Jul 03, 2025

Strategy Bulletin Vol.382

The Global Economy and Market Outlook under the Trump Regime

Lectured for the Securities Analysts Association of Japan (6/17) ~

Table of Contents

1. Introduction

2. Trump Tariffs, Their Aims and Consequences

(1) The True Aims of the Tariffs

(2) How to deter China's dramatic rise

(3) Who is Trump

3. The Great Contrast between the U.S. and Chinese Economies

(1) China's huge imbalance and risks to the global economy

(2) The Splendor of the U.S. Consumption-Driven Economy

4. The Japanese Economy and Investment Opportunities

(1) Improved corporate profits and consumption being left behind

(2) Stock Prices Rise due to Policy Shift

- Lecture by the Securities Analysts Association of Japan (6/17)

1. Introduction

This will be my first lecture at the Analysts Association of Japan in a year. During this period, many things have happened and there are many hypotheses, but what is the most probable outlook? We are undoubtedly at a major turning point, one element of which is the "extraordinary rise of China. The significant rise of China is an anomaly in which half of the world's industrial power is controlled by a country that has no respect for private property and a market economy based on the free will of the individual. Another major shift is the "AI revolution.” While previous industrial revolutions have made people happy, the AI revolution will clearly make people unnecessary. In terms of replacing jobs with machines, if left unchecked, the AI revolution will not lead to happy people and economies. These two realities are beyond the control of individuals and companies. To resolve these difficulties, great conceptual power and policies are needed.

From this perspective, it is necessary to interpret what is happening in the world today, and the much-maligned Trump administration in the United States cannot be evaluated without such big-picture thinking. Why are undemocratic and authoritarian responses, and behavior that sometimes ignores human rights, justified? Since the United States, a democratic country, recognizes such a leader, there must be some justification, and that justification must also be examined. Today, I would like to consider two underlying driving forces in the world: the “rise of China” and the "AI revolution.

As for Japan, I think it is safe to say that the “lost 30 years are already over. However, there is a big problem at hand: the extreme stagnation of household consumption. While the economy is recovering, consumption is still stagnant at below the level of 10 years ago, which is extremely unusual. Consumption will be the greatest power for the U.S. to overcome China, and as the AI revolution increases supply capacity, consumption will be the most important force providing demand. It is this most important consumption that is being most disregarded in Japan today, and this is a major problem in that the current policy is not addressing the essential issues. Japan's future will be brighter if this problem is cleared up, but for this to happen, it is essential to have the right policies in place that address the issues that Japan is facing today.

2. Trump Tariffs, Their Aims, and Consequences

(1) The Real Aims of the Tariffs

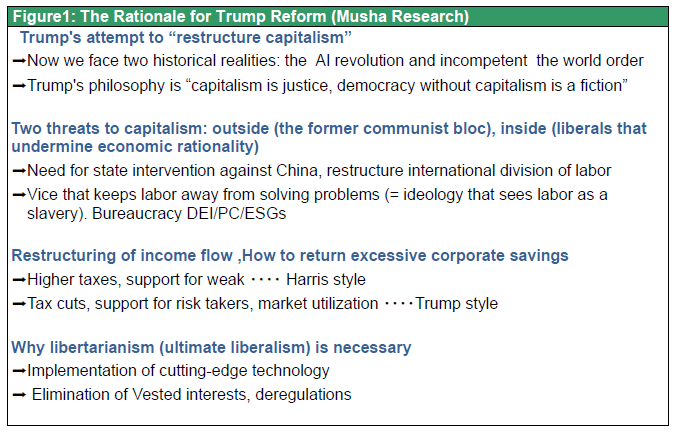

“Who is Trump?” I cannot understand Trump in terms of democracy. We believe the appropriate yardstick is capitalism (Figure 1).

Trump is a business owner and a firm believer that making money is righteous and propagating that to people will help the world and the American people. He can be seen as a kind of guardian deity of stock capitalism. From the perspective of capitalism, what he is trying to do can be interpreted in a certain way. Whether you think it is right or not depends on your position, but I would like to say that from the perspective of protecting and developing capitalism, there is a lot of rationality in what he is doing.

Right now, the world economy is facing the “rise of China” and the “AI revolution.” Within the U.S., the leftist trend is growing stronger, and the original capitalist management cannot be conducted. Simply put, it is the idea that "work is drudgery and should be denied.It is a big problem to bind the system by introducing principles that are far from capitalism such as DEI (Diversity, Equity & Inclusion), PC (Politically Collective), and ESGs (Environment, Social, Governance) into management.

Thus, rebuilding the economy, which has been challenged in many ways, is the essence of Trump's idea of "bringing back the golden age of the United States again.” Whether it will work or not, the U.S. economy will head toward bankruptcy if it is not challenged. From a stock investment perspective, we want Trump to succeed.

Regarding Trump, the phrase “TACO (Trump Always Chickens Out)” has been heard recently. Trump is a wimp. In fact, it often seems as if he has lowered his raised fist.Most notably, a series of moves on tariffs, most notably the April 2 announcement to raise reciprocal tariffs to an average of 22%, which we feared would usher in an era of trade protectionism akin to that of the Great Depression. However, the tariff rate on China, which was raised to 145%, has been reduced to about 60%, and reciprocal tariffs with other countries have also been lowered significantly. Trump is certainly saying and doing quite different things, but that is fine.

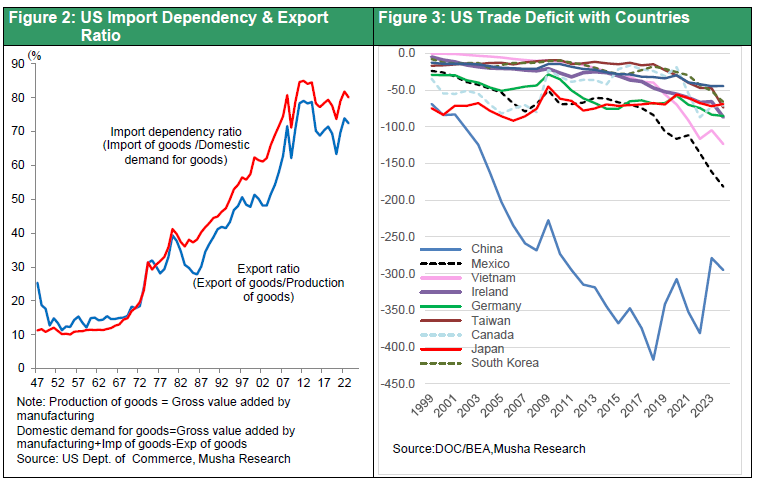

To raise tariffs to the extreme is to deny the international division of labor. U.S. dependence on product imports was around 10% in the 1970s, before the Nixon shock. The U.S. was self-sufficient in everything from clothing, televisions, and automobiles, but later became dependent on Japan, South Korea, Taiwan, and China for production, and now imports more than 80% of the goods Americans use (Figure 2).

If tariffs are raised and imports from abroad are cut off while the country is not self-sufficient, this will lead to a marked rise in prices and directly affect the lives of the people. Even if the tariffs are raised to bring all manufacturing back to the U.S., without an industrial base, the U.S. approach of denying the international division of labor is tantamount to spitting in its own face. There is no way such a thing will happen. In the end, even if the reciprocal tariffs are reduced significantly and the U.S. reliance on foreign countries is lowered from 80% to around 70%, it has become clear that there is no way that the U.S. will get everything back.

What exactly is the U.S. trying to get back? To put it simply, the U.S. wants to get back what supply capacity remains in the U.S. In other words, what remains in domestic supply is steel, aluminum, and automobiles, the very things that Japan supplies. This is why the U.S. is about to impose heavy tariffs on Japanese exports, even though it is the U.S.'s most important ally. The only way this will happen is through industrial cooperation with the U.S., as Nippon Steel acquired US Steel, and Japanese companies will be responsible for the revival of U.S. manufacturing in the U.S.

In the 1980s, the U.S., unable to impose import restrictions under the GATT, sought a Voluntary Restriction Agreement (VRA) from Japan. Japan complied and cut its own auto exports to the U.S. by less than half, but Toyota and Honda made up the difference by producing locally and are now U.S. companies that produce as much or more of their cars in the U.S. than GM does. Even if the US imposes a 25% import tariff on automobiles, the impact on Toyota will be minimal. The measure to bring back U.S. manufacturing can be adequately met by the shift to local production, which Japan has been dealing with to date.

On the other hand, those products that the U.S. does not have the ability to supply will be dependent on imports. To make the U.S. competitive again, the deficit will be reduced by weakening the dollar. While a reduced deficit may seem like a good thing, it is a negation of the dollar system. Not only would the U.S. suffer significant economic damage, but it would also damage the entire world economy, which has grown using dollars acquired from the U.S., because it would cut off the global circulation of money. Therefore, I thought from the outset that there was no way this could be accomplished, but as expected, we are now seeing that there will be no denial of the U.S. dollar regime nor a dramatic reduction of the large trade deficits of the U.S.

The most important target in this tariff hike controversy is China. Tariff negotiations are now underway with China, the main player in the tariff war that has cast a net over the entire world, but they are unlikely to proceed all at once. It is likely that they will slowly tie China's hands and feet and take their time to chip away at the global over-presence that China is gaining.

(2) How to Deter China's Dramatic Rise

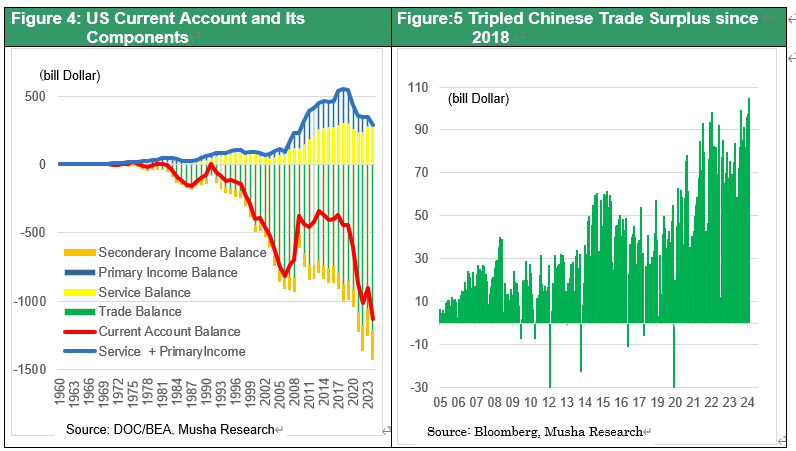

The first time the U.S. launched trade friction against China and first declared that China was a threat to the U.S. was in Vice President Pence's 2018 speech at the Hudson Institute. At that time, the U.S. current account deficit was about $440 billion, while the current account deficit in 2024 was $1.13 trillion. In other words, it has increased by about 2.5 times in the six years since the U.S. started bashing China. On the other hand, China's trade surplus in 2018 was $350 billion and $990 billion in 2024, a 2.8-fold increase in six years. Not only have export controls and other sanctions against China been completely ineffective, but China's presence in the world has increased even further (Figures 4 and 5).

There are three reasons for this. First, the tariff sanctions that have been imposed so far have been lukewarm. Second, the Corona pandemic provided China with a tailwind: while the world's factories were shut down by the 2020 Corona pandemic, China locked down Wuhan and kept its factories in operation, assuming sole responsibility for the world's supply capacity until 2021. During this period, China became more competitive and its trade surplus increased. The third reason is the war in Ukraine. While the West cut off the supply of manufacturing products to Russia through sanctions, it was China that took advantage of the gap to supply goods to Russia. Today, China accounts for 50% of Russia's imports of manufacturing products. While other countries were tying their own hands and feet, China controlled the Russian market. For these three reasons, China, which should have been weakened by sanctions, has become dramatically stronger and unruly.

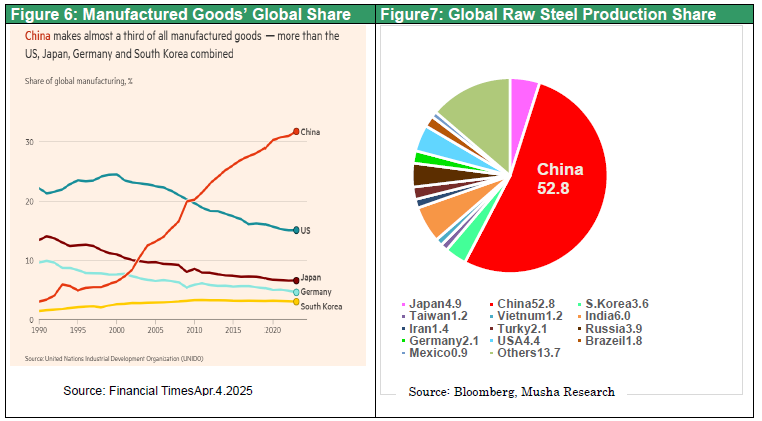

Heavy-Industries is in China's dominance. China's share of crude steel production was about 10% in 2000 and 52.8% in 2024, having at one point risen to 57%. In addition, commercial shipbuilding orders in 2024 will account for 70% of the world's orders, with South Korea and Japan unable to catch up at all.As for advanced industries, it also controls 70% of the world's commercial drones. It has also further strengthened its dominance in the green energy sector, with 60% in EVs, 60-70% in batteries, 80% in solar panels, and 80% in wind power. What has also become clear during this period is the fact that China is solely responsible to produce rare metals, especially smelting, which are indispensable for advanced products. Although it does not have that many reserves, it imports ore and now controls 90% of the world's smelting. Therefore, any attempt to sanction China would, on the contrary, result in a halt of exports from China and the disruption of various types of production. In fact, Japanese automobiles are also facing difficulties due to the reduced supply of rare metals from China. High-technology products using rare metals such as cobalt have always been Japan's forte. Japan was the sole supplier of powerful magnets and other products, but before long all these products were lost to China.

China's share of global manufacturing now stands at 40 to50%, and although the IMF puts China's share of global manufacturing at around 31%, this is calculated in current currency terms and is not a correct figure. China's renminbi exchange rate against the dollar is 7.2 yuan per dollar, but the actual purchasing power of the renminbi is much stronger, about 4 yuan per dollar, which is a lucrative business. If we estimate China's market share at 4 yuan per dollar, it will increase to 40-50%. Considering China's overwhelming share of steel, shipbuilding, wind power, Ev, and batteries 30% of the world market is too low an estimate (Figure 6,7).

In 1945, when World War II ended, the U.S. share of global industrial power was said to be 50%. In other words, China today has the same level of industrial power as the U.S. did then. This is an incredibly frightening reality and cannot be sustainable. How can this be changed? Without such a plan, there can be no future international strategy or various forms of trade. And it is the Trump administration that is formulating a strategy based on this reality. The tariffs are the first step in a process to change China's unipolar dominance, and just as the US-Japan Structural Impediments Initiative took more than a decade from the 1980s to tie Japan's hands and feet, so too will it slowly tie China's hands and feet, leaving it in a state of limbo.

Since an unusually low exchange rate of 7 yuan per dollar has been maintained against its strength of 4 yuan per dollar, which has led to its extreme competitiveness, raising the yuan to 4 yuan per dollar should be a simple solution. However, if the yuan strengthens, China could use it to make aggressive acquisitions of companies, acquire interests in various countries, and so on. While Japan ha punished by a stronger yen, punishing China with a stronger yuan could have the opposite effect. Thus, there is nothing to curb China's extraordinary strength except tariffs. Some criticize Trump tariffs, but it is not fair to criticize without a plan to curb China's extraordinary presence. It will take time to curb China, which controls 50% of industrial power, while the U.S. itself is heavily dependent on China for supplies.

While there is an argument to poke fun at “Trump is TACO,” it is only natural that he would change his previous statement since he would lose support if the U.S. economy took a hit and falls into a recession. A higher tactic of keeping China at bay while maintaining a certain level of economic growth is needed, and a deft hand is required.

(3) Who is Trump

There are three distinct groups of Trump supporters. One is the National Conservatives, or conservative nationalists. This group, which includes Stephen Bannon, Peter Navarro, and Vice President J.D. Vance, believes that globalism has decimated U.S. manufacturing. They are anti-global and on the side of U.S. manufacturing and workers. And since it was Wall Street that promoted globalism, they are anti-Wall Street and cannot tolerate global finance. When it comes to Stephen Bannon, he also says that he is a friend of workers, as if he is an enemy of capitalism, but in reality he supports Trump, who is like a capitalist right. I do not know if there is a rationale for this or if it is a double standard, but these are the Trump supporters, the core of MAGA (Make America Great Again). However, if they carry out their claims as they do, they will deny the international division of labor, deny the dollar hegemony system, deny international finance, and deny the dollar reserve currency system of the United States, the largest beneficiary of international finance, and they will dig their own grave. Therefore, while they say they are anti-global and anti-Wall Street, they do not actually advocate that strongly. The second group is techno-libertarians. These are those who seek the ultimate liberalism, represented by Elon Musk, and as Elon Musk quarreled with Peter Navarro, they should not be able to support the Trump administration's policies, saying that tariffs are outrageous, but their arguments often disappear along the way. The major common denominator between techno-libertarians and the Trump administration is a backlash against the anti-DEI, anti-PC, left-wing liberal ideology that is now gaining momentum in the United States. The third group is Wall Street conservatives, with people from financial backgrounds such as Scott Bessent gathering under the Trump umbrella.

Thus, three distinct groups support Trump, and Trump is running his administration by choosing between the opinions of three different people. The policy mix is a policy mix picked up from the three groups, but in the current series of moves on tariffs, international trade, and international finance, it seems that Trump trusts Scott Bessent, or Wall Street conservatives, the most to whom he has entrusted his discretion. This is welcome relief for the stock market, as they have shared interests with the financial markets. Trump is extremely skillfully trying to notice the conservative atmosphere that exists in the U.S. while trying to steer policy in the direction of stronger U.S. capitalism as a result. In this light, we can see that Trump is trying to rebuild U.S. capitalism.

3. The great contrast between the U.S. and Chinese economies

(1) China's huge imbalances and risks to the world economy

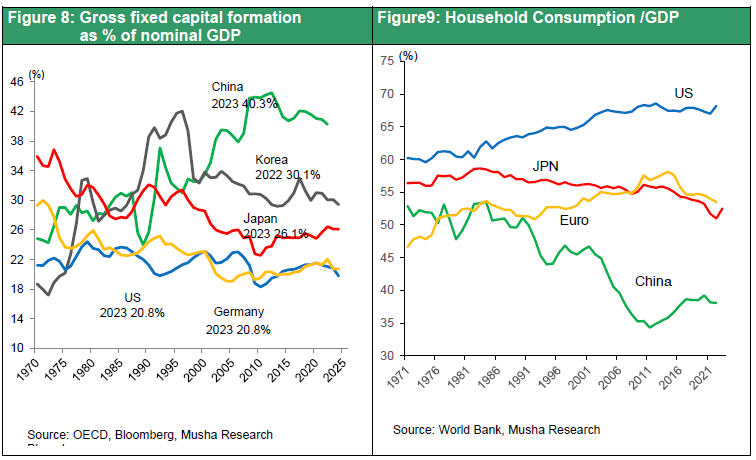

As Treasury Secretary Scott Bessent argues, the most dangerous thing for the world right now is the significant imbalances in the world economy, which are caused by China. China has 50% of the world's industrial strength, but domestic demand is extremely weak. The World Bank's ratio of household consumption to GDP for major countries shows China hovering between 36% and 37%. In contrast, China's fixed capital formation is 40% of GDP, with consumption much smaller than investment (Figures 8 and 9).

This is seen only in China and is an extremely distorted economy. China, with its weak consuming power, is now striking out into the world with an even stronger supply. China's exports have increased significantly, and even automobiles have finally overtaken Japan to become the world's largest exporter. Recently, China has been particularly focusing on its new quality production capacity, solar panels, electric vehicles, and lithium-ion batteries, which are known as the New Trio. These exports have increased significantly and have compensated for sluggish domestic demand. However, the shift of huge domestic savings into high-tech manufacturing investment and its increased supply capacity has led to a significant oversupply. For solar panels, the supply surplus is now large enough to supply all global demand in 10 years' time, and prices have fallen, resulting in significant losses for seven solar manufacturers. Going forward, this excess supply could become China's Achilles heel.

Why does the Trump administration insist on “de-carbonization”? It is true that the oil industry is behind this, but more importantly, the biggest beneficiary of “decarbonization” is China. China controls the world's supply of wind power, EVs, and solar power, and if we promote “decarbonization,” we will have no choice but to import from China. To end dependence on China, “decarbonization” must be halted. The trilemma of energy supply is that it is impossible to be “de-China dependent,” “decarbonized,” and “economically viable” at the same time. At least one of them must be abandoned, and the clearest strategy is the U.S., which has abandoned “decarbonization.” By “decarbonizing,” the U.S. can weaken its dependence on China and gain economic potential, thereby boosting the growth rate of its economy. This is the fact behind the Trump administration's set of policies. In this light, the opposition to the Trump administration's “decarbonization” policy is also a logically consistent argument.

On the other hand, China has gone ahead and created 80-90% of the world's clean energy supply capacity. If demand for clean energy falls in the future, China will have a tremendous excess supply capacity. In addition, China already has major real estate difficulties: research conducted by the IMF about two years ago showed that the ratio of local financing flatbed (LGFV) debt to GDP in 2023 was 53%, which is considered China's potential NPL, but is actually likely to be larger. Japan's financial NPLs were about 21% of GDP even in the worst phase of the crisis. This means that the potential NPLs on real estate are much larger in China today than in Japan at that time.

In fact, the price appreciation of Chinese real estate has been extreme: although the figures are for 2023, the annual income multiples of houses in Shanghai and Shenzhen are 40 to 50 times. Considering that at the peak of Japan's real estate bubble, the annual income multiple for a house in Tokyo was about 15 times, it is easy to see how China's real estate is in a bubble. Moreover, taking advantage of this real estate bubble, China's local governments are earning income from the sale of real estate (sale of land use rights), which has realized huge industrial investment. At its peak, 43% of local government income came from the sale of real estate, but this has fallen sharply and is now at the 30% level. The rise in real estate prices has benefited local fiscal revenues the most, but as real estate prices have fallen, people have been forced to increase their savings due to uncertainty about the future, which has further hurt domestic consumption, creating a vicious cycle in the domestic economy,

Under these circumstances, China's current policy of shifting huge household surpluses (= savings) to the manufacturing sector, which has a global surplus of supply, is extremely distorted, and stopping this policy is one of the most important contents of the U.S.-China talks that Mr. Bessent advocates.

(2) The Splendor of the U.S. Consumption-Driven Economy

When the world economy is in such a state, what is needed is the “power to consume” and the “power to create demand,” and the U.S. is the one that has this power. U.S. consumption exists as the savior of the world, and it will become increasingly important. The ratio of U.S. consumption to GDP was 60% in 1970; it is now 68%. While the ratio of consumption in other countries has been declining, the U.S. has created a strong consumption-driven demand pressure system. This is the essential strength of the U.S., and it is also the element that makes the U.S. the world's reserve currency. The world exports to U.S. consumption, thereby gaining the dollar, a growth currency, and as a result, a cycle of prosperity is taking place.

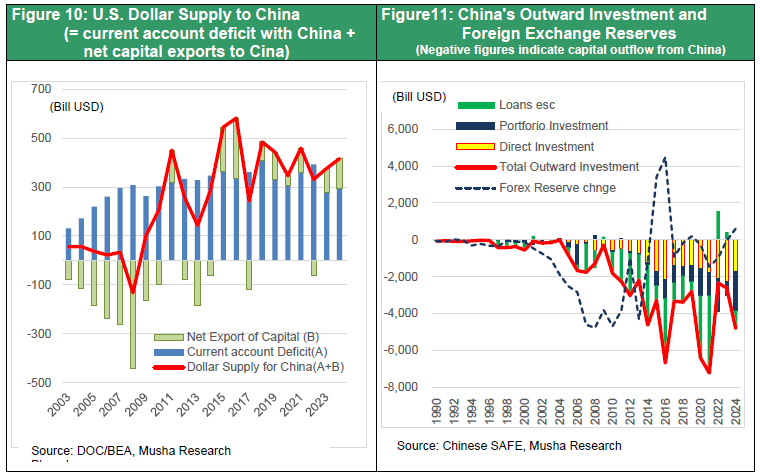

China, like the U.S., has increased its industrial power at a tremendous rate. It has also strengthened its military at a faster pace than the U.S., and during this period it has been acquiring dollars at a tremendous rate. China's means of acquiring dollars is through trade with the United States and American investment in China. This current account balance and the capital account balance is what allows China to acquire dollars, and since 2015, China's dollar acquisitions have been at the level of about $400 billion per year. China has made enormous amounts of free dollar for a decade (Figures 10 and 11). As for the use of the dollars raised, prior to the 2015 China financial crisis, a sizable portion was used to purchase U.S. government bonds as foreign exchange reserves, but after 2015, it stopped accumulating any foreign exchange reserves and began selling U.S. government bonds. China has been using a substantial portion of the dollars it has raised for outward direct investment and outward loans. The partners are the One Belt One Road countries or the Global South. In other words, it has been using the huge amount of dollars it has obtained from the U.S. to gain ground in the Global South. Then, Latin America, Africa, and ASEAN cannot complain to China.

So, can such a China be an ally of the Global South? Not at all. The reason is that China recovers the money it supplies in return for the goods it exports from China. Since China has an extremely excessive supply capacity, it is using the Global South as an outlet of China's while financing and investing them. This is an imperialistic acquisition of overseas markets, which creates a major conflict of interest between the Global South and China. Since the Marshall Plan ,90%of which was grant, the U.S. has provided the world with demand and the world has prospered by selling goods to the U.S. Today, China is superficially powerful, has a huge amount of dollars, and appears to be an ally of the Global South with its financial power, but it is developing a pattern with the Global South that is completely opposite to that of the United States. There is no way that such a China can be an ally.

An even bigger reason why consumption is important is the AI revolution. In the industrial revolutions of the past, the number of workers increased as car factories were built, factories were built, and a further virtuous cycle ensued. In the current industrial revolution, however, companies make money through investment, but no jobs are created. We must consider how we can respond to the relative decline in labor demand that is likely to occur in the future.

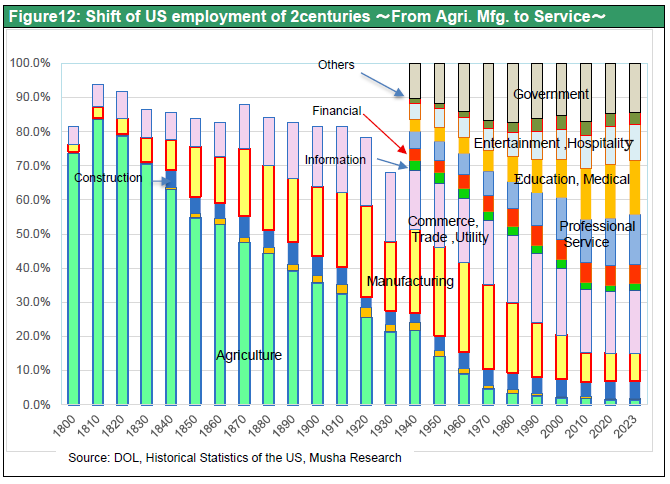

Looking at the composition of U.S. employment by industry, 80% of U.S. workers in 1800 were farmers; now, farmers account for 1.4% (in 2023) (Figure 12). However, the importance of agriculture has not disappeared. The reason for the decline in the number of farmers is that agricultural productivity has increased dramatically, eliminating the need to hire people. The same thing has happened in the manufacturing sector. At its peak, it accounted for 30% of total employment; now it accounts for 8.3%. Employment today is dominated by service industries such as “professional services,” “education and health care,” and “entertainment and tourism,” industries that did not exist at all 100 to 200 years ago. Various industries for people's enjoyment, such as professional baseball and events, as well as medical/health and educational services, have sprung up and become job providers released from agriculture. In this light, the ongoing shift to AI will result in significant job reductions in existing industries.

The key question in the age of AI is how to distribute income and employment to new industries. The answer, we believe, is "demand creation.” Demand creation" refers to fiscal and monetary bubbles. In the past, the supply of money and the creation of demand created demand for new industries, which in turn absorbed excess employment in the manufacturing and agricultural sectors. This demand, created through the creation of money and fiscal credit, is what has propelled the U.S. economy to this point.

The United States is the homeland of capitalism. The UK created capitalism but could not complete it. Finally, the UK was overtaken by the US and Germany and British industry declined. The main reason was that it profited from overseas finance and shipping but did not enrich its domestic economy. The U.S. did not follow the same path as the U.K. It created demand, and domestic demand became the recipient of new industries. It was credit creation, the most important driver of U.S. capitalism, which created domestic demand. The U.S. abandoned the gold standard, expanded its public finances, and at times provided various forms of capital to foreign countries under the dollar standard. By creating demand in this way, and by supplying jobs to those who have been made redundant by increased productivity, and to those who have emigrated from abroad, the U.S. economy has become stronger.

In the U.S. government policies are justified by only one rationale that improve the standard of living of its citizens. It is not restriction of credit, reduction of government debt or avoiding bubble creation. The national interest of the United States depends on this one thing, and Trump is always thinking about it. The U.S. democracy is evaluated based on whether the people's standard of living improves or not.

On the other hand, China does not have the most important golden rule of raising the standard of living, and unfortunately, neither does Japan. We would like to point out the difference between the United States, where the national goal is in focus, and China, where it is misaligned, and Japan, where it is beginning to be considerably misaligned.

This will only intensify as the AI revolution increases productivity and creates a surplus of supply capacity. What is required of Japan in the future is “how to create effective demand” and "how to raise people's standard of living as much as possible.

They are too anxious about the future and neglect efforts to raise their standard of living. Or, instead of spending income in the direction of raising the standard of living, they put it into savings, and eventually the surplus money flees overseas. This is Japan today. Thus, how healthy the U.S. is in terms of consumption, and how different it is from China and Japan.

4. The Japanese Economy and Investment Opportunities

(1) Improved Corporate Profits and Left Behind Consumption

Japan's prolonged slump is over, and stock prices have risen fourfold since their 2011-2012 bottom. The Japanese economy is in the process of a long-term recovery. The Japan bashing is over, the super-strong yen is over, and, in fact, the weakening of the yen has led to a significant recovery in competitiveness. Another factor is that Japanese companies have changed their business models. Once competing to be number one in the world, they have lost out to competition and shifted to the area of “only one,” where there is little competition, and more companies are now competing in the blue ocean with various innovations. Like Sony, which successfully shifted from electronics to content, many Japanese companies have drastically changed their business models and are now poised for long-term growth. In addition, Japanese people are diligent to begin with and have realized a variety of artisanal technologies through the sweat of their foreheads. A Harvard University study points out that Japanese companies rank number one in complexity in the world.

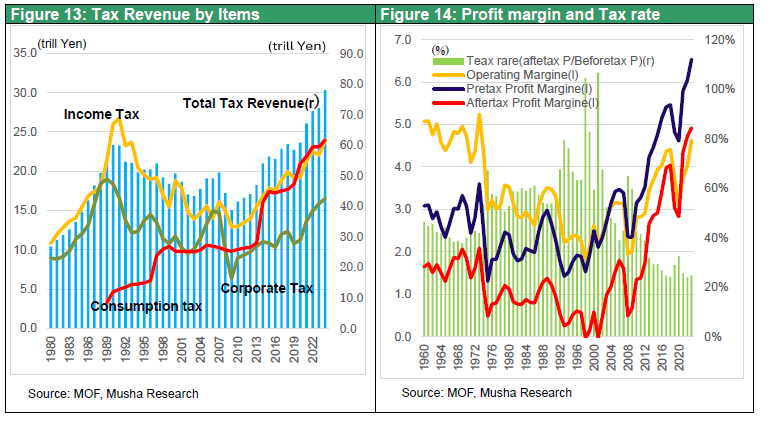

Japan's resurgence, however, is limited to the corporate sector. According to the Corporate Statistics of MOF, the after-tax profit margin has exceeded 5%. Considering that it was around 2% even during the high-growth period, it is clear that companies have become more profitable. One of the reasons is "global expansion.” Since they cannot make money domestically, they have expanded globally, and revenues from various patent rights, technology royalties, and dividends have increased significantly. In addition, the financial balance has also improved greatly. Furthermore, tax rates have dropped dramatically. In the past, the effective corporate tax rate in Japan was 55%-60%. The effective tax rate, which was close to 100% at its peak after the collapse of the bubble economy, is now below 30%. The significant tax benefits have led to a dramatic recovery in corporate profits. With these profits, companies have been able to significantly increase their dividend payments. The ratio of dividends to GDP for Japanese companies is 6%. In the U.S., it is 4%, much higher for Japanese companies.

In addition to corporate profits, tax revenues have also risen. Tax revenues have been rising by 5-6 trillion yen compared to the initial budget recently and are expected to be around 80 trillion yen in FY 2025 (Figure 13 and 14). One reason is that inflation has increased taxable income in the economy in nominal terms, and another is the consumption tax hike. Looking at tax revenues by item, the consumption tax is the largest tax revenue item at 25 trillion yen, all of which is borne by households. On the other hand, corporate taxes are below their peak level. Even though corporate profits have tripled, corporate tax revenues are below their peak level. This shows how corporations are being given preferential treatment in the tax system and households are bearing a high burden.

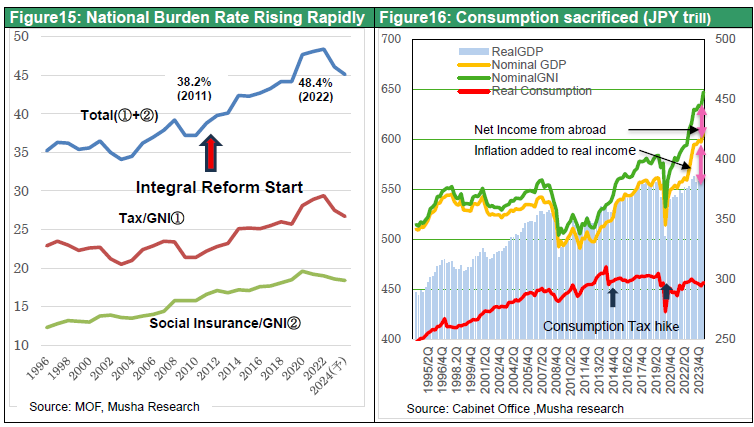

In addition, the burden of social insurance premiums on households has been rising since 2010, with the ratio of social insurance and taxes to national income rising from 38.8% in 2011 to 48% in 2022, an increase of 10 percentage points in 10 years, due to the consumption tax hike and other factors. This is an incredibly harsh increase (Figures 15 ).

In 2012, under the then Democratic Party of Japan's Noda administration, a comprehensive reform of the social security and tax systems was implemented.

From now on, the proportion of working people will decline due to the falling birthrate and aging population, and their income will decrease. Therefore, tax increases are necessary to sustain stable social insurance and pension services. It was then decided to increase the consumption tax as a stable source of revenue that would not be affected by economic fluctuations. As a result, while companies made money and tax revenues increased significantly, only household consumption was severely damaged: real consumption in GDP peaked at 310 trillion yen in the January-March 2014 period and has been falling ever since, hovering at a level 4-5% below the peak. This is an extremely distorted situation (Figure 16).

Whereas in the U.S., consumption has been increasing, thereby boosting demand, and improving people's standard of living, the situation in Japan is exactly the opposite. Even if companies make money, wages do not rise. Even if wages rise a little, they are eroded by inflation. In addition, our standard of living has been declining for a decade due to higher taxes and higher burdens.

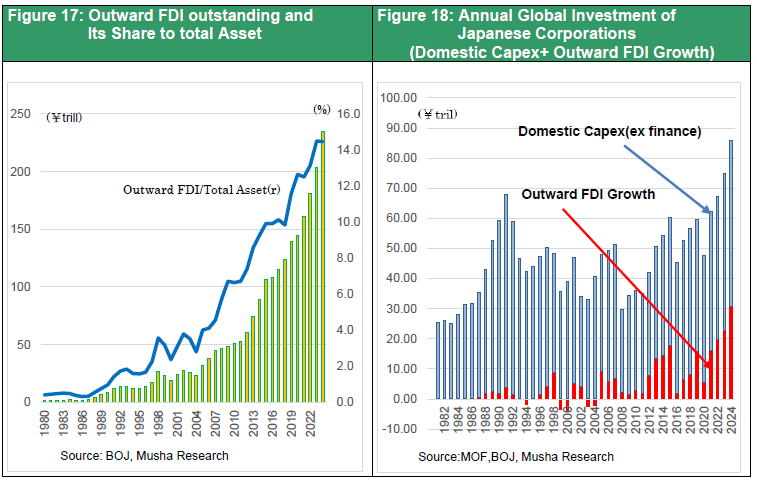

Japan's economy is in a very distorted state and is similarly serious as China's. There is ample corporate income and savings, but it has not been linked to the most important improvement in people's lives. Japan's global presence would certainly increase if the money made by corporations were channeled into overseas investments. In fact, global investment by Japanese companies is increasing, mostly in the US. Prime Minister Ishiba told Trump that “Japan has invested $800 billion in the U.S.” and he came back home with a triumphant tone. If that money had been invested in Japan, a booming economy would have arrived. However, Japanese companies have put all their savings into overseas investments. They will continue to be misled by Trump's words and invest more in the U.S. (Figure 17 and 18).

This is the main reason why the British Empire declined in the first place. The rich British neglected to improve their domestic standard of living and consumption and channeled this money into global investment. The U.S. transcontinental railroad was financed by British capital. Thanks to this, the U.S. has grown enormously thanks to foreign capital and domestic labor. It was also the British who developed Switzerland's tourism resources. The wealthy in the U.K. visited Switzerland's tourist attractions and spent their money there, making Switzerland the world's largest tourist destination. The UK, on the other hand, became poor as all its savings went overseas.

Japan is now trying to do something similar. This is the reality, and the political helm must be changed. If Japan's extremely ample savings surplus begins to circulate as domestic investment, it could become a major source of power. What is needed for this to happen is a consumption tax cut. It is necessary to change the extremely distorted tax burden on individuals and create a situation in which people can feel secure in putting their money into consumption. The fact that real income continues to be negative even though wages have risen so much is an extraordinary situation.

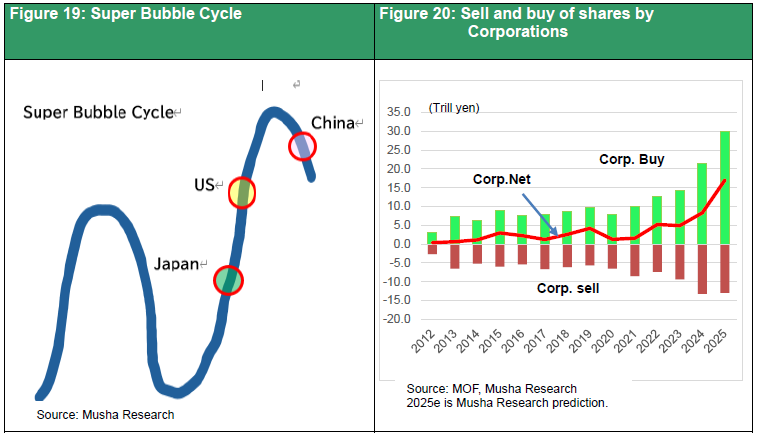

(2) A change in policy will boost stock prices

In the first place, Japanese stocks are extremely undervalued, and in addition, the supply-demand balance for stocks in Japan is extremely favorable. If the issues discussed above are resolved, it is quite possible that they will blossom and lead to a major stock market rally. Until now, profits have been made by investing in global companies, companies that make money across the globe, but if a virtuous cycle of domestic consumption and investment occurs, Japanese stock prices could be boosted by domestic stocks. Looking at the super bubble cycle, Japan is the furthest away from a bubble state. With China past the peak of its bubble and the U.S. near the peak of its bubble, Japanese equities are extremely attractive.

As for the supply-demand balance for Japanese equities, foreigners have sold more than 12 trillion yen in the past year, compared to the approximately 8 trillion yen they bought in the previous year, resulting in a large oversold position, but the supply-demand balance is so favorable that foreigners have had to rush to buy back Japanese stocks because they have sold too much. In addition, there has been a sudden boom in share buybacks: while 21 trillion yen in 2024, about 30 trillion yen in share buying by corporation (mostly share buybacks) are expected in 2025 and share buybacks on this scale will have far more power than foreign and BOJ ETF purchases. Furthermore, if households that have been buying U.S. stocks through NISA also decide that it is time to buy Japanese stocks, it is extremely likely that Japanese stocks will rise significantly in terms of supply and demand.

So, what triggers these changes? The key is a change in policy. If a new administration is born that at one stroke turns the helm toward domestic demand and domestic investment, Japanese stocks will rise by 20-30% in brief period. In fact, German stocks have risen 20% since the beginning of the year, and the reason for the rise is the shift in Germany's fiscal policy. A similar major market may occur, depending on changes in policy. In this regard, the upcoming election will be quite important. As an investor myself, I am secretly hoping that the administration will be one that will lead to higher stock prices.