Misunderstandings about the U.S. GDP Announcement

Pessimism in the United States has been growing following recent GDP announcements. The first quarter growth rate estimate of 1.9% was revised sharply downward to 0.4%. Furthermore, the preliminary second quarter GDP growth rate of 1.3% disappointed investors by falling far below the consensus outlook. Moreover, U.S. stock prices fell on July 29 (Friday) because of mounting fears about a possible U.S. default and credit rating cut due to the inability to reach an agreement with the Republican Party to raise the government’s debt ceiling. Another reason for the stock market drop was that July 29 (Friday) was the last trading day of July.

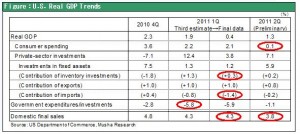

But I believe there will be a major reversal in this pessimism for three reasons: (1) problems involving the hike in the debt ceiling will almost certainly be resolved; (2) the actual state of the U.S. GDP does not warrant pessimism; and (3) stocks were sold off because of pessimism among speculators. Taking a close look at the U.S. GDP is the most important point of all. The large downward revision in the first quarter growth rate was caused almost entirely by downward revisions to two important components: inventories and imports. There was absolutely no change in domestic demand and the economy has not lost momentum. Revising inventory investments downward caused the quarter-on-quarter growth rate in private-sector investments to plunge from 12.4% to 3.8%. Furthermore, the increase in imports was revised sharply upward from 5.1% to 8.3%.

Expectations for a second half recovery are justified

For domestic final sales, a key indicator of demand, the final report of 4.3% growth was exactly the same as the forecast. Since government restructuring measures caused public-sector purchasing to plummet (-5.9%), this final sales growth shows that private-sector demand was in fact quite strong. The drop in growth in consumption from 2.1% in the first quarter to 0.1% in the second quarter was a major cause of disappointment in second quarter data. However, the drop was attributable almost entirely to falling sales of durable consumer goods, particularly automobiles. The cause is probably the interruption in the supply of products following the March 2011 earthquake in Japan. As a result, the second quarter downturn is likely to result in a rebound in demand in the third quarter. Declines in public-sector spending, which have been holding back the economy, are also likely to end. This is why the U.S. economic growth rate will probably increase steadily in the second half of 2011. Once pessimism linked to one-time factors in the first half winds down, we can expect to see upturns in both U.S. stock prices and the dollar.