Dec 31, 2025

Strategy Bulletin Vol.394

The Awakening of Nationalism Pushes the Nikkei Average to 65,000

Happy New Year!

We extend our warmest wishes for a splendid start to the new year.

As this promising new year unfolds, we pray for your continued prosperity.

Reiwa 8 (2026) New Year's Day

Musha Research Co., Ltd.

(1) China's Strengthening National Power Exerts Pressure on the West

We have entered a New Year marked by heightened tension. The US-China confrontation, the progress of the AI revolution, and the sharp rise in Japanese stocks to ¥50,000 were all as predicted last New Year. However, a significant error was also made: the underestimation of China's growing might. The most profound shock from this undervaluation of China is likely being felt by the United States, the leader of the world order, and President Trump. Should hostilities break out now, the United States has no chance of victory. China overwhelmingly surpasses the US in military might, industrial capacity, and the command authority to mobilize its populace for war. America's only viable strategy is to avoid immediate confrontation, prolong the conflict into a war of attrition, and thereby induce China's weakening.

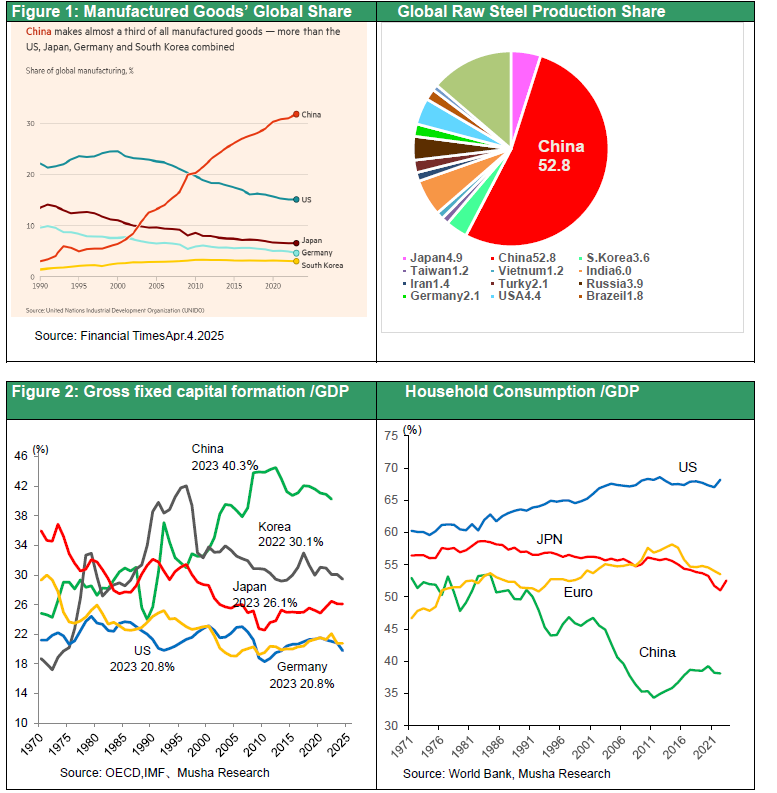

It is no exaggeration to say that the astonishing developments of 2025 stem from China's dramatic rise and growing power. The nightmare scenario is now reality: Russia's victory as the aggressor in the Ukraine war (seizing territory from Ukraine), the formation of an axis of authoritarian states comprising China, Russia, and North Korea, America's conciliatory stance towards Russia, friction between the US and Europe, China's dominance over global industrial power (supply chains) (see Figure1), and China's intimidation of Japan. Having passed through the era of Deng Xiaoping's “biding one's time and hiding one's capabilities,” Xi Jinping's China now openly displays its ambitions to become the world's hegemonic power.

China's rise to power was by no means inevitable; it was the product of complacency and underestimation by the United States, Europe, and other advanced nations. Specifically, unrealistic ideologies led to flawed policies: ① Support for China based on the expectation that its economic growth would bring democratization; ② An idealism overly concerned with human rights, the environment, and developing nations; ③ A sense of superiority viewing Western values as humanity's ultimate goal. Policies over the past forty years were based on the prediction that the end of the Cold War would usher in a permanent era of US superpower dominance (the “end of history”). The outcome proved entirely contrary to these expectations.

All strategies and policies must now be reconstructed under this new reality. Many of the Trump administration's policies, perceived as heavy-handed and abrupt, represent a response to this reality.

The world has entered an era of strong devouring the weak; the US must fundamentally transform its global strategy

An era where China, under one-party Communist rule with no freedom of speech and where citizens' every move is monitored by advanced technology, governs the world alongside the US – the G2 has become reality. The dystopia depicted by George Orwell in his novel Nineteen Eighty-Four exists there. It is said that, for now, Chinese citizens do not consciously feel significant oppression and exist in a state of “happy surveillance” with material affluence, lacking the novel's sense of misery. However, as seen in the suppression of democracy in Hong Kong, if economic deterioration progresses, the likelihood of intensified authoritarian repression is high.

The United States released its 2025 National Security Strategy (NSS), which completely repudiated its previous global strategy. It concluded that ‘overestimating America's capabilities and making a misguided, destructive bet on globalism and free trade... has eroded the very national characteristics that underpin America's strength, prosperity, and decency.’ Without China's support – purchasing Russian crude oil and supplying industrial goods to Russia, which faced Western embargoes – Russia's war effort would have been unsustainable. Moreover, the United States lacks the capacity to confront an alliance between two of the three major nuclear powers, China and Russia. Consequently, however undesirable, appeasement towards Russia remains the only viable option. The Trump administration's frustration with Europe's perceived lack of urgency and sense of responsibility stems from this disparity in assessing the current situation.

The 2025 National Security Strategy (NSS) states that "to safeguard God-given natural rights and the welfare and interests of the people, and to avert global war, we must: 1. prioritize national security interests above all; 2. achieve peace through strength = build the strongest economy, technology and military; 3. pursue realism and balance of power (non-intervention in other nations, yet preventing the rise of hostile forces); 4. tolerating no unfairness (free-riding, trade imbalances, predatory economic practices)", among others. Specific measures include economic security, correcting trade imbalances, reindustrialization, and regaining control of supply chains/revitalizing the defense industry, securing energy dominance/rejecting net-zero ideology, and maintaining financial dominance. Regionally, it advocates: ① reaffirming Monroe Doctrine principles in the Western Hemisphere, America's backyard; ② engaging with Asia as the global growth center while refusing to accept China altering the status quo in Taiwan or the Pacific; ③ encouraging Europe to restore national identity and confidence while rebuilding strategic stability with Russia.

While the narrative spans diverse themes, its overarching thread is a declaration of resolve and means to halt China's rise at all costs.

The Trump Administration Yielding to China's Rare Earth Export Ban

Against this backdrop, President Trump's shift towards a conciliatory stance towards China following the Trump-Xi summit in Gyeongju, South Korea, on 30th October was peculiar. It featured a parade of appeasement measures: mutual visits by 2026, substantial reductions in reciprocal tariffs on China, and restraint in critical remarks about China. Even in the face of China's intimidation towards Japan following Prime Minister Takaichi's remarks on a Taiwan contingency on 7th November, Mr. Trump offered no criticism whatsoever. He had yielded to China's threat to halt supplies of rare earth elements – materials essential for producing high-tech goods where China commands 90% of the global market share. Should high-tech production halt, the US would plunge into recession by 2026, jeopardizing victory in the midterm elections. Faced with China's industrial might, President Trump had no choice but to make a humiliating policy reversal. He referred to the US and China as the G2, thereby formally recognizing for the first time the status of two superpowers governing the world, as China has long asserted.

This situation casts doubt on the implementation of policies outlined in the 2025 National Security Strategy (NSS). Has the China containment policy, continued since the first Trump administration, fundamentally changed? Probably not. It should have strengthened the resolve to swiftly execute the critical task of reducing dependence on China's supply chains.

Advanced nations are shifting strategy from idealism to realism

The Trump administration's principles of 1. putting national security interests first, 2. peace through strength = building the strongest economy, technology and military, 3. realism and balance of power (not intervening in other countries but not allowing the rise of hostile forces), and 4. not tolerating unfairness (free riding, trade imbalances, predatory economic practices) are likely to be shared by developed countries, including Europe.

Vice President Vance's speech at the Munich Security Conference on 14 February 2025 came as a major shock to European allies. Vice President Vance criticized European Union (EU) leaders, pointing out that freedom of speech and democracy were in retreat. He also argued that Ukraine faced greater constraints than Russia and that, realistically, the only way to end the war was through negotiations, advocating appeasement towards Russia and causing consternation in Europe. Even more shocking was the meeting between President Trump and Ukrainian President Zelensky at the White House on 28 February. The scene in which President Trump forced President Zelensky to accept a ceasefire that effectively condoned the Russian occupation was reported around the world. The world was left stunned by this major shift in US policy on Ukraine.

However, Europe's subsequent response has mirrored that of the United States. Grounded in realism, it has been compelled to significantly increase defense budgets, amend Germany's constitution and abandon fiscal balance principles, face internal EU divisions over Russia and Ukraine, reconsider zero-carbon policies, and strengthen containment measures against China. The further rise of right-wing populist parties that advocating anti-immigration policies is conceivable. The Trump administration shares its ideology.

Japan's policy shift is part of this broader trend. The inauguration of the first female prime minister, Takaichi, signals the advance of a conservative revolution. The previous LDP-Komeito coalition represented a liberal centrist alliance (postponing constitutional revision, anti-espionage legislation, and defense capability enhancement to pursue liberal policies like LGBT rights legislation and optional separate surnames for married couples, alongside fiscal consolidation). In contrast, the new LDP-Ishin alliance represents a conservative coalition (advocating constitutional revision, self-reliant defense, and expansionary fiscal policy), marking a major pivot towards a conservative revolution. China's abnormal pressure tactics towards Japan also stem from this conservative revolution in Japan.

(2) Geopolitical confrontation shelved; US-China economic performance contest intensifies

Superficially, the US is shelving military and geopolitical confrontation, focusing its energies on economic competition with China. Economic strength underpins the sustainability of national power, and the US is betting on its reinforcement. This is because China's weakness lies in its economy, as explained below. The US and Chinese economic models are diametrically opposed; even if the east wind is pressing down on the west wind in the short term, America's superiority should be evident.

China's Beggar thy neighbor Economic Model

China, with only 17% of the world's population, accounts for just under 40% of global manufacturing output (more than double that of the US, according to Musha Research estimates based on PPP), and has captured a high global share of 52% for steel, 70% for shipbuilding, 80% for smartphones and drones, and 90% for PCs and TVs. Particularly in the field of green energy, it dominates with a 60-80% global share in solar panels, EVs, batteries, and wind power generation equipment, destroying the industrial base of other countries. Furthermore, in the semiconductor sector, which has been subject to export restrictions from the US, China has continued to invest heavily over the past few years, accounting for 30-40% of global semiconductor capital expenditure. It has significantly strengthened its competitiveness in legacy semiconductor fields such as power semiconductors, analogue semiconductors, DRAM, and has begun supplying these products to other countries at low prices. In addition, a significant increase in exports of solar panels, electric vehicles and lithium-ion batteries, considered to be new types of productive capacity, has offset sluggish domestic demand. Even in automobiles, China has surpassed Japan to become the world's largest exporter. This excess supply capacity exerts deflationary pressure not only within China but globally. China's trade surplus in 2025 reached approximately $1.15 trillion (with $1.0758 trillion recorded from January to November), amounting to a massive 1% of global GDP.

Conversely, the collapse of the property bubble, deflationary pressures, and rising unemployment have fueled future anxieties, prompting households to save even more. China's savings rate stands at 43% for total savings (2024) and 36% for household savings (2023), markedly higher than other countries. The cycle of underconsumption → excessive saving → overinvestment has produced a massive industrial overcapacity, a product of China's distorted economic structure. According to World Bank surveys on household consumption as a percentage of GDP in major economies, China's figure hovers around 38-39%. Meanwhile, China's fixed capital formation exceeds 40% of GDP, perpetuating an unprecedented economic anomaly where consumption remains smaller than investment over the long term (see Figure 2).

Criticism mounts against China for exporting deflation globally, yet a shift to a consumption-led economic model appears hopeless. Firstly, the bubble collapse is still at its outset; the exit remains entirely invisible beyond the tunnel's end. Japan's land prices fell by 80% from their peak, with enormous severe debt costs sapping corporate and household purchasing power. In contrast, China's decline remains around 20-30%, and the realization of bad debts, along with the associated costs of resolution and bankruptcy, has largely been avoided. While stopgap measures have suppressed chaos, persistent pessimism about the future, coupled with anxieties over employment and the economic outlook, mean that consumption growth is nowhere in sight. Secondly, the sudden surge in fiscal burdens required to resolve non-performing loans and stimulate consumption is simply unabsorbable. Even now, China's fiscal deficit is rapidly expanding, reaching 7% of GDP (OECD estimate for 2025) – the worst among major economies. Thirdly, with deteriorating corporate profits, worsening employment, and falling wages, an increase in disposable income is unlikely.

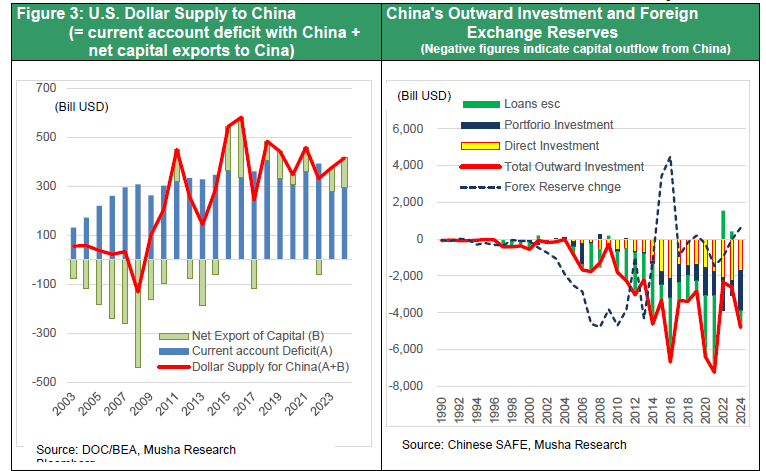

Thus, the only solution appears to be further increases in outward investment. Utilizing substantial foreign fund earned through large trade surpluses, China is reinvigorating overseas investment initiatives like the Belt and Road Initiative, which had once faltered, to expand its global presence (see Figure 3). This financial power is being channeled into military expansion, heightening global tensions. China's economic model, which fails to circulate domestically, precisely embodies the late 19th to early 20th century style imperialism criticized by Lenin. It is inherently a system of Beggar thy neighbor necessitating external expansion.

The US economy stands on credit expansion and consumption-led model

Amidst global supply surpluses driven by China's massive industrial capacity and AI-fueled productivity gains, what is needed is the ‘power to consume’ and the ‘power to create demand’ – capabilities possessed by the United States. American consumption stands as the world's last resort, and its importance will only grow. The share of US consumption in GDP stood at 60% in 1970 and now stands at 68%. While other nations' consumption shares have declined, the US has built a robust, consumption-driven demand pressure mechanism. This constitutes America's fundamental strength and underpins its continued status as the world's reserve currency. The cycle persists: nations export to the US market, thereby acquiring the dollar – a growth currency – and consequently prosper. The Trump administration's agenda to reduce the trade deficit does not disrupt this virtuous cycle.

America is the birthplace of capitalism. Britain created capitalism but failed to perfect it, succumbing to defeat by the United States and Germany, leading to the decline of British industry. While it generated income through overseas finance and shipping, domestic investment was neglected, and domestic demand failed to develop. The United States did not follow Britain's path. It created domestic demand, which became the foundation for new industries. The creation of this domestic demand was driven by credit creation, the most crucial engine of American capitalism. 1. Abandoning the gold standard, 2. Pursuing fiscal expansion, and 3. Supplying dollars overseas – all these increases in debt were channeled towards demand creation. The sole justification for this demand creation (i.e., growth supremacy) by the US government is the improvement of its citizens' standard of living. America's national interest hinges entirely on this point, and Mr. Trump constantly keeps it in mind. American democracy is evaluated based on whether citizens' living standards rise (see Figure 4).

The US shifts to a war of attrition (reducing dependence on China while awaiting its weakening)

The opposing economic models of China and the US stem from differing national objectives and fundamental values. America's goal is the American Way of Life: the relentless pursuit of higher living standards for its people. For China, it is the ‘Chinese Dream’ of national rejuvenation and enhanced international presence.

The ultimate deciding factor in the US-China confrontation is the loyalty and centripetal force of each nation's people towards their state. Can American capitalism make people happy? Elections serve as the arbiter of this judgement and are an essential process for strengthening centripetal force. Complaints exist that democracy, by constraining US policy towards China through elections, temporarily works against America's interests, but this is a minor concern.

Without elections and under an oppressive government, the people remain silent, yet it is doubtful whether loyalty is being cultivated.

In the performance battle between US equity capitalism and China's controlled economy (no capitalism), the long-term outcome is almost certain. The Chinese model, which does not make people happy, has no prospects. Yet the Chinese economy will demonstrate resilience for some time yet. With massive external surpluses and fiscal stimulus room, it possesses the ammunition to fire stopgap measures for years on end. Even if the sluggish state persists long-term, compared to the extreme poverty of decades past, the present is heaven, and the credit for achieving this goes to the Communist Party regime.

(3) Can the AI revolution sustain economic prosperity? The shadow protagonist is equity capitalism

Despite a challenging geopolitical environment, the US economy remains robust, with stock prices hitting record highs. The key lies in the AI revolution and equity capitalism (i.e., credit creation through rising share prices). To prevail in the US-China economic endurance contest, the AI revolution must elevate American living standards to new heights. Can the current model of US economic prosperity achieve this? A multifaceted examination is required.

Global demand for smartphones has peaked, and the high-tech boom has reached a temporary plateau. However, the emergence of ChatGPT has transformed the situation, propelling the US economy into a new AI-driven growth phase from 2024 onwards. The combined market capitalization of the five leading GAFAM companies has surged to $15 trillion at the end of last year, equivalent to half of US GDP. This cluster of just five giant corporations continues to grow at a remarkable pace, akin to that of a startup venture. The key lies in the dramatic productivity gains AI enables. The WSJ reports that the price per unit function (i.e., token, meaning question and response) has fallen to less than one-ninth even for very basic AI, at an annual rate. This represents an exponential change in a different order of magnitude compared to Moore's Law in semiconductors, which doubles integration density every two years (halving prices over the same period). While the spread of electricity and the internet once transformed people's lives and business, an even greater change is undoubtedly imminent.

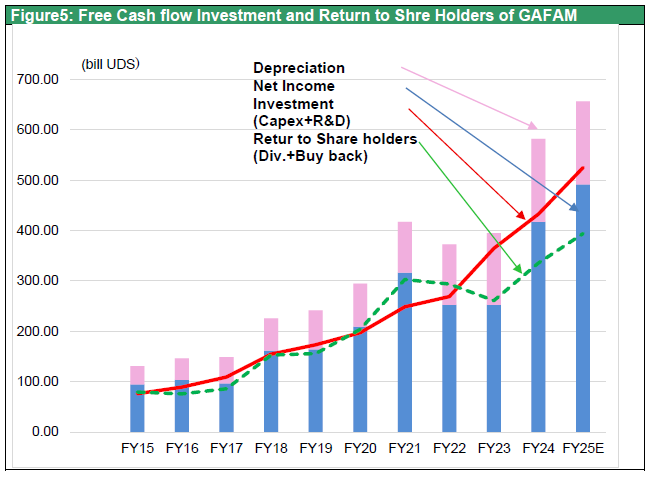

Players such as GAFAM, NVIDIA, Oracle, OpenAI, and SoftBank are grounded in equity capitalism as an economic and financial platform. Examining the GAFAM five companies via Figure 5 reveals that they have historically returned 90% of profits to shareholders through share buybacks and dividends. To avoid hoarding idle capital, their ROE has remained at an elevated level of around 60%. Despite this, investment has been within the bounds of their own funds (FCF), with truly little debt, resulting in a high equity ratio of 60-70%. The model GAFAM has achieved is a virtuous cycle: returning all profits to shareholders, gaining high financial strength through high share prices, and sustaining high investment to achieve high profit growth.

AI Era Economics, Surge in Initial Investment ,Productivity Growth and White-Collar Unemployment

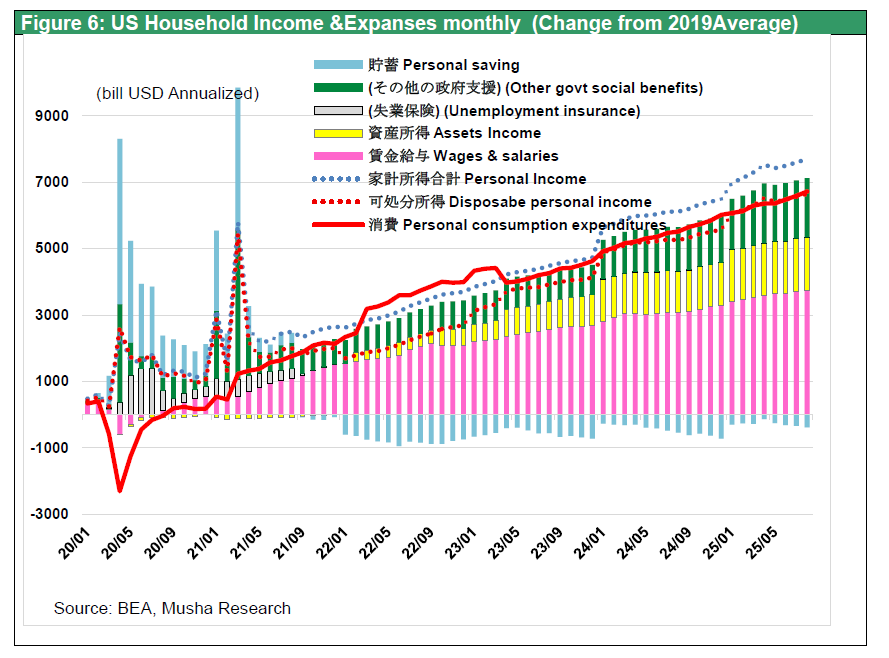

Initial investment in AI infrastructure, such as data centers, is currently surging, boosting the economy. Furthermore, high-tech firms like GAFAM are launching new AI-powered services, accelerating their profit growth. However, AI is displacing white-collar jobs in market research, document creation, graphic design, programming, and similar fields, also exacerbating labor supply-demand imbalances. Measures are needed to channel increasing corporate profits into household income and consumption growth. Figure 6 shows the post-COVID shock trend in monthly household income and consumption growth (annualized). It reveals that wages account for only half of household income growth, with the remainder covered by asset income (such as dividends and interest) and fiscal support.

This household income excludes capital gains from asset sales; factoring these in would push the reliance on equity-related income to over 20–30 per cent. Households have sustained consumption by drawing down savings precisely because of substantial unrealized gains from soaring asset prices. Thus, the stock market plays a decisive role as the primary conduit for surplus flows.

Furthermore, income transfers via fiscal measures—such as public support and tax cuts—are essential. Financial policies that induce and sustain high asset prices, coupled with fiscal high-pressure economic policies that boost demand pressure, will become necessary. The Trump administration's insistence on monetary easing and tax cuts is essential to counter the AI revolution and deflationary pressure from China.

There is a pessimistic view dismissing the exceptional stock price gains of GAFAM+NVIDIA as a bubble, but this is incorrect. Admittedly, the Magnificent Seven's share of the S&P 500 market capitalization has risen from 8% a decade ago to 32%, appearing overrepresented. They also seem expensive with high P/E ratios. The Magnificent Seven (GAFAM+NVIDIA, Tesla) boast a P/E ratio of 30 times, significantly outpacing the S&P 500 average of 22 times and 18 times for the remaining 493 S&P 500 companies. However, given that the Mag7 companies' profit growth rate is 20% annually, compared to the SP500 average profit growth of 7%, if the Mag7's exceptional growth continues for another three or four years, their valuation would appear undervalued rather than overvalued. Viewed through the valuation model (FED model) that treats 《the yield on 10-year government bonds=earnings Yield of SP500》 as fair value, the current situation represents a return to fair value following the end of an undervalued phase, with valuations at levels last seen between 1995 and 1996. Rather than fearing a bubble collapse, this is seen as an opportunity to take risks proactively.

No shadow over the dollar's credibility; bullish stock market environment persists into 2026

Many express concerns over the fragility of demand based on credit expansion. Persistent worries remain that rising interest rates due to fiscal deficits, declining dollar credibility stemming from increased external debt via trade deficits and falling stock and property prices could trigger an economic downturn or even the collapse of the economic prosperity model. Controlling interest rates, the dollar, and asset prices like stocks and property is central to economic management.

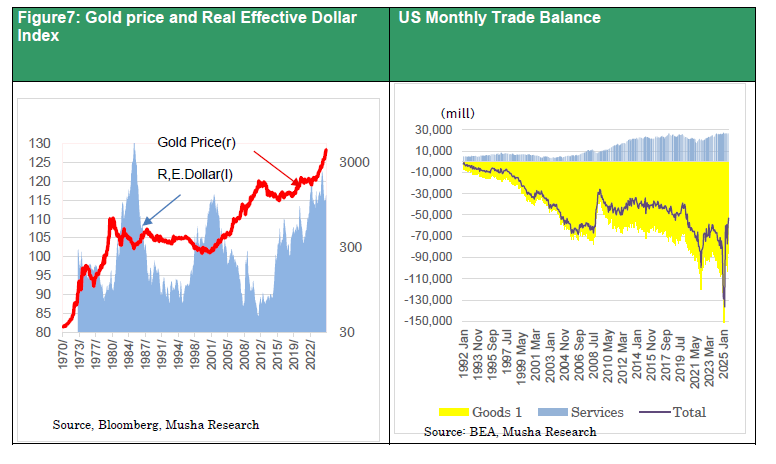

Concerns persist that the relentless rise in gold prices reflects heightened dollar instability, but this is incorrect. Historical analysis shows the correlation between gold and the dollar merely coincided with the dollar's decline from 2002 to 2011. The dollar correlates strongly with the US trade balance relative to GDP, yet the US trade deficit has significantly decreased since tariff implementation, which can be considered a factor supporting dollar strength (see Figure 7). So, what is driving the rise in gold prices? One key factor is the increase in gold holdings by Russia and China, which have been excluded from dollar settlements. However, it is thought to be even more intricately linked to the supply of dollar credit. The gold price surge in 1980 corresponded to the expansion of credit following the Nixon Shock (the end of the dollar-gold exchange). The rise in gold prices up to 2011 corresponded to the expansion of credit following the repeal of the Glass-Steagall Act. So, what is the credit likely to expand now in the US? It may be cryptocurrency.

Among the Trump administration's reforms, the one possessing the most striking historical significance may be the stablecoin revolution. It is a development that, viewed retrospectively from the future, may well be regarded as the invention of a new monetary system. To boldly summarize the essence of the GENIUS Act, enacted in July 2025 and scheduled for implementation from 2027 onwards, it represents a major shift in currency issuance: away from the symbolic authority of the papacy = central banks, towards the private sector and the market. A grand vision has begun to emerge as follows:

1. The entity issuing currency ➡ From government/central banks to the private sector/market.

2. The source of currency value ➡shifting from traditional governmental authority (i.e., the power to levy taxes) to the collective wisdom of technology and markets concentrated within blockchain.

3. The scope of currency circulation ➡ Expanding beyond national borders to encompass the entire universe, including cyberspace.

The issuance of stablecoins represents a new means of demand creation for the United States. Firstly, as stablecoin issuers are required to hold primarily US Treasury bonds as collateral, demand for these bonds will increase. Furthermore, permitting overseas companies to issue stablecoins will further strengthen US dollar credit creation and demand for the US dollar.

The global economy, US economy, and markets are projected to remain robust through 2026

The US, European, and Japanese economies must counter two deflationary forces (China and AI adoption) through high-pressure economic policies + militarization. For the time being, they will have little choice but to advance equity capitalism, the current source of prosperity.

(4) From 2026 Takaichi Conservative Revolution leads to Japanese Renaissance

Japan's lost 30 years are now fully over

Compared to 2012, just before Abenomics commenced:

- Stock market capitalization has increased 3.9-fold (¥301 trillion → ¥1,161 trillion)

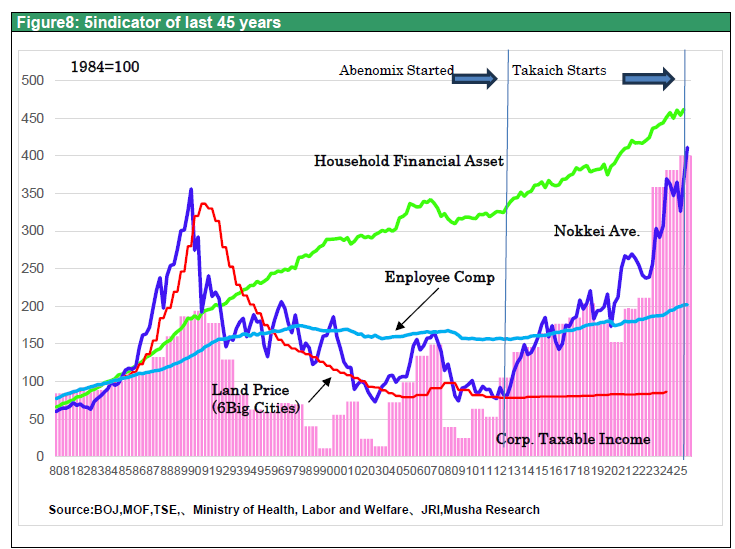

- Corporate ordinary profits have risen 2.4-fold (¥48.5 trillion → ¥114.8 trillion) General account tax revenue doubled (40.9 trillion → over 80 trillion yen), GPIF investment returns increased 6.6-fold (25 trillion → 166 trillion yen), and foreign tourists rose 4.8-fold (8.35 million → 40 million), showing remarkable growth. Nominal GDP increased by 1.24 times, the number of employed persons by 1.09 times, the female employment rate rose from 61% to 85%, and the minimum wage increased from ¥759 to ¥1,021, representing significant improvements. Deflation ended, and the policy interest rate, previously at 0%, was raised to 0.75%. The dollar-yen exchange rate, which was 85, rose to ¥156 (see Figure 8).

The post-war business model of Japanese companies, based on copying US technology and selling in the US market, shifted strategy towards “Only one” fields – uncontested Blue Oceans. Globalization to counter the strong yen also advanced significantly, producing many global top-tier companies. World demand began concentrating on Japan due to US-China confrontation and yen depreciation. Corporate governance reforms finally began to establish equity capitalism in Japan. Corporate dividends rose from 0.9% of GDP (FY2000) and 1.8% (FY2012) to 6.2% (FY2024), surpassing US levels. Cash deposits, which had accounted for 70% of household financial assets (excluding pension and insurance reserves), gradually began to decline, confirming a shift from savings to investment.

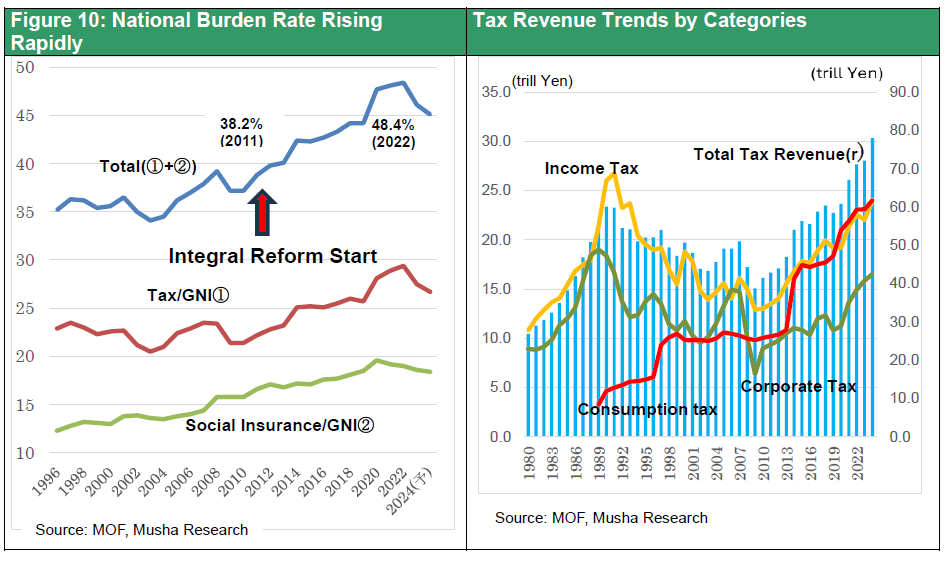

However, the standard of living for the populace remains mired in the “lost 30 years”. Real household consumption, at ¥302 trillion at the end of fiscal year 2012 and ¥311 trillion at the end of fiscal year 2013, has declined to ¥298 trillion in Q3 2025 (2020 price base). Economic growth rates also persist at the lowest levels among G7 nations. This is due to the sharp rise in the national burden ratio, which surged from 38.8% in fiscal year 2011 to 48.4% in fiscal year 2022 and is projected to be 46.2% in fiscal year 2024, following the forced implementation of the ‘integrated reform of social security and taxation’ under deflationary economic conditions. However, tax cuts under the Takaichi administration's high-pressure economic policy are now being introduced, and real consumption is likely to begin recovering. Domestic investment is also trending upwards, making it almost certain that a virtuous cycle of expanding consumption and investment will emerge (see Figure 9 and 10).

The true cause of Japan's decline... The loss of purpose (80 years of a Japan reliant on others) nears its end

Why has Japan fallen into such prolonged stagnation? Japan took pride in having not only avoided colonization through reforms following the Meiji Restoration, but also in being the sole non-Western nation to embrace democracy and achieve industrialization. Its miraculous post-war recovery was also perceived as a product of Japan's inherent strengths. The national character of sincerity, diligence, fairness, and cooperation that underpinned “Japan as number one” was celebrated as Japan's virtues. Yet these national virtues, which should not change overnight, have become entirely invisible.

Various analyses exist, but the most fundamental cause is the loss of a grand purpose – the nation's compass.

Meiji Japan possessed a powerful nationalism as its guiding principle: to catch up with advanced nations, embrace democracy, and achieve a wealthy nation and strong military.

The Shōwa era's compass after the war shifted to pacifism and economic pragmatism. Within the framework of war reflection and US military subordination, nationalism was shelved. The “merchant-state theory” (Naohiro Amaya) – advocating wise conduct within one's given fate – gained widespread acceptance. This state of shelved nationalism collapsed under US criticism of Japan, leaving Japan, bereft of purpose, in a state of bewilderment.

The Lost 30 Years were precisely an era of lost purpose. Corporations sought survival through de-Japanimation and globalization, while individuals reduced contact with the outside world, turning inward as “hikikomori” to seek mental tranquility. Amidst this state of division, politicians and bureaucrats lost their sense of autonomy. Their primary policy goals became trivial matters like reducing fiscal deficits and enhancing social services to alleviate anxieties about old age.

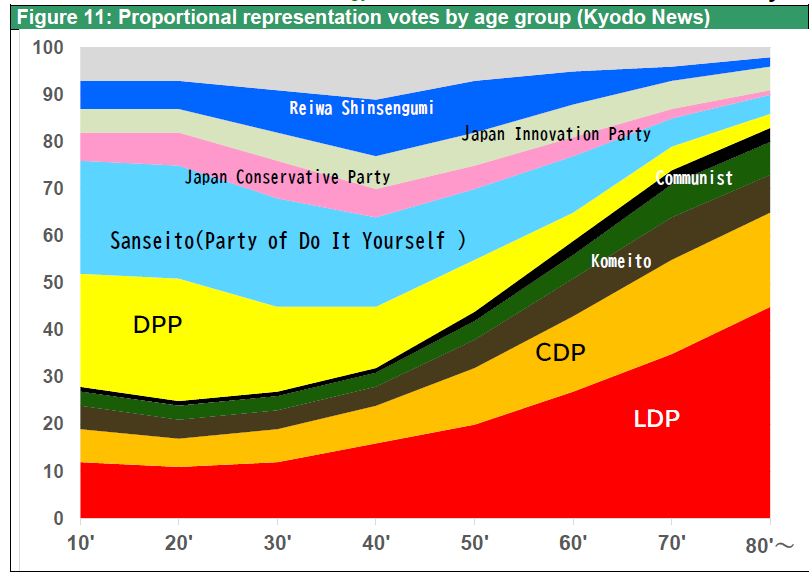

The Inevitable Emergence and Historical Mission of the Takaichi Administration

China's rise and the Trump administration's major shift in security strategy are compelling Japan once again to pursue national governance grounded in a grand purpose. The necessity of a shift towards nationalism, faith in strength, and realism is self-evident. The public and voters began to realize this sooner than politicians and opinion elites. The landslide victory of reformist conservative opposition parties in the July 2025 House of Councilors election, the election of Ms. Takaichi – previously a minority voice within the LDP – as Prime Minister and party president, the realignment of the coalition from LDP-Komeito to LDP-Ishin, and the cooperation of reformist conservative opposition parties in government represent changes propelled by public sentiment, leaving pundits and the old media behind (see Figure 11). It must be firmly understood that the emergence of the Takaichi administration carries both inevitability and historical significance.

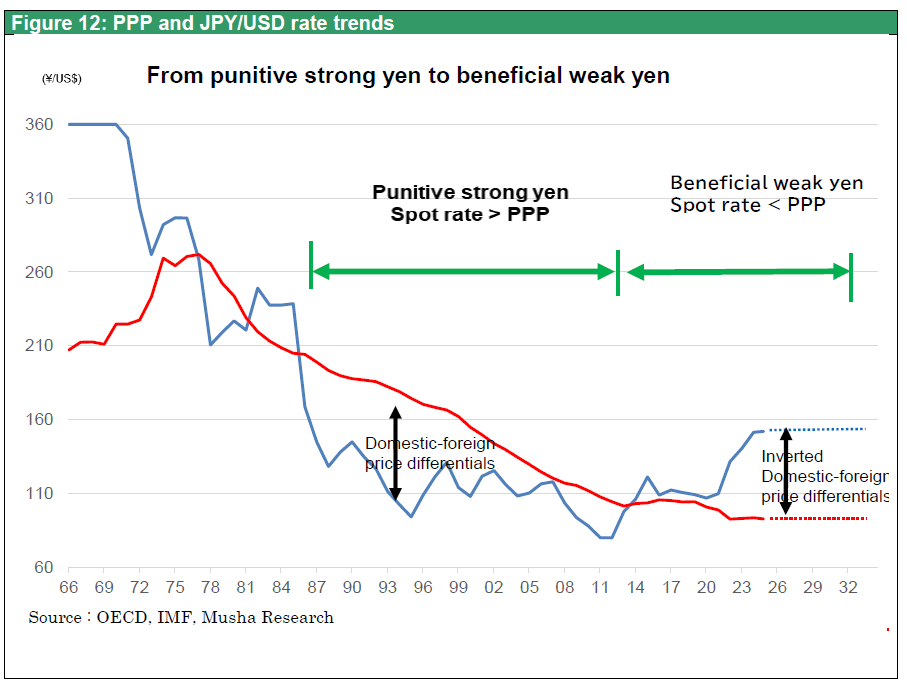

The Takaichi administration will conduct a conservative nationalism revolution with overwhelming public support. Movements will begin with the dissolution and general election that marks its inception. Improving the lives of the people, long sacrificed for national wealth and military strength and fiscal reconstruction, and securing advantageous positions in the international division of labor engineered by the US (such as production transfers from Taiwan to Japan) are essential. A weaker yen will accelerate production transfers to Japan (see Figure 12).

Japan has two forces for the conservative-nationalist revolution to success

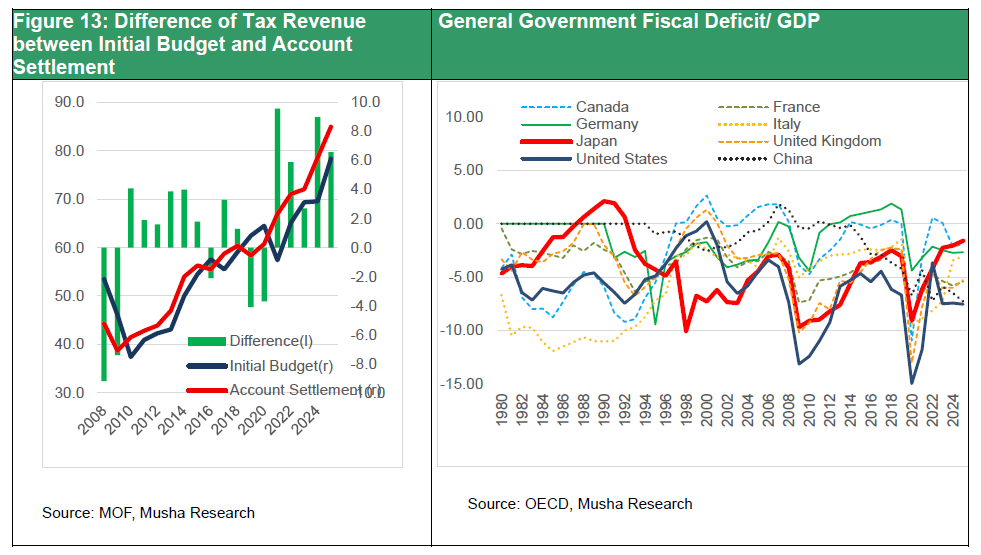

The first element, absent in the US, Europe, or China, is underutilized economic resources and investment power. This includes high corporate profitability, abundant savings and capital, and indeed substantial fiscal stimulus capacity (see Figure 13). Moreover, it is the nation with the world's highest mutual trust – a nation of trust – and the lowest risk premium.

Second is national cohesion. Current Japanese people should share the joy of standing on their own feet for the first time since WWⅡ. Japan possesses the world's most favorable conditions for uniting behind a great cause: a homogeneous national character, a heightened yearning for such a cause, Japan's fiercely competitive international environment (dangerous neighbors beyond the border China, Russia, and North Korea; an unreliable hegemonic power in the United States), and the restoration of previously forbidden nationalism (the rehabilitation of patriotism and nationalism).

Thus, should a great cause return to Japan, the vectors of policy and corporate action will align, hastening decision-making and accelerating change. Even fiscal debates, where opinions clash, will find immediate resolution.

The Takaichi reforms will advance rapidly. This will constitute the most potent support for share prices.