Jun 27, 2025

Strategy Bulletin Vol.381

Iran situation marks watershed, turning point in investment sentiment

~Tyrannical states on the defensive, a major stock market driver~

Q1) Six months after the birth of the Trump administration, the true nature of the Trump administration is coming into view. Amidst a chorus of criticism from the media and academia, the Trump administration has pushed through dramatic policy changes in many areas. The contours of the policies are beginning to emerge and the achievements are beginning to show. It is time to say that an interim summary is now possible. What is Musha Research's assessment?

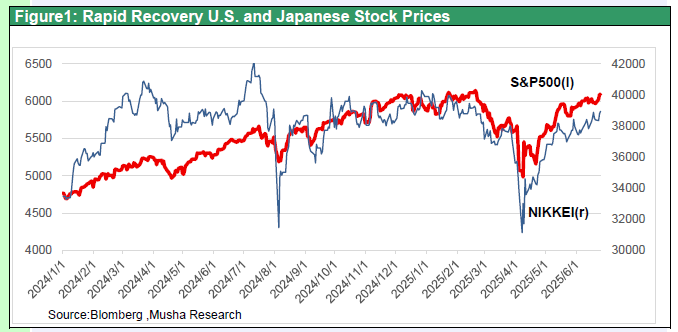

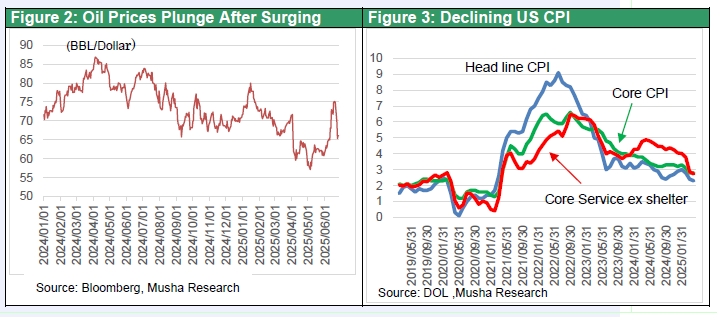

Musha) Stock prices have recovered sharply from their early April plunge, the possibility of a recession, which had been a concern, is becoming increasingly unlikely, and the view of pessimists and Trump critics is increasingly likely to be very wrong. Oil prices fell sharply after the bombing of Iran's nuclear facilities, making the prospect of falling U.S. prices more certain, and a rate cut later in the year will be on the horizon. Tax cuts financed by reciprocal tariff revenues should also materialize. It will only be a matter of time before U.S. stocks hit all-time highs.

Figure 1: Rapid Recovery U.S. and Japanese Stock Prices

Figure 2: Crude Oil Prices Plunge After Surging

Figure 3: U.S. CPI Gains Momentum in Decline

Q2) Trump has been criticized as a TACO (Trump Always Chickens Out). How about ending the war first? He has said he would end the war in Ukraine in one day, but he has yet to achieve even a cease-fire. But the bombing of Iran's nuclear facilities was brilliant. Could this bring about a major shift in the situation?

Musha) I think the Trump administration has achieved results; Operation Midnight Hammer was a success. The question is not whether Iran's nuclear enrichment capability has been completely severed, but the subsequent geopolitical power relations that will result from the operation. In the Middle East, the hardline measures of the Israeli Netanyahu government have been successful, and Iran, the world's largest state sponsor of terrorism, has been noticeably weakened. Under its Shiite theocracy, Iran has maintained its position as an enemy of the free world in that (1) it has been a key supporter of international terrorist organizations under the command of the Islamic Revolutionary Guard Corps, (2) it has insisted on the destruction of Israel, and (3) it has suppressed the freedom of its own citizens. However, Iran was in a bad position due to the collapse of the Assad regime in Syria at the end of last year, the weakening of Hamas, Hezbollah, and the Houthis due to Israel's hardline measures, as well as missile attacks by Israel and the deaths of its top officials by bullets. The U.S. military's attack on nuclear facilities at this juncture undercut Iran's willingness to fight. Iranian Foreign Minister Araghchi went to Russia to ask Putin for support but was rebuffed. Russia, with its hands full with the war in Ukraine, had no room for Iranian support, and Iran, in distress, agreed to a ceasefire as Trump had called for. This ceasefire is likely to last for a considerable period of time, as the U.S. and Israeli sides have overwhelming military superiority. The feared expansion of the war to the entire Middle East and its escalation into a quagmire did not occur. It is also unlikely that a power vacuum in Asia will occur as a result of allocating power to the Middle East.

Q3) Mr. Trump has demonstrated "peace through strength.

Musha) In 2013, the Obama administration announced that the use of chemical weapons against civilians by the Assad regime in Syria was a red line that must not be crossed, but it did not take military action against the use of chemical weapons. From there, Russian airstrikes on Syrian rebels (2015) and other actions began and the decline in U.S. influence became more pronounced. The Trump administration's use of military force is a reversal of this trend. Trump's claim of “peace through strength” is being put into practice, and the Trump (TACO)-only-say-it nonsense is gone.

Q4) The decline of Iran's influence has an impact on world affairs, including China.

Musha) China has increased its influence in the Middle East through Iran. China has been the lifeline of the Iranian economy. First, China has conducted military exercises with Iran and Russia near the Gulf of Oman in the Arabian Sea over the past five years. Second, it has promoted Iran's membership in the BRICS and Shanghai Cooperation Organization (SCO). Third, China is Iran's largest trading partner, purchasing about 90% of Iran's oil. It also supplies Iran, which is under sanctions for its nuclear program, with a full range of goods that other countries cannot export, including automobiles, consumer goods, and electronic equipment. This includes both military and civilian goods, and Chinese parts supply made possible the Iranian-made drones that were used in the war in Ukraine.

Any upheaval in the governance of the Iranian theocratic government would result in weakening China's pivot points against the United States. The situation in Iran with the loss of air control is the worst-case scenario for China in the future, and the psychological blow to the Chinese leadership will be significant.

Q5) You say that China, which has been on the offensive until now, is showing signs of modulation.

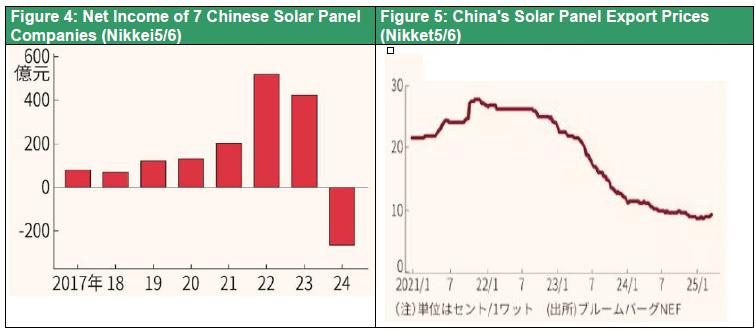

Musha) In particular, modulations are appearing in solar power, EVs, and batteries, the three treasures of new quality production power, which have been making rapid progress in recent years. The huge surplus of production capacity that China has built up is becoming more pronounced. The first is solar power. The Nikkei Shimbun reported (May 6, 2025) that the total final profit/loss of the seven major Chinese solar cell companies for the fiscal year ending December 2024 was in the red for the first time since 2017 when comparisons were available. The reason is that the supply from Chinese companies far exceeded the demand, resulting in a deteriorating market. In the solar cell industry, Chinese companies hold more than 80% of the global production capacity, from the raw material silicon metal to the intermediate products wafers and cells to the final products solar panels. Bloomberg NEF estimates that the projected new global installation of solar panels in2035 is 993 gigawatts worth. In contrast, solar panel production capacity was already 1,446 gigawatts at the end of 2024, already more than enough to meet demand 10 years future."

Figure 4: Net Income of Seven Chinese Solar Panel Companies

Figure5: China's Solar Panel Export Prices

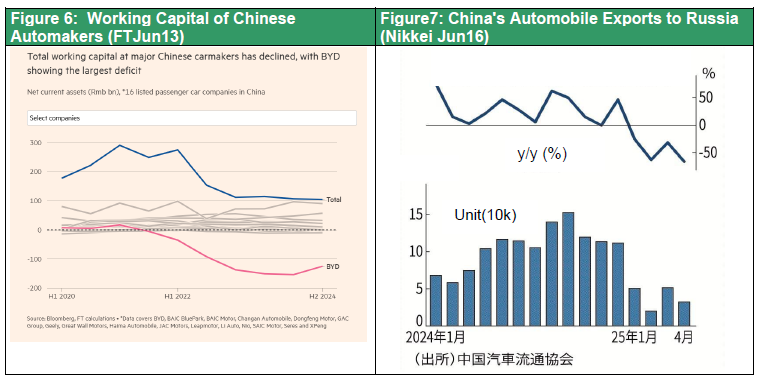

Second, the overcapacity problem is becoming apparent even in EVs and batteries, where China is now overwhelmingly strong. BYD, China's largest EV maker, which has been growing rapidly, is experiencing a sharp slowdown, with May production up 2% y/y, down sharply from the 41% y/y growth (4.3 million units) in 2024. Reuters reported that domestic sales of passenger cars were down for the second consecutive months in April and May, and that price discounts are rampant. In addition, BYD's working capital (current assets - current liabilities) has been in constant negative growth, and cash shortages have become the norm (6/13 FT).

Figure 6 Working Capital of Chinese Automakers

Figure 7 China's Automobile Exports to Russia

Furthermore, Chinese auto exports to Russia have been declining sharply. The number of vehicles exported to Russia, that was 1.28 million in 2024 , a seven-fold increase from 2022(the Chinese share of new car sales in Russia increased from 18% in 2022 to 58% in 2024) , in 2025 January to April fell 49% year-on-year to 155,000 units.. The biggest factor is the Russian government's policy of protecting its own industry. China's exports are showing that it is increasingly competing with local industries not only in developed countries such as the U.S. and Europe, but also in emerging countries (Nikkei Shimbun, June 18).

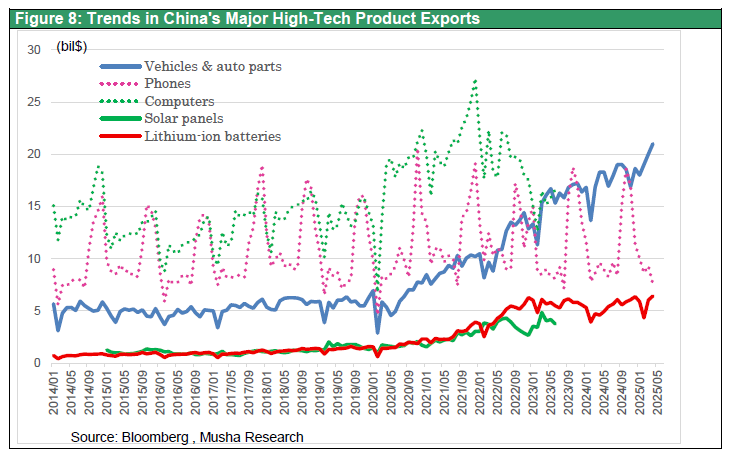

China's strategy of selling excess inventories outside of China at low prices to quickly increase its market share is causing trade friction in many countries. U.S. Treasury Secretary Scott Bessent focused on the problem of “deflationary exports caused by China's excess supply capacity” in the U.S.-China tariff talks. Similar problems are emerging with steel and EVs as well as solar cells. The U.S. has implemented safeguards (emergency import restrictions) on solar panels, and there is growing insistence in Europe that "trade defense measures should be taken to protect manufacturers in the region.” Because of these factors, exports of treasures of new quality products (solar panels, EVs, and lithium-ion batteries) on which China is now focusing its efforts have peaked out, except for EVs.

Figure 8: Trends in China's Major High-Tech Product Exports

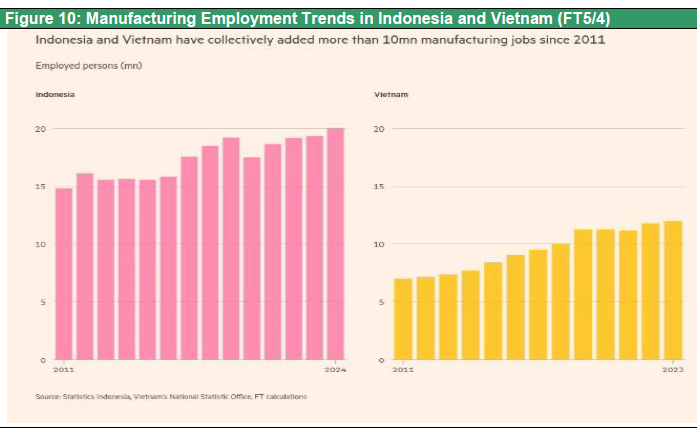

Furthermore, in existing labor-intensive industries, there has been a marked shift of factories from China to emerging countries such as ASEAN. While employment in China is declining, manufacturing employment is rapidly increasing in Indonesia, Vietnam, and other countries. The Chinese economy is unlikely to stop its ongoing deflationary process due to the export brake, the bursting of the bubble and sluggish consumption.

Figure 9: China's Labor-Intensive Industry Employment Trends (FT5/4)

Figure 10: Manufacturing Employment Trends in Indonesia and Vietnam

Q6) It can be said that the Trump administration's policies are clearly increasing the opportunities for the U.S. economy by cornering China and other countries. Then a scenario may emerge in which the stock market will continue to rise in the second half of 2025.

Musha) While China is turning geopolitically inferior due to the weakening of the Iran-Russia axis, its economy is also in limbo. On the other hand, the U.S. under the Trump administration is rather expected to strengthen its expectations by 1) increasing U.S. production through tariffs, 2) lowering interest rates by slowing inflation, 3) cutting taxes, and 4) strengthening dollar hegemony through the introduction of crypt currency stable coins and financial deregulation (to be reported later), etc. It is highly probable that stock prices will begin to rise, incorporating the concrete image of the arrival of the “Golden Age of the U.S.” that Mr. Trump has been advocating.

Thank you very much.