Sep 22, 2025

Strategy Bulletin Vol.386

The Resurgent Fear of Missing Out on Japanese Stocks

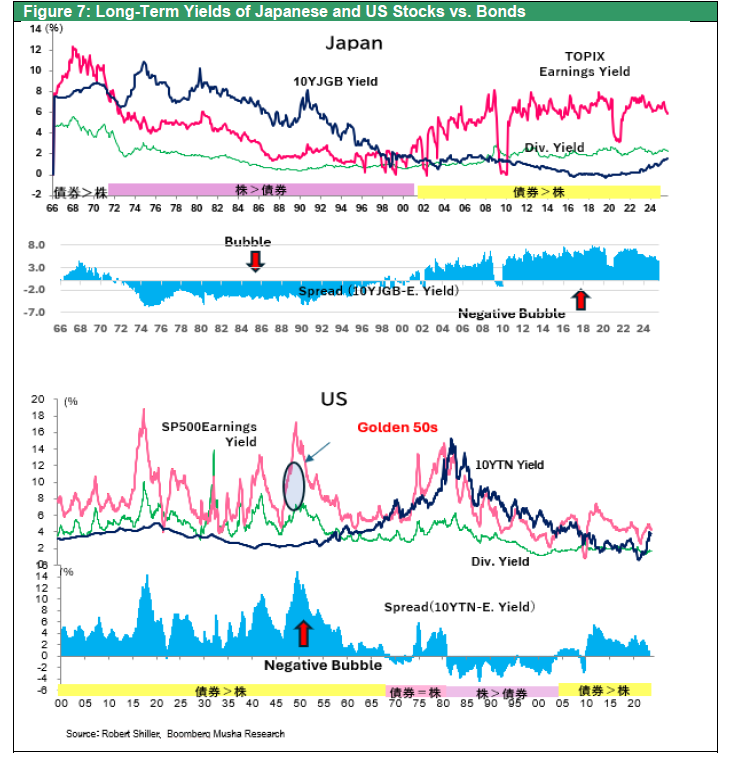

Market Hits New Highs, Surging 47% in Five Months

Who could have predicted a 47% increase to ¥45,800 (September 19) just five months after the April 9 low of ¥31,200—a 20% plunge triggered by the Trump tariff shock? Despite ongoing political turmoil, Japanese stocks continue to hit record highs. Even after this rise, Japanese stocks remain extremely undervalued, suggesting further upside potential. This trend is unlikely to change regardless of whether the new LDP president is the market-favored Ms. Takaichi or Mr. Koizumi. Mr. Koizumi has Mr. Kihara, who spearheaded the “New Capitalism” strategy in the Kishida cabinet, as his chief advisor.

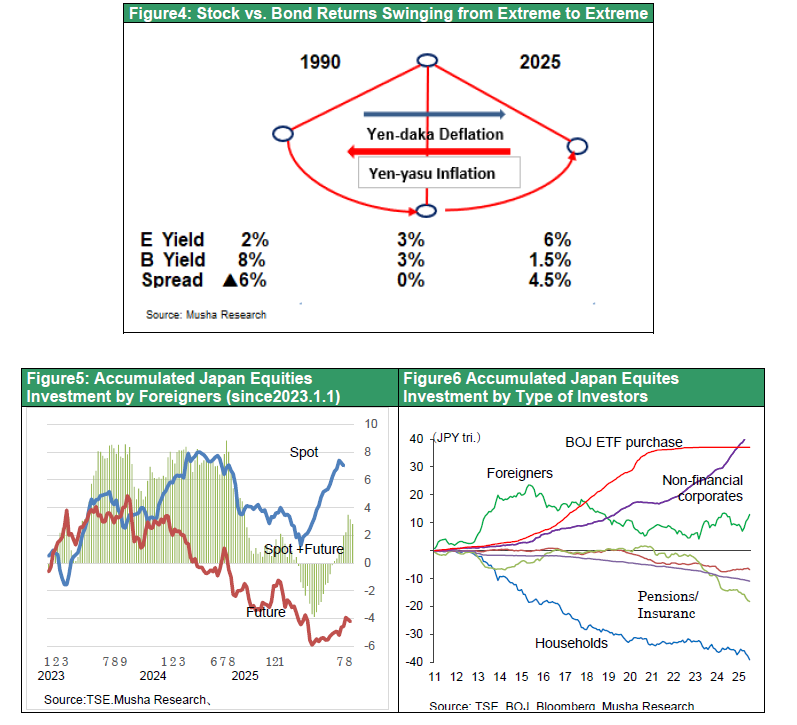

Stocks offer a dividend yield of 2.4% alone, and the earnings yield (the inverse of the P/E ratio) stands at 5.7%, significantly exceeding government bond yields and indicating an extremely undervalued state. Yet, of Japan's household financial assets totaling ¥1624 trillion (excluding pension insurance reserves), a staggering 68% is held in cash and deposits earning near-zero interest, while stocks and mutual funds account for a mere 25%. This represents a remarkably irrational investment attitude. By comparison, in the US, 74% of the $94.5 trillion in household financial assets under management (excluding pension insurance reserves) is in stocks and mutual funds, with cash and deposits accounting for only 16%. Now, serious reflection is emerging regarding this risk-averse, rigidly irrational investment stance among Japanese investors.

A Message from an Investor

A listener to a radio program sent the following message: "I always listen. Mr. Musha's comments are always convincing. My part-time income is about 80,000 yen per month, and my pension is similarly just under 100,000 yen per month, but my dividend income is 200,000 yen per month after taxes. I have been seriously investing in stocks for 20 years, and I thank myself for deciding to start stock investing 20 years ago. During last August's Bank of Japan Ueda shock, the COVID shock, and the Lehman shock, my portfolio dropped over 2 million yen in a single day. Yet I kept investing, and my dividend income eventually surpassed my salary income. Before complaining about stagnant wages, wouldn't it be better to act and invest to increase your income?"

The Inequality Wrought by Stock Investing

This individual receives 240,000 yen in monthly dividends before taxes; annualized dividends total 2.88 million yen. Calculating backwards from the Tokyo Stock Exchange average dividend yield of 2.4% suggests an estimated investment principal of 120 million yen. Since the Nikkei average was 12,000 yen twenty years ago, stock prices have risen 3.75 times since then. This means the original principal twenty years ago was calculated to be 32 million yen. Now, if someone had only kept bank deposit from 20 years ago until today, that ¥32 million principal would remain unchanged, with almost zero monthly interest income. This stark disparity created by stock investments isn't limited to individual households. It applies to foreigners, pensions/insurance, and corporations too – something Japanese citizens are facing.

Indeed, Japanese investors are inevitably gripped by FOMO (Fear of Missing Out) on rising stock prices. People are finally recognizing the absurdly undervalued state of Japanese stocks and must seriously consider the risk of not holding them. This signals a torrent of massive investment capital beginning to flow into Japanese equities.

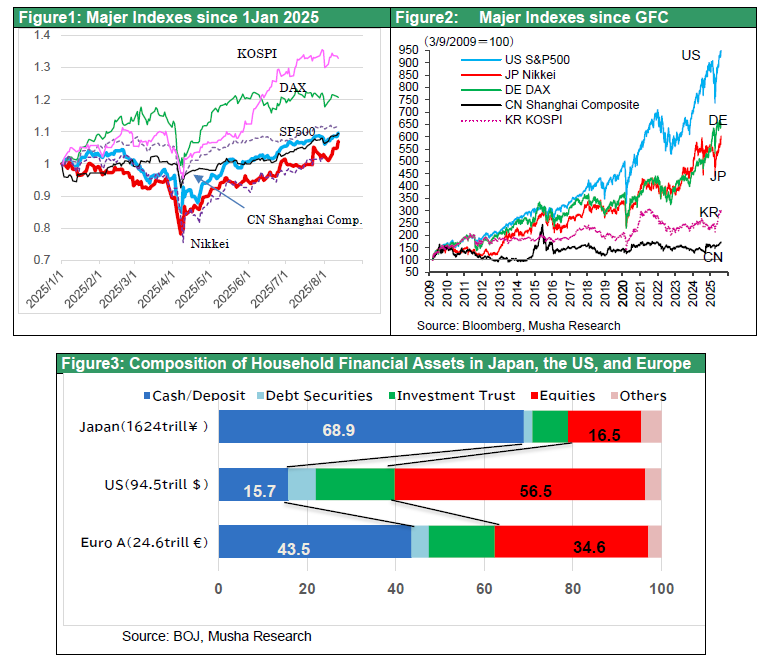

Let us look at the situation of each major investor group

1) Foreign investors, previously the largest investors, not only failed to increase their holdings of Japanese stocks but sold all of them. They sold a net 12 trillion yen from August last year (during the Ueda shock) to April this year and are now buying back. However, they have only just bought back half of what they sold. 2) Among individual investors, the NISA reform has sparked an investment boom, with 8.8 trillion yen purchased from January to June 2025. This represents an annual pace of 20 trillion yen. While overseas investment trusts currently account for most purchases, a rapid shift toward Japanese stocks is likely to occur. 3) Corporate entities have significantly increased their share buybacks since last year. Reasons include requests from the Financial Services Agency and Tokyo Stock Exchange to correct valuations below a PBR of 1, concerns that excessive cash holdings could make them M&A targets, and the fact that buying back shares is the most advantageous use of surplus funds. According to TSE data, corporate net share purchases (Jan-Aug) are projected at ¥2.8 trillion in 2023, ¥4.5 trillion in 2024, and ¥7.6 trillion in 2025, maintaining a 70% year-on-year growth pace. 4) Institutional investors like pension funds are also being forced to reduce their Japanese government bond holdings and shift toward equities amid entrenched inflation and rising interest rates. Government requests for more aggressive public pension fund management, such as through the KKR-style public pension fund (KKR), are gaining traction.

Thus, all investment entities are being pushed toward Japanese stocks. There is no doubt that a stock-centric asset management system is beginning to take hold in Japan with overwhelming momentum. Each time Japanese stock investors were halted by successive sharp declines—such as last year's Ueda shock, the Ishiba shock, and this year's Trump tariff shock—they were reminded once again of FOMO (the risk of not owning Japanese stocks). Please refer to the following stark data. Particularly, carefully consider the historical valuation trends for Japan and the US in Chart 7.

Figure 1: Major Country Stock Indexes Year-to-Dat

Figure 2: Major Country Stock Indices Since the Lehman Shock

Figure 3: Composition of Household Financial Assets in Japan, the US, and Europe

Figure 4: Stock vs. Bond Returns Swinging from Extreme to Extreme

Figure 5: Cumulative Investment in Japanese Stocks by Major Investors (Since 2011)

Figure 6: Cumulative Investment in Japanese Stocks by Foreign Investors (Since 2023)

Figure 7: Long-Term Yields of Japanese and US Stocks vs. Bonds