Dec 15, 2025

Strategy Bulletin Vol.393

Challenges Facing the Takaichi Administration and the 2026 Stock Price Outlook

Raising Consumption Levels Through Tax Cuts ~

Within a rapidly changing world, Japan stands poised for the most significant transformation. This is not merely due to the inauguration of Japan's first female Prime Minister, Takaishi. The new administration is poised to execute a conservative revolution. The previous LDP-Komeito coalition could be described as a liberal centrist alliance (postponing constitutional revision, anti-espionage legislation, and defense capability enhancement while prioritizing liberal policies like LGBT rights legislation and optional separate surnames for married couples, alongside fiscal consolidation). In contrast, the new LDP-Ishin alliance represents a conservative coalition (advocating constitutional revision, self-reliant defense, and expansionary fiscal policy), marking a fundamental pivot towards a conservative revolution. China's abnormal pressure tactics towards Japan also stem from this conservative revolution.

This major shift is considered positive for Japanese equities. While the immediate outlook remains uncertain—with the full capabilities of the Takaichi administration yet to be seen and China's abnormal criticism of Japan prolonging the current plateau—a resumption of upward momentum is highly likely once domestic economic buoyancy and the prospect of a long-term Takaichi administration become apparent.

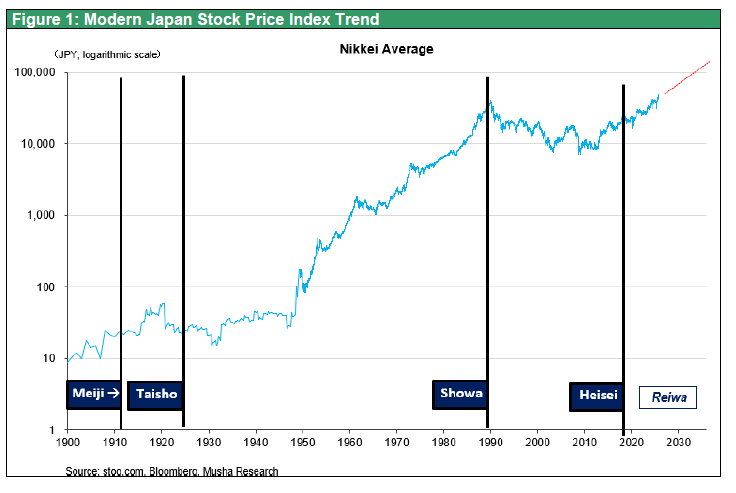

Considering the sustained long-term upward trend since the second Abe administration, with annual growth rates of 10-13%, calculations suggest the Nikkei could reach ¥100,000 by 2031 or, at the latest, 2033, and reach ¥120,000 to ¥160,000 by 2035. Japanese equities are inherently 1) extremely undervalued (with an equity yield of 5.6%, dividend yield of 2.4%, government bond yield of 1.9%, and deposit rates of 0.2-0.5%, making stock returns overwhelmingly higher), 2) in a highly favorable supply-demand situation (with enormous latent demand from individuals, foreigners, pensions, and corporations), and crucially, 3) the essential bullish narrative for rising stocks will be established through the Takaichi conservative revolution. All domestic and overseas investor segments will acutely feel FOMO (the risk of not holding Japanese stocks).

The Takaichi administration aims to raise its political capital through a general election

The key event in 2026 will be a general election. Prime Minister Takaichi's approval ratings are unprecedented, particularly among younger voters where support reaches a staggering 80%. However, governing as a minority party remains unstable. Moreover, this political upheaval has not yet undergone the baptism of an election and cannot be said to have secured public trust. Given such a significant policy shift, facing the public's judgement is only natural.

Furthermore, national security issues have emerged as the foremost concern. China has criticized Prime Minister Takaichi's parliamentary response on 7th November, claiming it signaled Japan's willingness to intervene in a Taiwan contingency. It is now demanding intense retaliatory measures against Japan and the retraction of that statement (equivalent to a pledge of non-intervention in a Taiwan contingency).

Japan faces a choice: should it continue appeasement towards China, or shift towards realism? This also represents a process of awakening from the post-war illusion of ‘absolute pacifism accompanied by the renunciation of military forces.’ Prime Minister Takaichi, alongside pursuing expansionary fiscal policy, will be compelled to push national security strategy as a key issue and dissolve the Diet for a general election. In the election, the liberal forces advocating appeasement towards China are likely to suffer defeat, strongly increasing the possibility that Japan's policy axis will shift towards conservatism, nationalism, and expansionary fiscal policy.

The pressing issue: restoring potential growth rate through boosting personal consumption

The challenge for the Takaichi administration in 2026 is to boost Japan's potential growth rate by improving people's livelihoods and restoring consumption. Abenomics succeeded in the most difficult task: restoring corporate profitability and achieving corporate governance reforms that had been criticized by foreign investors. It achieved the hardest feat – multiplying corporate profits by 2.5 times and share prices by 4 times – yet crucially, people's livelihoods have not improved at all. Real household consumption has remained negative for over a decade since Q1 2014 (immediately before the consumption tax hike) and currently stands at -4% compared to its peak. This is due to the impact of increased social insurance premiums and two consumption tax hikes under the ‘Integrated Reform of Social Security and Taxation’ enacted in 2012.

The national burden ratio (as a percentage of national income), comprising taxes and social insurance contributions, was pushed up to an alarming extent from 38.8% in 2011 to 48.4% in 2022.

Both the consumption tax and social insurance contributions increased during this period, and both are highly regressive (placing a greater burden on low-income earners). Moreover, they are rigid in response to economic fluctuations, significantly suppressing consumer spending. Taxes inherently possess a built-in stabilizer function, stabilizing the economy by reducing tax revenue during recessions and thereby mitigating income declines. However, Japan's tax authorities, focused solely on collection, have effectively neutralized this function.

Japan's Significantly Improved Public Finances

Conversely, Japan's public finances have markedly improved. Tax revenues doubled from ¥40 trillion to ¥80 trillion, with annual tax surpluses of ¥5-6 trillion becoming the norm in recent years. Japan's fiscal balance (as a percentage of GDP) reached -2.05% in 2024 and -1.60% in 2025 (OECD estimates), the smallest deficit among G7 nations. The most appropriate indicator of fiscal soundness, net interest payments as a percentage of GDP, also stands at 0.03% in 2024 and 0.2% in 2025, placing Japan at the very bottom of the G7. Furthermore, Japan possesses substantial hidden assets (unrealized gains).

These hidden assets comprise: ① foreign exchange gains of ¥40–50 trillion in the Foreign Exchange Special Account; ② approximately ¥50 trillion in investment gains from the Bank of Japan's ETF purchases; and ③ cumulative investment returns of ¥166 trillion from the Government Pension Investment Fund (GPIF). Together, these exceed ¥250 trillion – equivalent to two years' worth of the government budget.

The mission of the Takaichi administration lies in correcting this imbalance, with permanent tax cuts being the key. Tax cuts are the global standard for economic stimulus in developed nations, and their ability to boost consumption and raise potential growth rates is evident. Furthermore, two variables – the tax cut multiplier and tax revenue elasticity – ensure that the reduced tax revenue can be covered by subsequent increases in revenue. While concerns about inflation rising if tax cuts are implemented when the economy is operating at full capacity with no supply-demand gap are valid, in such a scenario, the nominal economic growth rate would increase, leading to further growth in tax revenue.

The risks of expansionary fiscal policy, such as rising interest rates, are often cited with reference to the Truss shock in the UK. However, (in Japan today, with sufficient dialogue with the Bank of Japan) there is absolutely no cause for such concern. The Truss shock occurred in the UK, a country with a significant savings deficit, characterized by a current account deficit equivalent to 4% of GDP. Japan, conversely, is one of the world's most savings-rich nations, boasting a current account surplus equivalent to 4% of GDP – the exact opposite position to the UK. In Japan today, the end of deflation and the revival of investment appetite (= demand for funds) are driving interest rates higher, but this is a beneficial rise in rates that brings growth and higher stock prices.

Japan's Renaissance Begins

When wage increases are combined with tax cuts, household disposable income rises significantly, stimulating consumption. Furthermore, inflation and rising asset prices have revived animal spirits. Moreover, against a backdrop of yen depreciation and US-China tensions, investment and factory relocations to safe-haven Japan are underway (e.g., TSMC's second phase Kumamoto plant shifting to cutting-edge semiconductor production, Sharp's server manufacturing).

The fundamental causes of Japan's decline were US pressure on Japan and the super-strong yen eroding competitiveness, coupled with the outflow of industrial bases to China, South Korea, and Taiwan. A major reversal of this trend is now commencing. China's intimidation tactics towards Japan are actually accelerating this trend, acting as a factor driving stock prices higher.

Against the backdrop of increasing political and economic fragmentation and turmoil in the US, China, and Europe, Japan – experiencing political stability and booming corporate profits alongside a major shift in economic sentiment – has a strong potential to become the world's bright spot. The day when the public believes in Ms. Takaichi's vision of ‘Japan flourishing at the center of the world’ may be drawing near.