Nov 24, 2025

Strategy Bulletin Vol.392

China's sanctions against Japan benefit the Takaichi administration and the Japanese stock market

China's sanctions against Japan benefit the Takaichi administration and the Japanese stock market

Japan escalates stance to ‘Taiwan contingency is Japan's contingency’

China's criticism of Japan has reached boiling point following Prime Minister Takaichi's parliamentary response. Until now, Japan's ambiguous strategy meant it had not directly challenged China's assertion that ‘a Taiwan contingency is China's internal affair, and Japan should not intervene’ (China had unilaterally treated this as established fact). However, Takaichi's response has given rise to the interpretation that ‘a Taiwan contingency is a Japanese contingency, and Japan may also need to take military action,’ perceived as Japan raising the level of its countermeasures against China. China is demanding either a retraction of the Prime Minister's statement (or a pledge that Japan will not intervene in a Taiwan contingency) or bearing the hostility between Japan and China. Japan has no option for the former, and Sino-Japanese confrontation is likely to intensify.

China's criticism of Japan is crude and excessive. Examples include: 1) Xue Jian, Consul General in Osaka, posting on X: ‘That filthy head must be severed without a moment's hesitation’; 2)Demands for Takaichi's retraction; 3) Travel advisories against Japan; 4) Recommendations to exercise caution regarding study in Japan; 5) Refusal of a Japan-China summit at the G20 6) Vessel incursions into Japanese territorial waters around the Senkaku Islands, 7)Postponement of Japanese film releases, 8) Ban on imports of Japanese seafood, 9)Calling for UN condemnation of Japan etc.

However, if Japan's stance towards China is indeed shifting, China's overreaction is not entirely incomprehensible.

The opening phase of containing China: China has subdued the West

The level of confrontation with China has also been raised in the US and Europe. In the US, this includes various sanctions and Trump tariffs; in Europe, it encompasses the Inter-Parliamentary Alliance on China (IPAC) campaigning on China policy, trade sanctions against China, the Dutch government's seizure of operational control of Chinese semiconductor firm Nexperia in the Netherlands, and Europe's rapprochement with Taiwan. In the UK, approval for the construction of Europe's largest Chinese embassy in central London has been delayed due to concerns it would become a base for Chinese intelligence activities.

In response to what it perceives as a provocation, China has intensified what could be seen as unreasonable criticism and sanctions against Japan. Against the US, it halted supplies of rare earths (where China holds 90% of the global market share). Against Europe, it stopped shipments of automotive semiconductors from its Chinese Nexperia factories. Faced with the prospect of halted high-tech and automotive production, the Trump administration in the US withdrew its tariff increases and secured a year's supply of rare earths. The Dutch government also secured semiconductor supplies by shelving its takeover of Nexperia. The UK approved the construction of an embassy.

Western advanced nations forging ahead with national security and decoupling from China

Thus, in the opening stages of the campaign to contain China, Western nations were unable to withstand China's threat of supply stoppages and were forced to withdraw pressure on China. However, China's threat to halt supplies of critical materials and goods should have made it abundantly clear to all Western nations that decoupling from China and delinking risks are now urgent matters linked to national security.

China's share of global industrial production stands at over 30% according to UN surveys (Musha Research estimates 40% on a PPP basis), a remarkably high proportion, placing Western nations in a state of economic security crisis. To break dependence on China for critical materials like rare earths and semiconductors, governments will intensify a comprehensive policy mobilization involving public funding, trade restrictions, and market interventions. Over the coming years, substantial shifts in the international division of labor are certain to materialize.

The Decline of Liberalism and Supply Chain Repatriation to Japan

In Japan, anti-China sentiment is boiling over due to China's unreasonable sanctions against Japan. This also marks a process of awakening from the post-war illusion of ‘absolute pacifism accompanied by the renunciation of military force.’ Liberal forces (certain political parties, media outlets, and opinion leaders), still fixated on an agenda opposing constitutional revision and independent defense, are increasingly losing public support. WSJ columnist Walter Russell Mead observes that ‘China's reason for picking a fight with Japan is to weaken Prime Minister Takaichi’ (18/11), but this is entirely counterproductive. China is losing friends in Japan and inadvertently strengthening Ms. Takaichi's political base.

The LDP-Komeito coalition government, up until the Ishiba administration, was a liberal centrist alliance prioritizing fiscal consolidation alongside liberal policies like the LGBT law and optional separate surnames for married couples. It postponed constitutional revision, anti-espionage legislation, and defense capability enhancement, adopting a conciliatory stance towards China. In contrast, the new LDP-Ishin coalition under the Takaichi administration represents a conservative alliance (advocating constitutional revision, self-reliant defense, and expansionary fiscal policy) and a realist approach towards China. This represents a fundamental pivot, a conservative revolution. Komeito's withdrawal from the coalition was made in anticipation of the major policy shift under Ms. Takaichi's LDP leadership. For Komeito, committed to pacifism, there was no other choice. However, the new administration has not yet faced the baptism of an election and cannot be said to have gained the people's trust. Given that such a significant policy shift was achieved through the logic of Nagatacho (the political district), public opinion is growing that it should face the people's judgement.

Prime Minister Takaichi will push for a snap general election, making national security strategy a key issue alongside expansionary fiscal policy. In such an election, the liberal forces advocating appeasement towards China are likely to suffer defeat, strongly tilting Japan's policy axis towards conservatism, nationalism, and expansionary fiscal measures.

Boosting Potential Growth Rate via Consumption and Further Stock Market Gains

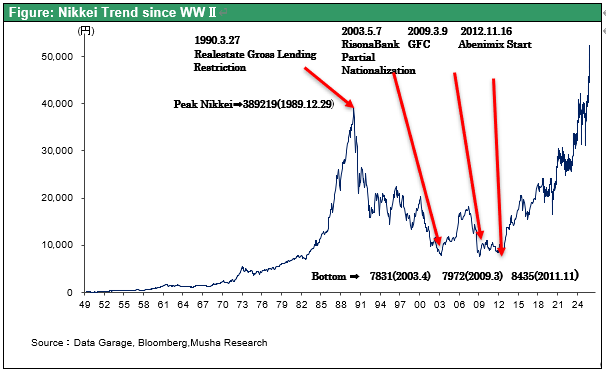

Expansionary fiscal policy and the return of production to Japan are likely to boost the potential growth rate, revive the Japanese economy, and lead to further stock market gains. Japanese stocks, currently showing signs of turbulence near year-end highs, are likely to return to a significant upward trajectory following political developments early to mid-next year. As seen in the figure below, market turning points have consistently coincided precisely with shifts in the policy regime.

The impact of China's travel restrictions on Japan is limited. Indeed, the reduction in imports from China and the return of production to Japan will benefit the Japanese economy. Japan's prolonged decline stemmed from the leakage of its technological and manufacturing base to China, South Korea, and Taiwan. Now that this reversal has begun, we should be confident that the winds of change are blowing in Japan's favor.