red for the first time in FY2024.

The reason is that the supply from Chinese companies far exceeded the demand, resulting in a deteriorating market price. In the solar PV industry, Chinese companies hold more than 80% of the global production capacity, from the raw material silicon metal to the intermediate products wafers and cells to the final products solar PVs. Bloomberg estimates that the projected new global installation of solar PVs in 35 years is 993 gigawatts. In contrast, the solar PVs production capacity was already 1,446 gigawatts at the end of 2012, already more than enough to meet demand 10 years later."

The reason Chinese companies have been able to boldly invest in increased production is due in part to the will of the Xi administration. In the past, the Chinese government positioned apparel, home appliances, and furniture as the “trio treasures of export” and stepped-up production and exports. In recent years, the government has placed more emphasis on advanced technology and has begun to support solar PVs, electric vehicles (EVs), and lithium-ion batteries, calling them the “new trio treasures.” In 2022, Mr. Xi advocated a “new quality production capacity” that would expand investment in advanced manufacturing, including EVs and artificial intelligence (AI), and poured enormous amounts of subsidies into this area. China is a huge consumer of solar PVs, accounting for more than half of the world's newly installed solar PVs, but even so, the supply of solar PVs has become too large for domestic consumption, and the overflow of products has headed out of the country. As a result, the price of solar PVs at the end of 2024 was 9 cents per watt, down nearly 70% from the beginning of 2022, and exports of solar PVs were $30.6 billion in 2024, up 50% from 2020.

Figure 4: Net Profit of Chinese Majer Sola PV Maker (Nikkei 5.6.25)

Figure 5: Export Trends of the New Trio Treasures (Nikkei 5.6.25)

(3) Will China's Leapfrog Succeed?

Countries moving to restrict imports from China, putting the brakes on China's New quality Products exports

China's strategy of selling its excess inventory cheaply outside the country and expanding its market share at once is causing trade friction in many countries. U.S. Treasury Secretary Scott Bessent focused on the problem of “deflationary exports caused by China's excess supply capacity” in the U.S.-China tariff talks. Similar problems are emerging with steel and EVs as well as solar PVs. The U.S. has implemented safeguards (emergency import restrictions) on solar PVs, and there is a growing insistence in Europe that "trade defense measures should be taken to protect manufacturers in the region. As a result, China's “new trio treasures” (solar PVs, EVs, and batteries), which had been making rapid progress, have begun to put a sudden brake on exports.

If we consider these developments in the context of the energy trilemma hypothesis discussed earlier, it can be said that the developed countries are now committed to sacrificing either economic efficiency or decarbonization in order to become less dependent on China. Emerging economies, whose imports from China are increasing rapidly, will also increasingly place the highest priority on reducing their dependence on China. The Trump administration's imposition of reciprocal tariffs aimed at avoiding Chinese export bypassing China will likely reinforce the trend among emerging economies to reduce their dependence on China.

Will China's Leapfrog succeed?

The theory of leapfrogging has long been discussed in the study of economic history. Whether or not Russia and China, which had no experience with capitalism in the past, could skip from an agrarian economy to socialism at once was a major question in political thought. Certainly, history is replete with examples of emerging countries without the old ties that have developed through the propagation of technologies realized by developed countries. Japan's development since the Meiji era may be a good example.

There have been many cases of emerging countries without existing social infrastructure introducing cutting-edge technology and leapfrogging developed countries, which has attracted attention as the leapfrogging phenomenon.

Developing countries where fixed-line telephones are not widely used have therefore easily spread cell phones at a stroke. China, which quickly gained a monopolistic market share in future technology areas such as green energy and EVs, can be seen as a successful example of the Communist regime's deliberate use of this historical theory for support. Whether or not to allow this pre-emptive frog-jumping by China.

Trump's oil price cut would be a blow that would halt the decarbonization movement and reveal the massive new energy supply overcapacity that China has pre-emptively set in place.