Jun 16, 2025

Strategy Bulletin Vol.380

Shift from Tax Cut Mode to Stealth Tax Hike

- Can the Ishiba Administration withstand public criticism?

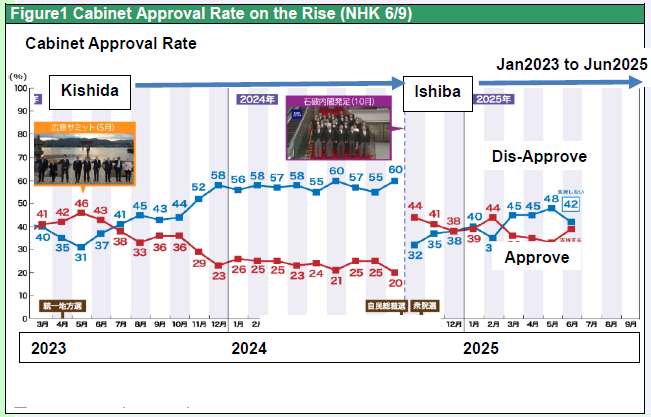

As the Diet session ends and we enter the period of contention for the Tokyo Metropolitan Assembly and House of Councillors elections, there has been a sudden change in the political situation that we did not expect a month ago. The situation has changed on two fronts. First, the overwhelming popularity of the Democratic Party For the People(DPP)has waned, while the LDP has recovered and its cabinet support has risen. The plummeting popularity of the DPP was due to an own-goal situation, such as the nomination of Shiori Yamao, who had been strongly criticized and rejected on social networking services, as the official candidate for the DPP. In addition, the rice riot of Reiwa is working to the LDP's advantage. The release of stockpiled rice under a voluntary contract by the new Minister of Agriculture, Koizumi, and the sharp drop in over-the-counter prices led to a sharp recovery in the LDP's support.

Shift in Policy Issues from Tax Cuts to Rice

The second and more important change is that the policy issues have shifted away from tax cuts. Since last year's lower house election, the policy debate has revolved around the DPP's tax-cut line of increasing take-home pay, but the rising price of rice and the release of stockpiled rice by new Agriculture Minister Koizumi have dampened enthusiasm for tax cuts.

Not only that, but the high burden line is beginning to be secretly pursued. The Pension Reform Act, suddenly passed by the current Diet session, can be described as the very essence of the high burden and fiscal consolidation policy. Specifically, the bill will increase burdens and reduce benefits by (1) using employee pension funds to cover shortfalls in the national pension system (to guarantee benefits for those in the “ice age” of employment), (2) reducing survivors' pensions, and (3) applying employee pensions to part-time workers (increasing the burden on households and companies), etc. If there are deficits in future benefits, a consumption tax hike will be justified.

Figure 1: Cabinet Approval Rate on the Rise (NHK 6/9)

Progressive stealth tax hike, return to high burden path

The “Child and Child Rearing Support Program” to be launched in April 2026 as part of measures to combat declining birthrates is also seen as a stealth tax hike that will raise insurance premiums. It is colloquially known as the “single tax” due to its unfairness to single people. The average social insurance burden will increase by 0.2% relative to annual income in FY2028, which is calculated as a 5% increase in annual social insurance premiums and is said to be equivalent to a 0.8% increase in the consumption tax.

Mr. Noda put political life on “Integral reform of the social security and tax systems”

It is surprising that, in the face of such an increase in public opinion's insistence on tax cuts, the government is increasing taxes and strengthening the path to fiscal soundness. What is going on? The key phrase is “Integrated reform of social security and taxation,” and the key person is Mr. Noda, the leader of the Constitutional Democratic Party of Japan (DPJ). The key phrase “The integrated reform of social security and taxation systems,” means that while spending on pensions and social insurance will increase as the birthrate declines and the population ages, the number of working people will decrease. Therefore, to continue to provide adequate benefits, it is necessary to strengthen the fiscal base by increasing taxes. “” It is essential to increase the consumption tax, which is a stable source of revenue unaffected by economic fluctuations (making the consumption tax a welfare objective)," they say. The Ministry of Finance was the instigator of this massive campaign, and the main advocate was then Prime Minister Noda, the current leader of the Constitutional Democratic Party of Japan (DPJ), who passed the bill in 2012. Noda conducted the consumption tax dissolution based on the three-party agreement (2012) and made Mr. Abe promise to raise the consumption tax twice under his administration.

Noda returned as leader of the Constitutional Democratic Party of Japan (DPJ) and joined forces with the Ishiba administration on the path to fiscal consolidation, and Noda's pension reform law was passed with the support of the LDP and Comito-Party.

The “Integral reform of social security and taxation” has been the main culprit in hurting people's lives

However, there is a strong possibility that the high-burden, fiscally sound path that runs counter to public opinion will run up against a wall. First, it is clear that the “Integrated reform of social security and taxation” is the main culprit for hurting people's lives.

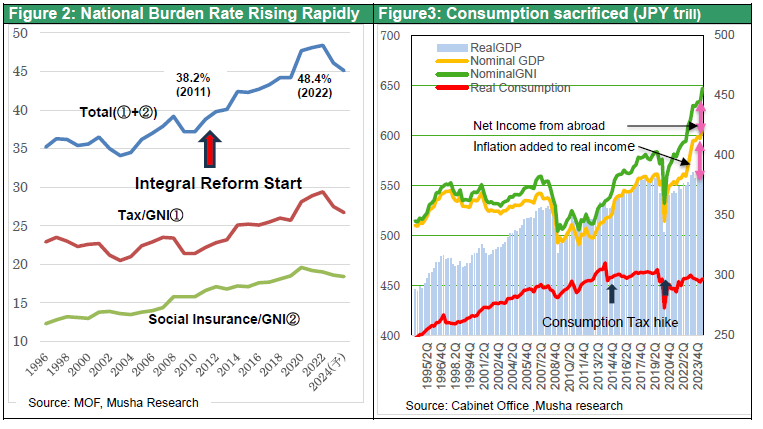

The national burden ratio (the ratio of taxes and social insurance premiums to national income) was 38.8% in 2011, before the introduction of the “Integrated reform,” but it has risen to 48.4% in 2022, an unprecedented 10-point increase in 10 years, directly impacting household consumption. Real household consumption peaked at ¥310 trillion in the January-March 2014 period, just before the consumption tax hike (5➡8%) in March 2014, and has never exceeded that level since. During this period, corporate profits have increased 2.4 times, stock market capitalization has increased 3.2 times, and general account tax revenues have increased 1.6 times, all at the expense of households (Figure 4).

Figure 2 National Burden Rate Unusually Rising Rapidly

Figure 3: Consumer spending sacrificed alone, peaked 10 years ago (1Q2014)

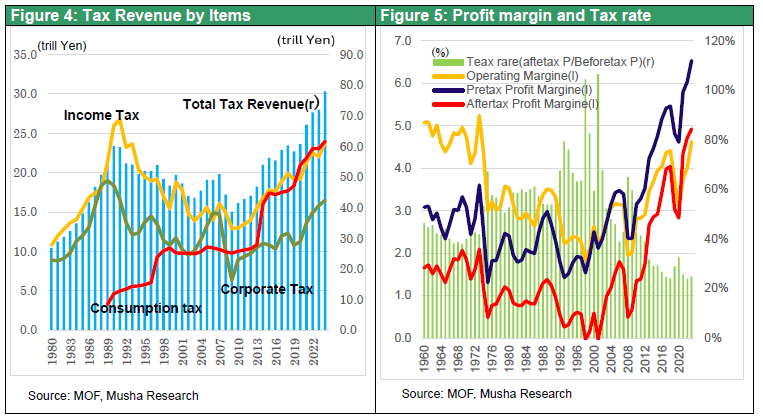

Increased tax revenue that can no longer be hidden

Second, tax revenue has been rising sharply due to tax hikes and inflation. The government has been trying to hide the fact that tax revenues have been rising by offering one-time tax cuts and benefits to make it difficult to see the actual fiscal improvement, but the scale of the improvement has ballooned to the point where it can no longer be concealed.

The actual tax revenue in FY2023 was 72 trillion yen, while in FY2024 it was 76 trillion yen, more than 6 trillion yen more than the initial budget, and is expected to reach 80 trillion yen in FY2025, clearly indicating that there are sufficient funds for permanent tax cuts.

Figure 4: Significant Tax Revenue Increase Relying on Individual Taxes (trillions of yen)

Figure 5: Profit Ratios Rising Rapidly, Effective Tax Rates Falling Sharply

Japan's finances are sound from every perspectives

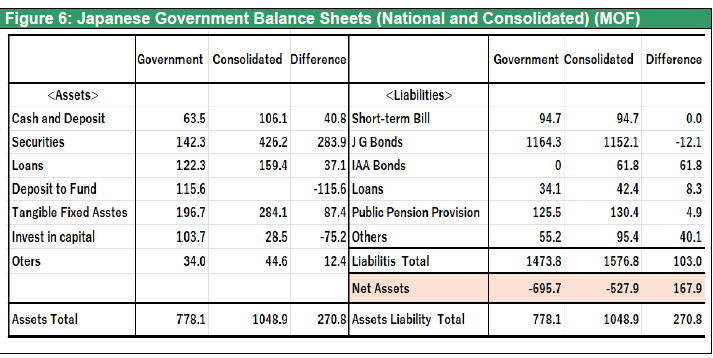

Third, it will no longer be possible to hide the fact that Prime Minister Ishiba's statement that Japan's finances are less than Greece's is a falsehood. The Ministry of Finance's gross government debt is the world's worst at 237% of GDP (Figure 7), but Japanese government has huge assets. Japan has more assets than any other country, including massive U.S. government bonds (141 trillion yen) held in the foreign exchange account, massive GPIF’s Portfolio investment (246 trillion yen), fixed assets that generate income such as expressways (41 trillion yen for expressways, 7 trillion yen for bullet trains, 246 trillion yen for airports and other assets related to the Ministry of Land, Infrastructure and Transport), loans to various special corporations with business income (159 trillion yen), and other assets totaling 1048 trillion yen on a consolidated basis (Figure 6).

Figure 6: Japanese Government Balance Sheets (National and Consolidated)

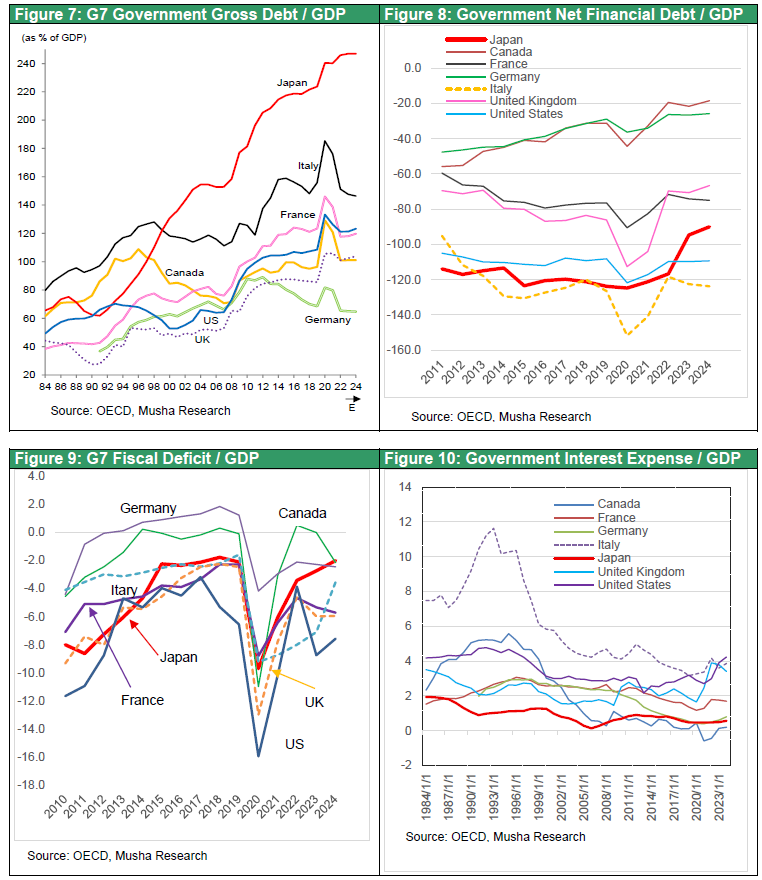

Net government debt on a consolidated basis, after subtracting these assets, is 528 trillion yen, or 89% of GDP, which is better than the G7 average. The OECD also publishes the ratio of government net financial debt to GDP, and Japan's ratio has improved significantly from 120% in 2020 to 90%, better than Italy and the U.S. (Figure 8). Furthermore, Japan's budget deficit as a percentage of GDP was 2.7% in FY2023, ranking third after Canada and Germany, but may overtake Canada and Germany to become the country with the smallest deficit in FY2024 (Figure 9). Japan's ratio of government interest expenses to GDP, a more objective measure of fiscal soundness, is 0.5%, the lowest among the G7 nations. Japan's massive government financial assets provide interest income and mitigate the cost of interest payments. Japan’s finances are in decent shape, far from being in crisis. (Figuere10)

Figure 7: G7 Government Gross Debt to GDP

Figure8: G7 Government Net Financial Debt to GDP

Figure9: G7 Fiscal Deficit/GDP

Figure 10: G7 Government Interest Expense/GDP

The Ishiba administration will not be able to withstand public criticism

Thus, it is clear that (1) only households have been sacrificed due to tax hikes and high social insurance premium burdens, (2) increased tax revenues have Powered up the capacity for fiscal assistance to households, and (3) Japan's fiscal situation is healthy in the world.

The errors of public opinion formation by the triumvirate of the Ministry of Finance, major media, and academics in denying and covering up this obvious fact will be exposed by the Internet media, including social networking services.

The LDP government of Ishiba, which has denied tax cuts and steered the nation toward a high tax burden, as choreographed by the Ministry of Finance, is likely to be harshly judged.