Dec 16, 2010

Strategy Bulletin Vol.37

A broad-based rebound in Japanese stocks in 2011 (2)

Japan is best positioned to be rewarded in 2011

Immense potential due to a low unit labor cost and hig

What goes around comes around. Both good fortune and bad luck do not last forever. Success for no reason eventually comes apart while failure for no reason is rewarded. We learned this lesson over the past few years as the economy moved like a roller coaster. The economy surged and plummeted as a housing bubble formed and dissipated and financial markets plunged and then staged a remarkable comeback. Examining these points holds the key to determining a strategy for 2011. Where are the success stories for no reason? And where are instances in which there was no reward even though there was a reason for success? Moreover, as I will discuss later, as of the end of 2010, Japan more than any other country in the world has not been rewarded even though there were many reasons to be rewarded. Next is Germany and then the United States. The global problem of excess of supply along with inadequate demand continues to become more serious. Many people believe that emerging countries are the only possible source of new demand. However, I believe that the potential for growth in 2011 exists instead in the core industrialized countries of Japan, Germany and the United States.

In Europe, Germany enjoys a tailwind

The economy in Europe is the clearest illustration of the concept of “what goes around comes around.” Emerging countries like Ireland and Spain were the stars of the European economy during the past decade. But now these countries are suffering because of a collapsed housing bubble, wages that climbed too high, and massive trade and budget deficits. Problems at Europe’s emerging countries are now much greater than the excessive good fortune these countries enjoyed during the past decade. But Germany, Europe’s core economy, had to hold down wages and housing prices consistently following the launch of the euro because the country had the highest productivity and wages in Europe. However, Germany used these measures to create an extremely lean economy and is now increasing its stature in the European economy. Germany has a large volume of savings. In addition, the country benefited from two results of the EU crisis: falling long-term interest rates and the decline of the euro. Because of this, Germany’s economic growth rate is increasing. Unemployment is falling and housing prices have started to climb in Germany. Stock prices have been weak in Spain and other European emerging economies as well as in France and Italy. But in Germany, stock prices have rallied to new highs.

The U.S. accelerates while emerging economies lose momentum

Considerable growth potential exists in industrialized countries now that the correction has ended while risk is increasing in emerging countries. This pattern is appearing in the EU and will probably become a global trend. Overheated economies in China, India, South Korea, Brazil and other emerging countries are creating a growing risk of inflation. Investors have come to recognize the growing bubbles in these countries as a restriction on upcoming economic expansion. Governments in these countries will probably encounter difficulties in managing their economies as they tighten monetary policies while dealing with appreciating currencies and a downward correction in asset prices. But in the United States, the world’s most advanced economy, corrections in employment, inventories and capital goods have been completed. Furthermore, the housing bubble has virtually dissipated now that the plunge in home prices has ended. Another positive sign is the remarkable progress in streamlining the real economy as households cut expenditures and boost saving rates. Corporate earnings have returned to the record highs of the past. The Obama administration suffered an enormous loss to the Republican Party in the midterm elections. Following this loss, the United States is about to enact extremely re-inflationary measures. Examples include a two-year extension of the Bush tax cuts (including a tax cut for wealthy people and a reduction in dividend and capital gains taxes), a one-year income tax cut of $120 billion and QE2 (purchase of $600 billion of Treasury securities). All this demonstrates that the U.S. economy has finished paying the price for its past problems and is now positioned for acceleration as full throttle.

Japan’s era of misfortune produced two springboards for growth

I have just explained why Germany and the United States appear to be well positioned for growth in 2011. But Japan has an even greater imbalance between its inherent strengths and its current performance. No country has endured more misfortune than Japan during the past 20 years. The world enjoyed a period of growth and prosperity over the past two decades. But in Japan, this period was the “lost 20 years.” The first lost decade was Japan’s payback for its excessive good fortune in the postwar years. But the second lost decade was a period when Japan failed to be rewarded even though the country was well positioned for growth.Springboard 1: High productivity and low wages (low unit labor cost) ⇒ Much potential for wage hikes

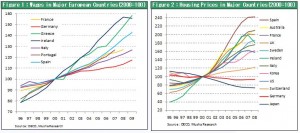

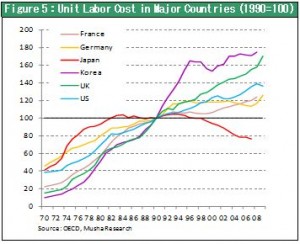

To examine Japan’s imbalance between its strengths and performance, we must look at the two key elements of economic activity: the providers of labor and the providers of capital. Are labor and capital each receiving a level of compensation that matches the associated performance? The first point is whether or not workers are receiving appropriate compensation in relation to their contributions. The answer depends solely on the ability to have wages properly reflect the contributions of workers. We can find the answer by examining unit labor cost (wages divided by productivity). As Figure 5 shows, Germany ranks first by a wide margin in Europe in terms of its unit labor cost while Japan is the undisputed leader worldwide. This also means that Japan ranks first in the gap between workers’ contributions and the inadequacy of their compensation. From the standpoint of what goes around comes around, this gap points to significant potential for a big increase in wages in Japan. If the global economy recovery and appreciation of the yen both reach a peak in 2011, we should see the beginning of a correction to Japan’s low wages and the end of deflation in Japan.

Springboard 2: Recovery in corporate earnings and low stock prices (high risk premium) = Much potential for higher stock prices

Next, we must determine whether or not capital is yielding rewards that match returns on invested capital. Here, the risk premium on stock is the best indicator to use. We can monitor the risk premium by looking at the difference between the return that providers of capital demand (a) and the cost of capital (b). Furthermore, we can simplify this process by using the earnings yield on stock for (a) and the long-term interest rates on government bonds as (b). Using this simplified method shows that Japan has a much higher risk premium than other major countries. In addition, Japan’s risk premium has reached an unprecedented high (except during the extreme volatility that followed the Lehman shock) even when compared with risk premiums in the past. A high risk premium shows that capital invested in companies is generating sufficient earnings but these earnings are not producing shareholder value in the form of rising stock prices. In other words, the high return on capital is not being passed on to shareholders. The high risk premium is also a sign of significant room for an upturn in stock prices because stocks are currently undervalued. Correcting the present undervaluation of stocks will occur only when investors abandon the desire for safety and become risk-takers again. The new financial initiative that the Bank of Japan announced in October 2010 (purchasing assets with risk) is aimed precisely at prompting investors to switch to this risk-taking stance.