Oct 10, 2025

Strategy Bulletin Vol.388

Sanaeonomics: Nikkei 100,000 in Sight

~Ms. Takaichi to Lead Long-Term Administration and Achieve Abe's Reforms~

Q) Ms. Takaichi has been elected LDP president, paving the way for Japan's first female prime minister. The stock market is rallying in welcome. How should we interpret this market movement?

A Sustained Long-Term Uptrend in Sight

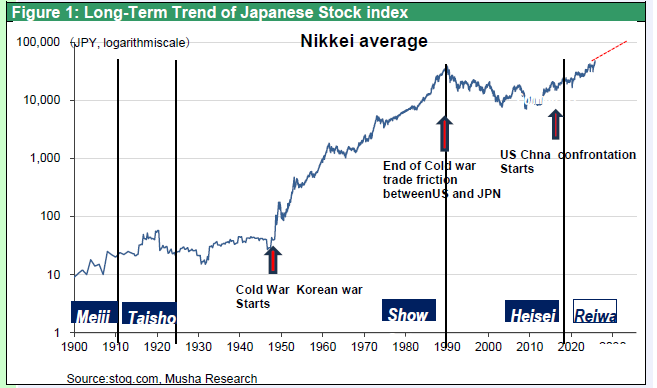

Musha) First, this significantly boosts the potential for a long-term uptrend in Japanese equities. Japanese stocks entered a long-term uptrend following the establishment of the second Abe administration in December 2012. Depending on where one sets the starting point, the Nikkei Average has grown at an annual rate of 10-13% up to the present. If this trend continues, calculations suggest it will reach 100,000 yen by 2031 or 2033 at the latest and reach 120,000 to 160,000 yen by 2035.

Figure 1: Long-Term Trend of Japanese Stocks

Q) Why is the bull market since Abenomics expected to continue? Other than the fact that Ms. Takaichi is widely seen as the successor to Mr. Abe.

Abenomics Achieved Much, but Failed to Solve Consumption Stagnation Due to Policy Error

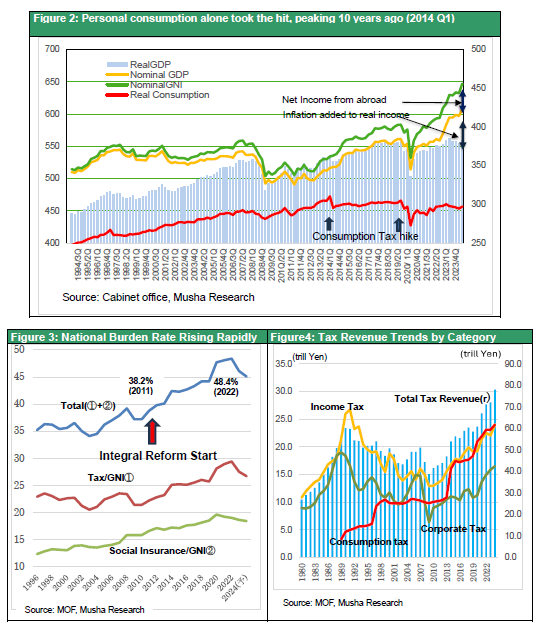

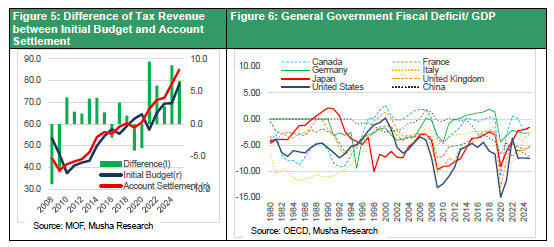

Musha) The reason Abenomics remains unfinished and has not achieved its goals lies solely in policy errors. The failure to meet objectives means that while corporate earning power has fully recovered, stock prices have quadrupled, and tax revenues continue to surge significantly, individuals' living standards have been forced into prolonged stagnation. Real household consumption remains below its peak level from ten years ago. The cause lies in excessive taxation. Under the banner of the “integrated tax and social security reform,” the national burden rate was brutally raised from 38% in 2011 to 48% in 2022. Even the long-awaited wage increases have failed to keep pace with inflation, and the increased tax burden is directly hitting consumption. Meanwhile, inflation has consistently driven tax revenues significantly higher than projected. Consequently, Japan's fiscal deficit (as a percentage of GDP) is projected to be 1.8% in 2025 (OECD estimate), the best among G7 nations. Conversely, the squeeze on consumption caused by the increased tax burden is the primary reason Japan's GDP growth rate has been pushed down to the lowest among G7 nations. The IMF Economic Outlook projects Japan's growth at 0.2% in 2024 compared to 2.8% for the US and 0.9% for the Eurozone, and at 0.7% in 2025 compared to 1.9% for the US and 1.0% for the Eurozone.

Ms. Takaichi's Mission: Correcting Policy Errors

The Takaichi administration will tackle these remaining challenges. In other words, the correction of policy errors is now in sight. Going forward, Japan's economy will likely boost its growth rate through consumption-led expansion. The departure of Yoichi Miyazawa, chairman of the LDP's Tax Commission, who had been an obstacle to proactive fiscal policies and tax cuts, has already been decided.

Figure 2: Stagnant Real Consumption

Figure 3: Tax Revenue Trends by Category

Figure4: The Rapid Rise in the National Burden Ratio

Figure 5: Substantial Tax Revenue Surpluses Becoming the Norm

Figure6: Japan's Best Fiscal Balance Among G7 Nations

Q) Corporate profits are strong, and Musha Research has explained that stock prices are extremely undervalued. So, with all these favorable conditions in place, the only thing that was wrong was policy, right? It sounds a bit too convenient to say that, excluding policy, all the conditions for a long-term stock market rally are in place.

Anti-Abenomics faction becomes obstacle to Abenomics achievement

Musha) It sounds too good to be true because Prime Minister Abe's Abenomics achieved the most challenging task: restoring corporate earning power and implementing corporate governance reforms that had been criticized by foreign investors. Abenomics accomplished the hardest part, but then policy interference kicked in. Bound by the administration's founding pledge of “integrated tax and social security reform,” it was forced to raise social insurance premiums and implement two consumption tax hikes, preventing a full recovery in consumption.

Those who have criticized Abenomics—the hardliners advocating fiscal consolidation and the mainstream economic commentariat opposed to Governor Kuroda's extraordinary monetary easing—have in fact obstructed its completion and success. Professor Emeritus Hiroshi Yoshikawa of the University of Tokyo published an article stating “Large-scale easing is entirely wrong” (Asahi, 1/11), while former University of Tokyo Professor Toshihiro Ihori published an article urging “Face the critical fiscal situation head-on” (Nikkei, 8/8). They have disparaged the Japanese economy, justifying statements like those of former LDP Secretary-General Ishiba that Japan's debt burden is the world's worst, worse even than Greece's.

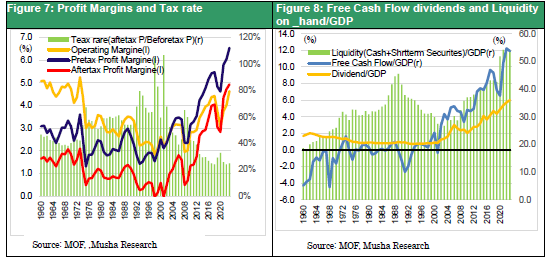

Figure 7: Rapidly Rising Corporate Profit Margins, Sharply Falling Effective Tax Rates

Figure8: Significantly Strengthened Corporate Earning Power (Free Cash Flow) and Surplus Funds

Q) Advocates for fiscal consolidation express concern about rising interest rates. In 2022, the UK's expansionary fiscal policy triggered a triple dip recession. Japan's long-term interest rates have also surged: 0.6% in early 2024, 1.1% in early 2025, and 1.7% on October 9, 2025.

Japan, with its massive savings surplus and current account surplus, cannot experience a Truss Shock

Musha) There is absolutely no concern about a repeat of the UK's Truss Shock (where the Truss administration's massive fiscal spending in September 2022 triggered rising interest rates, currency depreciation, and falling stock prices, leading to the government's short-lived tenure). The circumstances in the UK and Japan are completely opposite. The Truss Shock occurred because massive fiscal spending was announced against a backdrop of: 1) a long-term, substantial current account deficit coupled with negative net foreign assets, 2)the erosion of London's standing as an international financial center and capital outflows, and 3)overheating and high inflation. Japan's situation is the exact opposite of ① to ③; rather, it continues to enjoy massive savings surpluses and current account surpluses. Japan's rising interest rates stem from escaping deflation and the Bank of Japan's rate hikes, representing a healthy increase.

Parallel rise in interest rates and stock prices resembles the Golden 50s and 60s in the US

The appropriate comparison is the rise in US interest rates during the 1950s and 1960s. As the economy transitioned from deflation to growth and long-term rates rose gradually, animal spirits soared, fueling a prolonged stock market rally. The substantial negative yield spread narrowed. In Japan too, as interest rates rise and stock prices climb, the decline in earnings yields will continue, significantly narrowing the negative yield spread. Please refer to Figure 12 at the end of the report showing the trends in Japanese and U.S. stock earnings yields, government bond yields, and yield spreads.

Q) The Takaichi administration is a minority ruling party facing numerous obstacles to policy implementation. Can it overcome them?

Takaichi has three advantages: public support, market support, and...

Musha) While the LDP anti-Takaichi faction pushing fiscal consolidation, the ruling Komeito party, and the Constitutional Democratic Party may resist policy shifts, Takaichi's prospects are strong. First, she has the backing of public opinion. Aggressive fiscal policy and growth-first measures were the strong voice of the people in the recent House of Councillors election. The reformist conservative parties—the Democratic Party for the People, the Sanseito Party (Party of Do It Yourself), and the Japan Conservative Party—which responded to this, won. The established parties, the LDP, Komeito, and CDP—which turned their backs on it, lost. However, the reformist conservative parties faced doubts about their ability to govern, putting the realization of their policies in jeopardy. The birth of the Takaichi administration marks a major shift in the ruling LDP's agenda, moving away from fiscal consolidation toward an expansionary fiscal policy. With the cooperation of the three reformist conservative parties, the likelihood of policy implementation increases.

Second, there is market support. The fiscal consolidation path does not have the backing of the critically important markets either. Stock market reactions at the start of past administrations have been divided. When Mr. Kishida, who proposed financial income taxation, and Mr. Ishibashi, who advocated fiscal consolidation, took office, the stock market reacted with a sharp decline, forcing them to ease their strict fiscal stance. In contrast, when the second Abe administration took office, the Nikkei Average surged 73% in just six months, bolstering Mr. Abe's policy implementation (Abenomics). Without stock market support, Abenomics would have faltered. This year's stock market trends in various countries also reflect policy evaluations. South Korea's market has surged 47% year-to-date, rising 28% since the Lee Jae-myung administration took office (June 4). Germany's market is also performing well following the formation of the Merz administration (May 8), which shifted to proactive fiscal policy.

Figure9: Year-to-Date Stock Price Trends in Major Countries

Figure 10: The Initial Momentum of the Abenomics Market Expected to Repeat

The Existence of Huge Hidden Assets

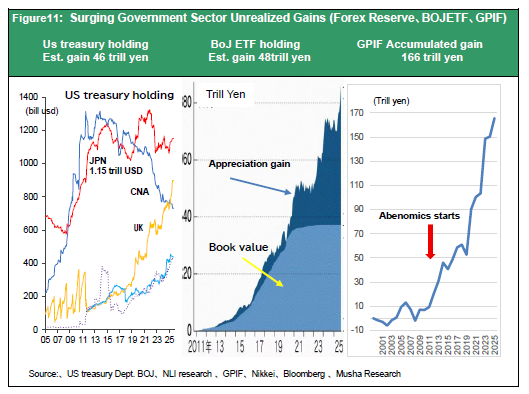

Third, there are huge hidden assets. In addition to significantly higher-than-expected tax revenues, these include:

1) GPIF's massive cumulative investment returns totaling ¥166 trillion (as of end-June 2025),

2) Estimated foreign exchange gains on US Treasury bonds held by the Foreign Exchange Fund: ¥46 trillion (assuming an acquisition cost of ¥110, valued at ¥150),

3) unrealized gains on the Bank of Japan's ETF holdings of ¥48 trillion (estimated by Mr. Ide of NLI Research Institute as of September 19th (Nikkei, September 20th)).

All these are outcomes of Abenomics and can be allocated as funding for Ms. Takaichi's policy initiatives. Among these, the foreign exchange gains from the Foreign Exchange Special Account and the unrealized gains from the Bank of Japan's holdings can be used for anything, including defense, national resilience, and research and technological development. GPIF’s accumulated investment gains can also be utilized for pension reform (significantly increasing benefits) and returned to public welfare. This shows how misguided the criticism from opponents that Abenomics brought nothing, but a weak yen and high stock prices truly were.

Figure11: Surging Government Sector Unrealized Gains (Foreign Exchange Account, BOJ, GPIF)

Q) If you say that a rising stock market will ensure the success of the Takaichi administration and lead to a long-term government, then the premise is that the stock market must rise. If the stock market does not rise, does that mean the Takaichi administration will fail?

The stock market supports growth policies

Musha) That's the key point. The most crucial point is whether Ms. Takaichi's policies will push up stock prices and foster growth in the economy and people's livelihoods. The austerity policies advocated by those who have criticized Ms. Takaichi have suppressed economic growth and consistently dampened stock prices. Going forward, the errors in the arguments of academics and media outlets critical of Abenomics and Ms. Takaichi's policies will be exposed by rising stock prices and economic growth.

The battle between pessimism/tax hike advocates and optimism/tax cut advocates is already decided

The Ministry of Finance, advocating fiscal consolidation, along with sympathetic academics and media, argued: “Japan's future is bleak due to declining birthrates and deflation. To maintain services like pensions and health insurance, tax hikes and higher burdens are necessary.” Told to accept tax hikes because the outlook is grim, consumers became increasingly hesitant and cut back on spending. However, a pleasant surprise occurred. Japan escaped from deflation, corporations became profitable, and tax revenues have consistently far exceeded estimates. Taxes were being collected in excess.

The future of the Japanese economy is bright. A shift to optimism is necessary—the view that tax revenues will continue to rise even without tax hikes, ensuring the stability of pensions and health insurance. Tax cuts would further boost consumption, and tax revenues are expected to increase even more due to heightened economic growth. Such optimism is welcomed by the stock market, pushing up share prices.

Q) Mr. Trump sent encouragement to Ms. Takaichi. He is visiting Japan as early as late October. Improved Japan-U.S. relations should be a positive factor, right?

Ms. Takaichi Welcomed by the World

Musha: Mr. Trump described her as “a respected figure with deep wisdom and strength.” He then offered his congratulations, saying, “This is wonderful news for the Japanese people. Congratulations.” Ms. Takaichi is the next leader recommended by Mr. Abe, who is deeply respected by President Trump and Treasury Secretary Bessent, and her belief based on national conservatism are well-matched.

Q) If the three factors of policy change, high stock prices, and good Japan-U.S. relations come together, the prospect of a long-term Takaichi administration opens. If there are any concerns, what are they?

How to overcome the hurdle of a minority ruling party

Musha) There are hurdles that must be overcome to achieve tax cuts, high stock prices, and economic growth. As ruling party is minority , cooperation with the opposition is essential, but the Komeito party is reluctant to form a coalition with Takaichi's LDP. First, obstacles must be overcome to coordinate with opposition parties and implement policies. If the administration runs aground due to obstruction from Komeito or anti-Takaichi factions within the LDP, stock prices could temporarily take a hit. A meticulous start for the Takaichi administration is hoped for.

On the other hand, if these hurdles are cleared, a powerful stock boom like the one seen at the start of the second Abe administration (as shown in Figure10) could occur.

Figure 12