(1) The mistaken view among the pessimists

The pessimistic view that is widely embraced is caught up in the mistaken notion that “misfortunes always come in pairs.” The Japanese economy has been putting off the expenses associated with budget deficits and a declining population. But now the economy must also deal with a huge misfortune: the catastrophic March earthquake. I explained in Bulletin No. 42 that the budget deficit and falling population are not problems that Japan has been pushing into the future. Furthermore, I noted in Bullet No. 43 that the earthquake will provide an opportunity for Japan to use demand created by reconstruction activities to narrow its supply-demand gap.

Deflation in Japan ? Market prices are far below the intrinsic values of goods

But optimists believe that Japan has considerable accumulated savings over the past two decades. They view the earthquake as an opportunity to take advantage of these savings. Exactly what has Japan accumulated? The answer is low market prices due to the yen’s appreciation and the prolonged period of deflation. During the past 20 years, these two forces have brought down wages and prices of assets like stocks and real estate. Market prices are now far below their intrinsic values. We can view this gap between value and market prices as a savings. At some point, this gap will disappear as wages and stock prices rise. If Japan uses suitable reflation measures in the wake of the earthquake that brings wages and asset prices back to their true values, we will see upturns in wages and stock prices. This would probably bring Japan’s economy back from its prolonged period of stagnation.

(2) A weaker yen will end wage deflation

The price of labor fluctuates along with foreign exchange. However, exchange rates do not affect the value of labor because its value is determined by productivity. This explains why fluctuations in foreign exchange rates create a gap between the price and value of labor. When such gap emerges, we see upward or downward pressure on wages in each country. Falling wages over many years were the primary cause of Japan’s “lost 20 years.” The yen appreciated faster than the improvement in labor productivity and wages in Japan became extremely high compared with these in other countries, which produced constant downward pressure on wages in Japan. In this environment, workers in Japan were the only one in the world that failed to benefit from advances in productivity. If the yen fell to \100 to the dollar, though, there would pressure to raise wages in Japan by 20%. Falling back to this exchange rate level would allow Japanese workers to receive a price that matches the value of their labor.

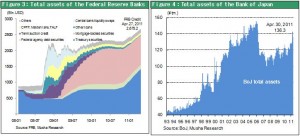

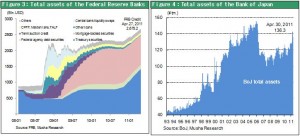

The BOJ has the power to prevent the yen from strengthening: More quantitative easing

The Fed has provided an outstanding lesson in the prescription that is required for Japan to end the yen’s strength and deflation. When zero interest rates are ineffective, a central bank must continue to enact quantitative easing measures. Since the end of 2010, the Fed’s balance sheet has grown substantially due to QE2. During that period, rising stock prices and a weakening dollar have completely suppressed any deflationary pressure. The BOJ is showing signs of following the Fed’s lead. BOJ Governor Masaaki Shirakawa stated that “the BOJ will use appropriate measures if necessary.” Furthermore, BOJ Deputy Governor Kiyohiko Nishimura has proposed to expand quantitative easing by raising asset purchases from \10 trillion to \15 trillion (at the April 28 policy meeting). There should be no problem at all in guiding the yen lower now as the G7 has agreed to prevent the yen from appreciating. By adopting this stance, the BOJ would play a big part in solidifying the perception that the yen appreciation has reached its peak. Even if the dollar continues to weaken worldwide, the yen would never drop below \80 to the US dollar (even if it does, only briefly).

(3) Rising stock prices will initiate a positive economic cycle

Price reduction reserves will become an extra profit

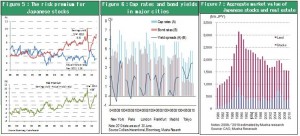

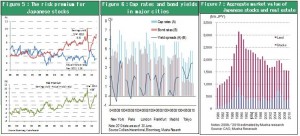

As the Fed has demonstrated, quantitative easing has a powerful influence on prices of stocks and assets. In Japan, stocks yield is 7% while the long-term interest rate is only 1%, resulting in a premium of 6%. This premium is enormous level on a historic basis as well as in comparison to other countries. This premium shows that Japanese stocks are undervalued (there is a gap between value and price). I believe we should regard this 6% premium as “Price reduction reserve.” Stock prices in Japan fell by two-thirds over the past 20 years. Since this decline equates to an annual rate of 5%, investors have been demanding prices that factor in this 5% decline in prices. However, once stock prices fall to the point where they cannot drop any more, the price reduction reserve of 5% becomes an extra profit for investors.

Rising stock prices will initiate a positive economic cycle

If the BOJ learns from the Fed and establishes a floor for stock prices (by increasing its asset purchases), investors will rush to buy Japanese stocks as they realize the 5% extra profit. Real estate prices would benefit from the same phenomenon. Real estate price in Tokyo area has the largest spread (investment return minus long-term interest rate) in the world, which a clear sign that Japanese real estate is undervalued. Approximately \1,500 trillion of value in stocks and real estate disappeared over the past 20 years in Japan. This meant that Japan lost almost \100 trillion of wealth every year, which is almost equal to 20% of the country’s GDP. Japanese economy was thus affected by a massive negative wealth effect. Investors responded by shunning all risk and falling financial income had a constant and severe impact on domestic demand. Today, prices of assets are well below where they should be. I have long referred to this situation as the “negative bubble.” Following the tragedy of earthquake, we will probably see the full-scale enactment of reflation measure that may convert asset deflation to asset inflation. If this happens, Japan would benefit from an enormous positive asset effect of \50 trillion to \100 trillion every year. This is precisely the mirror image of what has occurred in recent years.

(4) Lessons from the success of the Troubled Assets Relief Program

Financial authorities must make a commitment to end the “negative bubble”

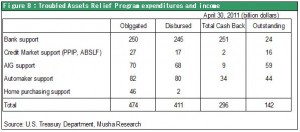

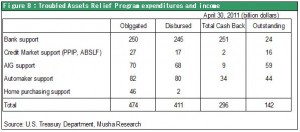

The success of the $700 billion TARP is the main factor to prevent severe economic downturn with the aftermath of the Lehman shock. Actual TARP expenditures were $411 billion and 60% of these expenditures is for assistance for banks, which is already generating gains (amounts recovered exceed expenditures) from repayments and gains on sales of investments. The shares of AIG and two automakers, General Motors and Chrysler, account for the majority of the remaining TARP outstanding. These expenditures as well would not end up as losses (AIG will conduct an IPO in May). Overall, this massive financial support program will end up costing nothing (or producing a small gain) (Figure 8).

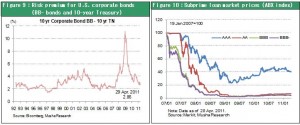

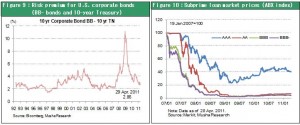

Rising prices of assets are the factor for TARP’s success. Financial authorities intervened in markets to boost prices that were far below fair value. Pushing prices up not only stabilized the U.S. economy and financial system but also generated a profit from this support program. Late in 2008, prices of U.S. corporate bonds and mortgage loan plummeted, but the subsequent recovery in market prices (Figures 9 and 10) is the proof that the 2008 drop in these prices was not an accurate reflection of these true values.

The emergence of a “negative bubble” in asset prices (when market prices are far below intrinsic values) is a sign that fear is preventing markets from functioning normally. By reacting with decisive measures, U.S. financial authorities succeeded in achieving both an upward correction in prices and an economic and financial recovery in U.S. Japan now has an excellent opportunity to boost wages and stock prices when the correct actions are taken by the authority. This is very much the “savings” that Japan has accumulated over its “lost 20 years.” Now that Japan is facing unprecedented challenges, the time has come to use these “savings”. It is nothing to do with “free lunch” or moral hazard at all.

(5) Few concerns about stock markets in May

“Sell in May and go away” is a well-known adage among investors. But this year may be different. U.S. stocks are still undervalued. Investors are not overly optimistic, as was demonstrated by the brief drop in stock prices after the earthquake in Japan. U.S. stocks have overcome challenges posed by the debt crisis in Greece and accompanying euro crisis. Moreover, after plummeting 60% after the Lehman shock, stocks doubled over the ensuing two years. However, the pace of the stock market rebound is slower than the recovery in earnings at U.S. companies. This explains why stocks are still undervalued (Figures 11 and 12). Earnings are backed by advances in productivity that is propelled by globalization and the Internet revolution. Once a full-scale rebound in employment and consumer spending begins, U.S. companies will report even higher earnings.

Investors have an increasing appetite for taking on risk in financial markets. This is especially evident in the prominent market profile of hedge funds. In the high-tech sector, the focus shifted from well-established big names like IBM to emerging companies like Google or Facebook. In the financial sector as well, we are about to witness the emergence of new names. Former Fed chairman, Alan Greenspan, believed that tighter regulations would hinder financial activity. This is why he criticized the recently enacted reforms to U.S. financial regulations. His belief is that financial markets can function more efficiently if they are guided by the invisible hand of God. No one knows yet exactly what the final regulatory system will look like, but there is no doubt that business opportunities are growing along with continuing advances in the financial sector. As a result, the U.S. economy and financial markets are becoming more dynamic.

There are good factors for high expectations in Japanese stocks in May, as firm U.S. stock price and the yen appreciation reaching their peak. This month, we will see many positive news in Japan as media reports concerning reconstruction activities become more frequent.