Nov 10, 2025

Strategy Bulletin Vol.391

Ms. Takaichi’s Ideological Revolution

~Building Optimism that Justifies Tax Cuts~

(1) All Beginnings Lie in Thoughts

Everything originates from Thoughts

The following words of Mother Teresa represent a fundamental truth of life that all young people should understand:

Be careful of your thoughts, for your thoughts become your words.

Be careful of your words, for your words become your deeds.

Be careful of your deeds, for your deeds become your habits.

Be careful of your habits, for your habits become your character.

Be careful of your character, for your character becomes your destiny.

Keynes also stated that the ideas of economists and political philosophers are more powerful than is commonly understood. ... Every man who is an actualist is a slave of past economists, concluding that ‘It is not vested interests that are dangerous, but ideas’ (The General Theory, Chapter 24).

The brilliance and truth of optimism as expounded by our forebears

The prevailing ideology enveloping Japan's economic society today is pessimism. Looking back at history, the maxims of great figures extolling optimism offer us courage. Each carries the persuasive weight of successful experience and strikes a chord.

Winston Churchill: The pessimist sees difficulty in every opportunity. The optimist sees opportunity in every difficulty.’

Alan: ‘Pessimism comes from our feelings; optimism comes from our will.’

Descartes: An optimist may see a light where there is none, but why must the pessimist always run to blow it out?’

Helen Keller: Optimism is the faith that leads to achievement. Nothing can be done without hope and confidence.’

Einstein: ‘I'd rather be an optimist and a fool than a pessimist and right.’

Mokichi Saito: ‘If you wish to be optimistic, become objective.’

When I asked Sarah Whitley, the legendary fund manager who spent 38 years building the world's largest Japanese equity fund at Edinburgh-based asset manager Baillie Gifford, what the secret to her success was, she replied: ‘Optimism, that's all... You too, surely?’

(2) Japan, Overwhelmed by Pessimism

Japan, Overwhelmed by Pessimism

Despite optimism being the correct mindset, contemporary Japan has become entrenched in pessimism, causing people to lose hope and the drive to challenge the future. This mindset has self-fulfillingly shrunk the Japanese economy.

Ms. Takaichi's challenge begins with fundamentally reshaping this flawed economic ideology. Sweeping away the pessimism pervasive in academia, media, and among investors will be key to victory. It is necessary to persuade others that building the ‘Japan that blooms at the center of the world,’ as Ms. Takaichi advocates, is indeed possible. Incidentally, in the US too, President Trump proclaimed the ‘beginning of America's golden age,’ advocating optimism and drawing criticism from many commentators, scholars, and economists.

The “Learned Helplessness” that entrenched pessimism

A series of misfortunes plunged the Japanese into a sense of apathy.

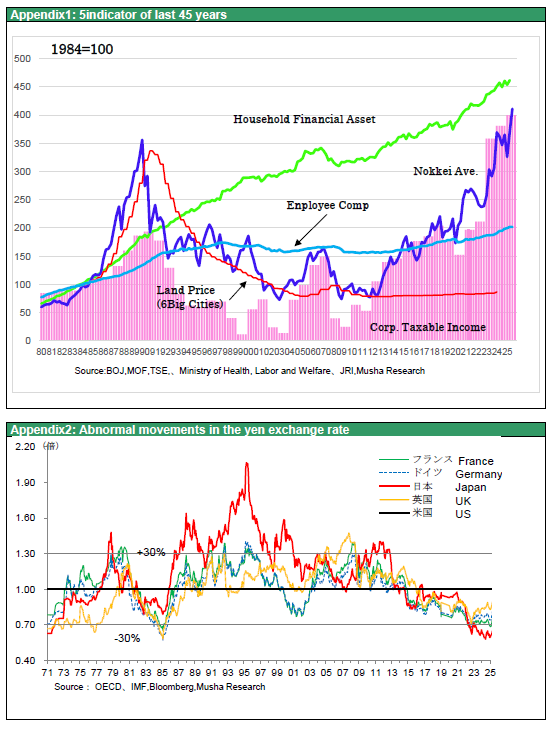

1) US criticism of Japan and the ultra-strong yen completely undermined the business model that had driven post-war Japan's success: the system of cheaply manufacturing US-derived technology and products for sale in the US market. Factories and capital, disillusioned with the domestic economy, fled overseas. Wages were forced into a prolonged slump to match lost international competitiveness, reducing the labor share of income and shrinking consumption. Figures 1, 2, 3

2) The bubble burst excessively, causing abnormal declines in stock and property prices (forming negative wealth effects). Massive paper losses killed animal spirits. Compounded by deflation, both businesses and households developed a bias towards cash (cash is king), leading to excessive deleveraging. Financial assets held by households and corporations rose without limit, yet their velocity of circulation plummeted. Addressing abnormal asset price declines and yen appreciation fell within the remit of monetary policy. In the US, Chair Bernanke implemented quantitative easing – criticized as a forbidden measure – to reverse the abnormal asset price decline. In contrast, the Bank of Japan took no action whatsoever. Figures 4, 5, 6

3) A fatalistic view that Japan could not grow under declining birth rates and an ageing population, the population onus theory, was widely propagated. Former Bank of Japan Governor Shirakawa, alongside the Democratic Party government of the time, shifted responsibility onto this fatalism, attributing Japan's economic stagnation to a decline in potential growth rate caused by low birth rates and an ageing population.

In this way, Japan fell into a state of ‘learned helplessness’

‘Learned helplessness’ is a psychological state proposed by psychologist Martin Seligman, in which repeated experiences of misfortune lead to the belief that ‘nothing I do will make a difference’ and a loss of motivation to take voluntary action. Japan fell into a state of collective loss of confidence unprecedented in other countries. It became a state of mass hysteria characterized by restraint of action, low self-esteem and emotional instability. This pessimism was amplified by the Bank of Japan's lack of action, and the Ministry of Finance took advantage of it.

(3) Economic policies that took advantage of pessimism

The Ministry of Finance capitalizes on pessimism

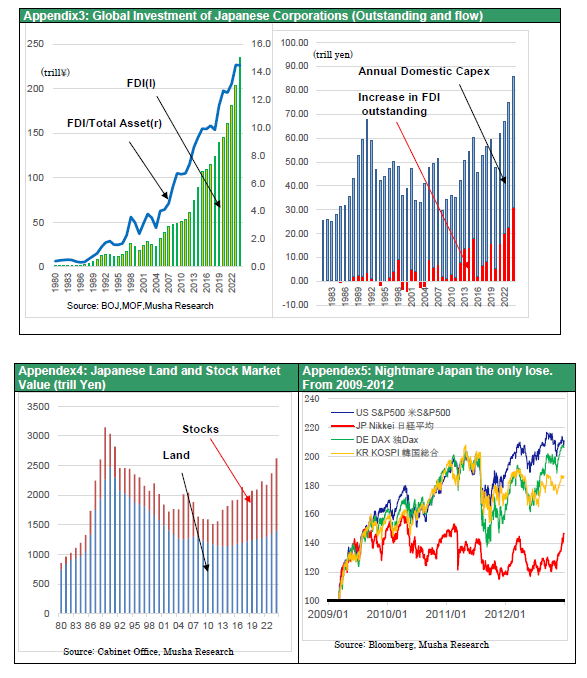

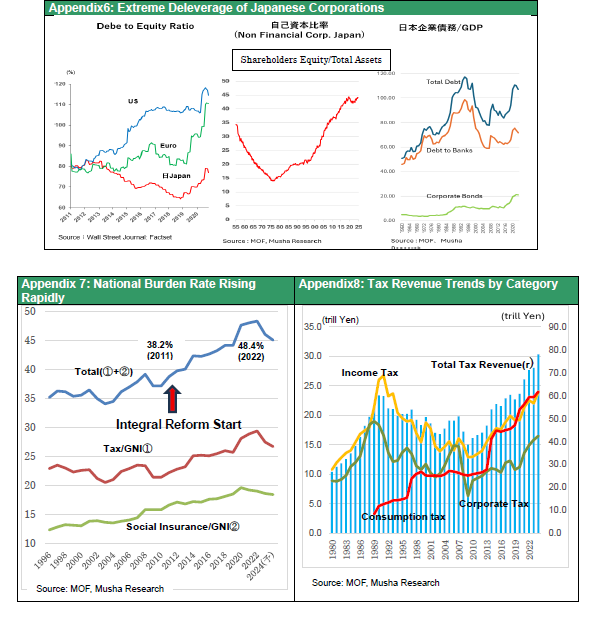

The Ministry of Finance capitalized on pessimism to make the public accept heavy burdens. The key phrase was “integrated reform of social security and taxation” and the key person was “Constitutional Democratic Party leader Noda.” The argument was: Integrated reform of social security and taxation is necessary because, as the population ages and birth rates decline, expenditure on pensions and social insurance increases while the working population shrinks. Therefore, to maintain adequate benefits, strengthening the fiscal base through tax increases is essential and A consumption tax increase, as a stable revenue source unaffected by economic fluctuations, is indispensable (the welfare purpose of the consumption tax).’ The architect of this major campaign was the Ministry of Finance, with the principal proponent being then Prime Minister Noda, who passed the bill in 2012 and is now leader of the Constitutional Democratic Party. Mr. Noda dissolved the Diet (in 2012) using the three-party agreement as leverage, securing promises for two consumption tax hikes under the Abe administration. The national burden ratio (the ratio of taxes and social insurance contributions to national income) stood at 38.8% in 2011, before the introduction of the ‘integrated reform’. By 2022, it had surged to 48.4% – an unprecedented 10-point jump in a decade – directly impacting household consumption. Real household consumption peaked at ¥304 trillion in January-March 2014, immediately before the March 2014 consumption tax hike (from 5% to 8%). It has never exceeded that level since and remains depressed at a level 4% below the peak of ten years ago, even now (Q2 2025). During this period, corporate profits increased 2.4-fold, stock market capitalization rose 3.7-fold, and general account tax revenue grew 1.8-fold. It can be said that households alone have been sacrificed (Figure 9).

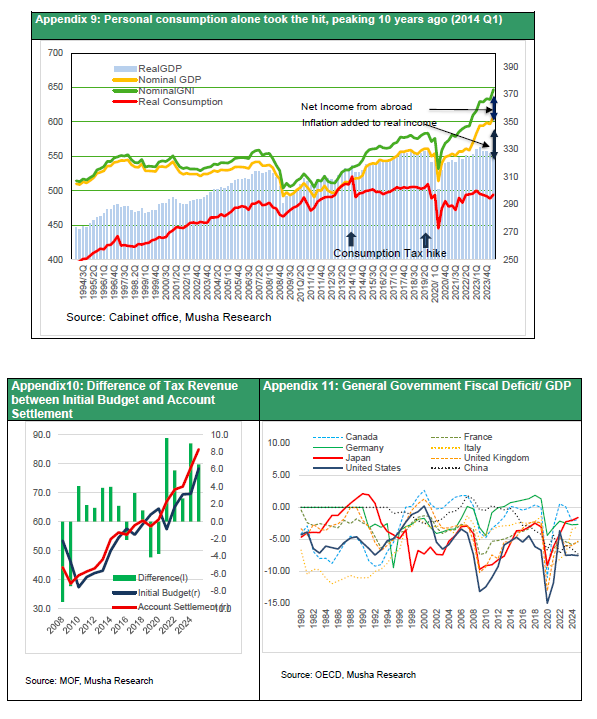

A major shift overturning pessimism

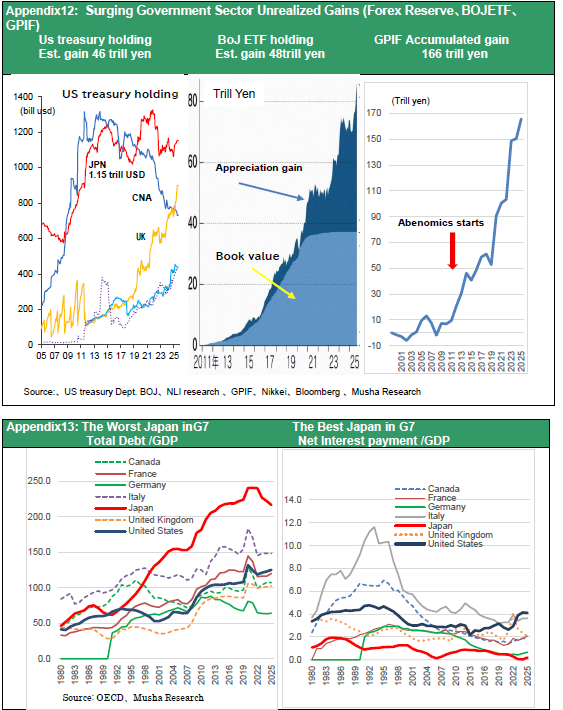

Yet here came a welcome surprise. Unexpected inflation, not anticipated by pessimists, coupled with yen depreciation, led to a sustained 4% growth in nominal GNI (nominal GDP + overseas income). This significantly increased tax revenues, severely disrupting the economic balance. Since 2021, tax revenues consistently exceeding the initial budget by 6 to 10 trillion yen has become the norm (Figure 10). The excess tax revenue amounts to 1.0–1.6% of GDP. As this is retained within the government under the guise of fiscal consolidation, private demand faces significant downward pressure. Indeed, comparing the general government fiscal balance as a percentage of GDP among G7 nations in the OECD's June Economic Outlook supplementary data reveals Japan's fiscal deficit reduction stands out sharply, despite having the lowest economic growth rate. As shown in Figure 11, Japan's fiscal deficit/GDP ratio stands at 4.2% in 2022, 2.3% in 2023, 2.05% in 2024, and 1.6% in 2025 (E), representing the smallest deficit among G7 nations. If the entire increase in tax revenue due to inflation were fully returned to households, Japan could achieve high growth comparable to that of the United States. Furthermore, substantial hidden investment resources exist, including ¥40 trillion in foreign exchange gains from US Treasury holdings, ¥50 trillion in unrealized gains from the Bank of Japan's ETF investments, and ¥166 trillion in cumulative investment gains from the GPIF. Please examine Figure 12 carefully. It should be crystal clear how well-endowed with fiscal leeway the Takaichi administration's launch is.

(4) The economic mission of the Takaichi administration: liberation from the shallow sense of justice that justifies austerity

The Takaichi administration's economic challenge: stimulating consumption through tax cuts

The Takaichi administration will tackle this remaining challenge: boosting consumption through tax cuts. Why are tax cuts key? Firstly, fiscal leeway exists while consumption remains severely depressed, fueling public discontent. Secondly, tax cuts are the global standard for economic stimulus in advanced nations. Thirdly, tax cuts invariably lead to economic expansion and increased tax revenues. Consequently, the Japanese economy is likely to achieve higher growth rates driven by consumption.

Prime Minister Takaichi is appointing fiscal doves to key posts for the government. Finance Minister Ms. Katayama, Minister for Growth Strategy Mr. Kiuchi, and Replacement of the LDP Tax Commission have already been set. As to selecting the members of Advisory Boards for the government pro-fiscal stimulus figures such as former BOJ vice governor Mr. Wakatabe, Daiichi life Research economist Mr.Nagahama , former member of BOJ policy board Mr. Kataoka and Mr. Aida of Crédit Agricole - Corporate and Investment Bank economist have been appointed.

However, opponents of tax cuts remain strong, with editorials in major newspapers uniformly critical:

‘Fiscal consolidation targets are wavering; lax fiscal discipline risks triggering interest rate rises’ (Asahi, 5/11)

‘Unrestrained fiscal spending cannot be permitted’ (Yomiuri, 8/11)

‘Gasoline tax cut: ruling and opposition parties must take responsibility for funding’ (Sankei, 6/11)

‘Fiscal discipline loosens; budget surplus “not just for one year but several years” – market confidence put to the test’ (Nikkei, 7/11)

The hardline fiscal consolidation faction remains robust, with mainstream economic commentators who opposed Governor Kuroda's unconventional monetary easing still active. These figures have criticized Abenomics and obstructed its completion and success. Professor Emeritus Hiroshi Yoshikawa of the University of Tokyo published an article stating ‘Large-scale easing is entirely mistaken’ (1/11 Asahi), while former University of Tokyo Professor Toshihiro Ihori published ‘Face the critical fiscal situation squarely’ (8/8 Nikkei), justifying Ishiba's statement that Japan's debt burden is the world's worst, worse even than Greece's.

The hidden benefits of tax cuts: the tax cut multiplier and revenue elasticity

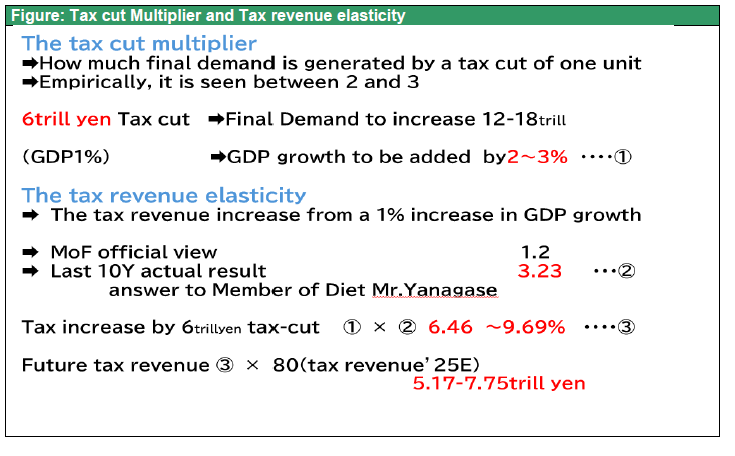

It remains curious, however, that when discussing tax cuts, only the disadvantages – increased fiscal deficits and shifting debt burdens onto future generations – are ever mentioned, while the benefits scarcely come up for discussion. The benefits of tax cuts depend on two variables: the tax cut multiplier and the tax revenue elasticity. The tax cut multiplier is the variable indicating how much final demand is generated by a tax cut of one unit; empirically, it is seen as being between 2 and 3. Furthermore, the tax revenue elasticity value indicates the percentage increase in tax revenue resulting from a 1% increase in GDP growth rate. While the Ministry of Finance's official view has been 1.1, revised to 1.2 this year, it significantly diverges from reality. In a government response (4 February 2025) to former House of Councilors member Hirofumi Yanagase of the Japan Innovation Party, who pointed this out, it was revealed that the average tax revenue elasticity value over the past decade was 3.23.

Figure: Tax Cut Multiplier and Tax Revenue Elasticity

Let us estimate how tax cuts affect the economy and tax revenue using these two variables. As shown in the Figure2, a ¥6 trillion tax cut (1% of GDP) increases final demand by ¥12–18 trillion, representing a 2–3% of GDP rise. Applying the 3.23 elasticity value cited in the response to Mr. Yanagase, tax revenue would increase by 6.46–9.69%. Assuming 2025 tax revenue is 80 trillion yen, this calculates to a 2026 tax

revenue will increase by ¥517-7.75trillion.

Ms. Takaichi must absolutely achieve a fundamental paradigm shift: moving away from the Ministry of Finance-led approach – the pessimism that argues high burdens are necessary because we are in a deflationary, low-growth economy – towards the optimism that asserts tax cuts are the correct course now that we have entered an inflationary, high-growth phase.