Oct 24, 2025

Strategy Bulletin Vol.390

The Crucial Difference Between Ms Takaichi and Mr. Abe

~ Why Ms Takaichi Could Become Japan's Thatcher ~

Discussing the significance of Prime Minister Takaichi's inauguration. Japan's first female prime minister. Despite this historic achievement preceding the US and France, public recognition remains low. What will happen next? Musha Research explains its perspective.

Q) The media and experts describe this as a difficult start, yet the stock market, hitting record highs daily, shows vastly different enthusiasm. Which assessment does Musha Research consider more valid?

Musha) The market's fervor is correct. The intense stock rally will persist, and the Nikkei 100,000 mark should be visible within three years, or five at the latest.

Q) That's a strong outlook. First, please outline the immediate schedule.

Musha) Following the prime ministerial nomination in the Extraordinary Diet session: 1) Passing a supplementary budget addressing pending inflation measures (tax credit with cash payments for lower incomes, abolishing provisional rates on gasoline/diesel transaction taxes), medical expense support, etc. 2) Making a spectacular diplomatic debut at the ASEAN Summit and Trump's visit to Japan. Trump's support for Ms. Takaichi will be clear. Favorable introductions and encouragement, such as being called a “wise person.” 3) Criticism from anti-Takaichi factions in the media, LDP, and opposition parties will intensify. It will feel like nitpicking. Policy passage could face delays.

Q) Even with Ishin joining the coalition, it remains a minority government. The administration's instability persists. This suggests a snap election could come sooner.

Musha) Correct. Beyond being a minority government, the new administration has not been tested by elections and cannot claim public mandate. This political upheaval fundamentally shifts the axis of postwar politics. It marks a transition from the liberal-centrist LDP-Komeito coalition (which prioritized liberal policies like LGBT rights and optional separate surnames over constitutional revision, anti-espionage laws, and defense buildup, while pursuing fiscal consolidation) to a conservative alliance (focused on constitutional revision, self-reliant defense, and expansionary fiscal policy). This signals the end of the post-Cold War era of ruling-opposition coalitions. Komeito's withdrawal from the coalition was made in anticipation of the LDP's policy shift under Takaichi. Consequently, public opinion is growing that the LDP's policy shift from a central liberal to a conservative stance should be subject to the people's judgment. It is highly likely that Takaichi will call for a dissolution and general election within the year or early in the new year.

Q) What outcome can be expected from the impending dissolution and general election?

Musha) A landslide victory for the LDP under Takaichi is probable. Takaichi possesses three key factors: 1) public support for her policies, 2) market support, and 3) her personal popularity.

First, Takaichi's election as LDP president despite being considered an underdog in pre-election assessments stemmed from public support that outweighed her unpopularity among lawmakers. She gained support through counter-narratives such as: 1) Overcoming old media disadvantages via online/SNS; 2) Countering elite disapproval with public backing; 3) Securing public support against vested interests despite lacking their endorsement; 4) Challenging hypocritical principles with realism-based solutions; 5) Confronting anti-capitalism without solutions using economic rationality. In the election, the LDP's recovery of lost ground and securing a ruling party majority are certain.

Second, the fiscal consolidation path does not have the backing of the critically important markets either. Stock market reactions at the start of past administrations have been divided. When Mr. Kishida, who proposed financial income taxation, and Mr. Ishiba, who advocated fiscal consolidation, took office, the stock market reacted with a sharp decline, forcing them to ease their strict fiscal stance. In contrast, when the second Abe administration took office, the Nikkei Average surged 73% in just six months, bolstering Mr. Abe's policy implementation (Abenomics). Without stock market support, Abenomics would have faltered.

Third, Takaichi's personal popularity surges. Mainstream media's anti-Takaichi coverage (such as reports saying, “We'll bring down her approval ratings,” “Photos that lower her ratings,” or “We'll only write things that hurt her ratings”) will fuel underdog sympathy. Furthermore, the exaggerated image of Takaichi as a tough-looking right-wing politician is expected to be corrected. Given her overwhelming popularity on social media, a repeat of the Hyogo prefectural governor election outcome in Hyogo prefecture is conceivable.

Q) So, the possibility of a long-term Takaichi administration grows stronger, doesn't it?

Musha) I believe it will be a long-term administration. Ms. Takaichi possesses three advantages that former Prime Minister Abe, her predecessor, lacked: 1) earning power, 2) the reality justifying conservatism and nationalism, and 3) the ability to disseminate information via the internet and social media.

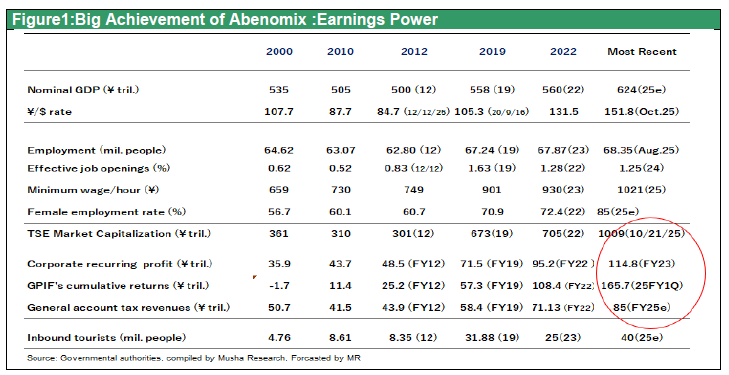

1) Earning power ➡ When the second Abe administration was formed in December 2012, Japan's earning power was at rock bottom. For over a decade after 2000, nominal GDP stagnated around ¥500 trillion, corporate profits hovered near ¥40 trillion, stock market capitalization and tax revenues declined by 10-20% compared to a decade prior, and Japanese corporate competitiveness plummeted under an ultra-strong yen at ¥85 to the dollar. The all-out effort of the national semiconductor venture, Elpida Memory, collapsed. Employment also fell by 5% over ten years. The Abe administration had absolutely no resources to redirect towards investment or improving people's lives. In contrast, at the start of the Takaichi administration, corporate profits have dramatically improved due to the success of Abenomics and the correction of the strong yen. Tax revenue has doubled, stock market capitalization has quadrupled, and national wealth has surged dramatically. In addition to the government's sustained upward revision in tax revenue (¥6–10 trillion annually), it possesses enormous hidden investment resources: ¥40 trillion in foreign exchange gains from US Treasury holdings, ¥50 trillion in unrealized gains from the Bank of Japan's ETF investments, and ¥166 trillion in accumulated GPIF investment profits. Please examine Figure1 carefully. It should be crystal clear how well-endowed the Takaichi administration is with investment capacity at its outset.

2) The reality justifying nationalism and conservatism ➡ At the dawn of the second Abe administration, Japan and China clashed over the Senkaku Islands, while America's stance remained ambiguous. Even the Wall Street Journal, a conservative US newspaper, ran a series of articles portraying Prime Minister Abe's visit to Yasukuni Shrine as heralding the emergence of a dangerous nationalist. China appealed to the US, arguing that since America and China had fought together against Japanese militarism, they should now fight together against its resurgence. China's land reclamation in the Spratly Islands, its domestic ethnic oppression, and Russia's invasion of Ukraine were all invisible then. North Korea's missiles were dismissed as mere fire-play. Domestically, this was before the Asahi Shimbun's self-criticism (August 2014) over its fabricated “comfort women” reporting. The media uniformly attacked Mr. Abe, who persistently raised this issue, branding it government interference in press freedom. Nothing justified nationalism and conservatism, Mr. Abe advocated. Yet now, with the birth of the Takaichi administration, the necessity of protecting Japan's territory and the lives of its citizens has become clear to all its people.

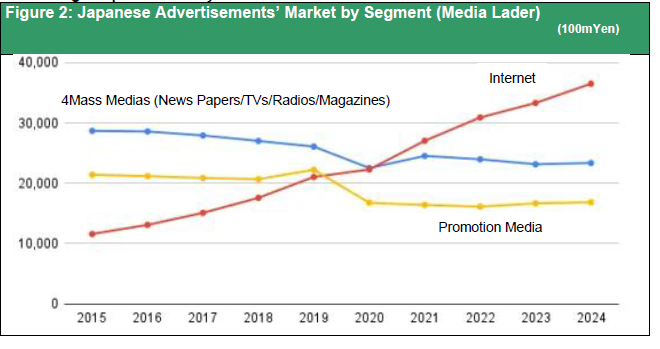

3) In 2012, individual information dissemination via the internet was limited, social media use was not widespread, and information dissemination was overwhelmingly dominated by the four mass media outlets (television, newspapers, radio, magazines). Today, however, internet advertising has vastly surpassed the four traditional media, significantly diminishing the influence of mass media. Both government and corporate entities disseminate information via social media, establishing a two-way channel where individual recipients can respond. The information gap that once existed has dramatically narrowed with the advent of social media, markedly weakening the existing media's power to control public opinion. Mr. Abe's attacks on the media were perceived as state-imposed censorship, but today all citizens can observe debates unfolding in a level playing field. The rise of the Trump administration in the US and the surge of conservative new parties in the recent House of Councilors election both stem from this radical shift in the information landscape. The Takaichi administration has begun bypassing mass media, addressing the public directly via social media.

Q) If the Takaichi administration becomes a long-term government, can Japan revive?

Musha) That possibility is entirely feasible. 1) There is a great legacy of Abenomics. 2) There are lessons from the Trump revolution. 3) True realism can be restored to Japanese politics.

Q) Under the Takaichi administration and Japan Renaissance, what would the stock market scenario look like?

Musha) Explosive growth. ¥100,000 within 3-5 years. Japanese stocks were already 1) extremely undervalued, 2) in a super-favorable supply-demand situation (with significant risk for those not holding shares), and now, crucially for a bull market, 3) the bull market narrative is being established through Takaichi's Japan Renaissance. A remarkably bright future awaits Japan.