Oct 12, 2025

Strategy Bulletin Vol.389

General Election and The Takaichi Boom will lead the Scenario for the Nikkei Reaching 60,000

Musha Research released its “Strategy Bulletin (No. 388) - Sanaeonomics, Nikkei Average 100,000 in Sight ~ Toward a Long-Term Takaichi Administration to Achieve Abe's Reforms ~” early Friday morning, October 10th. That same afternoon, news broke that the Komeito Party had dissolved its coalition with the LDP, raising the possibility that Ms. Takaichi might not be elected Prime Minister. Stock prices plunged 6% in the futures market. However, Musha Research believes there is no need whatsoever to alter the analysis and assertions in the October 10th report. The unstable period leading up to the selection of Prime Minister Takaichi is, in fact, seen as a favorable bottom-fishing opportunity. Below, we outline the optimistic scenario. The 60,000 yen mark by 2026 is within reach.

Difficult start as feared, but Takaichi's nomination as Prime Minister is almost certain

Last Friday's (10/10) news of Komeito leaving the coalition shocked the Japanese public and markets. The possibility emerged that Ms. Takaichi might not be selected as Prime Minister. The Prime Minister is selected by the person who secures a majority in the House of Representatives. However, if no candidate secures a majority in the first vote, a runoff between the top two candidates will be held, and the one receiving the majority in that runoff will be nominated.

The latest House of Representatives seat distribution by party shows the ruling coalition holding 220 seats (LDP 196, Komeito 24) against a majority threshold of 232 seats. Conservative opposition parties hold 74 seats (Democratic Party for the people 27, Japan Innovation Party 35, Volunteers for Reform 7, Sanseito 3, Japan Conservative Party 2), liberal opposition parties 165 (Constitutional Democratic Party 148, Communist Party 8, Reiwa Shinsengumi 9), and independents 6. No party holds a majority.

The Constitutional Democratic Party promptly called for cooperation among opposition parties, proposing Mr. Tamaki of the Democratic Party for the People as their unified candidate. However, the Democratic Party has rejected cooperation without policy alignment on key issues like national security, energy, and economic policy. The Japan Innovation Party aligns with the Democratic Party for the People stance. Furthermore, Komeito leader Saito has stated voting for an opposition candidate is unthinkable. Consequently, it is considered virtually certain that LDP member Takaichi will be designated Prime Minister in the runoff vote.

Prime Minister Takaichi will be like a fish in water

The new Prime Minister Takaichi will begin energetic activities immediately upon taking office, fully prepared. With the cooperation of reformist conservative parties, she will pass a supplementary budget including measures to tackle inflation, tax credits with cash payments, the abolition of provisional rates for gasoline and light oil taxes, and support for hospitals and nursing care facilities. On the diplomatic front, the new Prime Minister Takaichi is expected to make a spectacular debut with Trump's visit to Japan and the ASEAN Summit. Authoritarian states—China, Russia, and North Korea—demonstrated blatant solidarity through the Shanghai Cooperation Organization and the September 3rd commemoration of the “80th Anniversary of the Victory of the Chinese People's War of Resistance Against Japanese Aggression and the World Anti-Fascist War.” The Trump administration, having achieved Middle East peace, is shifting its focus to Asia and seriously pursuing cooperation against China Russia, and North Korea. Expectations for Japan, as a key player in this strategy, are rising.

Early Dissolution and General Election Likely; Takaichi Boom Could Help LDP Recover Lost Ground

The possibility of an early dissolution and general election is high. If opposition to Takaichi's policies intensifies and politics stalls, she will play her trump card: dissolving the Diet for a general election. Conversely, if policies proceed smoothly and public confidence in the administration grows, she will dissolve the Diet to correct the abnormal situation of a minority ruling party.

The key lies in Takaichi's popularity. It is anticipated that her popularity will rise for the following three reasons:

1) Support for policies ➡ The new LDP policies proposed by the Takaichi administration—centered on growth policies via expansionary fiscal measures, cautious immigration policies, and enhanced security measures—are likely to gain public support. These new policies closely resemble those of the three reformist conservative parties that won popular support in the recent House of Councilors election, potentially drawing back the core conservative LDP voters who had previously shifted to those parties.

2) Evaluation of the Takaichi administration's initial policy implementation and execution capabilities ➡ The public, weary of three months of political stagnation due to Mr. Ishiba's prolonged tenure, enthusiastically supports Ms. Takaichi's ability to get things done.

3) Takaichi's personal popularity surges ➡ Mainstream media's anti-Takaichi coverage (such as reports saying, “We'll bring down her approval ratings,” “Photos that lower her ratings,” or “We'll only write things that hurt her ratings”) will fuel underdog sympathy. Furthermore, the exaggerated image of Takaichi as a tough-looking right-wing politician is expected to be corrected. Given her overwhelming popularity on social media, a repeat of the Hyogo prefectural governor election outcome is conceivable.

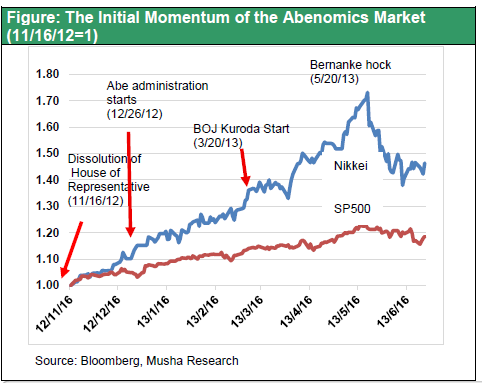

This could resemble the initial phase of the Abenomics rally (73% gain in 6 months)

Any near-term stock price decline due to political uncertainty is temporary. Once a full-fledged Takaichi administration is established and the prospect of a long-term government becomes clear, a sharp rally is highly probable. If the LDP under Takaichi wins the general election following a dissolution, the scenario could mirror the initial Abenomics rally, which surged 73% within six months of the administration's launch. International investors, starved for attractive investment targets, cannot afford to overlook the investment opportunities the Takaichi administration will create. All domestic and overseas investor groups will keenly feel the FOMO (the risk of not owning Japanese stocks)